Representatives' Push For $1.231 Billion In Oil Company Repayments

Table of Contents

The Rationale Behind the $1.231 Billion Repayment Demand

The representatives' demand for $1.231 billion in repayments stems from a complex interplay of accusations, including allegations of price gouging, environmental damage, and financial irregularities.

Allegations of Price Gouging and Unfair Practices

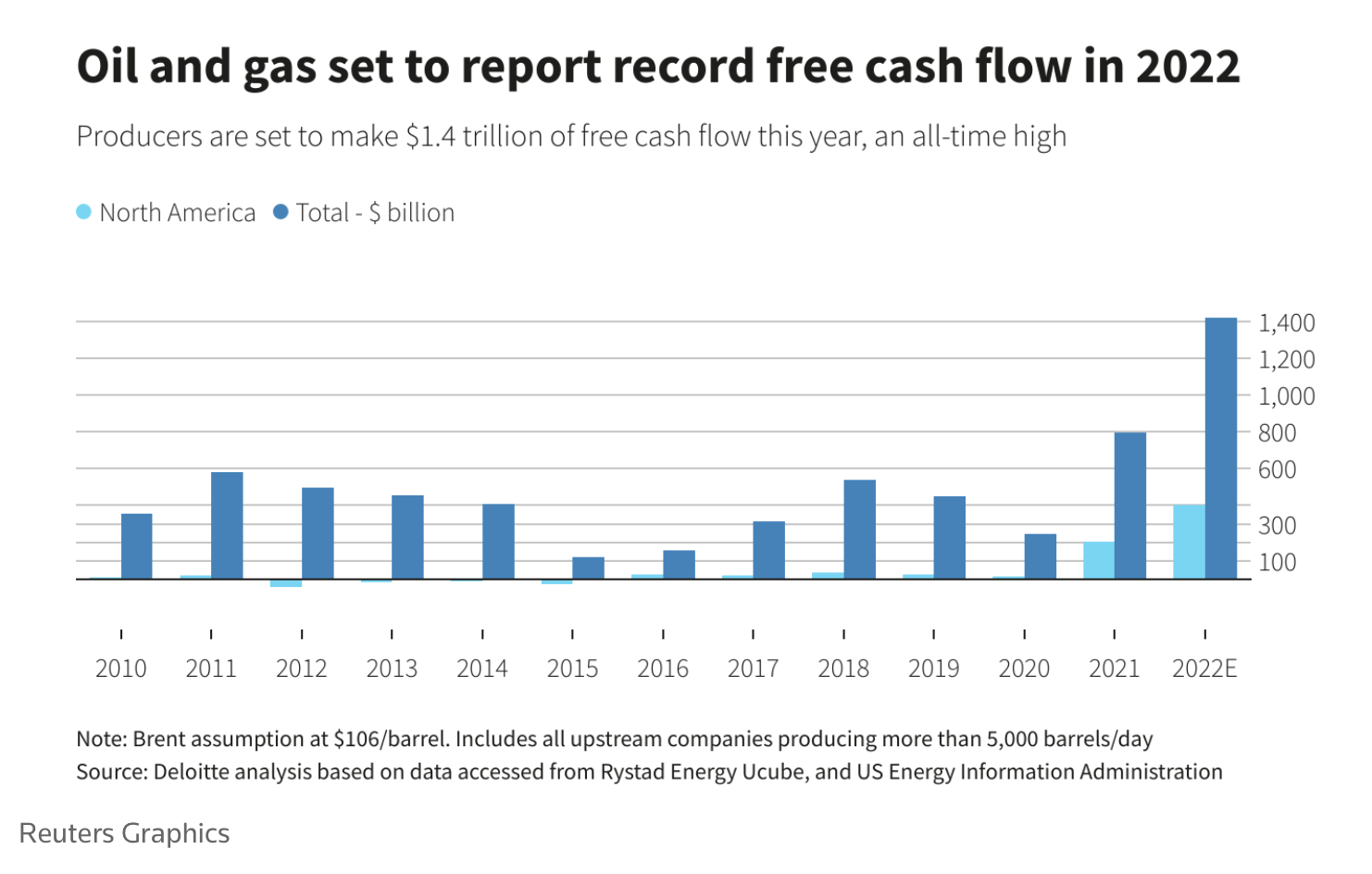

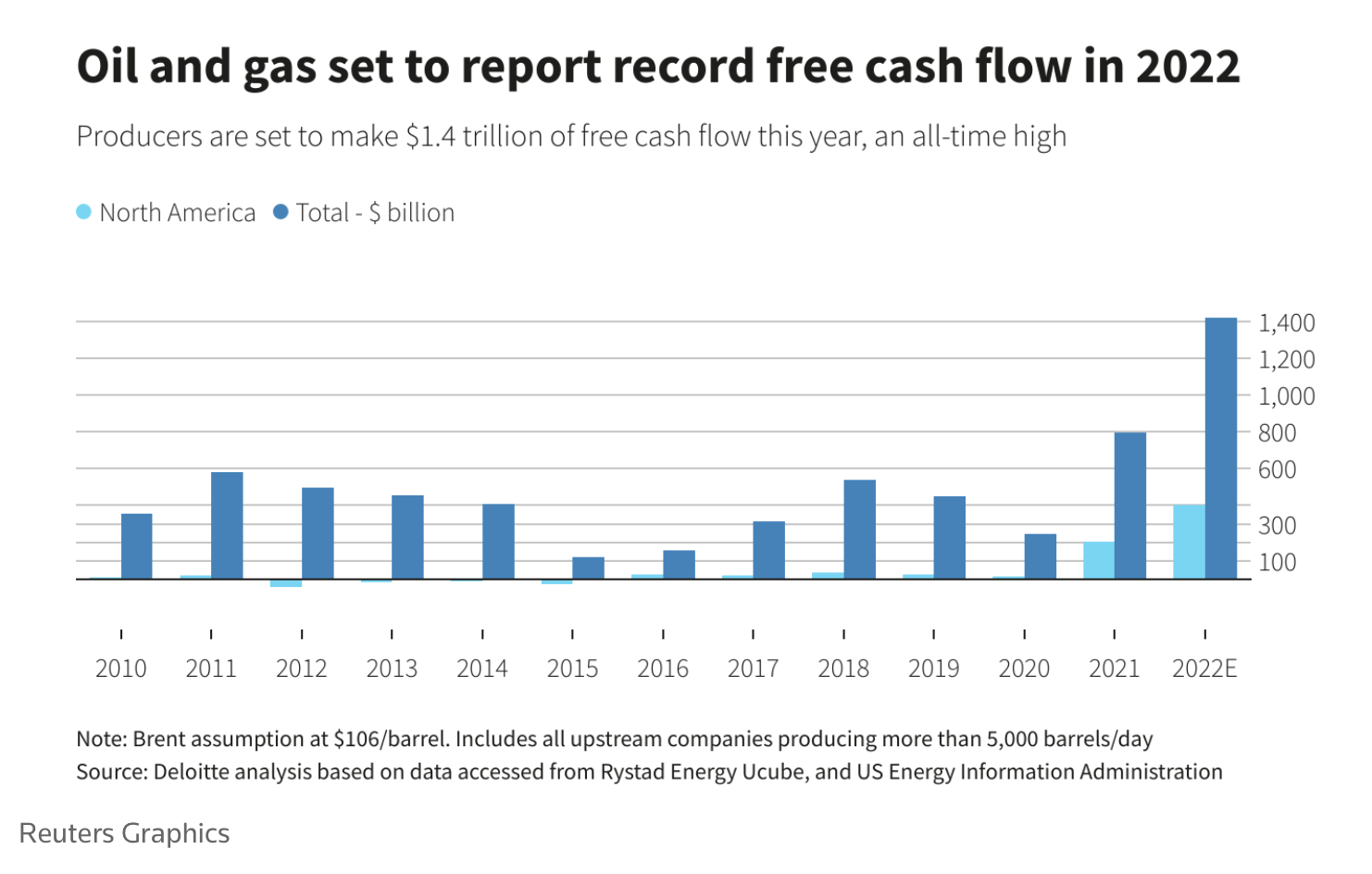

Representatives allege that several oil companies engaged in price gouging and unfair practices, exploiting market volatility to inflate fuel prices and generate excessive profits. This is a direct violation of [cite relevant legislation, e.g., the Consumer Protection Act], which prohibits unfair trade practices.

- Example 1: Evidence suggests a significant discrepancy between the cost of oil production and the retail price of gasoline, indicating potential price manipulation.

- Example 2: Internal company documents, obtained through [mention the source, e.g., a whistleblower], allegedly reveal coordinated efforts to artificially inflate prices.

- Legal Basis: The demand cites [mention specific laws] as the legal basis for the repayment, arguing that the oil companies violated these statutes through their actions.

Environmental Concerns and Liability

A significant portion of the $1.231 billion repayment demand relates to environmental damages attributed to the oil companies' operations. This includes pollution, habitat destruction, and the long-term consequences of climate change.

- Specific Environmental Issues: Oil spills, methane emissions, and contamination of water sources are among the cited environmental concerns.

- Cleanup Costs: The representatives estimate that the cost of cleaning up and remediating the environmental damage caused by these companies amounts to a significant portion of the $1.231 billion demand.

- Legal Arguments: The representatives are leveraging environmental protection laws such as [cite specific laws and regulations] to support their claims of environmental liability.

Tax Evasion and Financial Irregularities

Further fueling the demand for repayment are allegations of tax evasion and other financial irregularities. The representatives claim the oil companies employed sophisticated schemes to avoid paying their fair share of taxes.

