Analyzing The Bitcoin Rebound: What Investors Need To Know

Table of Contents

Understanding the Recent Bitcoin Price Drop and the Subsequent Rebound

Factors Contributing to the Price Drop

The recent Bitcoin price drop wasn't a single event but a confluence of factors. Understanding these is key to interpreting the current Bitcoin rebound and predicting future price movements. Key contributing factors include:

-

Increased regulatory scrutiny in various countries: Governments worldwide are increasingly scrutinizing the cryptocurrency market, leading to uncertainty and impacting investor confidence. For example, the SEC's actions against certain crypto exchanges have created a ripple effect across the market.

-

Macroeconomic factors like inflation and interest rate hikes: The broader economic climate plays a significant role. High inflation and rising interest rates often lead investors to shift away from riskier assets like Bitcoin towards more stable investments. The correlation between Bitcoin's price and traditional market indices is undeniable.

-

Negative sentiment surrounding specific crypto projects: The collapse of prominent projects has shaken investor confidence, leading to a general sell-off across the crypto market, including Bitcoin. This highlights the interconnectedness of the crypto ecosystem.

-

Market manipulation concerns: Allegations of market manipulation and insider trading continue to plague the cryptocurrency market, adding to uncertainty and volatility. Increased transparency and regulation are needed to address these concerns.

-

Specific Example (Regulatory Actions): The recent crackdown on crypto lending platforms in the US has directly impacted Bitcoin's price, creating fear and uncertainty among investors.

-

Specific Example (Macroeconomic Factors): The Federal Reserve's interest rate hikes in 2022 directly correlated with a significant decline in Bitcoin's price as investors sought safer, higher-yield options.

Drivers of the Current Bitcoin Rebound

Despite the challenges, several factors are contributing to the current Bitcoin rebound:

-

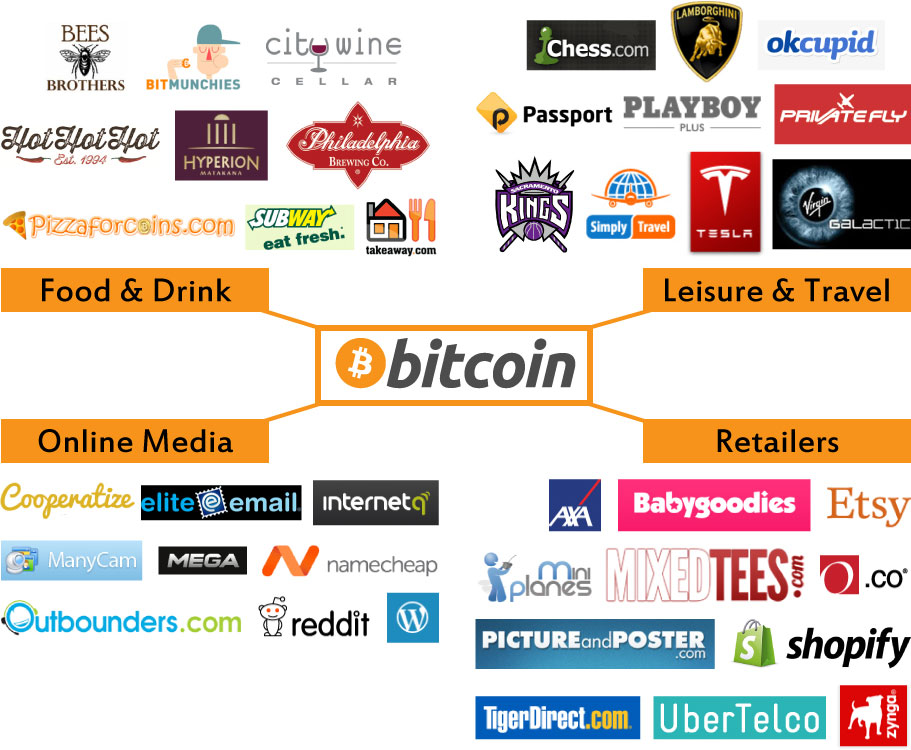

Increased institutional investment: Large institutional investors, including hedge funds and corporations, are increasingly allocating assets to Bitcoin, viewing it as a potential long-term store of value and a hedge against inflation. This influx of capital provides significant support for the price.

