Analyzing Warren Buffett's Apple Sale: Timing, Strategy, And Future Outlook

Table of Contents

The Timing of the Apple Sale

Market Conditions at the Time of the Sale

The Warren Buffett Apple Sale occurred amidst a backdrop of significant economic uncertainty. Several factors played a crucial role in the timing of this decision:

- Interest Rate Hikes: The Federal Reserve's aggressive interest rate hikes aimed at curbing inflation created a more challenging environment for equities. Higher interest rates increase borrowing costs for companies and reduce the attractiveness of riskier assets.

- Inflationary Pressures: Persistent inflation eroded consumer spending power and impacted corporate profitability, increasing the uncertainty surrounding future earnings growth for many companies, including Apple.

- Recessionary Fears: Growing concerns about a potential recession further dampened investor sentiment and increased market volatility, making it a prudent time for some investors to take profits.

- Stock Market Fluctuations: The stock market experienced significant fluctuations in the period leading up to the sale, potentially influencing Buffett's decision to adjust Berkshire Hathaway's position in Apple.

Berkshire Hathaway's Portfolio Diversification

The sale also needs to be viewed within the context of Berkshire Hathaway's overall portfolio diversification strategy. Buffett is known for his long-term, value-oriented approach to investing and maintaining a well-diversified portfolio:

- Other Major Holdings: Berkshire Hathaway's portfolio includes significant stakes in a diverse range of companies across various sectors, providing a cushion against losses in any single investment. Examples include Coca-Cola, Bank of America, and American Express.

- Portfolio Balance and Risk Management: Buffett's approach to portfolio management emphasizes risk mitigation. By strategically diversifying assets and occasionally trimming large positions, he aims to safeguard against significant losses and maintain a stable investment strategy.

- Investment Opportunities: The sale might have freed up capital for Berkshire Hathaway to pursue other investment opportunities that Buffett deems more attractive in the current market environment.

Strategic Rationale Behind the Sale

Profit Taking and Valuation Concerns

One of the primary reasons for the Warren Buffett Apple Sale could be profit-taking. Apple's stock had experienced significant growth in the preceding years, leading to a potentially high valuation:

- Sale Price and Apple's Stock Performance: The price at which Berkshire Hathaway sold its Apple shares needs to be compared with the stock's performance over the previous months and years to determine if the sale resulted in significant profit.

- Valuation Models: Buffett and his team likely employed various valuation models to assess Apple's intrinsic value. If the perceived value deviated significantly from the market price, it could have triggered a decision to reduce exposure.

Shifting Investment Priorities

The sale might also indicate a shift in investment priorities within Berkshire Hathaway:

- Other Investments and Acquisitions: It's crucial to examine other significant investments or acquisitions made by Berkshire Hathaway around the same time. This could reveal potential sectors where Buffett is reallocating capital.

- New Investment Targets: The sale may reflect Buffett's ongoing search for undervalued assets and attractive investment opportunities in other sectors, potentially indicating a strategic shift away from technology stocks.

Future Outlook: Implications for Apple and Berkshire Hathaway

Impact on Apple's Stock Price

The Warren Buffett Apple Sale had a noticeable, albeit short-lived, impact on Apple's stock price:

- Investor Sentiment and Market Reaction: The initial market reaction was negative, but the effect was relatively muted, suggesting that the market anticipated potential adjustments to Berkshire Hathaway's holdings.

- Future Growth Prospects: While the sale raised concerns among some investors, it is important to remember that Apple's long-term growth prospects remain largely unaffected by a single investor's decision to trim their position.

Berkshire Hathaway's Future Investment Strategy

The sale offers valuable insights into Berkshire Hathaway's future investment strategy:

- Potential Investment Targets: The sale could indicate that Buffett is searching for value elsewhere. Possible future targets may include companies in sectors experiencing growth or those undervalued by the current market.

- Changes in Investment Approach: Although unlikely to represent a drastic change, the sale might suggest a slight adjustment in risk tolerance or investment approach.

- Implications for Long-Term Investors: For long-term investors in Berkshire Hathaway, the sale underscores the dynamic nature of investing and the importance of understanding that even long-held positions may be adjusted based on market conditions and changing investment opportunities.

