Apple Stock Dips Below Key Levels Before Q2 Earnings Report

Table of Contents

Technical Analysis: Apple Stock Price Breakdown and Support Levels

Recent price movements in Apple stock paint a concerning picture for some. A look at the Apple stock chart reveals a breach of several key support levels, signaling potential for further downside. Traders are closely monitoring these developments, particularly the break below the [Insert specific price level and date here] support, a significant technical indicator.

-

Support and Resistance Levels: The [Insert specific price level] level acted as crucial support for several weeks, indicating strong buying pressure. Its breakdown suggests weakening investor confidence. The next key support level to watch is around [Insert specific price level]. Resistance, conversely, is currently seen around [Insert specific price level].

-

Technical Indicators: Moving averages, like the 50-day and 200-day moving averages, are currently [Describe their relative positions - e.g., crossing, diverging, etc.], which often signals a bearish trend. The Relative Strength Index (RSI) is also [Describe the RSI value and what it indicates – e.g., below 30, suggesting oversold conditions, or above 70, suggesting overbought conditions]. These technical indicators support the assessment of a potential further downward trend.

Analyzing the Apple stock chart meticulously is crucial for understanding current market sentiment and potential price action before the Q2 earnings report. This technical analysis, however, should be considered in conjunction with a fundamental assessment to provide a comprehensive understanding of the situation.

Fundamental Analysis: Factors Affecting Apple's Q2 Performance

Beyond technical indicators, understanding the underlying factors affecting Apple's Q2 earnings is essential for accurate stock price prediction. Several significant elements are likely to influence the results:

-

Supply Chain Issues: Ongoing supply chain disruptions, particularly concerning component shortages for iPhones and Macs, could negatively impact production and sales.

-

Consumer Demand: While Apple products generally maintain strong demand, global economic headwinds and increased inflation may lead to reduced consumer spending, affecting sales volumes.

-

Competition: Intense competition in the smartphone and tech markets, especially from Android manufacturers, continues to put pressure on Apple's market share and pricing strategies.

-

Global Economic Conditions: Recessions or significant economic slowdowns in major markets can severely impact consumer confidence and spending on discretionary items like Apple products. The current economic outlook therefore plays a crucial role in forecasting Apple's Q2 performance.

Analyzing recent news reports and market trends is crucial to accurately assess the impact of these fundamental factors on Apple’s Q2 earnings forecast. A combination of both technical and fundamental analysis provides a more holistic view.

Investor Sentiment and Market Reactions

The recent Apple stock dip reflects a shift in investor sentiment. Many investors are displaying caution, reflecting concerns about the factors discussed above. The market reaction to this dip has been [Describe the market's response – e.g., a sharp sell-off, a gradual decline, etc.], indicating a prevailing bearish sentiment.

- Trading Strategies: In light of this, some investors may adopt conservative strategies such as hedging their positions or reducing their Apple stock exposure. Others might see the dip as a potential buying opportunity, viewing the current price as undervalued. However, making investment decisions based solely on the current Apple stock dip is risky without a broader analysis.

Navigating this period requires a careful consideration of various trading strategies, taking into account personal risk tolerance and investment goals. The volatility surrounding the upcoming Q2 earnings report is a factor that must be carefully considered.

Expert Opinions and Predictions

Financial analysts hold diverse opinions on Apple's Q2 performance and subsequent stock price movement. Some predict a robust earnings report, citing strong pre-orders for new products, while others anticipate lower-than-expected results due to the aforementioned challenges. [Insert specific quotes from reputable financial analysts and news sources, properly cited]. These varying Apple stock predictions highlight the uncertainty surrounding the upcoming earnings report.

Conclusion: Navigating the Apple Stock Dip Before Q2 Earnings

The recent Apple stock dip ahead of the Q2 earnings report is a complex situation influenced by both technical and fundamental factors. Analyzing both the Apple stock chart and the underlying business conditions is crucial for making informed investment decisions. While the current dip presents both risk and opportunity, it is vital to remember the inherent uncertainty involved in predicting stock prices. Remember that the upcoming Q2 earnings report may significantly impact Apple stock prices.

To make sound investment choices, investors should conduct their own thorough research, carefully considering the Apple stock dip and the impending Q2 earnings announcement. Stay informed about Apple stock and the upcoming Q2 earnings report by following our regular market updates. Don't miss out on crucial information affecting Apple stock prices.