- Specific Examples: Allegations include the use of offshore accounts to hide profits, the manipulation of financial reports, and the exploitation of tax loopholes.

- Investigation Processes: The investigation into these alleged financial irregularities involved [mention investigation bodies and their methods].

- Potential Penalties: Based on the findings, the representatives argue that the penalties for these offenses contribute significantly to the $1.231 billion repayment demand.

The Oil Companies' Response to the Repayment Demand

The oil companies have vehemently denied the allegations and the $1.231 billion repayment demand. Their response has been multi-pronged, focusing on legal challenges and public relations efforts.

Official Statements and Counterarguments

The oil companies issued statements refuting the accusations of price gouging, environmental damage, and financial misconduct.

- Direct Quotes: [Insert direct quotes from the oil companies' official statements].

- Key Arguments: Their defense strategy centers on [summarize the key arguments used by the oil companies].

- Strategies: The companies are actively engaging in public relations campaigns to counter negative perceptions.

Potential Legal Challenges and Outcomes

The oil companies are expected to mount significant legal challenges against the representatives' demand.

- Legal Avenues: They are likely to pursue [mention the legal avenues the companies may use].

- Likely Outcomes: Based on previous legal precedents, the outcome of these cases remains uncertain.

- Timeline: The legal battles are expected to stretch over [estimate the timeline for the legal proceedings].

Political and Public Impact of the $1.231 Billion Repayment Demand

The representatives' push for $1.231 billion in oil company repayments has far-reaching political and public implications.

Public Opinion and Media Coverage

The news has sparked a heated public debate, with significant media coverage and diverse public reactions.

- Public Opinion Polls: [Include relevant poll data if available].

- Media Coverage: Major news outlets have reported on the story, with varied perspectives.

- Social Media Trends: Social media is buzzing with discussions related to the issue, often reflecting polarized opinions.

Implications for Future Energy Policy

This event could significantly impact future energy policy and government regulation of the oil industry.

- Potential Policy Changes: The outcome of this case could lead to stricter regulations and increased scrutiny of oil company practices.

- Increased Scrutiny: Expect increased oversight and accountability measures for the industry.

- Shift in Public Trust: The event will likely impact public trust and confidence in the oil industry.

Conclusion

The representatives' push for $1.231 billion in oil company repayments represents a pivotal moment in the energy sector. The allegations of price gouging, environmental damage, and financial irregularities raise serious concerns about corporate accountability and responsible energy practices. The legal battles ahead and the subsequent policy implications will shape the future of the energy industry and determine the extent to which oil companies are held responsible for their actions. Stay tuned for further updates on this critical development as representatives continue their push for $1.231 billion in oil company repayments, and let your voice be heard on the issue of corporate responsibility within the energy sector.

Featured Posts

-

Nyt Mini Daily Puzzle Solutions Tips And How To Play

May 20, 2025

Nyt Mini Daily Puzzle Solutions Tips And How To Play

May 20, 2025 -

Dzhenifr Lorns Ofitsialno Potvrzhdenie Za Vtoroto Y Bebe

May 20, 2025

Dzhenifr Lorns Ofitsialno Potvrzhdenie Za Vtoroto Y Bebe

May 20, 2025 -

Stock Market Valuation Concerns Expert Analysis From Bof A

May 20, 2025

Stock Market Valuation Concerns Expert Analysis From Bof A

May 20, 2025 -

Robert Pattinson And Suki Waterhouse A Look At Twilight Star Relationships

May 20, 2025

Robert Pattinson And Suki Waterhouse A Look At Twilight Star Relationships

May 20, 2025 -

Tariff Wars And Ryanairs Future The Significance Of The Buyback

May 20, 2025

Tariff Wars And Ryanairs Future The Significance Of The Buyback

May 20, 2025

Latest Posts

-

Architecture Toscane En Petite Italie De L Ouest Un Voyage Architectural

May 21, 2025

Architecture Toscane En Petite Italie De L Ouest Un Voyage Architectural

May 21, 2025 -

Decouvrir La Petite Italie De L Ouest Une Architecture Toscane Exceptionnelle

May 21, 2025

Decouvrir La Petite Italie De L Ouest Une Architecture Toscane Exceptionnelle

May 21, 2025 -

Preserving Cassis Blackcurrant Jams Jellies And Other Delights

May 21, 2025

Preserving Cassis Blackcurrant Jams Jellies And Other Delights

May 21, 2025 -

Cest La Petite Italie De L Ouest Architecture Toscane Et Charme Inattendu

May 21, 2025

Cest La Petite Italie De L Ouest Architecture Toscane Et Charme Inattendu

May 21, 2025 -

Cassis Blackcurrant Vs Other Berries A Comparative Analysis

May 21, 2025

Cassis Blackcurrant Vs Other Berries A Comparative Analysis

May 21, 2025