Understanding The GOP's Proposed Student Loan Repayment Plan

Table of Contents

Key Features of the GOP Student Loan Repayment Plan

The core tenets of the proposed GOP student loan repayment plan typically center around market-based solutions and modifications to existing income-driven repayment (IDR) structures. While specifics can vary depending on the particular proposal, several common threads emerge. The overarching goal is often to reduce the role of government intervention and encourage more individual responsibility in managing student loan debt.

-

Proposed Income-Driven Repayment (IDR) Modifications: Many GOP plans suggest altering existing IDR programs. This might involve adjusting income thresholds to determine eligibility, modifying the calculation of monthly payments based on income and family size, or potentially shortening the repayment period. For example, a proposal might cap the percentage of discretionary income allocated to student loan repayment at a lower rate than current IDR plans.

-

Changes to Loan Forgiveness Programs: The GOP generally approaches loan forgiveness with a more cautious approach than Democratic proposals. While some plans might retain limited loan forgiveness options, these are often tied to specific criteria, such as completing a certain amount of public service or working in high-demand fields. The overall aim is usually to decrease the amount of taxpayer money allocated to loan forgiveness.

-

Incentives for Specific Repayment Plans: To encourage borrowers to manage their debt responsibly, some GOP plans propose incentives for choosing specific repayment plans. These incentives could involve lower interest rates for borrowers who opt for faster repayment schedules or other strategies aligned with the plan's market-based principles.

-

Interest Rates and Loan Consolidation: While major changes to interest rates aren't always a central feature, the GOP's approach often involves maintaining a market-driven interest rate system, rather than implementing government subsidies to lower rates. Similarly, loan consolidation options may be reviewed with an eye towards streamlining the process and increasing efficiency.

