Bank Of Canada's Monetary Policy Under Fire: Rosenberg's Critique

Table of Contents

Rosenberg's Core Arguments Against the Bank of Canada's Approach

David Rosenberg, a prominent economist and strategist, has consistently voiced strong concerns regarding the Bank of Canada's approach to combating inflation. His central argument revolves around the belief that the Bank's actions are too aggressive and risk triggering a significant economic downturn without effectively curbing inflation.

- Overly Aggressive Rate Hikes: Rosenberg argues that the rapid pace of interest rate hikes is unnecessarily harsh, potentially pushing the economy into a deep recession. He believes a more gradual approach would be more effective in the long run.

- Ineffective Quantitative Tightening: He questions the effectiveness of the Bank's quantitative tightening (QT) measures, suggesting that they haven't significantly reduced liquidity in the system and may have unintended consequences.

- Misreading Inflationary Pressures: Rosenberg contends that the Bank of Canada is misinterpreting the root causes of inflation, focusing too heavily on demand-pull inflation while neglecting supply-side constraints and global factors. He suggests that their inflation targeting framework is outdated in the current environment.

Rosenberg's analysis, often disseminated through his firm, Rosenberg Research & Associates, consistently highlights these concerns. While specific sources are proprietary, his public commentary frequently echoes these criticisms, emphasizing the potential for a severe economic contraction as a consequence of the Bank's policy choices.

The Impact of Rising Interest Rates on the Canadian Economy

The Bank of Canada's interest rate increases are having a multifaceted impact on the Canadian economy:

- Housing Market Slowdown: Higher interest rates are significantly cooling the once-hot housing market, leading to decreased home prices and reduced construction activity. This impacts related industries and employment.

- Dampened Consumer Spending: Increased borrowing costs are affecting consumer spending, as individuals are less likely to take out loans for large purchases, leading to slower economic growth.

- Reduced Business Investment: Businesses are hesitant to invest in expansion or new projects due to higher borrowing costs, impacting job creation and economic output.

Rosenberg predicted many of these negative consequences, arguing that the Bank's aggressive approach would stifle economic activity without adequately addressing inflation. He frequently emphasizes the growing risk of recession, stemming directly from these policy decisions. The resulting economic slowdown could lead to increased unemployment and further complicate the situation for the Bank of Canada.

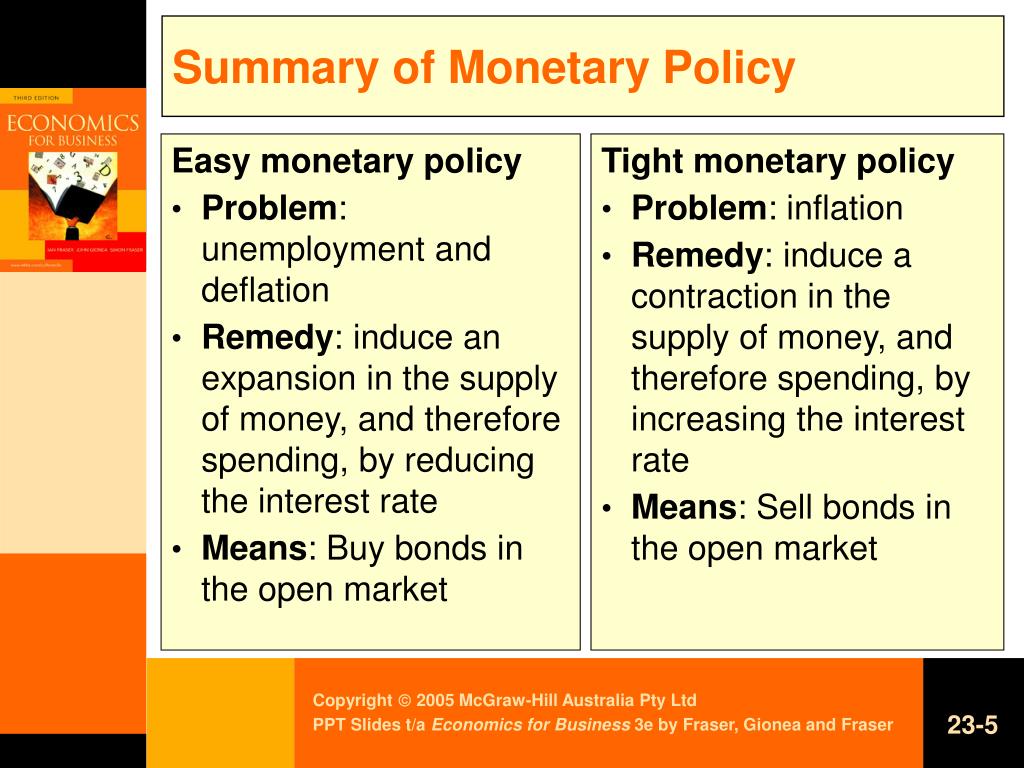

Alternative Monetary Policy Strategies Suggested by Rosenberg

While highly critical of the current approach, Rosenberg hasn't explicitly proposed a fully formed alternative monetary policy. However, his commentary consistently suggests a preference for a more measured and nuanced approach:

- Gradual Rate Hikes: A slower, more cautious increase in interest rates, allowing time to assess the impact on the economy.

