BigBear.ai Holdings, Inc. (BBAI): Analyst Downgrade And Growth Concerns

Table of Contents

Analyst Downgrade: Understanding the Rationale

Several analysts have recently downgraded BBAI stock, leading to significant reductions in target prices. Understanding the reasoning behind these actions is crucial for investors.

Specific Downgrades and Target Price Reductions

For instance, [Analyst Firm A] lowered its rating from [Previous Rating] to [New Rating] citing [Reason 1] and [Reason 2], simultaneously slashing the target price from $[Previous Target Price] to $[New Target Price]. Similarly, [Analyst Firm B] expressed concerns about [Specific Concern], resulting in a downgrade and a reduced target price. These actions highlight a growing skepticism regarding BBAI's near-term prospects.

Concerns Regarding Revenue Projections

Analysts' concerns primarily revolve around BigBear.ai's ability to meet its ambitious revenue projections. Specific concerns include:

- Slow contract wins: Competition in the AI and data analytics market is fierce, making securing new contracts challenging.

- Increased competition: Established players and new entrants are putting pressure on pricing and margins.

- Challenges in scaling operations: Rapid growth can strain resources and lead to inefficiencies, impacting profitability.

- Dependence on government contracts: Fluctuations in government spending can significantly affect revenue.

Evaluation of BigBear.ai's Financial Performance

Analyzing BigBear.ai's recent financial reports is essential to assess the validity of these concerns. While [mention positive aspects if any, e.g., strong growth in a specific sector], concerns remain about [mention specific financial metrics showing weakness, e.g., declining profit margins, slower than expected revenue growth in Q[Quarter]]. A thorough examination of the quarterly and annual reports is necessary for a complete understanding.

Comparison to Industry Peers

Comparing BBAI's performance and valuation to its competitors within the AI and data analytics sector provides valuable context. [Mention key competitors and a brief comparison of their performance metrics and valuations]. This comparative analysis helps determine whether the current market valuation of BBAI is justified given its performance relative to peers.

Growth Concerns for BigBear.ai (BBAI)

Beyond the immediate concerns reflected in the analyst downgrades, several long-term growth concerns exist for BigBear.ai.

Competitive Landscape

The AI and data analytics market is highly competitive. [Name key competitors] possess significant resources and established market positions. Market saturation in certain segments and the constant emergence of new technologies pose significant challenges to BigBear.ai's growth trajectory.

Dependence on Government Contracts

BigBear.ai's substantial reliance on government contracts exposes it to considerable risk. Budget cuts, shifts in government priorities, and delays in contract awards can all significantly impact revenue and profitability. Diversifying its client base beyond government contracts is crucial for long-term stability.

Technological Advancements and Innovation

The AI sector is characterized by rapid technological advancements. BigBear.ai needs to continually innovate and invest in R&D to remain competitive. Failure to keep pace with technological developments could lead to a loss of market share.

Integration Challenges and Operational Efficiency

BigBear.ai has pursued a strategy of acquisitions to expand its capabilities. Successfully integrating acquired companies and streamlining operations to improve efficiency are critical for realizing the full potential of these acquisitions. Integration challenges can lead to cost overruns and delays, hindering growth.

Potential Upsides and Mitigation Strategies

Despite the challenges, BigBear.ai possesses significant potential for long-term growth.

Long-Term Growth Potential in the AI Sector

The overall AI market is poised for substantial growth, offering significant opportunities for companies like BigBear.ai. Its specialization in [mention specific areas of expertise] positions it well to capitalize on this growth, provided it successfully addresses the aforementioned challenges.

Strategic Partnerships and Acquisitions

Strategic partnerships with technology providers and complementary businesses could significantly enhance BigBear.ai's capabilities and market reach. Well-chosen acquisitions can also accelerate growth by adding new technologies, expertise, and market access.

Focus on Key Market Segments

Concentrating on specific high-growth market segments where BigBear.ai's solutions offer a strong competitive advantage can significantly improve its growth prospects. Identifying and targeting these niche markets is crucial for maximizing returns.

