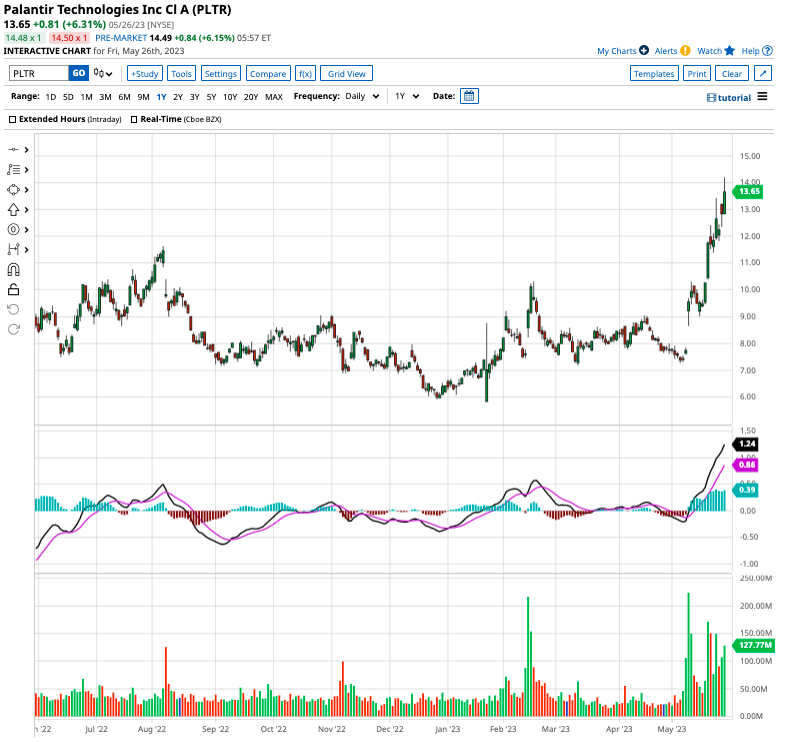

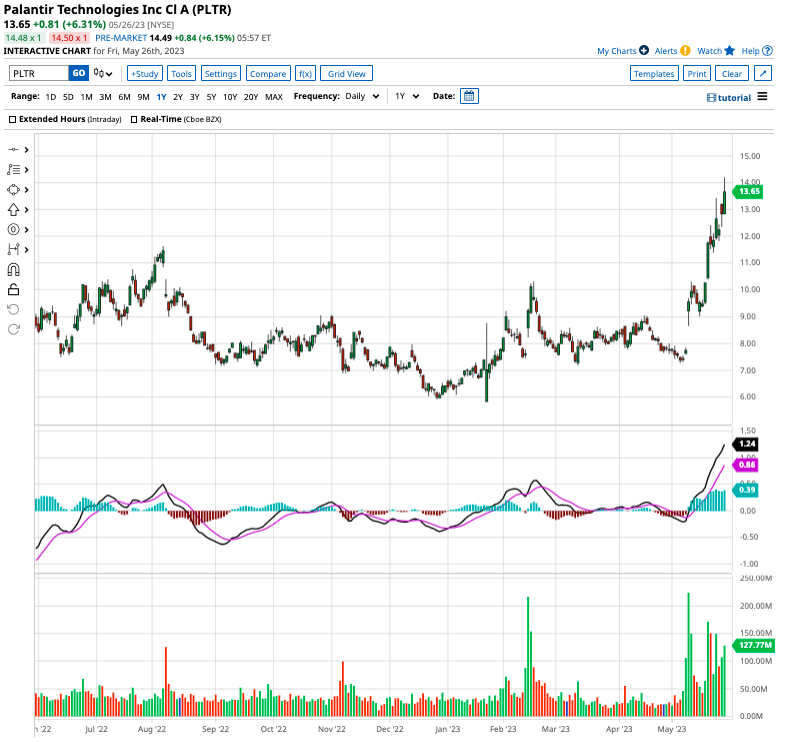

Analyzing Palantir Stock: Is It A Buy Before May 5th?

Table of Contents

Palantir's Recent Financial Performance and Key Metrics

Analyzing Palantir's recent quarterly earnings reports is crucial for understanding its current financial health. Let's examine some key financial metrics:

- Q4 2023 Revenue Growth: While specific numbers require referencing the official earnings reports, analyzing the percentage growth in revenue year-over-year and quarter-over-quarter offers insight into the company's ability to generate sales. A strong growth rate suggests increasing demand for Palantir's products and services.

