Analysts Recommend Buying The Dip In This Entertainment Stock

Table of Contents

Why Analysts are Bullish on [Entertainment Stock Name]

[Entertainment Stock Name]'s recent dip has piqued the interest of many analysts, who see it as a compelling entry point for long-term investors. Several factors contribute to their bullish outlook:

-

Recent Positive Developments: [Entertainment Stock Name] has recently announced [Specific positive development, e.g., a new streaming service launch, a highly anticipated movie release, a strategic partnership with a major player in the industry]. This positive news, coupled with [another positive development, e.g., strong subscriber growth, exceeding revenue projections], signals a positive trajectory for the company.

-

Strong Projected Future Earnings and Revenue Growth: Based on reputable sources like [Source 1, e.g., Morgan Stanley research report] and [Source 2, e.g., company's financial filings], [Entertainment Stock Name] is projected to experience significant revenue growth of [Percentage]% in the next fiscal year, driven primarily by [Key factors contributing to growth]. This strong projected growth is further supported by a robust pipeline of future releases and initiatives.

-

Solid Financial Performance: A detailed analysis of [Entertainment Stock Name]'s financial performance reveals a strong foundation. The company has consistently demonstrated [Key financial strengths, e.g., positive cash flow, increasing market share, efficient cost management]. This financial stability provides a safety net, mitigating some of the inherent risks in the entertainment industry. Its market capitalization currently stands at [Market Cap], reflecting its significant size and established position.

-

Competitive Advantage: Compared to its competitors, [Entertainment Stock Name] enjoys a distinct advantage in [Specific areas of advantage, e.g., strong brand recognition, a diverse content library, a technologically advanced platform]. This competitive edge positions the company for continued success in the evolving entertainment landscape.

-

Expert Opinions: Leading financial analysts at [Analyst firm 1] and [Analyst firm 2] have issued "buy" or "strong buy" ratings for [Entertainment Stock Name], citing its undervalued nature and high growth potential. [Quote from a reputable analyst, if available].

Understanding the "Buy the Dip" Strategy

The "buy the dip" strategy involves purchasing a stock when its price temporarily falls below its perceived intrinsic value. It's a risk management technique that capitalizes on market corrections or temporary setbacks. However, it's crucial to approach it strategically:

-

Thorough Due Diligence: Before implementing a "buy the dip" strategy for any stock, including [Entertainment Stock Name], conduct extensive research. Analyze the company's financial statements, understand its business model, and assess its competitive landscape.

-

Determining the Entry Point: Identifying the optimal entry point requires a blend of technical and fundamental analysis. Technical analysis can help identify support levels, while fundamental analysis provides insights into the company's long-term value.

-

Risk Management: Diversifying your investment portfolio is essential to mitigate risk. Avoid putting all your eggs in one basket. Setting stop-loss orders can help limit potential losses if the stock price continues to decline.

-

Long-Term Perspective: The "buy the dip" strategy is most effective when combined with a long-term investment horizon. Short-term market fluctuations should not dictate your investment decisions. Patience and a long-term outlook are key to realizing potential returns.

Analyzing the Current Market Conditions for [Entertainment Stock Name]

Analyzing the current market conditions for [Entertainment Stock Name] involves considering several factors:

-

Market Sentiment: The current market sentiment towards the entertainment industry is [Describe current sentiment, e.g., cautiously optimistic, slightly bearish]. However, the recent dip in [Entertainment Stock Name]'s price might present an attractive opportunity for investors with a longer-term perspective.

-

Stock Valuation: [Entertainment Stock Name]'s current valuation, as reflected by its price-to-earnings ratio (P/E) of [P/E Ratio], is [Describe valuation, e.g., considered relatively low compared to its historical average and competitors], suggesting potential undervaluation.

-

Market Indicators: Relevant market indicators, such as [Specific indicators, e.g., interest rates, consumer spending, inflation], may influence [Entertainment Stock Name]'s performance. However, the company’s strong fundamentals and projected growth suggest a degree of resilience to broader market fluctuations.

-

Growth Catalysts: Future growth catalysts for [Entertainment Stock Name] include [List potential growth drivers, e.g., new content releases, expansion into new markets, technological advancements].

Potential Risks Associated with Investing in [Entertainment Stock Name]

While the prospects for [Entertainment Stock Name] appear positive, potential risks must be acknowledged:

-

Market Risk: The entertainment industry is susceptible to broader market fluctuations, and unforeseen economic events could impact the stock's performance.

