Analyzing The Long-Term Effects Of Trump's Trade Policies On US Finance

Table of Contents

The Trump administration's dramatic shift in US trade policy, characterized by widespread tariff imposition, left an undeniable mark on the American economy. The imposition of tariffs on hundreds of billions of dollars worth of goods from China and other nations triggered a period of significant uncertainty and upheaval. Understanding the long-term effects of Trump's trade policies on US finance is crucial for navigating the current economic landscape and preventing future instability. This article aims to analyze the lasting consequences of these actions on the US financial system, examining their impact on inflation, global trade, and the US dollar's role in the international arena.

H2: The Impact of Tariffs on Inflation and Consumer Prices

H3: Increased Costs for Businesses and Consumers: Trump's tariffs directly increased the cost of imported goods. These increased costs were not absorbed by businesses but were passed on to consumers, leading to a rise in inflation.

- Examples: Tariffs on steel and aluminum raised prices for automobiles and construction materials. Tariffs on Chinese goods impacted various consumer products, from electronics to clothing.

- Data: Studies by the Federal Reserve and independent economists documented a clear correlation between tariff increases and higher consumer prices, impacting the Consumer Price Index (CPI).

- Analysis: This increase in prices reduced consumer purchasing power, potentially contributing to a slowdown in economic growth and impacting consumer confidence. The long-term effect could include a shift in consumer spending habits and a potential decrease in overall economic prosperity.

H3: Effects on Specific Sectors: The impact of tariffs wasn't uniform across all sectors. Certain industries, particularly agriculture and manufacturing, faced disproportionately negative consequences.

- Case Studies: The American farming sector, heavily reliant on exports, suffered from retaliatory tariffs imposed by China. The manufacturing sector faced increased input costs, affecting their competitiveness in global markets.

- Job Losses/Gains: While some sectors might have seen short-term gains from increased domestic production, the overall impact often led to job losses in export-oriented industries due to reduced demand and competitiveness.

- Analysis: The long-term competitiveness of these sectors in the global market remains a concern. The restructuring and adaptation required to overcome the negative impacts of these tariffs continues to be a challenge.

H2: The Shifting Global Trade Landscape and its Financial Repercussions

H3: Trade Wars and Retaliation: Trump's aggressive trade tactics ignited retaliatory measures from other countries. These actions, often described as "trade wars," significantly impacted US exports and businesses.

- Examples: China's retaliatory tariffs on soybeans and other agricultural products inflicted considerable damage on American farmers. Similar retaliatory measures were seen from the European Union and other trading partners.

- Analysis: These trade wars damaged international trade relationships, fostering uncertainty and decreasing investor confidence in both domestic and international markets. This uncertainty directly impacted financial markets, creating volatility and negatively affecting long-term investment strategies.

H3: Restructuring of Global Supply Chains: In response to Trump's policies, many companies began restructuring their global supply chains. This involved significant costs and strategic shifts.

- Examples: Some companies relocated manufacturing to other countries to avoid tariffs. Others invested heavily in automation to reduce reliance on imported components. Some diversified their suppliers, reducing dependence on single sources.

- Analysis: The long-term implications for US manufacturing and employment remain complex. While some companies benefited from reshoring or nearshoring, others faced substantial challenges and losses. The overall impact on job creation is still being evaluated.

H2: The Role of the US Dollar and International Investment

H3: The Dollar's Strength and Weakness: Trump's trade policies had a significant impact on the value of the US dollar. The initial strength of the dollar, partially attributed to a flight to safety during periods of trade uncertainty, later fluctuated.

