D-Wave Quantum (QBTS) Stock Performance: Impact Of Kerrisdale Capital's Report

Table of Contents

The release of Kerrisdale Capital's critical report on D-Wave Quantum (QBTS) sent shockwaves through the quantum computing investment landscape. This in-depth analysis examines the report's impact on QBTS stock performance, dissecting the key arguments and analyzing the market's subsequent reaction. We'll explore the implications for investors considering a stake in this rapidly evolving technological sector, helping you navigate the complexities of investing in quantum computing stocks.

Kerrisdale Capital's Report: Key Allegations and Evidence

Keywords: Kerrisdale Capital report, D-Wave Quantum allegations, short selling, fraud allegations, financial analysis, due diligence

Kerrisdale Capital's report leveled serious accusations against D-Wave Quantum, alleging issues ranging from questionable financial reporting to misleading claims about technological capabilities and customer acquisition. The report's core arguments centered on:

-

Inflated Revenue and Customer Acquisition: The report questioned the sustainability of D-Wave's revenue model, suggesting inflated customer numbers and limited real-world applications of their technology. Specific financial statements were scrutinized to support these claims.

-

Technological Limitations: Kerrisdale Capital argued that D-Wave's quantum annealing technology is significantly less powerful and versatile than competing approaches, like gate-based quantum computing. This limitation, they suggested, limits the technology's commercial viability.

-

Misleading Marketing and Public Statements: The report highlighted instances where it believed D-Wave had presented an overly optimistic view of their technology's capabilities and market potential, potentially misleading investors.

D-Wave Quantum responded to the report by issuing a press release and statement refuting the claims. However, the detailed nature of Kerrisdale's financial analysis, along with the specific examples cited, made the rebuttal somewhat less impactful for many investors. The credibility of Kerrisdale Capital's methodology, which involved extensive financial modeling and interviews, played a significant role in shaping investor perception. Independent verification of the claims remains crucial.

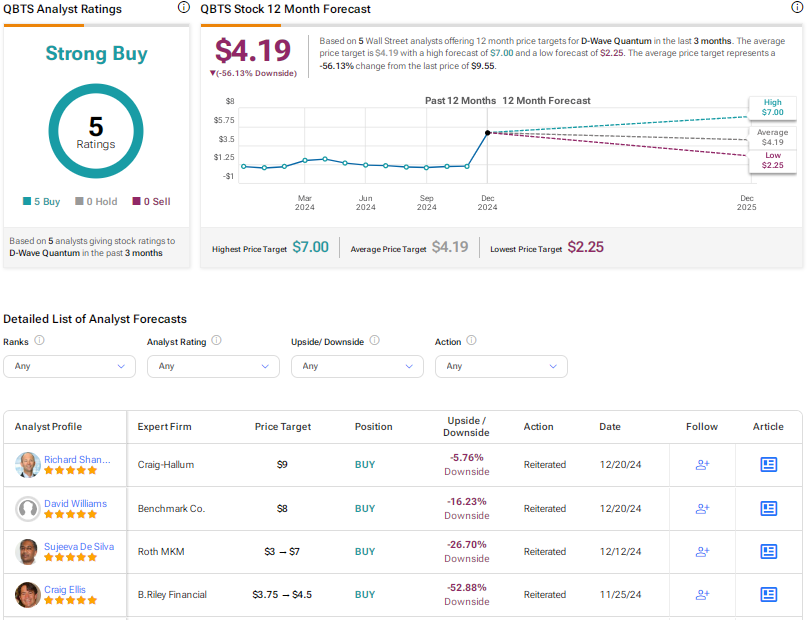

QBTS Stock Price Reaction Following the Report

Keywords: QBTS stock price, market reaction, stock volatility, investor sentiment, trading volume, stock chart analysis

The release of Kerrisdale Capital's report immediately triggered a sharp decline in QBTS stock price. The chart below (insert relevant stock chart here) illustrates the volatility surrounding the report's publication. Trading volume spiked significantly, indicating a surge in investor activity.

-

Initial Drop: The stock experienced a considerable immediate drop, reflecting a negative investor sentiment.

-

Volatility: Subsequent trading days saw considerable volatility, with price swings reflecting the ongoing uncertainty and debate surrounding the report's findings.

-

Analyst Downgrades: Several analysts downgraded their ratings and price targets for QBTS stock following the report, adding further pressure on the share price. This shift in investor sentiment contributed to a sustained period of low stock prices.

The overall market reaction demonstrates the significant impact of negative reports on even promising companies in a rapidly evolving sector like quantum computing. The stock's performance clearly illustrates the heightened sensitivity to negative news in speculative growth markets.

Impact on Investor Confidence and Future Outlook for D-Wave Quantum

Keywords: investor confidence, future outlook, quantum computing market, competition, technological advancements, long-term investment, risk assessment

The Kerrisdale Capital report severely impacted investor confidence in D-Wave Quantum. The allegations raised questions about the company's financial health, technological capabilities, and overall management.

-

Fundraising Challenges: Securing future funding rounds might prove more challenging for D-Wave Quantum in the short term, as investors become more cautious about the company's prospects.

-

Competitive Landscape: The report may have strengthened the positions of competitors in the quantum computing field, potentially attracting more investment and market share. This increased competition adds another layer of risk to the QBTS stock.