-

Growing adoption of Bitcoin as a hedge against inflation: With persistent inflation in many economies, Bitcoin's limited supply and decentralized nature are becoming increasingly attractive to investors seeking to protect their purchasing power. This narrative of Bitcoin as "digital gold" is gaining traction.

-

Technological advancements within the Bitcoin network: Ongoing developments in the Bitcoin ecosystem, such as the Lightning Network for faster and cheaper transactions, continue to improve its functionality and appeal. This enhances Bitcoin's utility and potential for wider adoption.

-

Positive news and developments in the crypto space: Positive regulatory developments in certain jurisdictions, alongside successful launches of new Bitcoin-related products and services, can significantly impact market sentiment and drive price increases.

-

Specific Example (Institutional Investment): BlackRock's recent application for a Bitcoin ETF signals a significant shift in institutional investor sentiment towards Bitcoin.

-

Specific Example (Bitcoin ETFs): The potential approval of Bitcoin ETFs in major markets could significantly boost market confidence and liquidity, driving further price appreciation.

Technical Analysis of the Bitcoin Rebound

Chart Patterns and Indicators

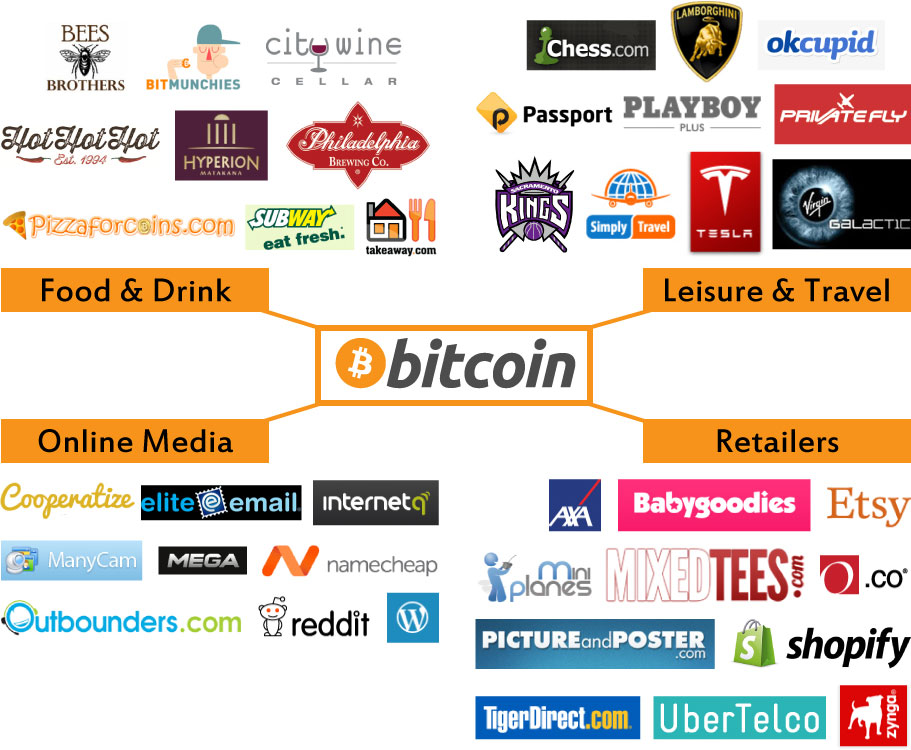

Technical analysis provides valuable insights into the potential trajectory of the Bitcoin rebound. Analyzing key chart patterns and indicators offers a data-driven perspective:

-

Support and resistance levels: Identifying key support and resistance levels on the price chart helps predict potential price reversals or breakouts. These levels represent psychological barriers that can influence buying and selling pressure.

-

Moving averages and relative strength index (RSI): Moving averages (like the 50-day and 200-day MA) smooth out price fluctuations and identify trends, while the RSI helps gauge the strength of price movements and potential overbought or oversold conditions.

-

Potential breakout scenarios: Analyzing chart patterns like triangles, head and shoulders, or flags can help predict potential breakout scenarios, indicating either a continuation of the upward trend or a potential reversal.

-

Chart and Graph Example: [Insert chart showing support/resistance levels, moving averages, and RSI].