Comparison to Current Student Loan Repayment Programs

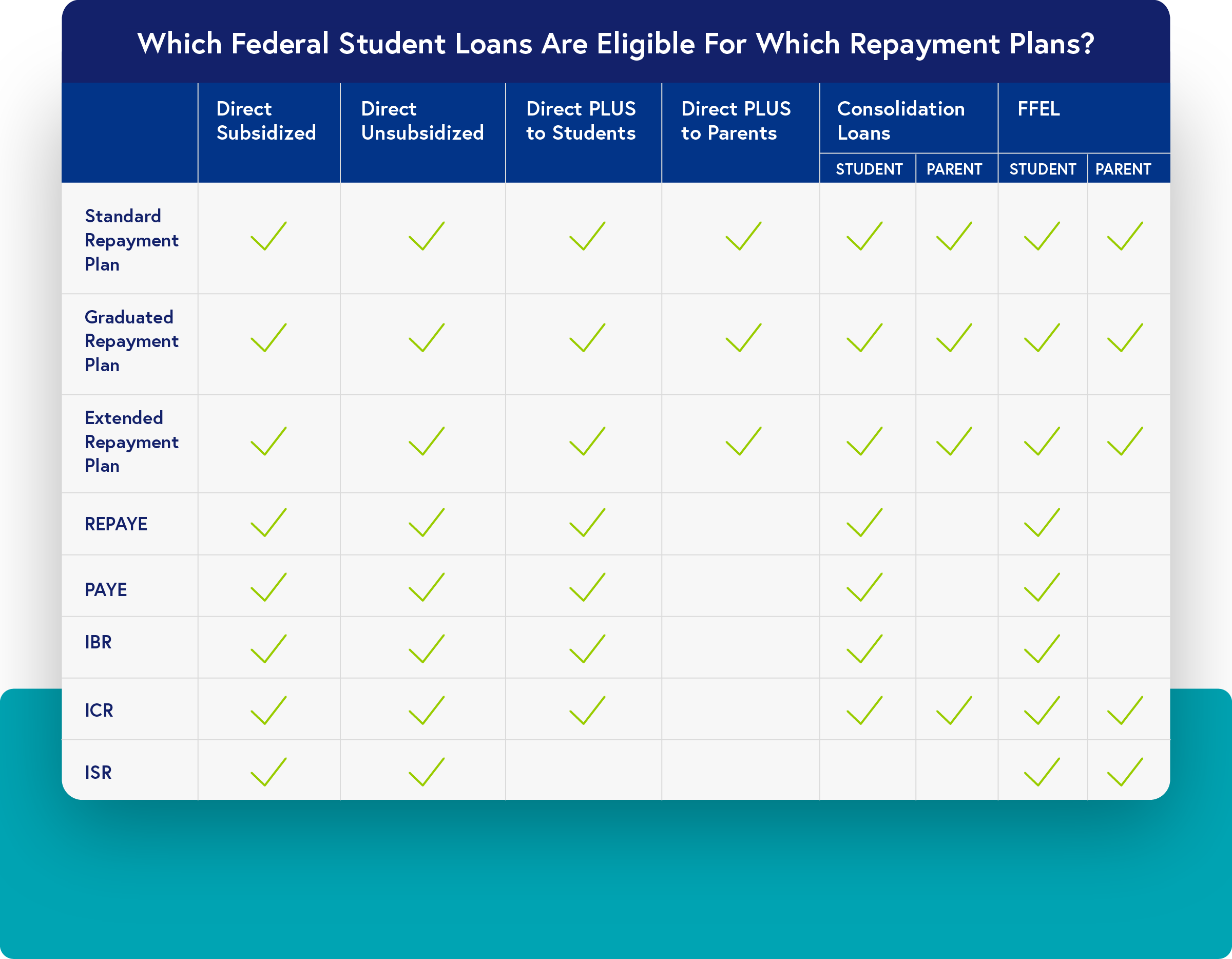

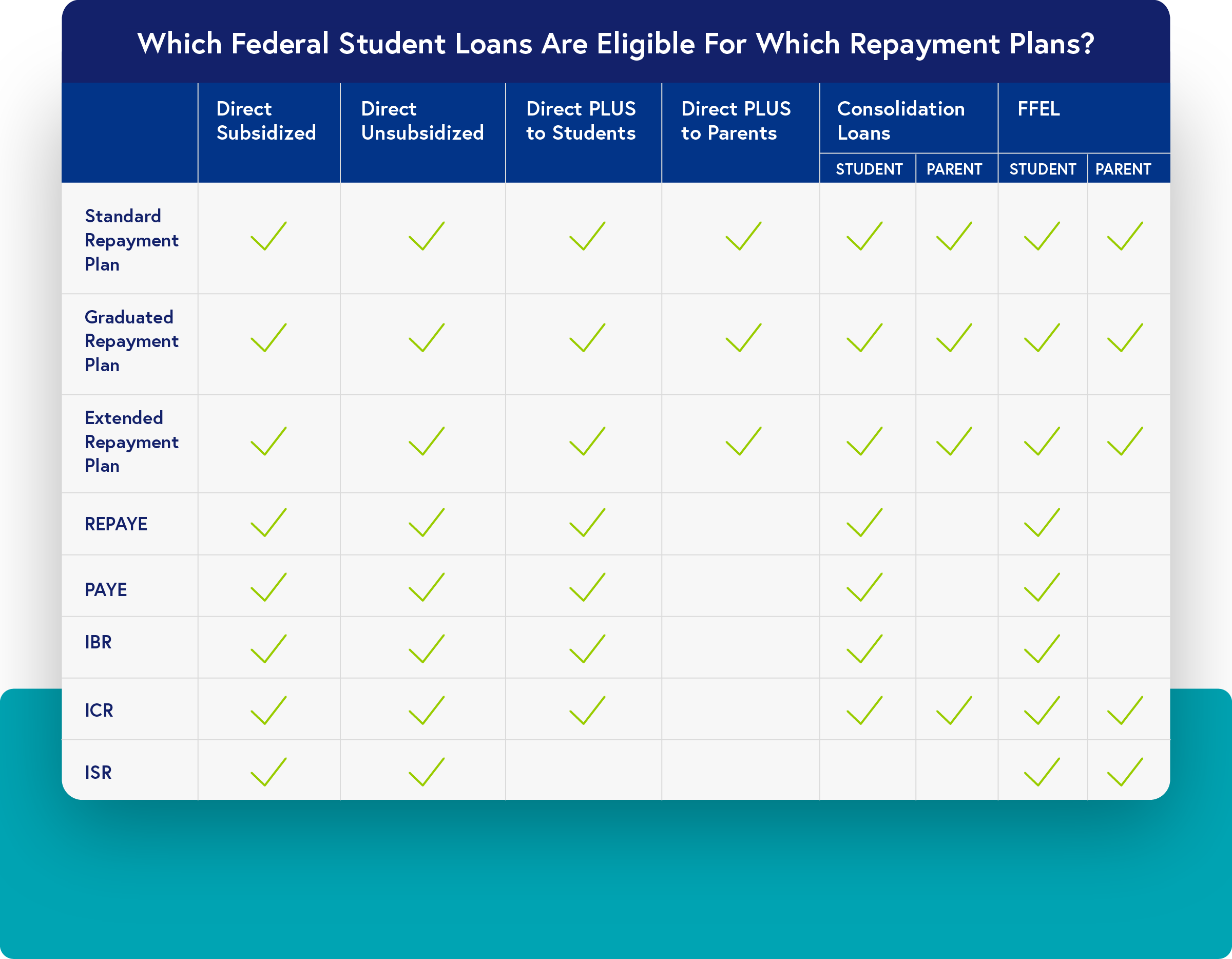

The GOP's proposed plan significantly differs from existing federal student loan repayment programs like Income-Driven Repayment (IDR) plans, the Standard Repayment Plan, and the Graduated Repayment Plan.

-

Payment Amounts: Under the GOP plan, monthly payments could be higher for some borrowers compared to current IDR plans, particularly those with lower incomes. This stems from potential changes to income thresholds and payment calculation formulas. Conversely, higher-income borrowers may see lower payments under a revised IDR system.

-

Loan Forgiveness Eligibility: The GOP's approach generally results in stricter eligibility requirements for loan forgiveness. Compared to existing programs, obtaining forgiveness would likely be more challenging under the GOP plan due to stricter criteria and potentially shorter forgiveness periods.

-

Repayment Timelines: While some borrowers might see faster repayment timelines due to potentially higher payments, others might face extended repayment periods depending on their income and the specific modifications to IDR plans.

-

Advantages and Disadvantages: Existing IDR plans offer greater flexibility and potentially lower payments for low-income borrowers, while the GOP plan might promote faster repayment but could be harsher on those with lower incomes. The Standard and Graduated Repayment plans offer less flexibility but may provide a more predictable repayment schedule.

Potential Benefits of the GOP Plan

Proponents of the GOP student loan repayment plan argue it offers several benefits:

-

Affordability and Accessibility: By focusing on market-based solutions, the GOP aims to enhance affordability and encourage responsible borrowing. The argument is that a more efficient system may lead to reduced overall costs and greater accessibility for future students.

-

Simplification of the Repayment Process: A streamlined process with fewer government programs and clearer guidelines could simplify repayment and reduce administrative burdens for both borrowers and lenders.

-

Economic Benefits: Increased consumer spending resulting from reduced debt burden and a more efficient higher education funding model could benefit the overall economy. This is a key argument often used to support market-based solutions.

Potential Drawbacks and Criticisms of the GOP Plan

Critics of the GOP plan raise several concerns:

-

Impact on Low-Income Borrowers: Changes to IDR plans could disproportionately affect low-income borrowers, potentially leading to higher payments and increased difficulty in repaying their loans.

