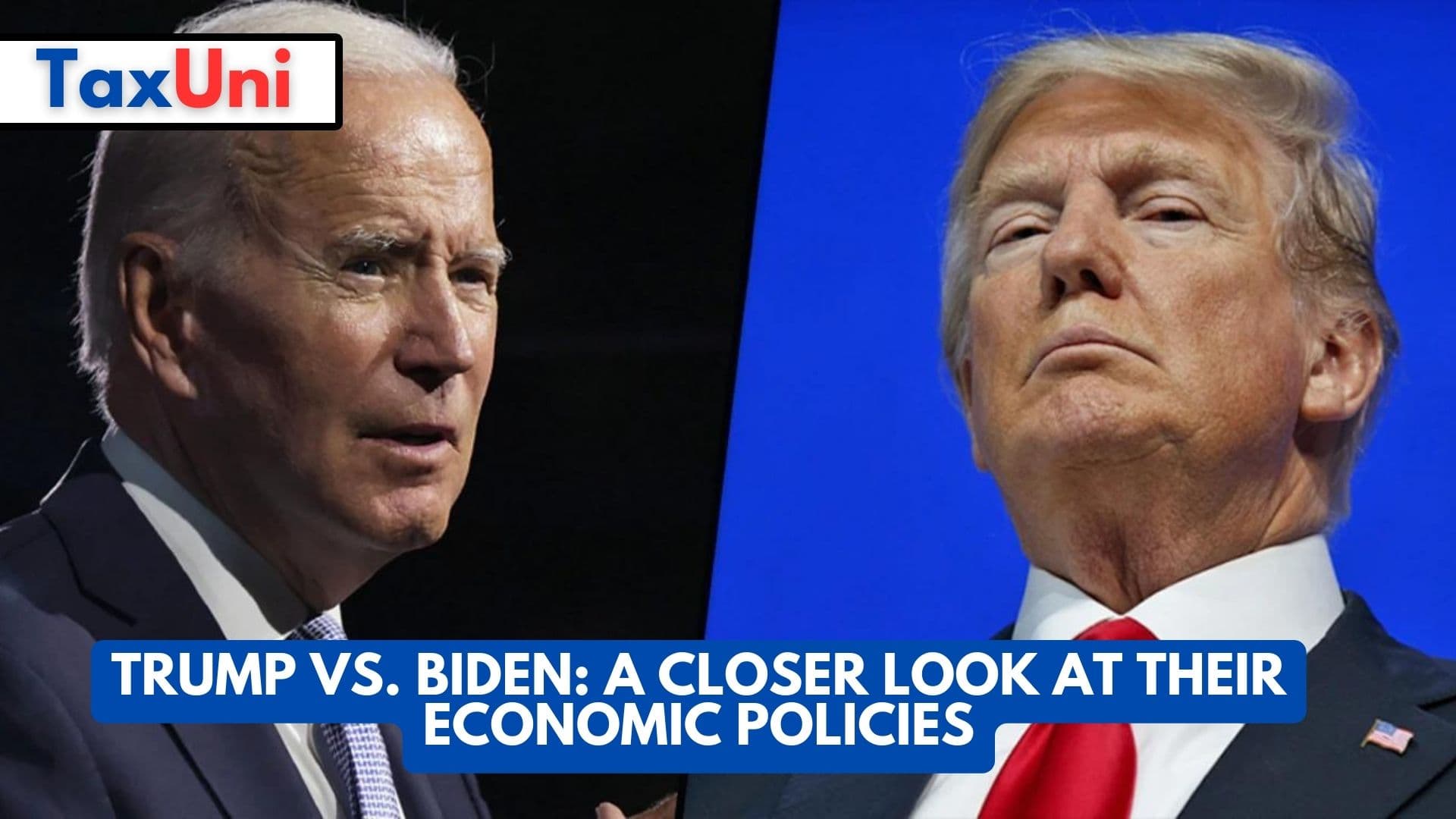

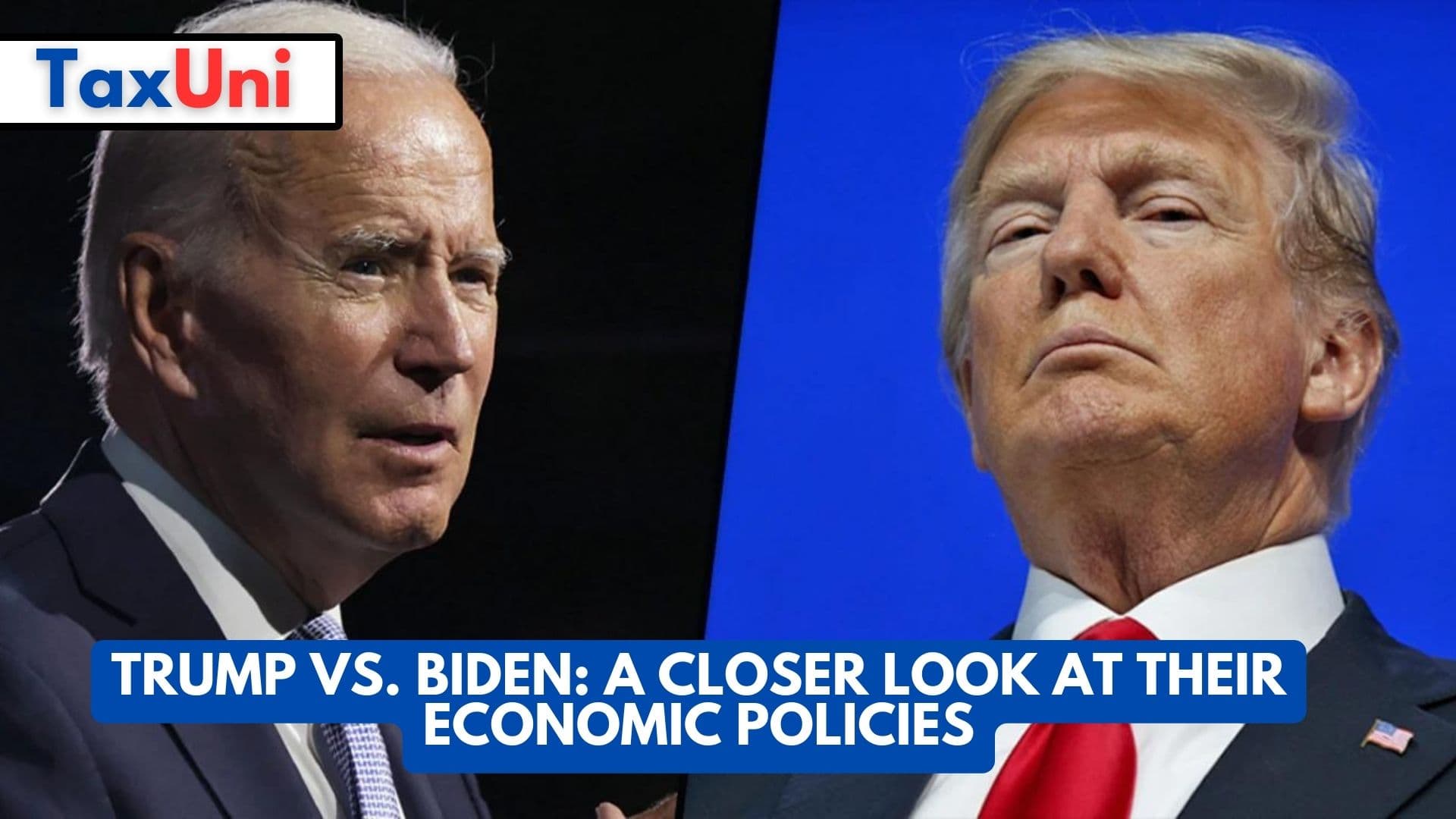

Assessing Trump's Economic Policies: A Review Of The Numbers

Table of Contents

H2: Tax Cuts and Their Impact

The cornerstone of Trump's economic agenda was the 2017 Tax Cuts and Jobs Act (TCJA). This landmark legislation significantly altered the US tax code, aiming to stimulate economic growth through reduced tax burdens on businesses and individuals.

