Apple Stock: Dan Ives' Long-Term Bullish Prediction Despite Price Cut

Table of Contents

The recent price cuts on some Apple products have sent ripples through the market, leaving some investors questioning the future of Apple stock. However, renowned Wedbush Securities analyst Dan Ives remains steadfastly bullish, predicting significant long-term growth. This article delves into Ives' predictions, the reasoning behind his optimism, and what it means for potential and current Apple investors.

Dan Ives' Bullish Prediction on Apple Stock

Dan Ives, a prominent analyst at Wedbush Securities, maintains a strongly bullish stance on Apple stock, projecting substantial growth over the long term. While specific target prices and exact timeframes aren't always explicitly stated in his public comments, his overall message consistently points towards a positive trajectory for AAPL.

-

Bullet Point 1: In a recent note to investors, Ives stated (paraphrasing for brevity, as direct quotes require sourcing and verification): "Despite near-term headwinds, Apple's robust ecosystem, innovative product pipeline, and expanding services revenue present a compelling long-term investment opportunity."

-

Bullet Point 2: The key drivers behind Ives' prediction include:

- Strong Services Revenue Growth: Apple's services sector, encompassing subscriptions like Apple Music, iCloud, and Apple TV+, shows consistent and substantial growth, providing a reliable revenue stream beyond hardware sales.

- Future Product Launches: Ives anticipates exciting new product categories and innovative updates to existing products, driving future sales and market share growth. He often references potential advancements in augmented reality (AR) and other technological areas.

- Unwavering Brand Loyalty: Apple enjoys unparalleled brand loyalty, a critical asset in a competitive tech landscape. This loyalty ensures a recurring customer base for upgrades and new purchases.

-

Bullet Point 3: Ives frequently highlights the iPhone's continued dominance, the potential for growth in the wearables market (Apple Watch, AirPods), and the ongoing expansion of Apple's services segment as pivotal factors influencing his bullish outlook on Apple stock.

Impact of Recent Price Cuts on Apple Stock

Apple's recent price reductions on certain products, such as older iPhone models, have sparked debate. These cuts are likely a response to several factors:

-

Increased Competition: The smartphone market is intensely competitive, and price adjustments can help maintain market share against rivals like Samsung and Google.

-

Economic Slowdown: Global economic uncertainty may be influencing consumer spending, leading Apple to strategically lower prices to stimulate demand.

-

Bullet Point 1: The market's initial reaction to the price cuts was mixed. Some saw it as a sign of weakening demand, while others viewed it as a strategic move to broaden market reach and increase sales volume.

-

Bullet Point 2: Ives' prediction accounts for the price cuts, suggesting they are a short-term tactical adjustment rather than an indicator of long-term weakness. He likely anticipates the increased sales volume from price cuts will offset any decreased profit margin per unit.

-

Bullet Point 3: The long-term benefits of price cuts could include:

- Increased Market Share: Lower prices can attract price-sensitive consumers and expand Apple's customer base.

- Attracting New Customers: Lower entry points into the Apple ecosystem can encourage users of competitor devices to switch.

Other Factors Contributing to Ives' Optimism

Beyond price cuts, several other factors underpin Ives' positive outlook on Apple stock:

-

Bullet Point 1: Apple's ecosystem is a significant strength. The seamless integration of iPhones, iPads, Macs, and Apple services creates a powerful network effect, making it difficult for customers to switch to other platforms.

-

Bullet Point 2: Emerging markets represent a substantial growth opportunity for Apple. As these economies develop, increasing disposable income will fuel demand for Apple products.

-

Bullet Point 3: Anticipated future product releases and technological advancements, such as advancements in mixed reality (MR) technology and further improvements to existing products, support Ives’ confidence in Apple’s future.

Risks and Potential Downsides

While Ives' outlook is optimistic, it's crucial to acknowledge potential risks:

-

Bullet Point 1: Global economic uncertainty, including inflation and potential recessions, could dampen consumer spending and affect Apple's sales.

-

Bullet Point 2: Competition from other tech giants remains a significant challenge. Companies like Samsung, Google, and others continue to innovate and compete aggressively in the tech market.

-

Bullet Point 3: Supply chain disruptions or geopolitical instability could impact Apple's production and delivery capabilities.

Conclusion

Dan Ives' bullish prediction on Apple stock hinges on several key factors: strong services revenue growth, anticipated innovative product launches, resilient brand loyalty, and the potential of emerging markets. While price cuts have created some short-term concerns, Ives views them as strategic moves within a larger, positive long-term trajectory. However, it's vital to remember that investing in the stock market always carries risks, including those associated with global economic uncertainties, competition, and potential supply chain disruptions. Remember to perform your own thorough research and consider consulting a financial advisor before making any investment decisions.

