Are Late Student Loan Payments Hurting Your Credit Score?

Table of Contents

How Student Loan Delinquency Impacts Your Credit Score

Your credit score, most commonly represented by the FICO score, is a three-digit number that lenders use to assess your creditworthiness. This score is heavily influenced by your payment history, with late payments carrying significant weight. The FICO scoring system considers several factors, but payment history is typically the most impactful. A single missed student loan payment can negatively affect your score, and multiple late payments can have a devastating effect.

-

Negative impact on credit score: Even one 30-day late payment can lower your credit score. The severity increases with the number of late payments and the length of delinquency. Multiple late payments can significantly reduce your score, making it harder to qualify for favorable loan terms in the future.

-

Potential for collection agencies and further negative marks: If your student loan payments become severely delinquent (90 days or more), your loan may be sent to collections. This results in further negative marks on your credit report, making it even harder to repair your credit. Collection agencies will also aggressively pursue payment, adding to your financial stress.

-

Increased difficulty securing loans, credit cards, or even renting an apartment: A low credit score due to delinquent student loan payments can make it difficult to qualify for new credit, such as mortgages, auto loans, or credit cards. Landlords also often check credit scores, so late payments can impact your ability to secure housing.

-

Higher interest rates on future borrowing: Lenders view individuals with poor payment histories as higher risks. As a result, you'll likely face higher interest rates on any future borrowing, increasing the overall cost of loans and credit cards.

The impact of delinquency varies depending on the duration of the late payment:

- 30-day delinquency: This is the least severe, but it still negatively impacts your credit score.

- 60-day delinquency: A significantly more severe hit to your credit score.

- 90+ day delinquency: This is the most damaging, often leading to accounts being sent to collections and causing a substantial drop in your credit score. According to Experian, a 90+ day delinquency can decrease your score by 100 points or more.

Understanding Your Student Loan Payment History

Regularly checking your credit report is crucial for maintaining good credit health. Accurately monitoring your student loan payment history allows you to identify and address any issues promptly.

-

How to access your credit reports: You're entitled to a free credit report from each of the three major credit bureaus (Equifax, Experian, and TransUnion) annually through AnnualCreditReport.com. Don't use other websites claiming to offer free reports; they may be scams.

-

What to look for on your credit report: Carefully review your report for any discrepancies regarding your student loans. Verify the loan amounts, payment history (including any late payments), and account status.

-

Steps to dispute inaccuracies: If you find any errors on your credit report, dispute them immediately with the relevant credit bureau. Provide documentation to support your claim. This is essential for protecting your credit score and ensuring accuracy.

Using free credit monitoring services can help you stay on top of your credit report and alert you to any changes or potential issues.

Strategies to Avoid Late Student Loan Payments

Proactive strategies are key to avoiding late student loan payments and maintaining a healthy credit score.

-

Setting up automatic payments: Automate your student loan payments to ensure on-time payments every month. This eliminates the risk of forgetting or missing a payment due to busy schedules or oversight.

-

Budgeting and prioritizing loan payments: Create a detailed budget that prioritizes essential expenses, including student loan payments. Track your income and expenses carefully to ensure you have enough money to meet your loan obligations.

