Sensex & Nifty LIVE Updates: Market Rally Continues, Broad-Based Gains

Table of Contents

Sensex Gains Momentum: Sector-Wise Analysis

The Sensex has demonstrated remarkable momentum, climbing steadily throughout the trading session. This Sensex surge is not confined to a single sector; instead, it represents a broad-based rally fueled by strong performances across various industry segments. We've seen significant sectoral gains, with some outperforming others.

- Banking Sector Dominance: Banking stocks have led the charge, contributing significantly to the Sensex's rise. HDFC Bank and SBI, two major players, have seen substantial percentage increases, reflecting positive investor sentiment towards the financial sector. The robust performance is likely linked to healthy credit growth and positive regulatory developments.

- IT Sector Strength: The IT sector also experienced strong gains, driven by positive global cues and impressive quarterly results from several key players. This reflects continued confidence in the Indian IT industry's capabilities and its ability to navigate global economic headwinds.

- FMCG Sector Stability: The Fast-Moving Consumer Goods (FMCG) sector showed steady growth, indicating resilience amidst inflationary pressures. This stability showcases the consistent demand for essential goods.

| Sector | Percentage Gain (%) |

|---|---|

| Banking | +2.5 |

| IT | +1.8 |

| FMCG | +1.2 |

| Pharmaceuticals | +0.8 |

Nifty Index Follows Suit: Key Drivers of Growth

The Nifty index mirrors the Sensex's positive performance, exhibiting robust growth driven by a confluence of factors. This Nifty surge is not a random event; rather, it's a result of several key drivers contributing to the overall market positivity.

-

Strong FII Inflows: Significant Foreign Institutional Investor (FII) inflows have played a crucial role in boosting the Nifty index. This influx of foreign capital signals a positive outlook for the Indian economy and its potential for future growth.

-

Positive Global Sentiment: Positive global sentiment, driven by easing inflation concerns in certain major economies, has also contributed to the market's upward trajectory. This improved global outlook provides a supportive backdrop for Indian equities.

-

Robust Domestic Demand: Strong domestic demand continues to underpin the growth of the Nifty, indicating robust consumer spending and overall economic activity within India. Improved macroeconomic indicators further bolster investor confidence.

-

Improved Macroeconomic Indicators:

- Increased industrial production

- Stable inflation rates

- Positive GDP growth projections

Live Market Data & Key Stock Performances

(Note: The following data is illustrative and should be replaced with live market data at the time of publishing.)

As of [Time of Publication], the Sensex closed at [Sensex Closing Price] with a percentage change of [+X%]. The Nifty closed at [Nifty Closing Price] with a percentage change of [+Y%].

Here's a snapshot of some key stock performances:

| Stock Name | Percentage Change (%) |

|---|---|

| Reliance Industries | +3.0 |

| Tata Consultancy Services (TCS) | +2.5 |

| HDFC Bank | +2.0 |

| Infosys | +1.8 |

(Insert a visually appealing table or chart here displaying key stock performances.)

Expert Opinions & Market Outlook

Market experts remain cautiously optimistic about the continued market rally. While the current surge is encouraging, they also advise caution, recognizing potential risks.

- "The current market rally appears sustainable in the short term, provided global uncertainties remain contained," says [Expert Name], [Expert Title].

- "However, rising inflation and potential geopolitical events could pose challenges," adds [Another Expert Name], [Another Expert Title]. "Investors should maintain a balanced portfolio and monitor developments closely."

Conclusion: Stay Updated on Sensex & Nifty LIVE Updates

The continued market rally, with significant gains in both the Sensex and Nifty indices, is a positive sign for the Indian economy. The broad-based nature of these gains, across various sectors, reflects strong investor sentiment and underlying economic strength. Key contributing factors include strong FII inflows, positive global cues, and robust domestic demand.

To stay abreast of the dynamic market situation, monitoring live updates is crucial. The information presented here provides a snapshot of the current market trend; however, market conditions can change rapidly. Therefore, regularly checking for Sensex & Nifty live updates is essential to make informed investment decisions. Subscribe to our newsletter or set up price alerts to stay informed about the latest developments in the Indian stock market. Stay updated on Sensex and Nifty live updates!

Featured Posts

-

The Epstein Files Analyzing Ag Bondis Decision And The Public Vote

May 09, 2025

The Epstein Files Analyzing Ag Bondis Decision And The Public Vote

May 09, 2025 -

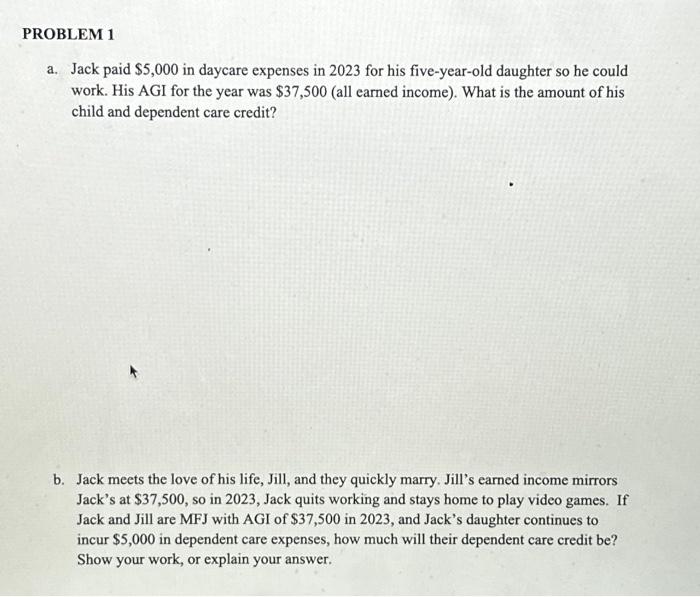

Man Learns Costly Lesson After 3 000 Babysitting Bill Results In Higher Daycare Fees

