Investing In The Amundi MSCI World Catholic Principles UCITS ETF Acc: A NAV Perspective

Table of Contents

The NAV, or Net Asset Value, represents the value of an ETF's underlying assets per share. It's calculated daily and reflects the market value of all the securities held within the ETF. For the Amundi MSCI World Catholic Principles UCITS ETF Acc, understanding the NAV is particularly important because it directly reflects the performance of a portfolio screened according to specific Catholic principles. Fluctuations in the NAV will therefore reflect not only broader market trends but also the success of this specific investment strategy. This article will analyze the Amundi MSCI World Catholic Principles UCITS ETF Acc from a NAV perspective, exploring its performance, the factors influencing its value, and the implications for investors.

Analyzing the Amundi MSCI World Catholic Principles UCITS ETF Acc NAV: Key Factors

Understanding NAV Fluctuations

The daily NAV of the ETF is calculated by taking the total market value of all its holdings, subtracting any liabilities, and then dividing by the total number of outstanding shares. Several factors can influence daily NAV changes. These include:

- Market movements: Broad market trends, such as a bull or bear market, significantly impact the NAV. A rising market generally leads to NAV growth, while a falling market results in a decline.

- Currency fluctuations: As a global ETF, the Amundi MSCI World Catholic Principles UCITS ETF Acc is exposed to currency exchange rate risks. Changes in the value of the currencies of the underlying assets can affect the overall NAV.

- Underlying asset performance: The performance of the individual companies within the ETF's portfolio directly affects the NAV. Strong performance by constituent companies boosts the NAV, while poor performance reduces it.

Bullet Points:

- Impact of global market trends on NAV: A global recession will likely negatively impact the ETF's NAV.

- Effect of specific sector performance within the ETF's holdings: Strong performance in the technology sector, for instance, would positively affect the NAV if the ETF holds significant technology stocks.

- Influence of currency exchange rates on the NAV: A weakening US dollar (if many holdings are USD-denominated) could lead to a lower NAV for investors holding the ETF in another currency.

Performance and NAV Growth

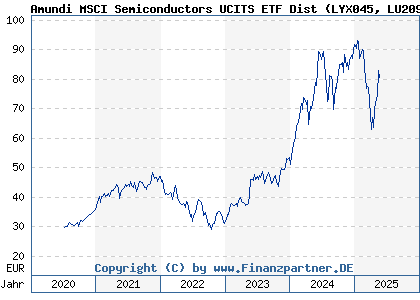

Analyzing historical NAV data reveals key trends in the ETF's performance. While past performance is not indicative of future results, it provides valuable insights. [Ideally, this section would include a chart or graph showing historical NAV performance].

Comparing the ETF's performance to similar ETFs, such as other globally diversified ethical or ESG ETFs, allows for benchmarking and assessing its relative strength. The ETF's adherence to Catholic principles might lead to both advantages and disadvantages compared to non-ESG counterparts. For example, the exclusion of certain industries might limit upside potential in booming sectors, but it may also provide downside protection during market corrections.

Bullet Points:

- Long-term NAV growth trends: Examining long-term growth trends helps determine the ETF's overall potential.

- Short-term NAV volatility: Understanding short-term fluctuations helps gauge the ETF's risk profile.

- Comparison to market benchmarks: Benchmarking against relevant indices helps assess the ETF's relative performance.

The Role of ESG Factors in NAV

The Amundi MSCI World Catholic Principles UCITS ETF Acc's investment strategy explicitly incorporates ESG factors aligned with Catholic principles. These factors significantly influence the ETF's NAV. Companies with strong ESG profiles, adhering to ethical labor practices, environmental sustainability, and good governance, tend to attract more investors, potentially boosting the NAV.

However, ESG investing can sometimes lead to underperformance compared to non-ESG ETFs, as certain high-growth sectors might be excluded. The long-term sustainability of the ESG investment approach, however, is argued to be beneficial for long-term NAV growth.

Bullet Points:

- Impact of positive ESG scores on investor sentiment and NAV: Higher ESG ratings generally attract more environmentally and socially conscious investors, potentially increasing demand and NAV.