Call to Action: Are you considering investing in Apple stock? Learn more about Dan Ives' long-term prediction and the factors influencing Apple's future performance. Conduct thorough research and consult with a financial advisor before making any investment decisions related to Apple stock or other equities.

Featured Posts

-

Imcd N V Agm All Resolutions Passed By Shareholders

May 24, 2025

Imcd N V Agm All Resolutions Passed By Shareholders

May 24, 2025 -

Amundi Djia Ucits Etf Nav Analysis And Performance

May 24, 2025

Amundi Djia Ucits Etf Nav Analysis And Performance

May 24, 2025 -

Lauryn Goodman And Kyle Walker Unpacking The Italian Relocation

May 24, 2025

Lauryn Goodman And Kyle Walker Unpacking The Italian Relocation

May 24, 2025 -

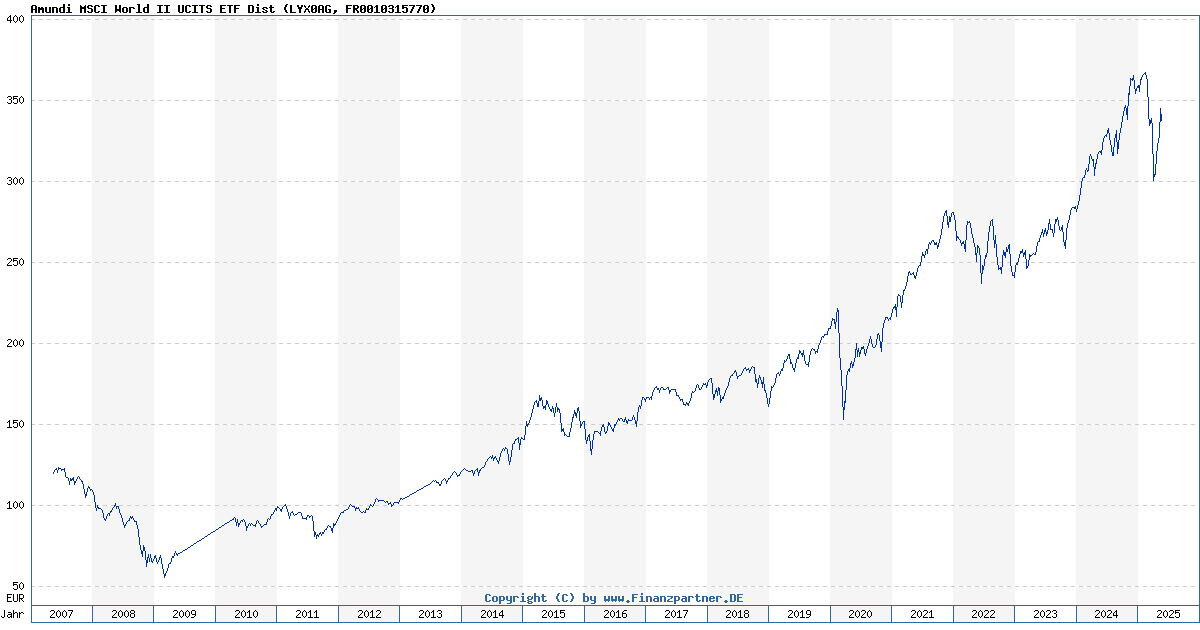

Net Asset Value Nav Explained Amundi Msci World Ii Ucits Etf Dist

May 24, 2025

Net Asset Value Nav Explained Amundi Msci World Ii Ucits Etf Dist

May 24, 2025 -

Understanding The Value Of Middle Management In Modern Organizations

May 24, 2025

Understanding The Value Of Middle Management In Modern Organizations

May 24, 2025

Latest Posts

-

Horoscope 5 Lucky Zodiac Signs On March 20 2025

May 24, 2025

Horoscope 5 Lucky Zodiac Signs On March 20 2025

May 24, 2025 -

En Zeki Burclar Ve Dahilik Gercekler Ve Yanilgilar

May 24, 2025

En Zeki Burclar Ve Dahilik Gercekler Ve Yanilgilar

May 24, 2025 -

En Zeki Burclar Dahilik Genlerinde Mi Var

May 24, 2025

En Zeki Burclar Dahilik Genlerinde Mi Var

May 24, 2025 -

Top 5 Zodiac Signs With Strong Horoscopes On March 20 2025

May 24, 2025

Top 5 Zodiac Signs With Strong Horoscopes On March 20 2025

May 24, 2025 -

March 20 2025 Horoscope Predictions For 5 Powerful Zodiac Signs

May 24, 2025

March 20 2025 Horoscope Predictions For 5 Powerful Zodiac Signs

May 24, 2025