Bitcoin's Recent Rebound: Long-Term Implications

Table of Contents

Analyzing the Drivers Behind Bitcoin's Recent Rebound

Several interconnected factors have contributed to Bitcoin's recent price rebound. Understanding these drivers is crucial for predicting future price movements and assessing the long-term viability of Bitcoin as an investment.

Macroeconomic Factors

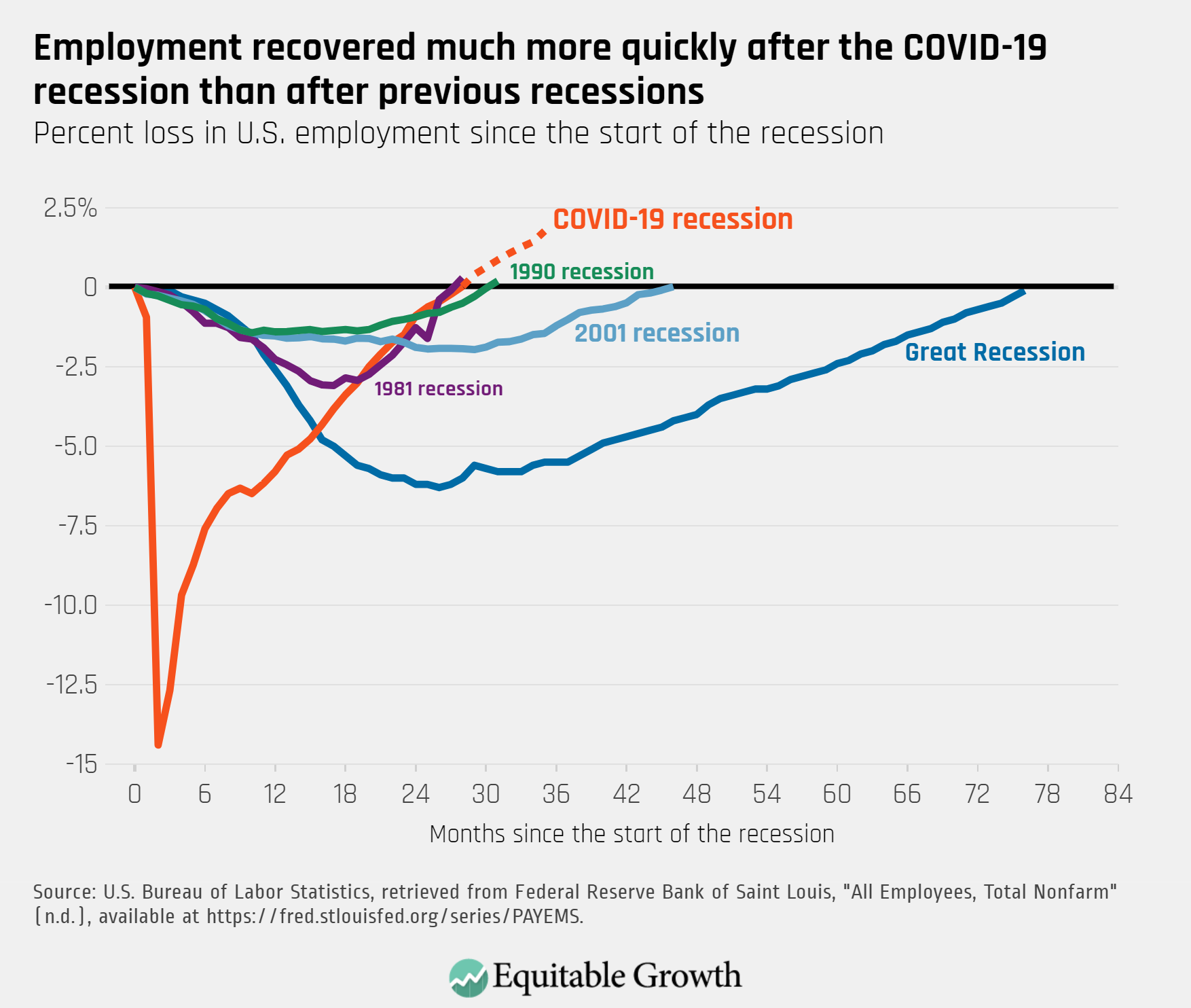

Global macroeconomic instability has played a significant role in Bitcoin's recent resurgence. High inflation rates in many countries, coupled with fears of a looming recession, have driven investors to seek alternative assets that might act as a hedge against traditional markets. Bitcoin, often viewed as "digital gold," benefits from this uncertainty. Investors see it as a store of value less susceptible to the whims of traditional financial systems.

- Increased institutional investment: Large financial institutions are increasingly allocating a portion of their portfolios to Bitcoin, boosting demand and price.

- Regulatory clarity in certain jurisdictions: More defined regulatory frameworks in some countries are creating a more stable and attractive environment for Bitcoin investment.

