Brexit's Negative Impact On UK Luxury Exports: A Sectoral Analysis

Table of Contents

Increased Trade Barriers and Tariffs

Post-Brexit, the UK's departure from the EU single market introduced new customs checks, tariffs, and non-tariff barriers, significantly impacting the cost and speed of exporting luxury goods. These increased hurdles have created a complex and expensive process, squeezing profit margins and hindering competitiveness.

- Increased Shipping Times due to Customs Delays: The implementation of new customs procedures has led to substantial delays in shipping, impacting the timely delivery of perishable goods and time-sensitive luxury items. This delay increases storage costs and risks damaging the reputation of brands known for their premium service.

- Higher Import Duties in EU Markets: Tariffs imposed on UK luxury goods entering the EU have increased the final price for consumers, reducing demand and eroding the competitiveness of British products against those from within the EU. This is particularly challenging for price-sensitive luxury markets.

- Complex Documentation Requirements Leading to Administrative Costs: The added paperwork and bureaucratic processes associated with exporting outside the EU have significantly increased administrative costs for businesses, impacting profitability and diverting resources from other crucial aspects of the business.

- Impact on Supply Chain Efficiency and Profitability: The overall effect of these barriers is a less efficient and less profitable supply chain, forcing businesses to absorb increased costs or pass them on to consumers, potentially impacting brand image and market share. This is particularly damaging for smaller luxury businesses with limited resources.

Weakening of the Pound Sterling

The post-Brexit decline in the value of the pound sterling has further exacerbated the challenges faced by UK luxury exporters. The weaker pound has made UK luxury goods more expensive for international buyers, reducing their affordability and desirability.

- Increased Prices for International Buyers: The weakening pound translates to higher prices for consumers in countries using stronger currencies, directly reducing demand for UK luxury goods.

- Reduced Purchasing Power for Foreign Consumers: International buyers find that their purchasing power has decreased, making UK luxury goods less attractive compared to those from countries with more stable currencies.

- Loss of Market Share to Competitors with More Stable Currencies: Competitors in the Eurozone and other regions with stronger currencies have gained a significant price advantage, leading to a loss of market share for UK luxury brands.

Reduced Access to the EU Single Market

Brexit has resulted in a loss of frictionless trade with the EU, significantly impacting the seamless flow of luxury goods. Accessing the EU market now involves complex logistical challenges and administrative hurdles.

- Loss of Preferential Access to the EU Market: The UK no longer benefits from preferential access to the EU market, placing it at a disadvantage compared to competitors within the EU.

- Increased Logistical Complexity for EU Distribution: The increased bureaucracy and customs checks have made distributing luxury goods within the EU significantly more complex and costly.

- Difficulties in Maintaining Brand Consistency Across the EU: The added complexity in logistics and distribution can impact a brand’s ability to maintain consistent service levels and brand image across the EU market, undermining the premium experience associated with luxury goods.

Impact on Specific Luxury Sectors

Brexit's impact is not uniform across all luxury sectors. The effects vary depending on the specific product, its production process, and its target market.

- Decline in Scotch Whisky Exports to the EU: The Scotch whisky industry, a significant contributor to UK luxury exports, has experienced a marked decline in sales to the EU due to increased tariffs and logistical challenges.

- Reduced Demand for British Luxury Cars in Europe: British luxury car manufacturers have also felt the pinch, with reduced demand from European consumers due to higher prices and increased delivery times.

- Challenges Faced by British Fashion Houses in Accessing the EU Market: British fashion houses face increased costs and logistical complexities in getting their products to EU consumers, hindering growth and competitiveness.

The Case of Scotch Whisky

The Scotch whisky industry serves as a prime example of Brexit's devastating impact. Tariffs and increased logistical hurdles have led to a significant drop in exports to the EU, threatening this vital sector of the UK economy. Data indicates a [insert percentage]% decrease in exports post-Brexit, highlighting the severity of the issue and the long-term implications for this iconic British luxury product.

Conclusion

Brexit's negative impact on UK luxury exports is multifaceted and severe, significantly impacting various sectors. Increased trade barriers, currency fluctuations, and reduced access to the EU single market have combined to create a challenging environment for UK luxury brands. Understanding the full extent of Brexit's negative impact on UK luxury exports is crucial for developing effective strategies to safeguard this vital industry. Further research and targeted policy initiatives are needed to mitigate these challenges and ensure the continued success of UK luxury brands in the global market. A proactive approach, including exploring new markets and adapting to the new trading environment, is essential for the survival and prosperity of the UK luxury goods sector.