-

Company-Specific Risks: [Entertainment Stock Name] faces company-specific risks, including competition, changing consumer preferences, and potential production delays.

Conclusion

Analysts recommend buying the dip in [Entertainment Stock Name] due to its strong fundamentals, positive growth projections, and current undervaluation. The "buy the dip" strategy offers a potential avenue for capitalizing on this opportunity, but thorough due diligence and risk management are paramount. Remember to consider your own risk tolerance and investment goals before making any decisions.

Are you ready to capitalize on this potentially lucrative investment opportunity? Don't miss out on the chance to buy the dip in this promising entertainment stock. Conduct your own research and consider adding [Entertainment Stock Name] to your portfolio today. Remember to always consult with a financial advisor before making any investment decisions.

Featured Posts

-

Artistas Latinos En Ascenso Descubre A Jacqie Rivera Y Otros Talentos

May 29, 2025

Artistas Latinos En Ascenso Descubre A Jacqie Rivera Y Otros Talentos

May 29, 2025 -

Is A Live Nation Breakup Inevitable The Pressure Builds

May 29, 2025

Is A Live Nation Breakup Inevitable The Pressure Builds

May 29, 2025 -

Nieuw Statendam In Invergordon A Boost For Easter Rosss Cruise Tourism

May 29, 2025

Nieuw Statendam In Invergordon A Boost For Easter Rosss Cruise Tourism

May 29, 2025 -

Bucks Collapse Leads To Giannis Antetokounmpo Post Game Incident

May 29, 2025

Bucks Collapse Leads To Giannis Antetokounmpo Post Game Incident

May 29, 2025 -

Stalgigant Overtages Trumps Rolle I Den Historiske Aftale

May 29, 2025

Stalgigant Overtages Trumps Rolle I Den Historiske Aftale

May 29, 2025

Latest Posts

-

Friday Forecast Further Losses Predicted For Live Music Stocks

May 30, 2025

Friday Forecast Further Losses Predicted For Live Music Stocks

May 30, 2025 -

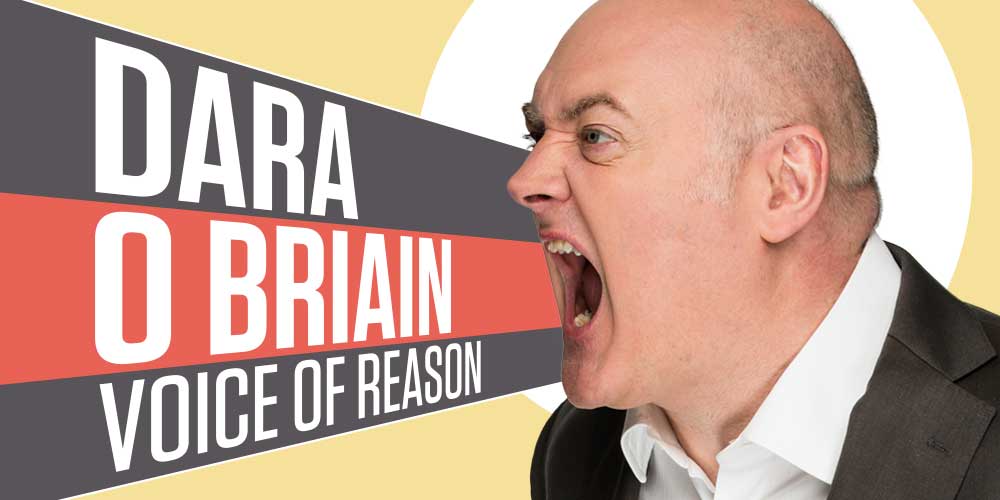

Analyzing Dara O Briains Voice Of Reason A Comedic Approach To Serious Issues

May 30, 2025

Analyzing Dara O Briains Voice Of Reason A Comedic Approach To Serious Issues

May 30, 2025 -

Dara O Briains Voice Of Reason Dissecting His Stand Up And Tv Persona

May 30, 2025

Dara O Briains Voice Of Reason Dissecting His Stand Up And Tv Persona

May 30, 2025 -

Live Music Stock Slump What To Expect Friday

May 30, 2025

Live Music Stock Slump What To Expect Friday

May 30, 2025 -

Dara O Briains Voice Of Reason Dissecting Current Events Through Wit

May 30, 2025

Dara O Briains Voice Of Reason Dissecting Current Events Through Wit

May 30, 2025