-

Increased Costs for Taxpayers: While proponents argue for reduced government spending, some argue that a reduced loan forgiveness program may shift the burden to taxpayers in the long run due to higher default rates and other economic consequences.

-

Long-Term Sustainability: Concerns exist about the long-term sustainability and overall effectiveness of a market-based approach, given that student loan debt is a complex issue with multiple factors at play.

-

Limited Loan Forgiveness Options: The reduction or stricter requirements for loan forgiveness under the GOP plan could leave many borrowers with significant debt burdens for many years.

Political Landscape and Future Outlook of the GOP Student Loan Repayment Plan

The political feasibility of the GOP student loan repayment plan is highly dependent on the specifics of the proposal and the prevailing political climate.

-

Political Support and Opposition: The plan is likely to face significant opposition from Democrats and advocacy groups concerned about the potential impact on low-income borrowers and access to higher education. Support within the GOP itself may also vary depending on the specifics of the plan.

-

Potential Amendments and Modifications: Any proposed plan is likely to undergo significant changes during the legislative process, incorporating amendments and compromises to garner broader support.

-

Long-Term Impact on Student Loan Debt: The long-term impact will depend largely on how effectively the plan addresses the underlying issues of rising tuition costs and the increasing burden of student loan debt.

Conclusion:

The GOP's proposed student loan repayment plan presents a fundamentally different approach to managing student loan debt compared to existing federal programs. While proponents highlight potential benefits such as increased affordability and a simplified repayment process, critics express concerns about the potential negative impacts on low-income borrowers and the long-term sustainability of the plan. Understanding the nuances of the GOP student loan repayment plan—its key features, potential benefits, and criticisms—is crucial for borrowers and policymakers alike. Stay informed about developments regarding the GOP student loan repayment plan and its potential impact on your financial future. Further research into specific aspects of the plan is encouraged to make informed decisions about your student loan repayment strategy.