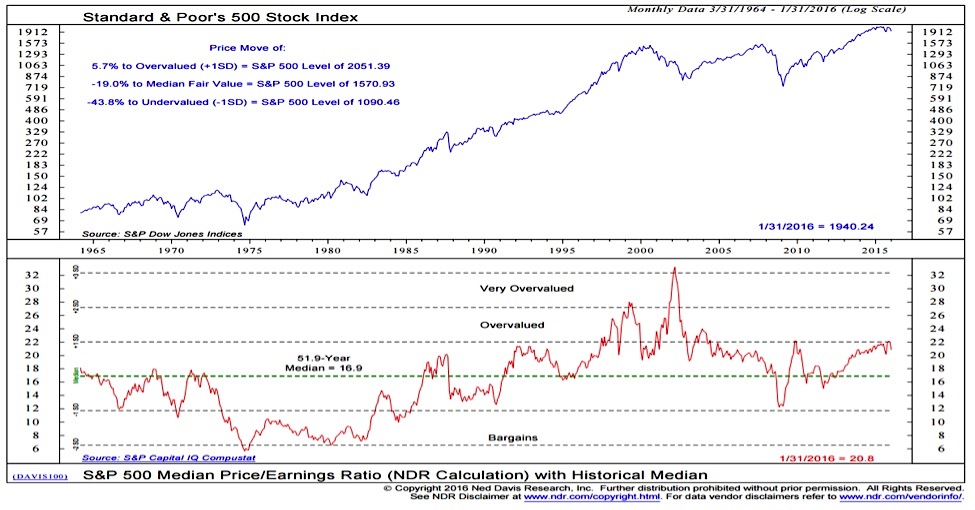

- Charts and Graphs: Economic data and visual representations showing the fluctuations in the value of the US dollar during this period would illustrate the impact of trade policies on currency exchange rates.

- Analysis: Fluctuations in the dollar's value impacted US exports and imports. A stronger dollar made US exports more expensive and imports cheaper, while a weaker dollar had the opposite effect, creating both benefits and drawbacks for various sectors.

H3: Impact on Foreign Direct Investment (FDI): The uncertainty generated by Trump's trade policies had a chilling effect on foreign direct investment (FDI) in the US.

- Data: Statistics on FDI inflows and outflows during this period could reveal the extent to which uncertainty hampered investment.

- Examples: Specific examples of companies delaying or canceling investment projects in the US due to trade uncertainty would strengthen this analysis.

- Analysis: A reduction in FDI can have long-term effects on US economic growth and job creation, particularly in sectors reliant on foreign investment.

Conclusion: Understanding the Lasting Legacy of Trump's Trade Policies on US Finance

In summary, Trump's trade policies had multifaceted and far-reaching consequences for US finance. Tariffs led to increased inflation and hurt specific sectors. The resulting trade wars damaged international relationships and investor confidence. The value of the US dollar fluctuated, and FDI inflows were negatively impacted. The long-term outlook suggests continued ripple effects, including ongoing adjustments to supply chains and lingering impacts on inflation and economic growth. For a deeper analysis of Trump's trade policies and their long-term financial implications, further study of US finance in the post-Trump era is crucial. Resources such as the Congressional Research Service reports, Federal Reserve publications, and academic journals offer valuable insights for continued learning.

Featured Posts

-

Overcoming The Hurdles Robots And Nike Sneaker Production

Apr 22, 2025

Overcoming The Hurdles Robots And Nike Sneaker Production

Apr 22, 2025 -

Access To Birth Control The Otc Revolution After Roe V Wade

Apr 22, 2025

Access To Birth Control The Otc Revolution After Roe V Wade

Apr 22, 2025 -

Metas Future Under The Shadow Of The Trump Administration

Apr 22, 2025

Metas Future Under The Shadow Of The Trump Administration

Apr 22, 2025 -

Los Angeles Palisades Fire A List Of Celebrities Who Lost Their Properties

Apr 22, 2025

Los Angeles Palisades Fire A List Of Celebrities Who Lost Their Properties

Apr 22, 2025 -

Why Investors Shouldnt Fear High Stock Market Valuations Bof As Perspective

Apr 22, 2025

Why Investors Shouldnt Fear High Stock Market Valuations Bof As Perspective

Apr 22, 2025

Latest Posts

-

Jazz Cash And K Trade Partner To Democratize Stock Investing And Trading

May 10, 2025

Jazz Cash And K Trade Partner To Democratize Stock Investing And Trading

May 10, 2025 -

Dakota Johnson Supported By Family At Materialist La Screening

May 10, 2025

Dakota Johnson Supported By Family At Materialist La Screening

May 10, 2025 -

Dakota Johnsons Family Rallies At Materialist Premiere

May 10, 2025

Dakota Johnsons Family Rallies At Materialist Premiere

May 10, 2025 -

Dakota Johnson Ir Kraujas Is Nosies Tiesa Apie Nuotraukas

May 10, 2025

Dakota Johnson Ir Kraujas Is Nosies Tiesa Apie Nuotraukas

May 10, 2025 -

Podoba Je Zarazajuca Slovenska Dakota Johnson

May 10, 2025

Podoba Je Zarazajuca Slovenska Dakota Johnson

May 10, 2025