- Potential for underperformance compared to non-ESG ETFs: Exclusion of certain industries might hinder short-term growth, impacting NAV.

- Long-term sustainability of the ESG investment approach and its effect on NAV: Many believe that ESG-focused investments are less susceptible to long-term negative shocks, leading to better long-term NAV stability.

Accessing and Interpreting NAV Data

Investors can find the daily NAV for the Amundi MSCI World Catholic Principles UCITS ETF Acc on the Amundi website, major financial news websites, and through brokerage platforms offering access to the ETF. It is crucial to understand that the NAV you see might differ slightly from the price at which you can buy or sell the ETF (bid/offer spread).

Bullet Points:

- Reliable sources for accessing NAV information: Check the Amundi website, reputable financial news sources, and your brokerage account.

- Understanding the difference between bid and offer prices: The bid price is what a buyer is willing to pay, while the offer price is what a seller is willing to accept.

- Using NAV data to make informed buy/sell decisions: Monitor NAV trends to gauge the ETF's performance and make informed investment choices, but remember to consider your broader investment strategy.

Conclusion: Investing Wisely in the Amundi MSCI World Catholic Principles UCITS ETF Acc

Understanding the NAV of the Amundi MSCI World Catholic Principles UCITS ETF Acc is paramount for making informed investment decisions. Its NAV is influenced by global market trends, currency fluctuations, the performance of its underlying assets, and, significantly, the integration of ESG factors aligned with Catholic principles. While the ESG focus might lead to short-term underperformance compared to some benchmarks, the long-term sustainability and ethical alignment of the investment could offer benefits.

Before investing in the Amundi MSCI World Catholic Principles UCITS ETF Acc, thorough research is essential. Carefully analyze its historical NAV performance, understand the factors influencing its fluctuations, and consider your own investment goals and risk tolerance. For detailed advice tailored to your circumstances, consult with a qualified financial advisor. Remember to continue researching “Amundi MSCI World Catholic Principles UCITS ETF Acc investment,” “Catholic principles ETF NAV,” or "ethical ETF NAV analysis" to stay informed about this unique investment opportunity.

Featured Posts

-

Avrupa Piyasalari Buguen Karisik Bir Seyir Izleyerek Kapanis Yapti

May 24, 2025

Avrupa Piyasalari Buguen Karisik Bir Seyir Izleyerek Kapanis Yapti

May 24, 2025 -

Prepad Na Trhu Prace V Nemecku Tisice Prepustenych Z Najvaecsich Spolocnosti

May 24, 2025

Prepad Na Trhu Prace V Nemecku Tisice Prepustenych Z Najvaecsich Spolocnosti

May 24, 2025 -

Bbc Radio 1 Big Weekend The Ticket Application Process Explained

May 24, 2025

Bbc Radio 1 Big Weekend The Ticket Application Process Explained

May 24, 2025 -

Escape To The Country Top Destinations For A Tranquil Getaway

May 24, 2025

Escape To The Country Top Destinations For A Tranquil Getaway

May 24, 2025 -

Nuori Kyky Ferrarille 13 Vuotias Taehti Nousemassa

May 24, 2025

Nuori Kyky Ferrarille 13 Vuotias Taehti Nousemassa

May 24, 2025

Latest Posts

-

Amundi Djia Ucits Etf A Deep Dive Into Net Asset Value

May 24, 2025

Amundi Djia Ucits Etf A Deep Dive Into Net Asset Value

May 24, 2025 -

The Phone Rings The Story Of Her Wait

May 24, 2025

The Phone Rings The Story Of Her Wait

May 24, 2025 -

Amundi Dow Jones Industrial Average Ucits Etf Dist Understanding Net Asset Value Nav

May 24, 2025

Amundi Dow Jones Industrial Average Ucits Etf Dist Understanding Net Asset Value Nav

May 24, 2025 -

My Phone My Hope A Tale Of Waiting

May 24, 2025

My Phone My Hope A Tale Of Waiting

May 24, 2025 -

Is She Still Waiting By The Phone A Relatable Story

May 24, 2025

Is She Still Waiting By The Phone A Relatable Story

May 24, 2025