BP Executive Compensation: A 31% Decrease

Table of Contents

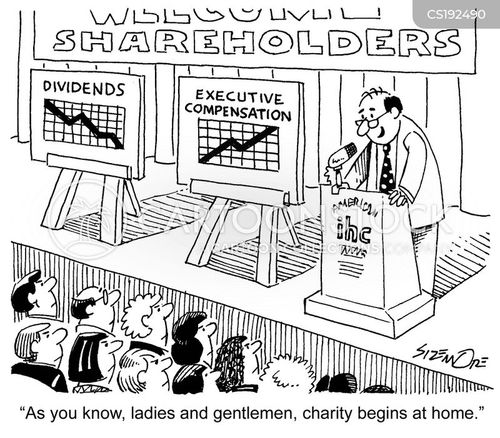

The Magnitude of the Reduction and its Context

BP's announcement regarding executive compensation revealed a staggering 31% decrease compared to the previous year's figures. While the exact figures for individual executives weren't publicly released in the same level of detail as previous years, it's clear the reduction impacted all top-level executives significantly. This wasn't a random decision; instead, it appears to be a strategic response to various factors affecting the company's performance and external pressures.

- Specific Numerical Data: While precise figures for individual executive compensation packages (CEO, CFO, etc.) remain partially undisclosed to the public at this time, analysts estimate a significant reduction across the board, representing a dramatic shift in compensation strategy compared to previous years.

- Industry Averages: Compared to industry averages for executive compensation in the oil and gas sector, BP's reduction places it considerably below many competitors, suggesting a deliberate attempt to align executive pay more closely with current economic realities and shareholder expectations.

- Bonuses and Stock Options: The decrease encompasses all forms of compensation, including bonuses and stock options. The value of stock options, in particular, is directly tied to BP's stock performance, meaning the reduction reflects a response to the changing market landscape and company profitability.

Potential Reasons Behind the Decrease in BP Executive Pay

Several interconnected factors likely contributed to BP's decision to slash executive compensation. These include:

-

Falling Oil Prices and Reduced Profitability: Fluctuations in global oil prices directly impact the profitability of oil and gas companies. A period of lower oil prices can necessitate cost-cutting measures, and reducing executive compensation is often seen as a way to demonstrate fiscal responsibility.

-

Shareholder Activism and Pressure to Reduce Executive Pay: Increasingly, shareholders are scrutinizing executive compensation packages, demanding greater alignment between pay and company performance. Activist investors may have played a role in pushing for this reduction.

-

Internal Company Restructuring or Cost-Cutting Measures: BP may be undergoing internal restructuring, leading to a broader cost-cutting initiative. Reducing executive pay is one way to signal a commitment to efficiency and fiscal responsibility to both internal employees and external investors.

-

Government Regulations Impacting Executive Compensation: In certain jurisdictions, there is increased government scrutiny and regulation of executive compensation in large corporations. BP may have adjusted its strategy pre-emptively in response to this changing regulatory environment.

-

Analysis of BP's Financial Performance: Examination of BP's financial reports from the relevant period shows a downturn in profits, creating pressure on all aspects of the company's spending, including executive pay.

-

Shareholder Resolutions: While specifics may not be publicly available, it's possible that shareholder resolutions concerning executive pay influenced the board's decision.

-

Internal BP Statements: BP's official statements likely cite the necessity of cost-cutting and a commitment to responsible financial management as justifications for the reduction in executive compensation.

Impact of the Decrease on BP's Future and its Stakeholders

The 31% decrease in BP executive compensation will undoubtedly have far-reaching consequences:

- Potential Effects on Employee Morale and Motivation: While the reduction targets top executives, it could impact overall employee morale and motivation if perceived as unfair or inconsistent with broader compensation strategies.

- Implications for Attracting and Retaining Top Talent: Lower executive compensation may make it more difficult for BP to attract and retain top talent in a competitive job market, particularly in the oil and gas industry.

- Analysis of Investor Reaction: Investor reaction has been mixed, with some seeing the reduction as a positive sign of fiscal responsibility, while others may view it as a sign of weakening financial prospects. Stock price fluctuations will provide some indication of this impact.