-

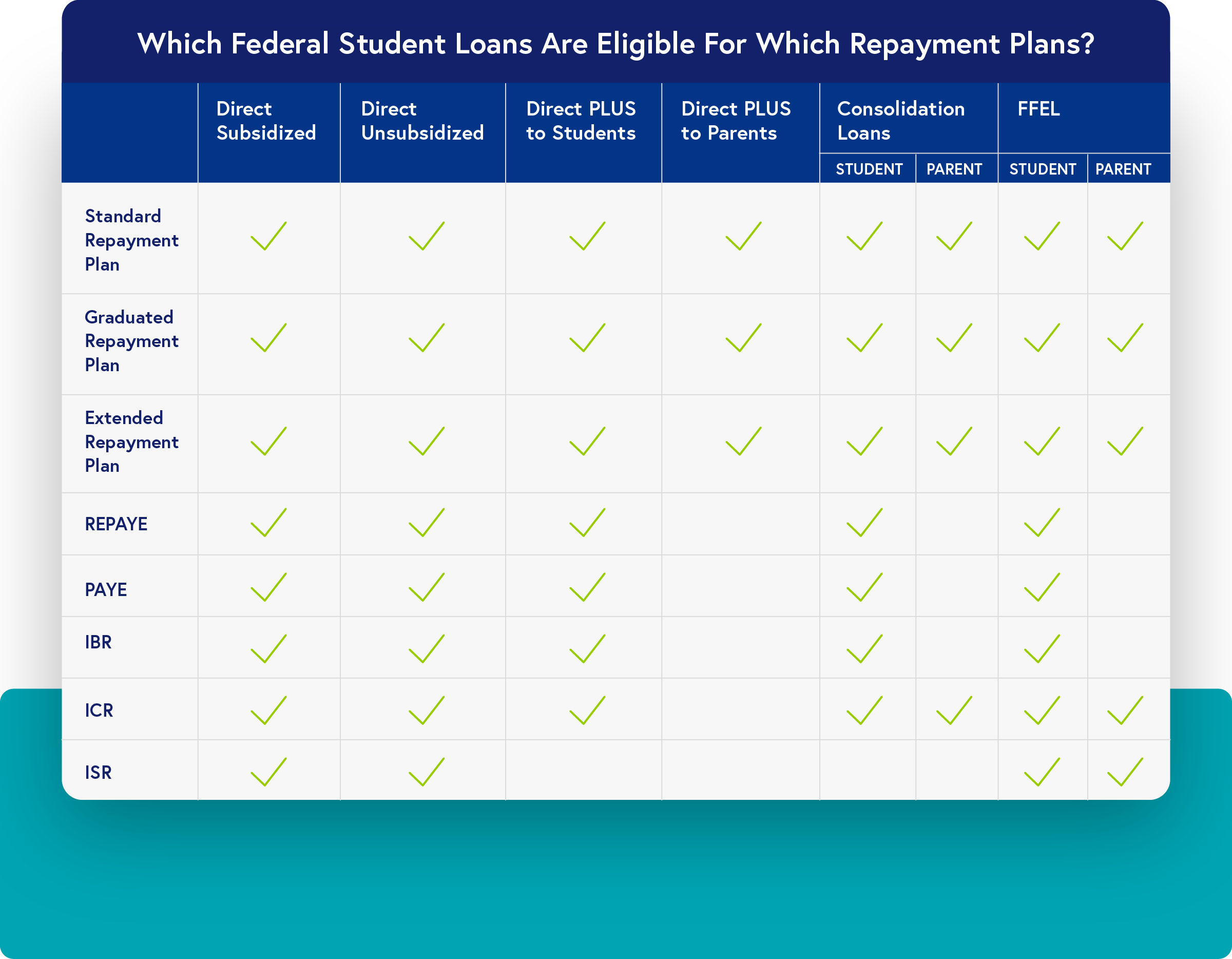

Exploring income-driven repayment plans: If you're struggling to make your student loan payments, explore income-driven repayment plans. These plans adjust your monthly payments based on your income and family size, making them more manageable. You can learn more about these plans at StudentAid.gov.

-

Contacting your loan servicer: Don't hesitate to contact your loan servicer if you anticipate difficulties making a payment. They may offer forbearance, deferment, or other options to help you manage your debt.

-

Utilizing budgeting apps and financial planning tools: Numerous budgeting apps and financial planning tools are available to help you track expenses, create budgets, and manage your finances effectively.

Recovering from Late Student Loan Payments

If you've already experienced late student loan payments, repairing your credit takes time and effort.

-

Paying off delinquent loans as quickly as possible: The sooner you pay off delinquent loans, the sooner the negative impact on your credit score will begin to lessen.

-

Maintaining on-time payments on all other accounts: Demonstrate responsible financial behavior by consistently making on-time payments on all your other accounts. This shows lenders you're committed to improving your credit.

-

Building positive credit history: Gradually build positive credit history by using credit responsibly and making all payments on time. This will help offset the negative impact of past late payments.

-

Considering credit repair services (with caution): While credit repair services exist, approach them cautiously. Many reputable credit counseling agencies can offer guidance, but be wary of companies making unrealistic promises.

Negative marks from late payments typically remain on your credit report for seven years from the date of delinquency.

Conclusion

Late student loan payments significantly damage your credit score, potentially impacting your financial life for years to come. However, by proactively managing your student loan debt, utilizing available resources, and monitoring your credit report regularly, you can avoid delinquency and protect your financial future. Don't let late student loan payments hurt your credit score. Take control of your finances today by exploring your repayment options and establishing a sound financial plan. Learn more about managing your student loan debt effectively and protecting your creditworthiness.

Featured Posts

-

Gwendoline Christie From Game Of Thrones To Severances Complex Challenges

May 17, 2025

Gwendoline Christie From Game Of Thrones To Severances Complex Challenges

May 17, 2025 -

Understanding The Gops Proposed Student Loan Repayment Plan

May 17, 2025

Understanding The Gops Proposed Student Loan Repayment Plan

May 17, 2025 -

Fortnites Latest Shop Update A Disappointment For Many Fans

May 17, 2025

Fortnites Latest Shop Update A Disappointment For Many Fans

May 17, 2025 -

Reese Shows Motherly Love Supporting Brothers Ncaa Game Win

May 17, 2025

Reese Shows Motherly Love Supporting Brothers Ncaa Game Win

May 17, 2025 -

From Scatological Data To Insightful Podcast The Power Of Ai

May 17, 2025

From Scatological Data To Insightful Podcast The Power Of Ai

May 17, 2025

Latest Posts

-

Fortnite Community Outraged Over Reversed Music Update

May 17, 2025

Fortnite Community Outraged Over Reversed Music Update

May 17, 2025 -

186 Milyon Dolar Novak Djokovic In Gelir Kaynaklari Ve Basarisi

May 17, 2025

186 Milyon Dolar Novak Djokovic In Gelir Kaynaklari Ve Basarisi

May 17, 2025 -

Novak Djokovic 37 Yasinda Performans Zirvesi

May 17, 2025

Novak Djokovic 37 Yasinda Performans Zirvesi

May 17, 2025 -

Evrobasket Pripreme Analiza Generalke Srbije Odigrane U Bajernovoj Dvorani

May 17, 2025

Evrobasket Pripreme Analiza Generalke Srbije Odigrane U Bajernovoj Dvorani

May 17, 2025 -

Fortnite Players Revolt Backwards Music Change Criticized

May 17, 2025

Fortnite Players Revolt Backwards Music Change Criticized

May 17, 2025