May 09, 2025

Man Learns Costly Lesson After 3 000 Babysitting Bill Results In Higher Daycare Fees

May 09, 2025 -

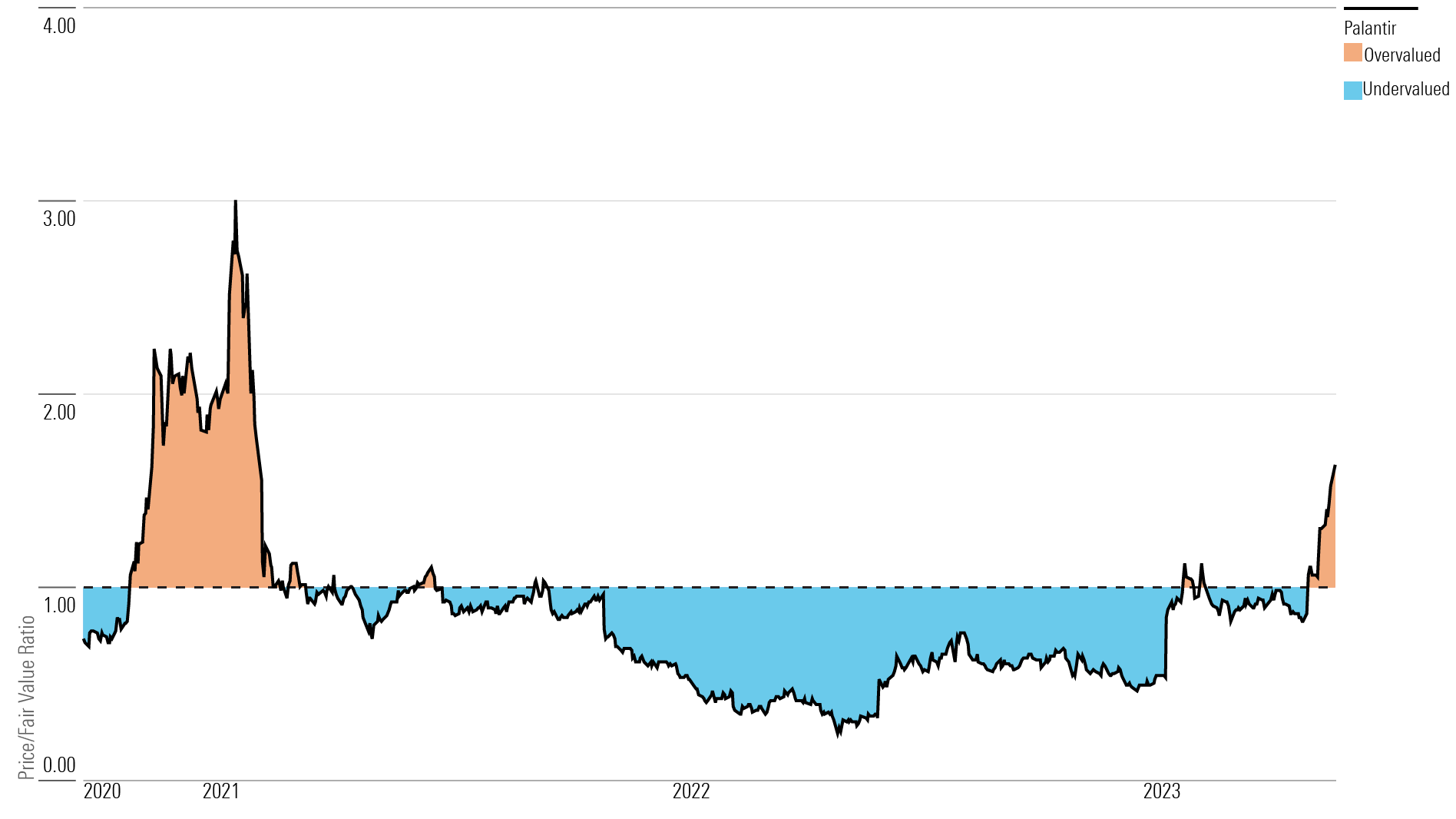

Should You Buy Palantir Stock Before May 5th Wall Streets Surprising Consensus

May 09, 2025

Should You Buy Palantir Stock Before May 5th Wall Streets Surprising Consensus

May 09, 2025 -

Nhl Highlights Kucherov Powers Lightning Past Oilers 4 1

May 09, 2025

Nhl Highlights Kucherov Powers Lightning Past Oilers 4 1

May 09, 2025 -

Jayson Tatum Colin Cowherds Continued Critique And Its Validity

May 09, 2025

Jayson Tatum Colin Cowherds Continued Critique And Its Validity

May 09, 2025