Analyzing Novo Nordisk's Market Share: Ozempic's Performance In The Weight-Loss Industry

Table of Contents

Ozempic's Sales Growth and Market Penetration

Analyzing Ozempic's Revenue Streams

Ozempic's revenue streams are multifaceted, stemming from both its initial indication as a Type 2 diabetes treatment and its increasingly popular off-label use for weight loss. This dual revenue stream has significantly contributed to Novo Nordisk's overall market share growth.

- Significant Sales Growth: While precise sales figures fluctuate and are subject to Novo Nordisk's quarterly reports, consistent year-over-year growth in Ozempic sales demonstrates strong market demand, particularly within the weight management sector. This growth has far exceeded initial projections, driven by both increased prescription rates for diabetes and significant adoption for off-label weight loss.

- Marketing and Advertising: Novo Nordisk's sophisticated marketing campaigns, targeted towards both healthcare professionals and consumers, have played a pivotal role in increasing Ozempic's brand awareness and driving sales. These campaigns effectively highlight Ozempic's efficacy in both diabetes management and weight loss.

Market Share Comparison with Competitors

Ozempic holds a substantial market share within the GLP-1 receptor agonist class and is a significant competitor in the broader weight-loss medication market. However, the competitive landscape is dynamic.

- Competitive Advantage: Ozempic's established reputation for efficacy in diabetes treatment, coupled with its demonstrated weight-loss capabilities, provides a significant competitive advantage. Its relatively well-understood safety profile compared to some newer entrants also contributes to its market position.

- Comparison with Wegovy and Mounjaro: While Wegovy (also a GLP-1 receptor agonist from Novo Nordisk) and Mounjaro (from Eli Lilly) are strong competitors, Ozempic maintains a significant market presence due to its earlier market entry and established brand recognition. The pricing strategies of these competing drugs also influence their respective market shares. Further analysis of market access, specifically insurance coverage and patient affordability, is crucial for a complete understanding of market dynamics.

Factors Contributing to Ozempic's Success

Efficacy and Safety Profile

Ozempic's success is rooted in its proven efficacy and relatively favorable safety profile. Clinical trials have demonstrated significant weight loss in patients using Ozempic, making it an attractive option for individuals seeking effective weight management.

- Clinical Trial Results: Numerous clinical trials have shown substantial weight loss with Ozempic, often exceeding results seen with other weight-loss medications. These data points are crucial in physician recommendations and patient choices.

- Side Effects and Safety Concerns: While generally well-tolerated, Ozempic, like other GLP-1 receptor agonists, can cause side effects. Transparency about potential adverse effects (such as nausea, vomiting, and constipation) is crucial for responsible marketing and patient education. Understanding these risks and managing them effectively is vital for maintaining a positive safety profile.

Marketing and Brand Strategy

Novo Nordisk's strategic marketing and branding efforts have significantly boosted Ozempic's success in the weight-loss market.

- Targeted Advertising: Novo Nordisk’s advertising campaigns have successfully targeted both physicians and patients, emphasizing Ozempic's benefits in weight management.

- Physician Recommendations: The role of physician recommendations cannot be overstated. Positive clinical experiences and strong data supporting Ozempic's efficacy have encouraged widespread prescription.

- Influencer Marketing: Utilizing social media influencers and online platforms has further increased brand awareness and reached broader consumer audiences, contributing significantly to market penetration.

Challenges and Future Outlook for Ozempic

Competition and the Emergence of New Drugs

The weight-loss market is highly competitive, and new drugs are constantly emerging, posing a potential threat to Ozempic's market dominance.

- Emerging Competitors: Companies are developing new weight-loss medications with potentially improved efficacy or safety profiles, creating increased competition for Ozempic. These new entrants will undoubtedly influence market share in the coming years.

- Future Market Trends: Monitoring the development and market penetration of these competing drugs is crucial to assessing the ongoing success of Ozempic. Analyzing their pricing strategies and market access will provide further insight into future market dynamics.

Regulatory Hurdles and Potential Risks

Regulatory hurdles and potential safety concerns could impact Ozempic's future in the weight-loss market.

- Long-Term Safety Data: Continued monitoring of Ozempic's long-term safety profile is crucial for maintaining regulatory approval and patient confidence. Gathering extensive long-term data on its effects will address any lingering concerns.

- Pricing and Access: Pricing regulations and issues related to patient access could also impact Ozempic's market share. Ensuring affordability and equitable access will be crucial for sustaining its popularity.

Conclusion

Ozempic's success in the weight-loss market has undeniably boosted Novo Nordisk's market share. Its efficacy, relatively favorable safety profile, and targeted marketing have contributed significantly to its success within the GLP-1 receptor agonist class. However, the competitive landscape is highly dynamic, with emerging competitors and regulatory considerations posing ongoing challenges. Continued analysis of Novo Nordisk's strategic response, including monitoring sales figures, competitor activities, and regulatory developments, will be crucial in determining their future success in this lucrative market. To stay informed on the latest developments regarding Novo Nordisk's market share and Ozempic's performance in the weight-loss industry, continue to follow industry news and conduct further research.