Featured Posts

-

Nintendos Action Forces Ryujinx Switch Emulator To Halt Development

May 24, 2025

Nintendos Action Forces Ryujinx Switch Emulator To Halt Development

May 24, 2025 -

Ftc Probes Open Ais Chat Gpt Privacy And Data Concerns

May 24, 2025

Ftc Probes Open Ais Chat Gpt Privacy And Data Concerns

May 24, 2025 -

Iam Expat Fair Housing Finance Fun And Kids Activities

May 24, 2025

Iam Expat Fair Housing Finance Fun And Kids Activities

May 24, 2025 -

G 7 Nations Debate Lowering Tariffs On Chinese Imports

May 24, 2025

G 7 Nations Debate Lowering Tariffs On Chinese Imports

May 24, 2025 -

Pengalaman Unik Porsche Indonesia Classic Art Week 2025

May 24, 2025

Pengalaman Unik Porsche Indonesia Classic Art Week 2025

May 24, 2025

Latest Posts

-

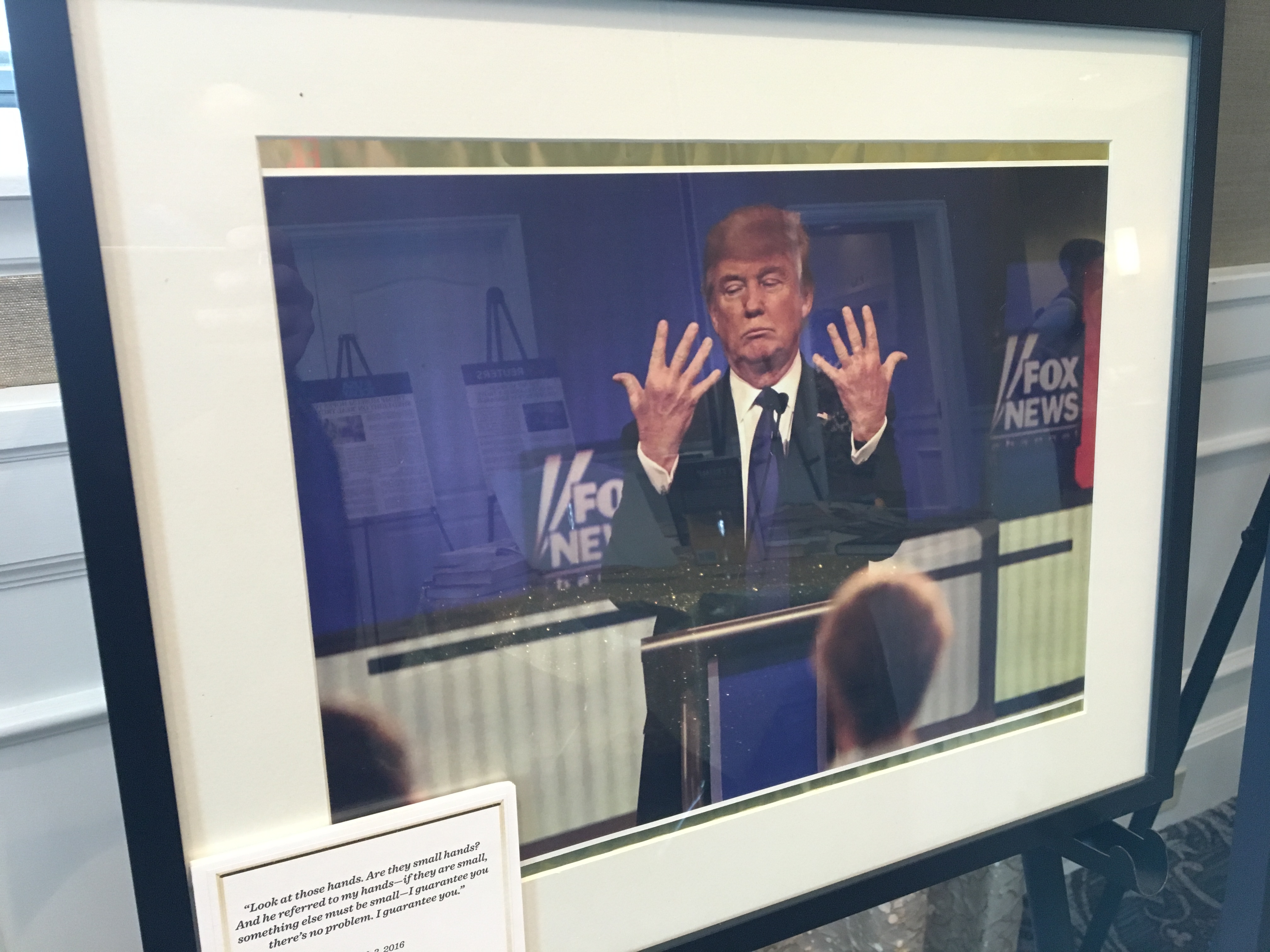

Trump Administrations Impact On Museum Funding And Cultural Institutions

May 24, 2025

Trump Administrations Impact On Museum Funding And Cultural Institutions

May 24, 2025 -

Analyzing The Long Term Effects Of Trumps Museum Funding Cuts

May 24, 2025

Analyzing The Long Term Effects Of Trumps Museum Funding Cuts

May 24, 2025 -

The State Of Museum Programs Following Trumps Budget Reductions

May 24, 2025

The State Of Museum Programs Following Trumps Budget Reductions

May 24, 2025 -

Funding Cuts And The Future Of Museum Programs A Post Trump Perspective

May 24, 2025

Funding Cuts And The Future Of Museum Programs A Post Trump Perspective

May 24, 2025 -

Trumps Budget Cuts Threaten Museum Programs A Critical Analysis

May 24, 2025

Trumps Budget Cuts Threaten Museum Programs A Critical Analysis

May 24, 2025