Bank Of Canada Interest Rates: Desjardins Sees Three More Cuts

Table of Contents

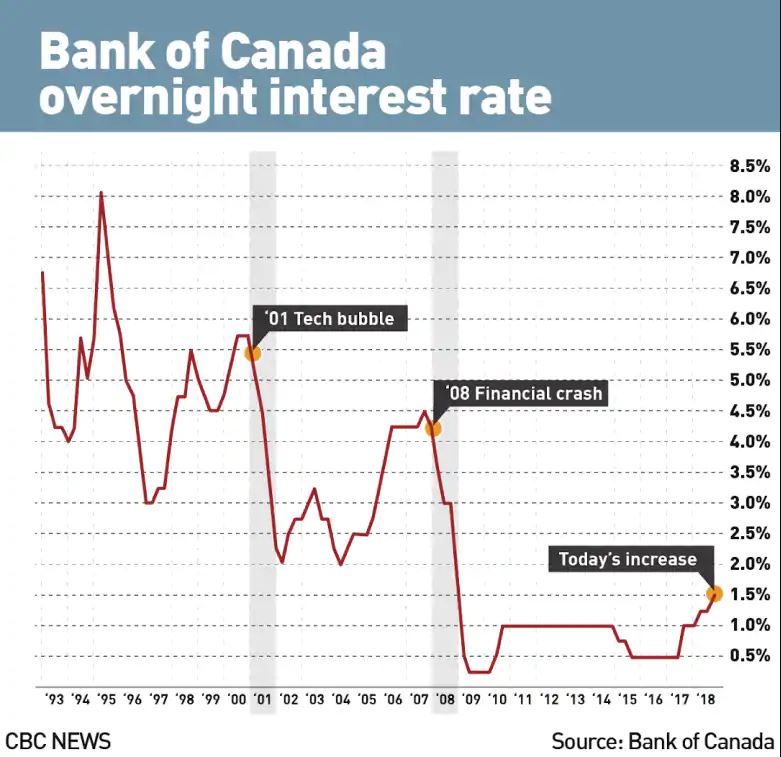

The current economic climate is a turbulent one, marked by persistent inflation and fluctuating global markets. The decisions made by the Bank of Canada regarding interest rates are therefore critically important, influencing everything from mortgage rates to consumer spending. In a surprising prediction, Desjardins, a major Canadian financial institution, forecasts three more cuts to Bank of Canada interest rates. This prediction carries significant weight, potentially reshaping the Canadian economic landscape and impacting consumers across the nation. This article will delve into Desjardins' rationale, explore the potential consequences for the Canadian economy, analyze alternative viewpoints, and ultimately offer guidance on navigating this evolving financial situation.

<h2>Desjardins' Rationale for Predicting Three More Interest Rate Cuts</h2>

Desjardins bases its prediction of three further Bank of Canada interest rate cuts on a careful analysis of several key economic indicators. Their assessment points towards a more cautious approach than previously anticipated by the central bank.

- Lower-than-expected inflation figures: While inflation has cooled somewhat, it remains stubbornly above the Bank of Canada's target range. Desjardins believes the current rate reductions will further slow inflation without triggering a significant economic downturn.

- Concerns about a potential recession: The global economic outlook is uncertain, with several major economies facing potential recessions. This risk prompts Desjardins to anticipate more accommodative monetary policy from the Bank of Canada.

- Weakening consumer spending: Consumer confidence is waning as inflation continues to erode purchasing power. Desjardins believes that lower interest rates are needed to stimulate consumer spending and prevent a deeper economic contraction.

- Global economic uncertainty: Geopolitical tensions and supply chain disruptions add to the overall uncertainty in the global economy. Desjardins argues that the Bank of Canada will need to respond to these external shocks by easing monetary policy.

Desjardins' reasoning involves the application of key principles of monetary policy. By lowering interest rates, the Bank of Canada aims to inject liquidity into the financial system, thereby stimulating borrowing, investment, and ultimately, economic growth. This approach is reminiscent of past periods of quantitative easing, although the scale and specific implementation would differ.

<h2>Impact of Potential Interest Rate Cuts on the Canadian Economy</h2>

The potential impact of further Bank of Canada interest rate cuts on the Canadian economy is multifaceted, presenting both opportunities and risks.

- Increased affordability for mortgages and loans: Lower interest rates will translate to lower borrowing costs for individuals and businesses, making mortgages, car loans, and other forms of debt more affordable.

- Potential for increased economic growth: Reduced borrowing costs can encourage businesses to invest, leading to job creation and overall economic expansion. Increased consumer spending, fueled by lower borrowing costs, would further boost this growth.

- Risk of higher inflation in the long term: While intended to stimulate the economy, lower interest rates could fuel inflation if not carefully managed. This would defeat the Bank of Canada's ultimate goal of price stability.