- Focus on Supply-Side Solutions: Addressing supply-side bottlenecks and global inflationary pressures through targeted government interventions, rather than solely relying on monetary policy tools.

- Enhanced Communication & Transparency: Improving communication with the public and market participants to manage expectations and avoid unnecessary volatility.

These implied alternatives suggest a belief that a more holistic approach, combining monetary policy with targeted fiscal measures, would be more effective in achieving stable prices and sustainable economic growth. The potential benefit lies in avoiding a harsh recession, but the drawback could be a slower reduction in inflation.

Counterarguments and Rebuttals to Rosenberg's Critique

Not all economists agree with Rosenberg's assessment. Many argue that the Bank of Canada's actions are necessary to curb inflation and prevent a wage-price spiral. These counterarguments include:

- Inflationary Expectations: Some analysts believe that the Bank's aggressive actions are crucial to anchoring inflationary expectations and preventing further price increases. A weaker response could embolden inflation and prolong the problem.

- Global Inflationary Pressures: The Bank argues that global inflationary pressures necessitate a strong response to prevent further damage to the Canadian economy. They suggest that Rosenberg underestimates the severity of the external factors.

- Lagged Effects of Monetary Policy: Critics point out that the full impact of monetary policy changes takes time to materialize, meaning the current slowdown might reflect past decisions rather than a direct effect of the recent rate hikes.

These counterarguments highlight the complexities of monetary policy decision-making, emphasizing the challenges of balancing inflation control with economic growth. The ongoing debate underscores the lack of consensus on the optimal approach.

Conclusion: Assessing the Bank of Canada's Monetary Policy and Rosenberg's Critique

David Rosenberg's critique of the Bank of Canada's monetary policy highlights the ongoing debate surrounding the appropriate response to persistent inflation. While the Bank's actions aim to control inflation, Rosenberg's concerns about the potential for a deep recession and the effectiveness of their approach are valid points to consider. Counterarguments emphasize the global inflationary pressures and the need to control expectations. Ultimately, the effectiveness of the Bank of Canada's monetary policy will depend on the interplay of numerous factors, and the ongoing debate is crucial to understanding the complex economic landscape.

Stay informed about the Bank of Canada's monetary policy and continue following Rosenberg's analysis of the Bank of Canada's actions to gain a deeper understanding of this critical economic discussion. Learn more about the ongoing debate surrounding the Bank of Canada's monetary policy to make informed decisions about your personal finances and investments.

Featured Posts

-

American Expat Life In Spain One Returned One Stayed Why

Apr 29, 2025

American Expat Life In Spain One Returned One Stayed Why

Apr 29, 2025 -

The Thriving Venture Capital Secondary Market Trends And Insights

Apr 29, 2025

The Thriving Venture Capital Secondary Market Trends And Insights

Apr 29, 2025 -

Minnesota Film Production The Impact Of Tax Credits

Apr 29, 2025

Minnesota Film Production The Impact Of Tax Credits

Apr 29, 2025 -

Los Angeles Wildfires The Rise Of Disaster Betting And What It Means

Apr 29, 2025

Los Angeles Wildfires The Rise Of Disaster Betting And What It Means

Apr 29, 2025 -

Packers 2025 International Game Possibilities Two Chances To Play Abroad

Apr 29, 2025

Packers 2025 International Game Possibilities Two Chances To Play Abroad

Apr 29, 2025

Latest Posts

-

Sylvester Stallone And Coming Home A Missed Oscar Opportunity

May 12, 2025

Sylvester Stallone And Coming Home A Missed Oscar Opportunity

May 12, 2025 -

Kojak Itv 4 Schedule When And Where To Watch

May 12, 2025

Kojak Itv 4 Schedule When And Where To Watch

May 12, 2025 -

Exposition D Art Post Rencontre Avec Sylvester Stallone

May 12, 2025

Exposition D Art Post Rencontre Avec Sylvester Stallone

May 12, 2025 -

Une Rencontre Inattendue L Histoire De La Visite De Stallone A L Atelier D Une Artiste

May 12, 2025

Une Rencontre Inattendue L Histoire De La Visite De Stallone A L Atelier D Une Artiste

May 12, 2025 -

Rencontre Exceptionnelle Sylvester Stallone Et L Artiste De Renommee Mondiale

May 12, 2025

Rencontre Exceptionnelle Sylvester Stallone Et L Artiste De Renommee Mondiale

May 12, 2025