- Net Income/Loss: Profitability is a key indicator of a company's financial strength. Examining net income (or loss) for recent quarters helps determine if Palantir is generating profits or operating at a loss. This should be compared to previous periods and industry benchmarks.

- Debt-to-Equity Ratio: This metric reveals Palantir's financial leverage. A high debt-to-equity ratio indicates a higher level of risk. Assessing this ratio against industry averages provides context to the company's financial stability.

Keywords: Palantir earnings, Palantir revenue, Palantir profitability, financial metrics, Palantir financials. Comparing these metrics to previous periods and competitors like other data analytics companies is essential for a complete picture. A positive trend in revenue growth, coupled with improving profitability and manageable debt, would suggest a healthy financial position.

Market Sentiment and Analyst Predictions for Palantir

Market sentiment towards Palantir stock fluctuates. Examining reputable financial news sources and analyst ratings provides a gauge of overall investor confidence. Consider:

- Bullish vs. Bearish Sentiment: Is the overall market outlook positive or negative regarding Palantir's future performance? News articles, social media discussions, and analyst reports offer insight into prevailing sentiment.

- Analyst Ratings and Price Targets: What are the price targets set by leading financial analysts for Palantir stock in the near future, especially before May 5th? This gives a range of expectations.

- Recent News Impact: Significant events like new contract wins (especially large government contracts), successful product launches, or regulatory changes can influence the stock price and investor confidence.

Keywords: Palantir stock forecast, Palantir analyst ratings, market sentiment, stock predictions, Palantir news. Analyzing these factors provides a clearer understanding of the current market perception and potential price movements.

Growth Potential and Long-Term Prospects for Palantir

Palantir's long-term prospects depend on several key factors:

- Government Contracts Pipeline: A significant portion of Palantir's revenue comes from government contracts. Analyzing the size and potential of this pipeline is critical for evaluating future revenue streams.

- Commercial Sector Growth Potential: Palantir is actively expanding its commercial operations. The success of this expansion will be a key driver of long-term growth.

- New Product Development and Technological Innovation: The company's ability to innovate and introduce new products will determine its ability to compete in the dynamic data analytics market.

Keywords: Palantir growth, Palantir future, long-term investment, data analytics market, government contracts. The potential for growth in both the government and commercial sectors, coupled with ongoing innovation, is essential for long-term success.

Risks and Challenges Facing Palantir

Investing in Palantir also involves understanding the inherent risks:

- Competition: Palantir faces competition from larger tech companies with substantial resources.

- Dependence on Government Contracts: A significant reliance on government contracts exposes the company to potential budget cuts or shifts in government priorities.

- Economic Downturn: Economic downturns can negatively impact spending on data analytics solutions.

- Data Privacy Concerns: Operating in the data analytics space requires careful consideration of data privacy regulations and potential security breaches.

Keywords: Palantir risks, Palantir challenges, investment risks, market volatility. A comprehensive understanding of these risks is essential for making a well-informed investment decision.

Conclusion: Should You Buy Palantir Stock Before May 5th?

Based on our analysis, Palantir stock presents both opportunities and challenges before May 5th. While the company shows potential for growth in the data analytics market and boasts a strong pipeline of government contracts, risks associated with competition, economic conditions, and reliance on government funding need careful consideration. Whether it's a buy, sell, or hold depends on your risk tolerance and investment horizon. A thorough examination of Palantir's financials, market sentiment, and future prospects is crucial. Conduct your own due diligence before making any investment decisions regarding Palantir stock. Keywords: Palantir stock recommendation, Palantir buy or sell, investment decision, Palantir analysis.

Featured Posts

-

Melanie Eiffel Une Figure Incontournable De L Histoire De Dijon Et De La Tour Eiffel

May 09, 2025

Melanie Eiffel Une Figure Incontournable De L Histoire De Dijon Et De La Tour Eiffel

May 09, 2025 -

The Closing Of Anchor Brewing Company Impact On The Craft Beer Industry

May 09, 2025

The Closing Of Anchor Brewing Company Impact On The Craft Beer Industry

May 09, 2025 -

Joanna Page Accuses Wynne Evans Of Trying Too Hard On Bbc Show

May 09, 2025

Joanna Page Accuses Wynne Evans Of Trying Too Hard On Bbc Show

May 09, 2025 -

Will Hertls Injury Sideline The Golden Knights

May 09, 2025

Will Hertls Injury Sideline The Golden Knights

May 09, 2025 -

Sensex And Nifty Live Updates Market Rally Continues Broad Based Gains

May 09, 2025

Sensex And Nifty Live Updates Market Rally Continues Broad Based Gains

May 09, 2025