Analyzing QBTS Stock Performance Before And After Earnings

Table of Contents

QBTS Stock Performance Before Earnings Announcements

Examining Pre-Earnings Sentiment

Investor sentiment significantly impacts QBTS stock price in the lead-up to earnings. Analyzing this sentiment is crucial for predicting potential price movements. Several methods can be employed:

- News Article Analysis: Scrutinize financial news articles, press releases, and analyst reports for insights into the prevailing market opinion on QBTS. Look for keywords indicating positive or negative sentiment.

- Social Media Sentiment: Utilize social listening tools to gauge public opinion on QBTS from platforms like Twitter and StockTwits. Positive buzz can suggest bullish sentiment, while negative commentary might indicate a bearish outlook. Tools like Brandwatch or Talkwalker can aid this process.

- Analyst Predictions: Review earnings estimates and price targets from financial analysts covering QBTS. A consensus of positive predictions could signal a potential upward price movement.

Historically, QBTS stock has shown [insert specific example, e.g., a slight upward trend] in the week leading up to earnings announcements, though this is not always consistent. Analyzing historical price movements provides a valuable context for understanding pre-earnings behavior.

Identifying Price Volatility

QBTS stock exhibits considerable price volatility before earnings releases. Understanding this volatility is key to effective risk management.

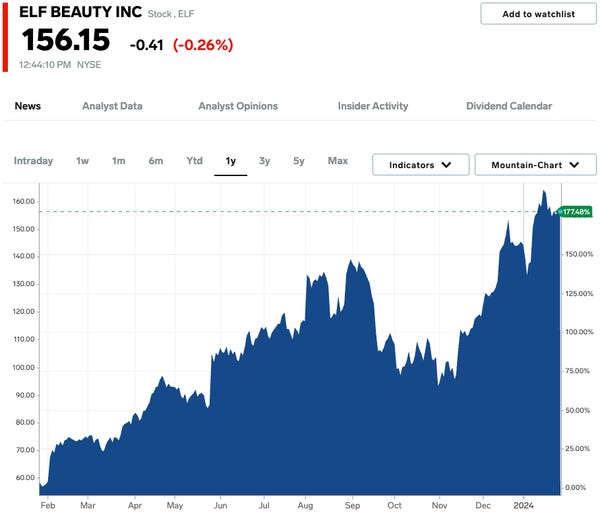

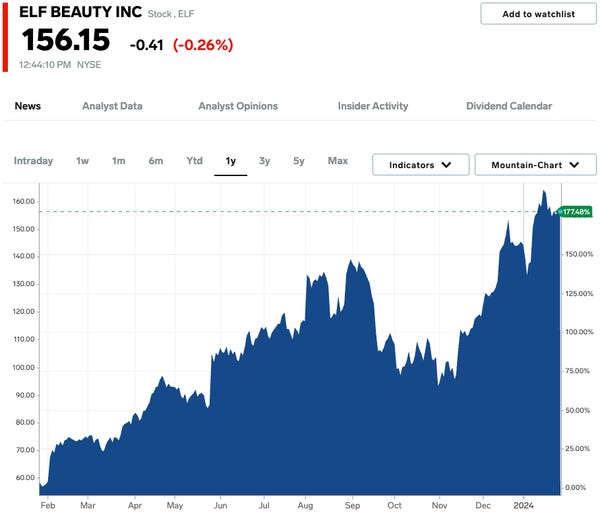

- Historical Volatility: Charts and graphs illustrating the standard deviation of QBTS stock prices in the weeks before past earnings announcements will highlight the typical fluctuation range. [Insert chart/graph here]

- Contributing Factors: Several factors contribute to this volatility: market-wide uncertainty, speculation surrounding the upcoming earnings report, and the release of company-specific news.

- Impact on Investment Strategies: High volatility can impact investment strategies. Conservative investors may prefer to reduce their exposure before earnings, while more aggressive investors might see opportunities for leveraged trading.

QBTS Stock Performance After Earnings Announcements

Immediate Post-Earnings Reaction

The immediate market reaction to QBTS earnings reports is often dramatic and depends heavily on whether the results were better or worse than expected.

- Earnings Surprises: Positive earnings surprises (beating analyst expectations) typically lead to an immediate price surge, while negative surprises often trigger sharp declines.

