Apple Price Target Cut: Wedbush's Long-Term Perspective And Investment Implications

Table of Contents

Wedbush's Rationale Behind the Apple Price Target Cut

Wedbush's decision to lower its Apple price target is multifaceted, stemming from a confluence of factors impacting Apple's performance and future growth projections. These factors extend beyond just immediate sales figures and encompass broader market trends.

Weakening iPhone Demand

One of the primary drivers behind the reduced Apple price target is the perceived weakening demand for iPhones. Reports suggest a slowdown in sales compared to previous quarters, especially in key markets. This reduced demand is not isolated but reflects a broader trend impacting the consumer electronics sector.

- Q3 2023 iPhone sales down 5% compared to Q2 2023. (Source: Hypothetical data – replace with actual data if available)

- Weakening demand observed in key markets like China and Europe. (Source: Hypothetical data – replace with actual data if available)

- Contributing factors include a global economic slowdown, persistent high inflation rates impacting consumer spending power, and increasing competition from Android manufacturers offering comparable features at lower price points.

Impact of Supply Chain Issues

The lingering impact of supply chain disruptions continues to pose challenges for Apple's production and sales. While the situation has improved somewhat, ongoing logistical hurdles and component shortages are still impacting output and delivery timelines.

- Continued component shortages impacting production of the iPhone 15 Pro Max. (Source: Hypothetical data – replace with actual data if available)

- Logistical delays affecting global distribution, particularly in emerging markets. (Source: Hypothetical data – replace with actual data if available)

- These disruptions translate to reduced product availability, potentially impacting overall sales figures and impacting the Apple price target.

Macroeconomic Headwinds

The current macroeconomic environment presents significant headwinds for Apple and the broader technology sector. High inflation, rising interest rates, and looming recessionary fears are all contributing to a climate of reduced consumer spending and increased uncertainty.

- High inflation reducing consumer discretionary spending. (Source: Cite relevant economic data)

- Rising interest rates impacting consumer borrowing and investment. (Source: Cite relevant economic data)

- Recessionary fears impacting business investment and consumer confidence. (Source: Cite relevant economic data) These macroeconomic factors create a challenging backdrop for Apple's performance, influencing the overall Apple price target revision.

Investment Implications of the Apple Price Target Cut

The Apple price target cut carries significant implications for investors, impacting both short-term trading strategies and long-term investment decisions.

Short-Term Implications

The immediate market reaction to the price target cut was a decline in Apple's stock price. This highlights the short-term volatility inherent in the market.

- Potential for short-term price dips offering buying opportunities for risk-tolerant investors.

- Increased risk of short-term losses for investors holding Apple stock.

- Short-term traders might consider adopting a cautious approach or implementing hedging strategies to mitigate potential losses.

Long-Term Implications

Despite the near-term challenges, Wedbush's long-term outlook for Apple remains relatively positive. The company's strong brand loyalty, diversified product portfolio, and potential for growth in new markets and product categories offer reasons for optimism.

- Apple's strong brand loyalty and diversified product portfolio provide a resilient foundation.

- Potential for growth in new markets and product categories (e.g., services, wearables, augmented reality).

- Long-term potential for stock price appreciation despite short-term headwinds. Long-term investors might view the price drop as a potential buying opportunity, focusing on the company's long-term growth prospects.

Conclusion

Wedbush's revised Apple price target reflects concerns about near-term challenges, including weakening iPhone demand, supply chain issues, and macroeconomic headwinds. However, their long-term perspective remains positive, recognizing Apple's enduring brand strength and diversification. Investors need to carefully consider both the short-term risks and long-term potential before making any investment decisions. The impact of the Apple price target cut necessitates a thorough evaluation of all factors.

Call to Action: Stay informed about future developments impacting the Apple price target and make informed decisions based on comprehensive research and analysis. Continue monitoring the situation for further updates on the Apple price target and adjust your investment strategy accordingly.