-

Significance of Key Price Levels: Breaking above the $30,000 level could signal a strong continuation of the Bitcoin rebound, while failure to hold above $28,000 could indicate a potential pullback.

Volume and Market Sentiment

Understanding trading volume and market sentiment is crucial for interpreting price movements:

-

Trading volume: High trading volume accompanying price increases confirms the strength of the upward trend, suggesting sustained buying pressure. Conversely, low volume could indicate a weak rally prone to reversals.

-

Social media sentiment and news coverage: Monitoring social media sentiment and news coverage can help gauge overall market sentiment towards Bitcoin. Positive sentiment generally correlates with higher prices, while negative news can trigger sell-offs.

-

Correlation between Trading Volume and Price: A surge in trading volume alongside a price increase indicates strong buying pressure and a sustained upward trend.

-

Interpreting Social Media Sentiment: Positive social media sentiment, along with favorable news coverage, generally indicates bullish market sentiment and potential for further price increases.

Risk Assessment and Investment Strategies for the Bitcoin Rebound

Managing Risk in a Volatile Market

Investing in Bitcoin carries inherent risks due to its volatility. Effective risk management is crucial:

-

Diversification strategies for cryptocurrency portfolios: Don't put all your eggs in one basket. Diversify your cryptocurrency portfolio across various assets to mitigate risk.

-

Dollar-cost averaging (DCA) as a risk mitigation technique: DCA involves investing a fixed amount of money at regular intervals, regardless of price fluctuations. This reduces the risk of investing a large sum at a market peak.

-

Understanding stop-loss orders and their importance: Stop-loss orders automatically sell your Bitcoin if the price drops below a predetermined level, limiting potential losses.

-

Example Diversified Portfolio: A diversified portfolio might include Bitcoin, Ethereum, stablecoins, and other altcoins, each with a carefully considered allocation.

-

Advantages and Disadvantages of DCA: While DCA reduces risk, it might also mean missing out on significant price gains if the market experiences a rapid and sustained upward trend.

Long-Term vs. Short-Term Investment Approaches

Investors should choose an approach aligned with their risk tolerance and investment goals:

-

Strategies for long-term Bitcoin holders (HODL): HODLing (Holding On for Dear Life) involves buying and holding Bitcoin for the long term, believing in its long-term value proposition. This strategy requires patience and resilience to withstand short-term price fluctuations.

-

Trading strategies for short-term gains (day trading, swing trading): Day trading and swing trading involve attempting to profit from short-term price movements. These strategies require significant market knowledge, technical analysis skills, and risk tolerance.

-

Importance of Investment Timeframe: A clear investment timeframe is crucial. Short-term traders focus on daily or weekly price movements, while long-term investors focus on years.

-

Risks and Rewards: Short-term trading offers high potential rewards but also high risk, while long-term HODLing offers lower risk but potentially slower returns.

Conclusion

The Bitcoin rebound presents both opportunities and challenges for investors. Understanding the underlying factors driving the price fluctuations, employing sound technical analysis, and implementing effective risk management strategies are crucial for navigating this dynamic market. By carefully considering the information presented in this analysis of the Bitcoin rebound, investors can make more informed decisions about their cryptocurrency investments. Stay informed on market trends and continue to analyze the Bitcoin rebound to capitalize on potential opportunities. Remember to always conduct thorough research and consult with a financial advisor before making any investment decisions.

Featured Posts

-

Difficultes D Epicure A La Cite De La Gastronomie De Dijon Implication Municipale

May 09, 2025

Difficultes D Epicure A La Cite De La Gastronomie De Dijon Implication Municipale

May 09, 2025 -

Analyzing Palantir Stock Is It A Buy Before May 5th

May 09, 2025

Analyzing Palantir Stock Is It A Buy Before May 5th

May 09, 2025 -

Wynne Evans Road To Recovery Illness Details And Future Plans

May 09, 2025

Wynne Evans Road To Recovery Illness Details And Future Plans

May 09, 2025 -

Survivors Anguish Nottingham Attack Victim Speaks For The First Time

May 09, 2025

Survivors Anguish Nottingham Attack Victim Speaks For The First Time

May 09, 2025 -

Cheaper Elizabeth Arden Skincare Best Deals Online

May 09, 2025

Cheaper Elizabeth Arden Skincare Best Deals Online

May 09, 2025