- Expert Opinions and Forecasts: Financial analysts and industry experts will be closely monitoring the long-term impact of this decision on BP's performance and ability to compete effectively.

Comparison to Other Major Oil and Gas Companies' Executive Compensation

To understand the significance of BP's move, it's crucial to compare its executive compensation practices to those of other major oil and gas companies such as Shell, ExxonMobil, and Chevron. While precise comparisons require detailed analysis of individual compensation packages, it's evident that BP's drastic reduction sets it apart from many of its competitors who may have implemented smaller, more gradual adjustments to their executive pay structures. This emphasizes the unique circumstances facing BP and its more aggressive approach to cost-cutting.

- Comparative Table: A detailed table comparing key executive compensation figures across these major oil companies would provide a clear benchmark and reveal the extent to which BP deviates from industry norms. [Note: This would require up-to-date data from various public company filings and potentially financial analysis reports].

- Trends and Differences: Analysis of this comparative data could reveal trends and differences in compensation strategies, such as reliance on stock options versus base salaries, and the sensitivity of executive pay to market conditions and company profitability.

- Industry Reports: Numerous industry reports and analyses are likely to emerge, offering insightful comparisons and interpretation of these compensation patterns within the oil and gas sector.

Conclusion: Understanding the Implications of the BP Executive Compensation Reduction

The 31% decrease in BP executive compensation is a significant event with far-reaching implications. Driven by a combination of falling oil prices, shareholder pressure, and internal cost-cutting measures, this decision reflects a strategic response to the challenges facing the company. While the immediate impact on employee morale and the ability to attract top talent remains uncertain, the long-term effects will be shaped by investor reactions, the company’s financial performance, and the broader competitive dynamics within the oil and gas sector. To stay informed about the evolving situation and understand the full ramifications of this significant shift in BP's compensation strategy, stay updated on BP executive compensation by following BP's investor relations website and reputable financial news sources. Learn more about BP's financial strategies and follow the latest news on BP executive pay to gain a comprehensive understanding of this important development.

Featured Posts

-

Carlo Ancelotti Nin Yerine Klopp Avantajlar Ve Dezavantajlar

May 22, 2025

Carlo Ancelotti Nin Yerine Klopp Avantajlar Ve Dezavantajlar

May 22, 2025 -

Finding Peppa Pig Online Free Streaming Options And Parental Controls

May 22, 2025

Finding Peppa Pig Online Free Streaming Options And Parental Controls

May 22, 2025 -

New Indoor Bounce Park Opens In Mesa Introducing Funbox

May 22, 2025

New Indoor Bounce Park Opens In Mesa Introducing Funbox

May 22, 2025 -

Making Your Own Cassis Blackcurrant Liqueur At Home

May 22, 2025

Making Your Own Cassis Blackcurrant Liqueur At Home

May 22, 2025 -

Mas Alla Del Arandano El Mejor Alimento Para Prevenir Enfermedades Cronicas

May 22, 2025

Mas Alla Del Arandano El Mejor Alimento Para Prevenir Enfermedades Cronicas

May 22, 2025

Latest Posts

-

Remont Pivdennogo Mostu Pidryadniki Vartist Ta Termini

May 22, 2025

Remont Pivdennogo Mostu Pidryadniki Vartist Ta Termini

May 22, 2025 -

Huizenmarktprognose Abn Amro Stijgende Prijzen Dalende Rente

May 22, 2025

Huizenmarktprognose Abn Amro Stijgende Prijzen Dalende Rente

May 22, 2025 -

Optimalisatie Van Uw Kamerbrief Certificaten Verkoopprogramma Bij Abn Amro

May 22, 2025

Optimalisatie Van Uw Kamerbrief Certificaten Verkoopprogramma Bij Abn Amro

May 22, 2025 -

Abn Amro Rentedaling En Verwachte Huizenprijsstijging

May 22, 2025

Abn Amro Rentedaling En Verwachte Huizenprijsstijging

May 22, 2025 -

De Afhankelijkheid Van Goedkope Arbeidsmigranten In De Nederlandse Voedingsindustrie Een Abn Amro Perspectief

May 22, 2025

De Afhankelijkheid Van Goedkope Arbeidsmigranten In De Nederlandse Voedingsindustrie Een Abn Amro Perspectief

May 22, 2025