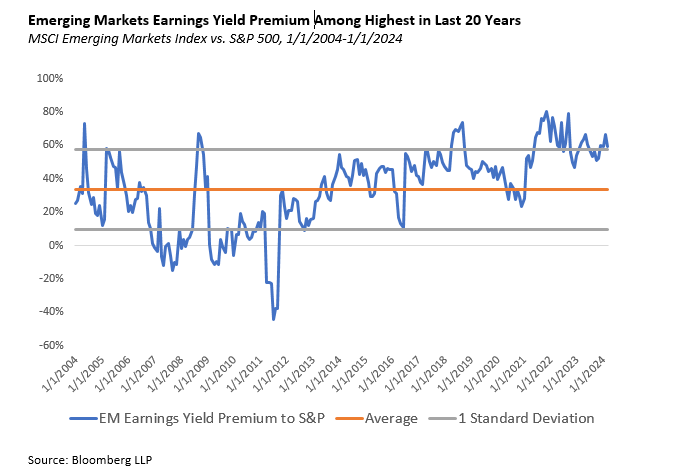

- Growing adoption in emerging markets: Bitcoin adoption is growing rapidly in developing economies where traditional financial systems are less accessible or reliable. This increased demand from emerging markets is pushing up the price.

Technical Analysis

Technical indicators also suggest a potential bullish trend for Bitcoin. Chart patterns and trading volume data point towards a sustained price recovery.

- Breaking key resistance levels: Bitcoin's recent price action has seen it break through significant resistance levels, indicating growing bullish momentum.

- Increasing trading volume: Higher trading volume accompanying the price increase confirms the strength of the rebound and suggests genuine market interest.

- Positive RSI and MACD indicators: Technical indicators like the Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) are showing positive signals, suggesting further upward price movement.

Market Sentiment and News

Positive news coverage and a shift in market sentiment have also significantly impacted Bitcoin's recent rebound. Positive media portrayals and endorsements from influential figures fuel investor confidence and encourage further investment.

- Positive regulatory announcements: Favorable regulatory developments or statements from governing bodies can significantly influence market sentiment and drive up the price.

- Major company adoption of Bitcoin: When major corporations add Bitcoin to their balance sheets or begin accepting it as payment, it signals a growing acceptance and legitimacy, boosting confidence.

- Positive statements from influential figures in the crypto space: Endorsements from prominent figures within the cryptocurrency community can trigger a wave of optimism and propel the price higher (FOMO).

Potential Long-Term Implications of the Rebound

Bitcoin's recent rebound could have significant long-term implications for the cryptocurrency market and the broader financial landscape.

Increased Mainstream Adoption

The current price increase could accelerate the mainstream adoption of Bitcoin. As more individuals and institutions become familiar with and invest in Bitcoin, its market capitalization and price are likely to continue growing.

- Growing number of Bitcoin ATMs: Increased access to Bitcoin through ATMs makes it more convenient for individuals to buy and sell.

- Increased availability of Bitcoin payment options: More businesses accepting Bitcoin as payment drives adoption and usage.

- Expansion of Bitcoin-related financial products: The emergence of new financial products like Bitcoin-backed loans and ETFs facilitates wider participation.

Regulatory Landscape

The regulatory environment surrounding Bitcoin is constantly evolving. Government policies and regulatory decisions will play a crucial role in shaping Bitcoin's long-term prospects.

- Government initiatives to regulate cryptocurrencies: Governments worldwide are developing regulatory frameworks for cryptocurrencies, impacting market stability and growth.

- The influence of regulatory bodies like the SEC and CFTC: Decisions made by regulatory bodies will significantly influence Bitcoin's legal status and trading environment.

- The impact of different national approaches to crypto regulation: Varying regulatory approaches across different countries can create both opportunities and challenges for Bitcoin adoption.

Technological Advancements

Technological advancements within the Bitcoin ecosystem will continue to enhance its scalability, usability, and overall appeal.

- Layer-2 scaling solutions: Technologies like the Lightning Network improve transaction speeds and reduce fees, making Bitcoin more practical for everyday use.

- Improvements in transaction speeds and fees: Faster transaction speeds and lower fees make Bitcoin more competitive and user-friendly.

- Development of new Bitcoin-related applications: The development of new applications and use cases expands Bitcoin's utility and attracts new users.

Conclusion

Bitcoin's recent rebound presents a complex picture with various contributing factors. While macroeconomic conditions and market sentiment play crucial roles, technological advancements and regulatory developments are equally important in shaping Bitcoin's long-term trajectory. The sustained nature of this rebound remains uncertain, but it undoubtedly signals renewed interest in the cryptocurrency.

Call to Action: Understanding the nuances of Bitcoin's recent rebound is crucial for investors. Stay informed about the latest developments and trends affecting Bitcoin's price and potential. Continue researching Bitcoin's recent rebound and its implications to make informed decisions about your investment strategy.

Featured Posts

-

Go Compare Drops Wynne Evans After Strictly Come Dancing Scandal

May 09, 2025

Go Compare Drops Wynne Evans After Strictly Come Dancing Scandal

May 09, 2025 -

Elon Musks Net Worth Soars Tesla Stock Surge After Stepping Back From Dogecoin

May 09, 2025

Elon Musks Net Worth Soars Tesla Stock Surge After Stepping Back From Dogecoin

May 09, 2025 -

U S Federal Reserve Assessing The Pressure To Maintain Interest Rates

May 09, 2025

U S Federal Reserve Assessing The Pressure To Maintain Interest Rates

May 09, 2025 -

Sharp Decline In Indonesias Reserves Impact Of Rupiah Depreciation

May 09, 2025

Sharp Decline In Indonesias Reserves Impact Of Rupiah Depreciation

May 09, 2025 -

Federal Reserve Maintains Rates Weighing Inflation And Unemployment

May 09, 2025

Federal Reserve Maintains Rates Weighing Inflation And Unemployment

May 09, 2025