BigBear.ai (BBAI): Penny Stock Potential And Risks

Table of Contents

BBAI's Growth Potential: Exploring the Upsides of this AI Penny Stock

BigBear.ai (BBAI) presents a compelling case for growth, primarily driven by its expertise in AI and its strong presence in government contracting. Several factors contribute to its potential:

-

Competitive Advantage: BBAI possesses a unique blend of AI capabilities and deep experience working with government agencies. This allows them to offer sophisticated solutions tailored to the specific needs of defense and intelligence clients. Their specialized AI solutions provide a significant competitive advantage.

-

Financial Performance and Projections: While past performance is not indicative of future results, analyzing BBAI's revenue growth, contract wins, and future projections is crucial. Examining financial statements and analyst reports can shed light on the company’s financial health and growth trajectory. A rising BBAI stock price often reflects positive financial news and market sentiment.

-

Innovative AI Solutions: BBAI leverages advanced AI technologies, including machine learning and data analytics, to deliver cutting-edge solutions. These technologies are crucial for modern defense and intelligence operations, driving demand for BBAI's services. The ongoing evolution and innovation in AI further strengthens BBAI's potential.

-

Market Expansion Opportunities: The company has opportunities to expand into new markets and secure additional government contracts, which could significantly boost revenue and the BBAI stock price. This includes exploring international markets and diversifying its service offerings.

Navigating the Risks: Understanding the Challenges of BBAI Penny Stock

Despite the potential for growth, investing in BBAI, like any penny stock, carries significant risk:

-

Penny Stock Volatility: The inherent volatility of penny stocks is a major concern. BBAI's stock price can experience dramatic swings, leading to substantial gains or losses in short periods. This high volatility makes BBAI unsuitable for risk-averse investors.

-

Financial Risks: Investors should carefully assess BBAI's financial statements, focusing on its debt levels, profitability, and cash flow. High debt levels and inconsistent profitability present significant financial risks.

-

Market Competition: The AI and government contracting sectors are highly competitive. BBAI faces competition from established players with greater resources and market share. Analyzing the competitive landscape is crucial for understanding potential threats to BBAI's market position.

-

Regulatory Risks: BBAI's operations are subject to government regulations, which can change unexpectedly and impact the company's profitability and ability to secure contracts. Changes in defense spending or procurement policies can also significantly impact the company.

-

Legal and Reputational Risks: Any existing lawsuits, controversies, or negative publicity surrounding BBAI can severely impact its stock price and investor confidence. Thorough due diligence is necessary to identify and assess such risks.

BBAI Stock Valuation and Investment Strategies: A Balanced Perspective

Valuing BBAI stock requires a careful assessment of its current market conditions and future prospects.

-

Valuation Methods: Several valuation methods can be employed, including Discounted Cash Flow (DCF) analysis and comparable company analysis. These techniques attempt to estimate BBAI's intrinsic value and compare it to its current market price.

-

Market Capitalization and Growth Potential: BBAI's current market capitalization should be considered in relation to its projected growth. A high market capitalization might suggest the stock is already priced for future growth.

-

Investment Strategies: Investment strategies can range from long-term buy-and-hold to short-term trading. However, the high volatility of BBAI makes short-term trading extremely risky. A well-diversified portfolio can mitigate the risk associated with investing in a single penny stock.

-

Risk Tolerance and Diversification: Investing in penny stocks requires a high degree of risk tolerance. Diversification across different asset classes is crucial to mitigate potential losses.

Making Informed Decisions About BigBear.ai (BBAI) Penny Stock

Investing in BigBear.ai (BBAI) offers the potential for significant returns but comes with considerable risk. Thorough due diligence is paramount. Understand the company's financial performance, competitive landscape, regulatory environment, and valuation before making any investment decisions. Remember, past performance is not indicative of future results. Consult with a qualified financial advisor to assess the suitability of BBAI for your investment portfolio and risk tolerance. Learn more about BigBear.ai (BBAI) and assess its suitability for your investment portfolio. Understand the potential and risks of BigBear.ai (BBAI) penny stock investment before making any decisions.

Featured Posts

-

Hercule Poirot Su Play Station 5 Prezzo Sotto I 10 E Su Amazon

May 20, 2025

Hercule Poirot Su Play Station 5 Prezzo Sotto I 10 E Su Amazon

May 20, 2025 -

Fenerbahce De Talisca Tadic Tartismasinin Ardindan Transfer Hamlesi

May 20, 2025

Fenerbahce De Talisca Tadic Tartismasinin Ardindan Transfer Hamlesi

May 20, 2025 -

Obstacles To A Smooth Mls Transfer For Giorgos Giakoumakis

May 20, 2025

Obstacles To A Smooth Mls Transfer For Giorgos Giakoumakis

May 20, 2025 -

Fieldview Care Home Des Allegations Graves De Maltraitance Et D Abus Sexuels

May 20, 2025

Fieldview Care Home Des Allegations Graves De Maltraitance Et D Abus Sexuels

May 20, 2025 -

Tariff Wars And Ryanairs Future The Significance Of The Buyback

May 20, 2025

Tariff Wars And Ryanairs Future The Significance Of The Buyback

May 20, 2025

Latest Posts

-

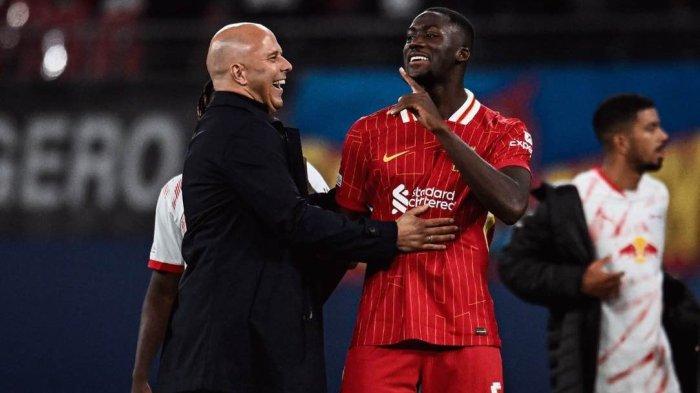

Liverpool Juara Liga Inggris 2024 2025 Para Pelatih Di Balik Kesuksesan The Reds

May 21, 2025

Liverpool Juara Liga Inggris 2024 2025 Para Pelatih Di Balik Kesuksesan The Reds

May 21, 2025 -

Cubs Fans Lady And The Tramp Hot Dog Scene Goes Viral Nbc Chicago

May 21, 2025

Cubs Fans Lady And The Tramp Hot Dog Scene Goes Viral Nbc Chicago

May 21, 2025 -

Dennis Quaid Meg Ryan And James Caan An Overlooked Western Neo Noir

May 21, 2025

Dennis Quaid Meg Ryan And James Caan An Overlooked Western Neo Noir

May 21, 2025 -

Real Madrid In Yeni Teknik Direktoerue Klopp Mu Ancelotti Mi

May 21, 2025

Real Madrid In Yeni Teknik Direktoerue Klopp Mu Ancelotti Mi

May 21, 2025 -

Klopp Un Ancelotti Ye Uestuenluegue Taktiksel Analiz

May 21, 2025

Klopp Un Ancelotti Ye Uestuenluegue Taktiksel Analiz

May 21, 2025