H3: The 2017 Tax Cuts and Jobs Act

The TCJA implemented several key changes:

- Reduction in corporate tax rate: The most significant change was the reduction of the federal corporate tax rate from 35% to 21%. This was intended to boost business investment and competitiveness.

- Individual tax bracket changes: The act also modified individual income tax brackets, standard deductions, and personal exemptions. These changes resulted in lower tax rates for many individuals, particularly higher-income earners.

- Impact on national debt: The tax cuts were projected to significantly increase the national debt over the long term. This projection was a significant point of contention during the debate surrounding the legislation.

The actual revenue impacts of the TCJA fell short of initial projections. While economic growth did increase in the short term, the extent to which this growth can be directly attributed to the tax cuts remains a subject of debate among economists. Critics argued that the tax cuts disproportionately benefited corporations and high-income earners, exacerbating income inequality. This regressive nature of the tax cuts is supported by studies showing a widening gap between the wealthiest and the rest of the population during this period. Further research is needed to fully understand the long-term effects of these changes on income distribution and economic stability.

H3: Impact on Business Investment and Job Creation

A key argument in favor of the TCJA was that lower corporate taxes would spur business investment and job creation. While there was an increase in business investment in the years following the tax cuts, it's difficult to isolate the contribution of the tax cuts from other factors, such as general economic conditions and technological advancements.

- Business investment: Data on business investment showed a modest increase following the TCJA, but this increase was not uniform across all sectors.

- Job creation numbers: Job creation numbers during this period were positive, but again, attributing this solely to the tax cuts is problematic due to other influencing economic variables.

- Comparison to previous administrations: Comparing job creation and investment numbers under the Trump administration to previous administrations shows mixed results. While the rate of job creation was comparable to some previous periods, it was not exceptionally high considering the significant tax cuts implemented.

The relationship between the tax cuts and actual job growth and investment remains a complex issue requiring further analysis to establish a definitive causal link.

H2: Trade Policies and Their Consequences

Trump's administration pursued a protectionist trade policy, characterized by increased tariffs and renegotiation of existing trade agreements.

H3: Trade Wars and Tariffs

The Trump administration initiated trade disputes with several countries, notably China, imposing significant tariffs on a wide range of imported goods.

- Key tariffs implemented: Tariffs were imposed on steel, aluminum, and various consumer goods, impacting multiple industries.

- Impact on specific industries: The tariffs heavily impacted industries reliant on imported goods, such as agriculture and manufacturing. Farmers, for instance, faced retaliatory tariffs from China.

- Impact on consumer prices: The tariffs led to increased prices for some consumer goods, impacting household budgets and inflation rates.

The impact of these tariffs on trade deficits is complex. While some argued that the tariffs reduced the trade deficit with certain countries, overall trade deficits persisted, and the tariffs sparked retaliatory measures that harmed American businesses. The long-term economic consequences of these trade wars are still being assessed.

H3: Renegotiation of Trade Agreements (NAFTA/USMCA)

The renegotiation of the North American Free Trade Agreement (NAFTA) resulted in the United States-Mexico-Canada Agreement (USMCA).

- Key changes in USMCA: The USMCA introduced changes regarding labor standards, intellectual property, and automotive manufacturing rules of origin.

- Impact on specific sectors: The automotive industry experienced significant adjustments due to the new rules of origin.

- Changes in trade flows: The overall impact of USMCA on trade flows remains a topic of ongoing analysis. Some sectors benefited from the changes, while others faced challenges adapting to the new regulations.

While the USMCA aimed to create a more balanced and equitable trade relationship, its full economic impact is yet to be fully realized and requires further study.

H2: Regulatory Changes and Deregulation

The Trump administration pursued a significant deregulation agenda, aiming to reduce the burden of government regulations on businesses.

H3: Deregulation Efforts across Sectors

Deregulation efforts were observed across various sectors:

- Environmental regulations: Numerous environmental regulations were rolled back, impacting air and water quality standards.

- Financial regulations: Financial regulations implemented after the 2008 financial crisis were also relaxed.

- Projected and actual economic effects: Proponents argued that deregulation would stimulate economic growth and efficiency. However, the actual economic effects were varied and often debated.