Management's Response to Analyst Concerns

It is important to examine BigBear.ai management's response to the analyst downgrades and their plans to address the identified concerns. [Summarize management’s response and any planned mitigation strategies]. The effectiveness of these strategies will be a key factor in determining BBAI's future performance.

Conclusion: BigBear.ai (BBAI) Investment Outlook: Weighing Risks and Rewards

The analyst downgrades and growth concerns surrounding BBAI stock present a complex investment scenario. While challenges exist regarding revenue projections, competition, and reliance on government contracts, the long-term potential within the rapidly expanding AI sector remains significant. BigBear.ai's ability to effectively address these challenges, innovate, and execute its strategic plans will ultimately determine its success. Before making any investment decisions regarding BigBear.ai (BBAI) stock, conduct thorough due diligence, research BBAI's financial performance, and analyze the risks and rewards carefully. Learn more about BigBear.ai and its future prospects to make informed investment choices.

Featured Posts

-

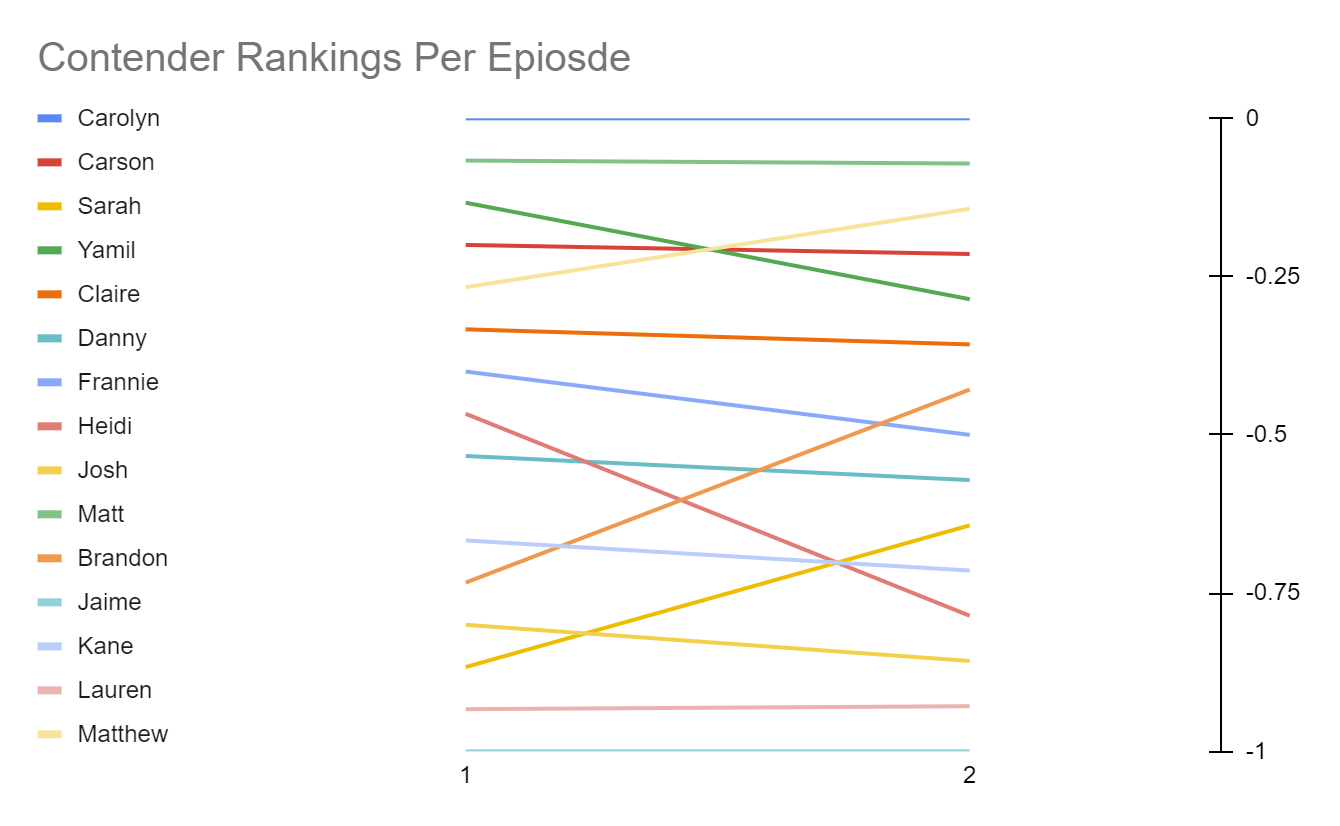

Eurovision Final 2025 Top 5 Predictions And Contender Analysis

May 20, 2025

Eurovision Final 2025 Top 5 Predictions And Contender Analysis

May 20, 2025 -

Manchester Uniteds Pursuit Of Matheus Cunha Intensifies