- Possible impact on the Canadian dollar exchange rate: Lower interest rates could weaken the Canadian dollar relative to other currencies, making imports more expensive and potentially impacting trade balances.

<h2>Alternative Perspectives and Market Reactions</h2>

Not all economists agree with Desjardins' prediction. Several financial institutions maintain that the Bank of Canada will hold steady or even implement further rate hikes to combat inflation, citing persistent inflationary pressures and the need to maintain price stability.

- Opinions from other financial institutions: A range of opinions exists among economists and analysts, reflecting the complexity of the current economic situation. Some believe inflation is more persistent than others predict.

- Analysis of market response to the prediction: The market's reaction to Desjardins' prediction has been mixed, with bond yields exhibiting some volatility and the stock market showing a cautious response. This uncertainty underscores the complexity of interpreting economic signals.

- Potential volatility in the financial markets: The conflicting predictions highlight the potential for increased volatility in financial markets as investors try to gauge the future direction of interest rates.

- Impact on government borrowing costs: Lower interest rates would reduce the cost of government borrowing, potentially providing fiscal space for government spending or debt reduction.

<h3>Considering the Bank of Canada's Mandate</h3>

The Bank of Canada's primary mandate is to maintain price stability and promote full employment. The predicted interest rate cuts might align with the employment goal in the short term but present a potential conflict with the price stability objective.

- Inflation targets of the Bank of Canada: The Bank of Canada aims to keep inflation within a specific target range. Lower interest rates could jeopardize this goal if inflation fails to respond as expected.

- Current employment levels and trends: Current employment levels and future projections will significantly influence the Bank of Canada's decisions.

- Potential conflicts between inflation and employment goals: Balancing the need to stimulate the economy with the need to control inflation poses a difficult challenge for the Bank of Canada. Navigating this trade-off will likely be a key factor shaping future interest rate decisions.

<h2>Conclusion: Understanding the Implications of Bank of Canada Interest Rates</h2>

Desjardins' prediction of three more Bank of Canada interest rate cuts is based on a careful analysis of key economic indicators and a cautious outlook for the global economy. While such cuts could stimulate economic growth and enhance affordability, they also carry the risk of increased inflation and a weakened Canadian dollar. It's crucial to understand that other economists hold differing viewpoints, resulting in considerable uncertainty within the markets.

Staying informed about changes in Bank of Canada interest rates and their potential impacts is essential for both personal financial planning and investment strategies. Regularly monitoring future announcements from the Bank of Canada and consulting with a qualified financial advisor are recommended steps to navigate the complexities of the evolving Canadian interest rate landscape and effectively manage your finances in light of these predicted Bank of Canada rate cuts and the broader Canadian interest rate forecast.

Featured Posts

-

Big Rig Rock Report 3 12 Essential Information For Truck Drivers From Rock 106 1

May 23, 2025

Big Rig Rock Report 3 12 Essential Information For Truck Drivers From Rock 106 1

May 23, 2025 -

Roger Daltreys Health The Who Singer Battles Hearing And Vision Loss At 81

May 23, 2025

Roger Daltreys Health The Who Singer Battles Hearing And Vision Loss At 81

May 23, 2025 -

Beyond Best And Final Strategies For Job Offer Negotiation

May 23, 2025

Beyond Best And Final Strategies For Job Offer Negotiation

May 23, 2025 -

Milly Alcock And Meghann Fahy Face Toxic Workplace In Siren Trailer

May 23, 2025

Milly Alcock And Meghann Fahy Face Toxic Workplace In Siren Trailer

May 23, 2025 -

Broadcoms V Mware Acquisition At And T Exposes Potential 1 050 Price Hike

May 23, 2025

Broadcoms V Mware Acquisition At And T Exposes Potential 1 050 Price Hike

May 23, 2025

Latest Posts

-

Intimacy And Growth Matt Maltese Talks About His Sixth Album Her In Deep

May 24, 2025

Intimacy And Growth Matt Maltese Talks About His Sixth Album Her In Deep

May 24, 2025 -

New Matt Maltese Album Her In Deep Exploring Themes Of Intimacy And Growth

May 24, 2025

New Matt Maltese Album Her In Deep Exploring Themes Of Intimacy And Growth

May 24, 2025 -

Matt Maltese Discusses Her In Deep Intimacy Growth And His Sixth Album

May 24, 2025

Matt Maltese Discusses Her In Deep Intimacy Growth And His Sixth Album

May 24, 2025 -

Matt Maltese Intimacy Growth And His New Album Her In Deep

May 24, 2025

Matt Maltese Intimacy Growth And His New Album Her In Deep

May 24, 2025 -

Bbc Radio 1 Big Weekend How To Increase Your Chances Of Getting Tickets

May 24, 2025

Bbc Radio 1 Big Weekend How To Increase Your Chances Of Getting Tickets

May 24, 2025