-

Technological Advancements: While D-Wave continues to advance its technology, the report's criticisms highlight the need for demonstrable progress and real-world applications to restore investor trust. This necessitates a successful commercialization strategy.

The long-term outlook for D-Wave Quantum depends heavily on its ability to address the concerns raised in the report, demonstrate tangible progress in its technology and market adoption, and rebuild investor confidence. Investing in QBTS stock currently carries considerable risk, requiring a careful assessment of both potential rewards and potential downsides.

Alternative Perspectives and Further Analysis

Keywords: expert opinions, alternative viewpoints, independent analysis, risk management, due diligence, investment strategy

Several financial news outlets and analysts have offered alternative perspectives on the Kerrisdale Capital report and its impact on D-Wave Quantum. Some have pointed to the potential for bias in short-selling reports, highlighting the importance of conducting independent research and due diligence before making any investment decisions. A thorough risk assessment is paramount before investing in high-growth, speculative stocks like QBTS.

Conclusion

Kerrisdale Capital's report on D-Wave Quantum (QBTS) has undeniably shaken investor confidence and significantly affected the company's stock performance. The allegations, the market's reaction, and the future implications all demand careful scrutiny. Investors must undertake comprehensive due diligence, weighing potential risks and rewards before investing in QBTS.

Call to Action: Stay informed about the ongoing developments surrounding D-Wave Quantum (QBTS) and the broader quantum computing market. Conduct thorough research and consider seeking professional financial advice before making any investment decisions related to D-Wave Quantum stock or other quantum computing investments. Remember that investing in QBTS stock involves considerable risk.

Featured Posts

-

D Wave Quantum Qbts Reasons Behind The Significant Stock Drop In 2025

May 20, 2025

D Wave Quantum Qbts Reasons Behind The Significant Stock Drop In 2025

May 20, 2025 -

Poslednji Pozdrav Andelki Milivojevic Tadic Tuga Kolega I Prijatelja

May 20, 2025

Poslednji Pozdrav Andelki Milivojevic Tadic Tuga Kolega I Prijatelja

May 20, 2025 -

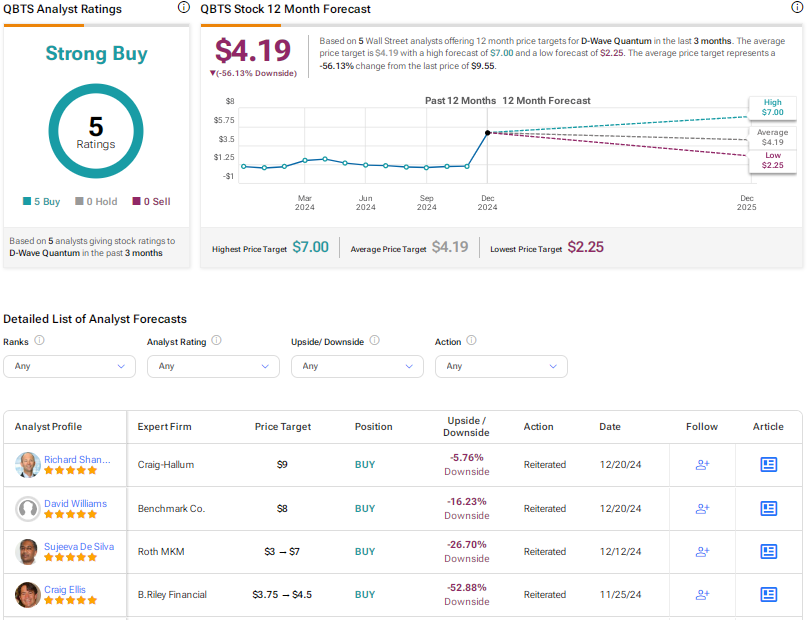

Activision Blizzard Acquisition Ftcs Appeal Against Court Ruling

May 20, 2025

Activision Blizzard Acquisition Ftcs Appeal Against Court Ruling

May 20, 2025 -

Des Cours D Ecriture Ia Agatha Christie Reinventee Innovation Ou Simple Copie

May 20, 2025

Des Cours D Ecriture Ia Agatha Christie Reinventee Innovation Ou Simple Copie

May 20, 2025 -

Wireless Headphones Innovations And Enhancements For Superior Sound

May 20, 2025

Wireless Headphones Innovations And Enhancements For Superior Sound

May 20, 2025

Latest Posts

-

Awkward Exchange Lorraine Kelly And David Walliams Cancelled Remark

May 20, 2025

Awkward Exchange Lorraine Kelly And David Walliams Cancelled Remark

May 20, 2025 -

Sandylands U Your Complete Tv Guide

May 20, 2025

Sandylands U Your Complete Tv Guide

May 20, 2025 -

Lorraine Kelly Reacts To David Walliams Controversial Comment

May 20, 2025

Lorraine Kelly Reacts To David Walliams Controversial Comment

May 20, 2025 -

David Walliams Cancelled Joke Leaves Lorraine Kelly Uncomfortable

May 20, 2025

David Walliams Cancelled Joke Leaves Lorraine Kelly Uncomfortable

May 20, 2025 -

Lorraine Kellys Awkward Tv Moment David Walliams Cancelled Comment

May 20, 2025

Lorraine Kellys Awkward Tv Moment David Walliams Cancelled Comment

May 20, 2025