May 20, 2025

Manchester Uniteds Pursuit Of Matheus Cunha Intensifies

May 20, 2025 -

Eurovision 2024 France Louane Revele Son Titre Pour L Eurovision

May 20, 2025

Eurovision 2024 France Louane Revele Son Titre Pour L Eurovision

May 20, 2025 -

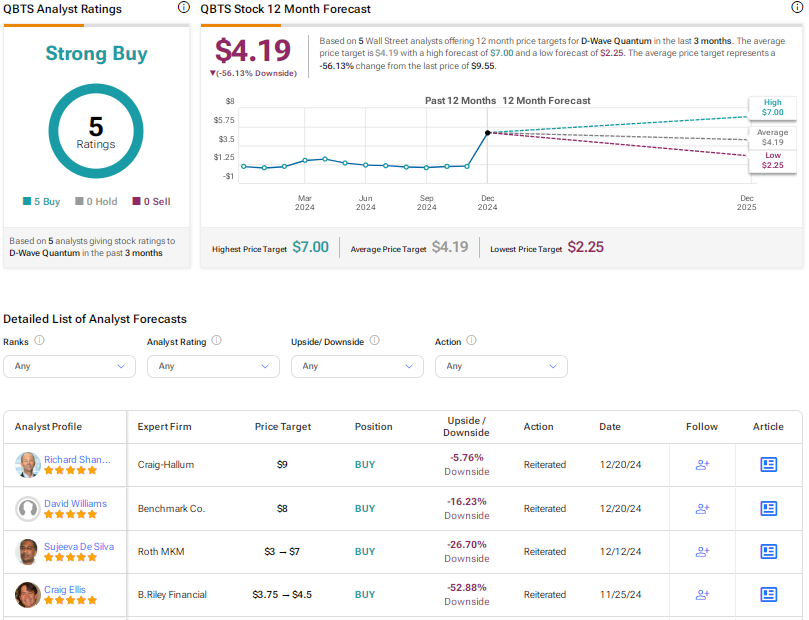

D Wave Quantum Qbts Stock Performance Impact Of Kerrisdale Capitals Report

May 20, 2025

D Wave Quantum Qbts Stock Performance Impact Of Kerrisdale Capitals Report

May 20, 2025 -

Fsv Mainz 05 Vs Bayer 04 Leverkusen Matchday 34 Report And Highlights

May 20, 2025

Fsv Mainz 05 Vs Bayer 04 Leverkusen Matchday 34 Report And Highlights

May 20, 2025

Latest Posts

-

Real Madrid In Yeni Teknik Direktoerue Klopp Mu Ancelotti Mi

May 21, 2025

Real Madrid In Yeni Teknik Direktoerue Klopp Mu Ancelotti Mi

May 21, 2025 -

Klopp Un Ancelotti Ye Uestuenluegue Taktiksel Analiz

May 21, 2025

Klopp Un Ancelotti Ye Uestuenluegue Taktiksel Analiz

May 21, 2025 -

Ancelotti Nin Yerine Klopp Real Madrid Icin Dogru Secim Mi

May 21, 2025

Ancelotti Nin Yerine Klopp Real Madrid Icin Dogru Secim Mi

May 21, 2025 -

Juergen Klopp Mu Carlo Ancelotti Mi Teknik Direktoer Karsilastirmasi

May 21, 2025

Juergen Klopp Mu Carlo Ancelotti Mi Teknik Direktoer Karsilastirmasi

May 21, 2025 -

Premier League 2024 25 Champions Images And Highlights

May 21, 2025

Premier League 2024 25 Champions Images And Highlights

May 21, 2025