Featured Posts

-

June 2025 Air Jordan Releases Dates Styles And Where To Buy

May 30, 2025

June 2025 Air Jordan Releases Dates Styles And Where To Buy

May 30, 2025 -

Sangre Del Toro Documentary On Guillermo Del Toro Launches At Cannes

May 30, 2025

Sangre Del Toro Documentary On Guillermo Del Toro Launches At Cannes

May 30, 2025 -

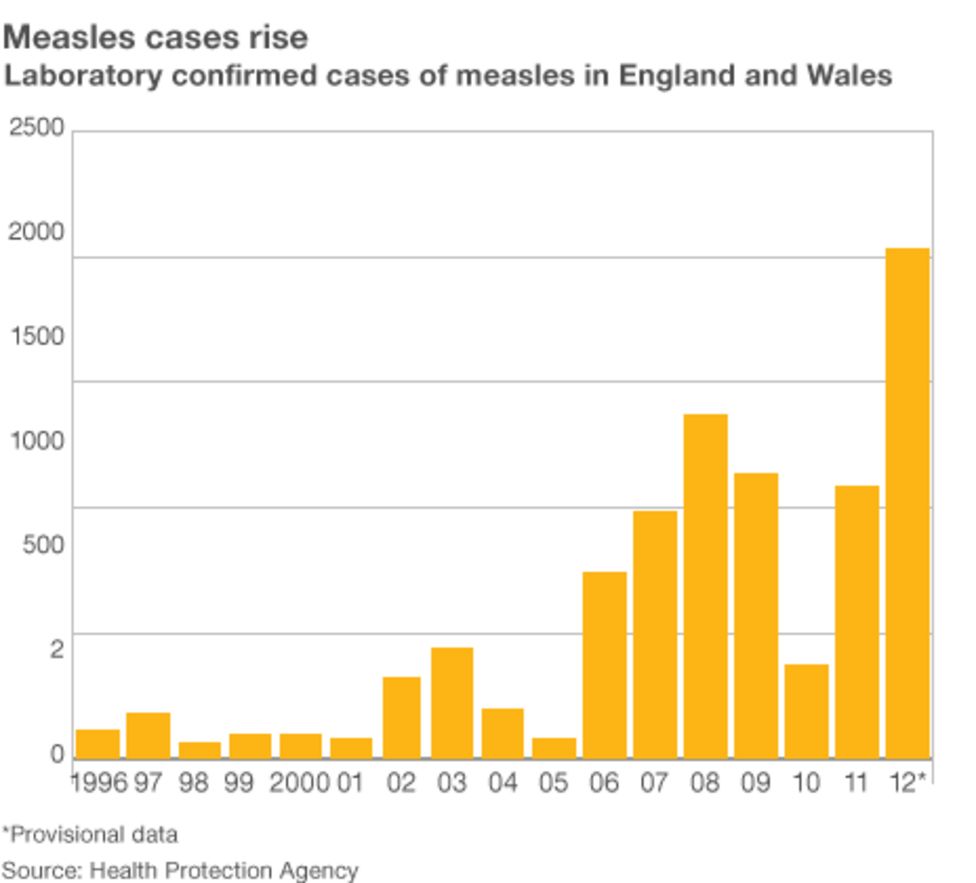

Measles Cases In The Us Rise To 1 046 Indiana Outbreak Concludes

May 30, 2025

Measles Cases In The Us Rise To 1 046 Indiana Outbreak Concludes

May 30, 2025 -

The Threat To Canadas Measles Elimination Status A Fall 2024 Outlook

May 30, 2025

The Threat To Canadas Measles Elimination Status A Fall 2024 Outlook

May 30, 2025 -

Vaer Og Badetemperaturer Hopp I Sjoen

May 30, 2025

Vaer Og Badetemperaturer Hopp I Sjoen

May 30, 2025

Latest Posts

-

The Factors Behind Thompsons Monte Carlo Failure

May 31, 2025

The Factors Behind Thompsons Monte Carlo Failure

May 31, 2025 -

New Covid 19 Variant What We Know About The Recent Case Surge

May 31, 2025

New Covid 19 Variant What We Know About The Recent Case Surge

May 31, 2025 -

A Look At Thompsons Losses In Monte Carlo

May 31, 2025

A Look At Thompsons Losses In Monte Carlo

May 31, 2025 -

Analysis The Link Between A New Covid 19 Variant And Increased Infections

May 31, 2025

Analysis The Link Between A New Covid 19 Variant And Increased Infections

May 31, 2025 -

Thompsons Monte Carlo Challenges A Comprehensive Review

May 31, 2025

Thompsons Monte Carlo Challenges A Comprehensive Review

May 31, 2025