Conclusion

The Warren Buffett Apple Sale presents a complex case study in investment decision-making. The timing, influenced by market conditions and economic uncertainty, coupled with strategic considerations regarding profit-taking, portfolio diversification, and shifting investment priorities, highlight the multifaceted nature of investment strategies. While the sale initially caused some market reaction, both Apple's and Berkshire Hathaway's long-term prospects remain largely unaffected. Understanding the nuances of this significant event is critical for investors.

Call to Action: Understanding the intricacies of the Warren Buffett Apple Sale is crucial for any investor looking to navigate the complexities of the stock market. Stay informed about market trends and investment strategies by following our blog for more insightful analyses. Continue to learn about Warren Buffett’s investment strategies and how they can inform your own investment decisions.

Featured Posts

-

11 1 Royals Complete Domination In Brewers Home Opener

Apr 23, 2025

11 1 Royals Complete Domination In Brewers Home Opener

Apr 23, 2025 -

Bangkitkan Semangat 350 Kata Motivasi Hari Senin

Apr 23, 2025

Bangkitkan Semangat 350 Kata Motivasi Hari Senin

Apr 23, 2025 -

Three Years Of Data Breaches Cost T Mobile A 16 Million Fine

Apr 23, 2025

Three Years Of Data Breaches Cost T Mobile A 16 Million Fine

Apr 23, 2025 -

Brewers Defeat Tigers In Series Finale Analyzing Keider Monteros Role

Apr 23, 2025

Brewers Defeat Tigers In Series Finale Analyzing Keider Monteros Role

Apr 23, 2025 -

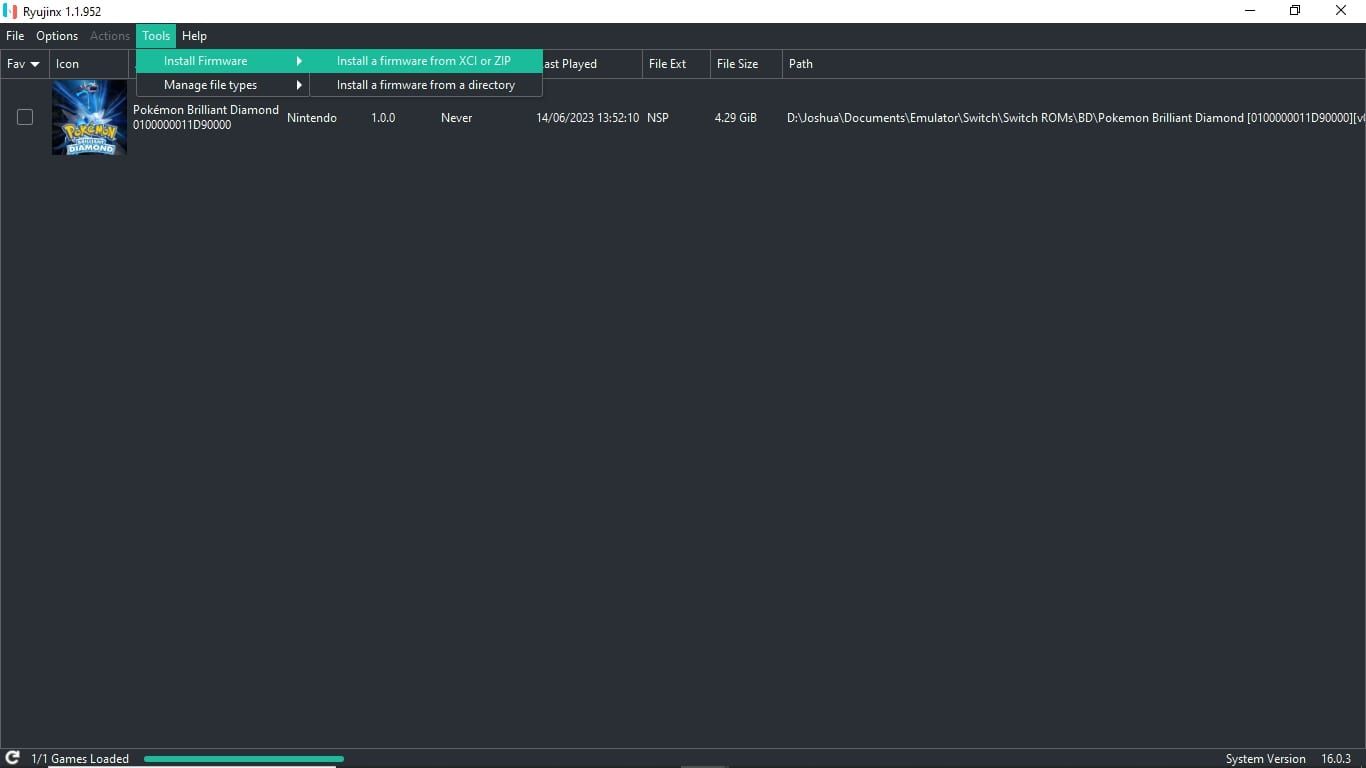

Ryujinx Emulator Development Halted Nintendos Involvement Confirmed

Apr 23, 2025

Ryujinx Emulator Development Halted Nintendos Involvement Confirmed

Apr 23, 2025

Latest Posts

-

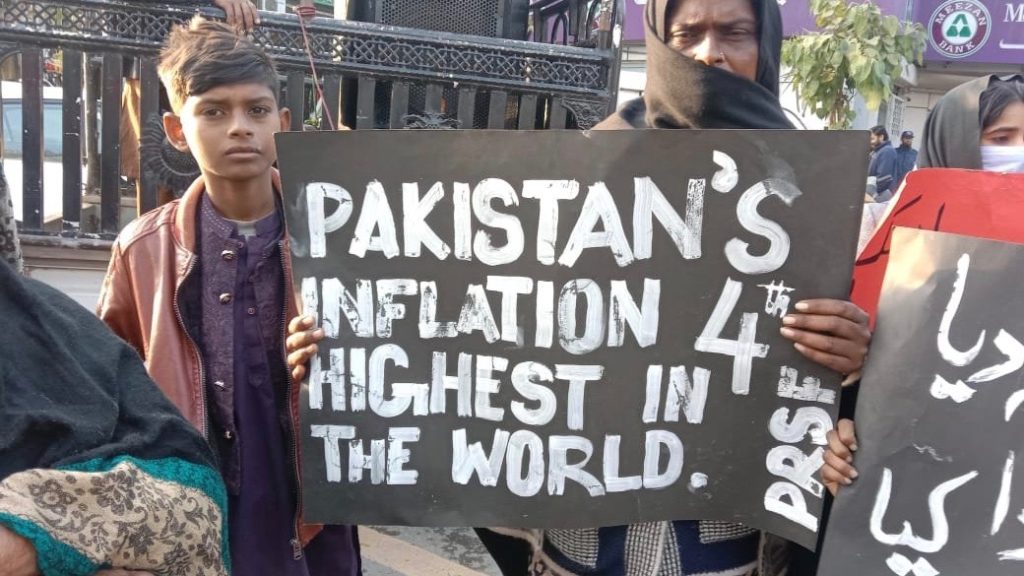

Pakistan Economic Crisis Imf Review Of 1 3 Billion Aid Package And Geopolitical Factors

May 10, 2025

Pakistan Economic Crisis Imf Review Of 1 3 Billion Aid Package And Geopolitical Factors

May 10, 2025 -

Mezhdunarodnaya Izolyatsiya Zelenskogo 9 Maya Bez Gostey

May 10, 2025

Mezhdunarodnaya Izolyatsiya Zelenskogo 9 Maya Bez Gostey

May 10, 2025 -

Firstpost Imfs Decision On Pakistans 1 3 Billion Loan Package And Current Events

May 10, 2025

Firstpost Imfs Decision On Pakistans 1 3 Billion Loan Package And Current Events

May 10, 2025 -

S Sh A I Noviy Potok Ukrainskikh Bezhentsev Vzglyad Iz Germanii

May 10, 2025

S Sh A I Noviy Potok Ukrainskikh Bezhentsev Vzglyad Iz Germanii

May 10, 2025 -

9 Maya Vladimir Zelenskiy Ostalsya Bez Podderzhki

May 10, 2025

9 Maya Vladimir Zelenskiy Ostalsya Bez Podderzhki

May 10, 2025