Featured Posts

-

Tom Thibodeau On Officiating Knicks Game 2 Post Game Reaction

May 17, 2025

Tom Thibodeau On Officiating Knicks Game 2 Post Game Reaction

May 17, 2025 -

Trumps Middle East Visit May 15 2025 Analysis And News

May 17, 2025

Trumps Middle East Visit May 15 2025 Analysis And News

May 17, 2025 -

Ontarios 14 6 Billion Deficit Tariff Impacts And Economic Outlook

May 17, 2025

Ontarios 14 6 Billion Deficit Tariff Impacts And Economic Outlook

May 17, 2025 -

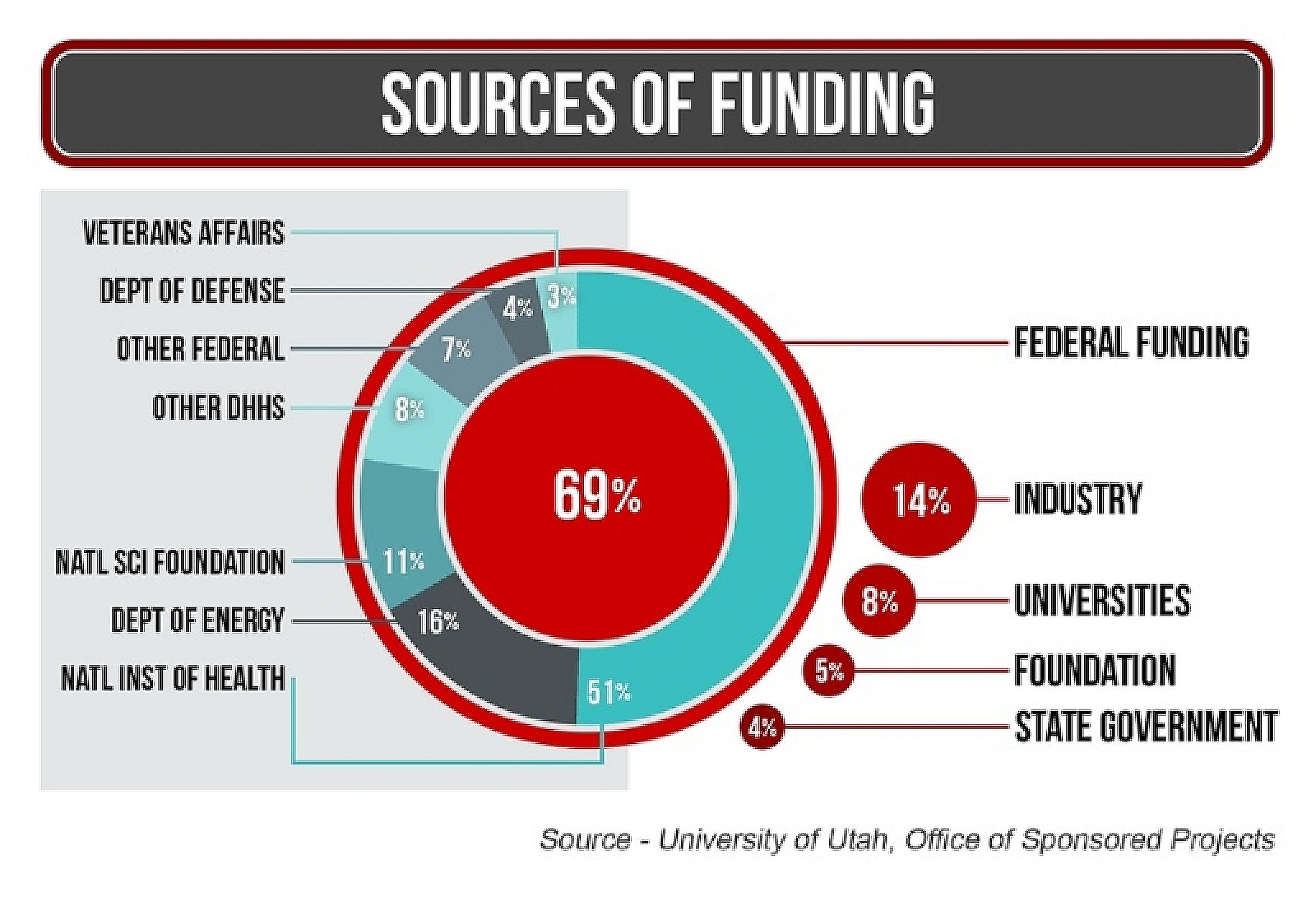

U Of U Receives 75 Million For New West Valley Hospital And Health Campus

May 17, 2025

U Of U Receives 75 Million For New West Valley Hospital And Health Campus

May 17, 2025 -

The 1 Debt Tom Cruise And Tom Hanks Unresolved Hollywood Story

May 17, 2025

The 1 Debt Tom Cruise And Tom Hanks Unresolved Hollywood Story

May 17, 2025

Latest Posts

-

Real Money Online Casinos New Zealand 7 Bit Casino And Other Top Choices

May 17, 2025

Real Money Online Casinos New Zealand 7 Bit Casino And Other Top Choices

May 17, 2025 -

Could These Etfs Profit From Ubers Autonomous Vehicle Technology

May 17, 2025

Could These Etfs Profit From Ubers Autonomous Vehicle Technology

May 17, 2025 -

7 Bit Casino Leading The Pack Of Top Online Casinos In New Zealand

May 17, 2025

7 Bit Casino Leading The Pack Of Top Online Casinos In New Zealand

May 17, 2025 -

Guide To Traveling With Pets On Uber In Mumbai

May 17, 2025

Guide To Traveling With Pets On Uber In Mumbai

May 17, 2025 -

Betting On Ubers Driverless Future Etfs That Could Pay Off

May 17, 2025

Betting On Ubers Driverless Future Etfs That Could Pay Off

May 17, 2025