The environmental impact of these deregulation efforts is a significant concern, with studies suggesting potential negative consequences for public health and the environment.

H3: Impact on Economic Growth and Inequality

The impact of deregulation on economic growth and inequality is a subject of ongoing research and debate.

- GDP growth figures: While GDP growth was positive during parts of the Trump administration, it is difficult to definitively link this growth solely to deregulation.

- Income inequality metrics: Income inequality metrics, such as the Gini coefficient, provide mixed results regarding the impact of deregulation on wealth distribution.

- Wealth concentration data: Data on wealth concentration shows a continued trend of increasing wealth inequality during this period.

The relationship between deregulation, economic growth, and income inequality requires further detailed analysis to understand the long-term effects of these policies.

3. Conclusion:

This analysis of Trump's economic policies reveals a complex picture. While the tax cuts initially spurred economic growth, their long-term sustainability and distributional effects remain debatable. The trade wars had a mixed impact, hurting some sectors while benefiting others. Deregulation efforts aimed to stimulate growth but also raised concerns about environmental protection and income inequality. A comprehensive assessment of Trump's economic legacy requires a nuanced understanding of these interacting factors. Further research and analysis are needed to fully understand the lasting effects of these policies on the US and global economies. To continue exploring this crucial topic, further research into the impact of specific policies on different demographics and industries is encouraged – continue your assessment of Trump's economic policies by examining specific sector data and detailed economic models.

Featured Posts

-

Victoria Contundente De Rayadas Gracias A Burky

Apr 23, 2025

Victoria Contundente De Rayadas Gracias A Burky

Apr 23, 2025 -

Dodgers Roberts Admits Crucial Hit Altered World Series Outcome

Apr 23, 2025

Dodgers Roberts Admits Crucial Hit Altered World Series Outcome

Apr 23, 2025 -

Nowhere To Hide Trumps Trade Policies And The Canadian Economy

Apr 23, 2025

Nowhere To Hide Trumps Trade Policies And The Canadian Economy

Apr 23, 2025 -

Erzurum Okul Tatili 24 Subat Pazartesi Guencel Durum Ve Aciklama

Apr 23, 2025

Erzurum Okul Tatili 24 Subat Pazartesi Guencel Durum Ve Aciklama

Apr 23, 2025 -

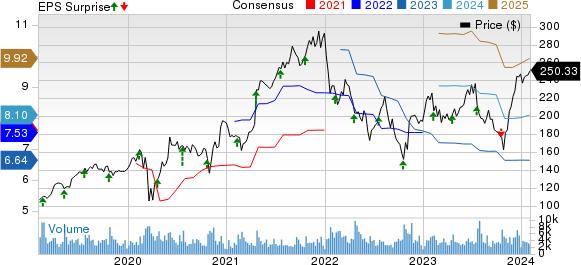

Equifaxs Efx Strong Q Quarter Earnings Profit Exceeds Forecasts

Apr 23, 2025

Equifaxs Efx Strong Q Quarter Earnings Profit Exceeds Forecasts

Apr 23, 2025

Latest Posts

-

Figmas Ai A Deeper Dive Into Its Competition With Adobe Word Press And Canva

May 10, 2025

Figmas Ai A Deeper Dive Into Its Competition With Adobe Word Press And Canva

May 10, 2025 -

Analyzing Figmas Ai Advancements Competitive Implications For Adobe Word Press And Canva

May 10, 2025

Analyzing Figmas Ai Advancements Competitive Implications For Adobe Word Press And Canva

May 10, 2025 -

Ai Driven Podcast Creation Digesting Repetitive Scatological Documents

May 10, 2025

Ai Driven Podcast Creation Digesting Repetitive Scatological Documents

May 10, 2025 -

Putins Victory Day Ceasefire Analysis And Implications

May 10, 2025

Putins Victory Day Ceasefire Analysis And Implications

May 10, 2025 -

Revolutionizing Voice Assistant Development Open Ais Latest Tools

May 10, 2025

Revolutionizing Voice Assistant Development Open Ais Latest Tools

May 10, 2025