- Past Examples: Examining the immediate price movements following past earnings announcements (e.g., Q1 2023, Q2 2023) provides valuable case studies of market reactions. [Insert examples and data points here]

- Trading Volume: Increased trading volume immediately following the earnings release underscores the market's heightened activity and interest in QBTS stock.

Long-Term Performance Following Earnings

While the immediate reaction is significant, the long-term impact of earnings reports on QBTS stock price is equally crucial.

- Long-Term Trends: Charts illustrating the long-term performance of QBTS stock following various earnings reports can reveal consistent patterns or notable exceptions. [Insert chart/graph here]

- Influencing Factors: Long-term performance is influenced by factors like company guidance (future earnings projections), the overall market outlook, and any strategic initiatives announced by QBTS.

- Predictive Value: While not always reliable, analyzing post-earnings price changes can provide clues about the market's perception of the company's long-term prospects.

Factors Influencing QBTS Stock Performance

Macroeconomic Factors

Broader economic conditions significantly impact QBTS stock performance.

- Interest Rates & Inflation: Rising interest rates and high inflation can negatively affect investor sentiment and decrease demand for growth stocks like QBTS.

- Recessionary Fears: Fears of an economic recession often lead to decreased investment, potentially impacting QBTS's stock price negatively.

Company-Specific Factors

Beyond earnings, various company-specific events can sway QBTS's stock price:

- New Product Launches & Partnerships: Successful new product launches or strategic partnerships can boost investor confidence and drive the stock price up.

- Competitive Landscape: QBTS's competitive positioning within its industry significantly impacts its performance. Market share gains or losses can affect investor perception.

- Management Changes & Company Strategy: Changes in leadership or significant shifts in company strategy can cause uncertainty and impact the stock price, either positively or negatively.

Conclusion

Analyzing QBTS stock performance before and after earnings requires a multifaceted approach, considering pre-earnings sentiment, post-earnings reactions, and both macroeconomic and company-specific factors. Understanding the typical patterns and influencing factors allows investors to make more informed decisions. By carefully analyzing QBTS stock performance before and after earnings, you can enhance your understanding of this volatile asset and make more strategic investment choices. Continue your research and stay updated on QBTS’s performance to optimize your investment strategy. Remember to conduct thorough due diligence before making any investment decisions related to QBTS or any other stock.

Featured Posts

-

Diplomatie Succes De La Visite Du President Mahama A Abidjan

May 20, 2025

Diplomatie Succes De La Visite Du President Mahama A Abidjan

May 20, 2025 -

Officieel Jennifer Lawrence Is Opnieuw Moeder Geworden

May 20, 2025

Officieel Jennifer Lawrence Is Opnieuw Moeder Geworden

May 20, 2025 -

Hmrc Communication Responding To Recent Post

May 20, 2025

Hmrc Communication Responding To Recent Post

May 20, 2025 -

Guide Des Meilleurs Nouveaux Restaurants De Biarritz

May 20, 2025

Guide Des Meilleurs Nouveaux Restaurants De Biarritz

May 20, 2025 -

Nyt Mini Crossword Answers For March 31

May 20, 2025

Nyt Mini Crossword Answers For March 31

May 20, 2025

Latest Posts

-

I Megali Tessarakosti Esperida Stin Patriarxiki Akadimia Kritis

May 20, 2025

I Megali Tessarakosti Esperida Stin Patriarxiki Akadimia Kritis

May 20, 2025 -

Symposio Megalis Tessarakostis Patriarxiki Akadimia Kritis

May 20, 2025

Symposio Megalis Tessarakostis Patriarxiki Akadimia Kritis

May 20, 2025 -

Mnaqsht Tqryry Dywan Almhasbt 2022 2023 Fy Albrlman Iqrar Almkhalfat W Alathar Almtrtbt

May 20, 2025

Mnaqsht Tqryry Dywan Almhasbt 2022 2023 Fy Albrlman Iqrar Almkhalfat W Alathar Almtrtbt

May 20, 2025 -

Esperida Megalis Tessarakostis Stin Patriarxiki Akadimia Kritis

May 20, 2025

Esperida Megalis Tessarakostis Stin Patriarxiki Akadimia Kritis

May 20, 2025 -

Representatives Push For 1 231 Billion In Oil Company Repayments

May 20, 2025

Representatives Push For 1 231 Billion In Oil Company Repayments

May 20, 2025