Featured Posts

-

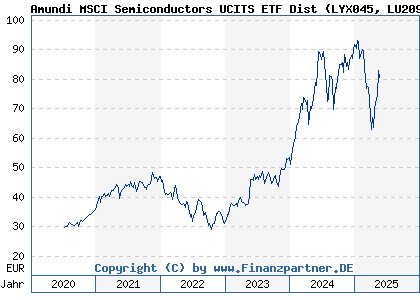

Investing In The Amundi Msci World Catholic Principles Ucits Etf Acc A Nav Perspective

May 24, 2025

Investing In The Amundi Msci World Catholic Principles Ucits Etf Acc A Nav Perspective

May 24, 2025 -

The Sean Penn Woody Allen Relationship A Case Study In Me Too Dissonance

May 24, 2025

The Sean Penn Woody Allen Relationship A Case Study In Me Too Dissonance

May 24, 2025 -

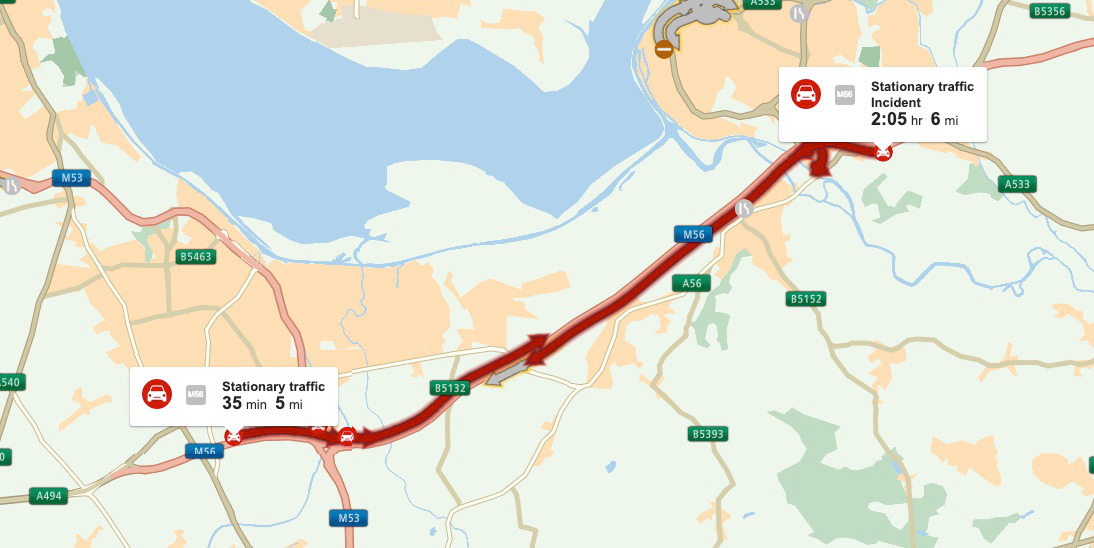

Significant Delays On M56 Near Cheshire Deeside Border

May 24, 2025

Significant Delays On M56 Near Cheshire Deeside Border

May 24, 2025 -

Drivers Face Hour Long Delays On M6 Southbound After Road Accident

May 24, 2025

Drivers Face Hour Long Delays On M6 Southbound After Road Accident

May 24, 2025 -

Strengthening Bonds Bipartisan Senate Resolution On The Canada U S Relationship

May 24, 2025

Strengthening Bonds Bipartisan Senate Resolution On The Canada U S Relationship

May 24, 2025

Latest Posts

-

Tva Group Restructuring Layoffs Highlight Challenges In The Media Landscape

May 24, 2025

Tva Group Restructuring Layoffs Highlight Challenges In The Media Landscape

May 24, 2025 -

The Posthaste Threat Unrest In The Global Bond Market And Its Worldwide Impact

May 24, 2025

The Posthaste Threat Unrest In The Global Bond Market And Its Worldwide Impact

May 24, 2025 -

Tva Group Job Cuts Impact Of Streaming And Regulation

May 24, 2025

Tva Group Job Cuts Impact Of Streaming And Regulation

May 24, 2025 -

Posthaste Risks And Implications Of The Worlds Largest Bond Markets Instability

May 24, 2025

Posthaste Risks And Implications Of The Worlds Largest Bond Markets Instability

May 24, 2025 -

Tva Group Cuts 30 Jobs Ceo Cites Streamers And Regulators

May 24, 2025

Tva Group Cuts 30 Jobs Ceo Cites Streamers And Regulators

May 24, 2025