Featured Posts

-

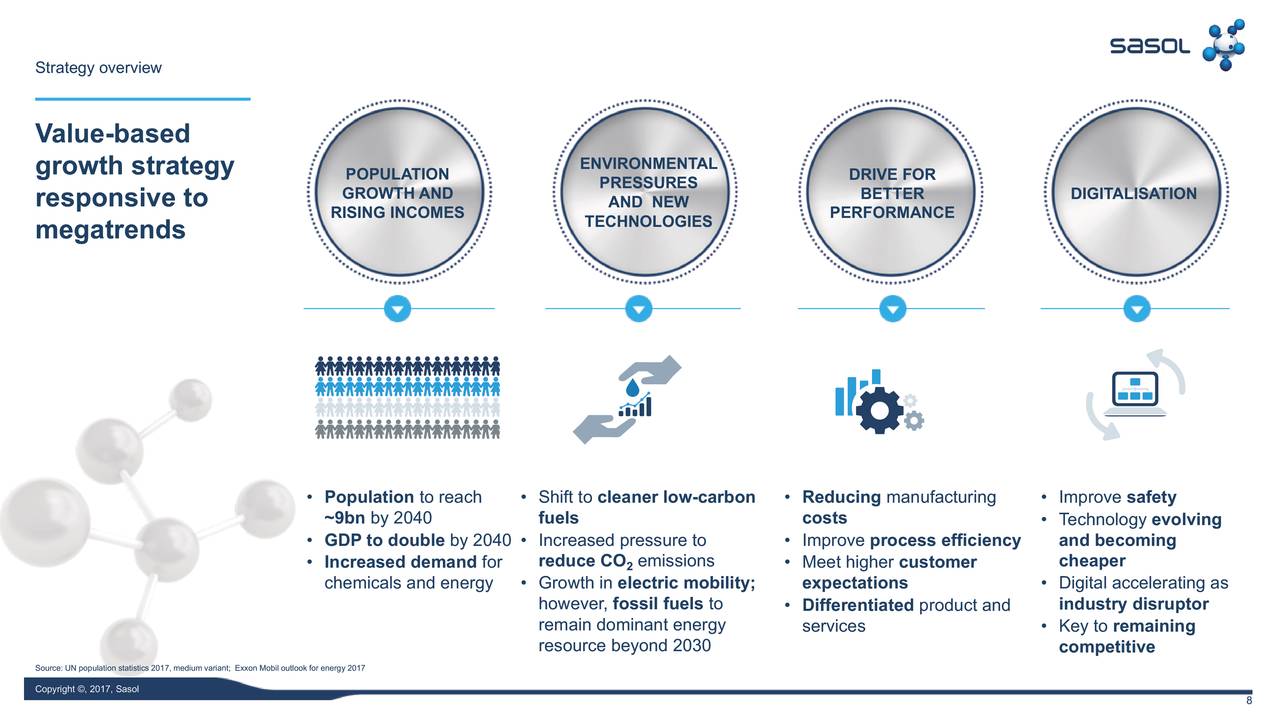

Sasol Sol Investor Concerns After Two Year Strategy Silence

May 20, 2025

Sasol Sol Investor Concerns After Two Year Strategy Silence

May 20, 2025 -

Japanese Manga Sparks Travel Fears Disaster Prediction Impact

May 20, 2025

Japanese Manga Sparks Travel Fears Disaster Prediction Impact

May 20, 2025 -

Talisca Ve Tadic Fenerbahce Nin Transfer Operasyonu Ve Saha Tartismasi

May 20, 2025

Talisca Ve Tadic Fenerbahce Nin Transfer Operasyonu Ve Saha Tartismasi

May 20, 2025 -

Dusan Tadic Fenerbahce Tarihine Gececek Bir Ilk

May 20, 2025

Dusan Tadic Fenerbahce Tarihine Gececek Bir Ilk

May 20, 2025 -

D Wave Quantum Qbts Stock Jump Analyzing Todays Increase

May 20, 2025

D Wave Quantum Qbts Stock Jump Analyzing Todays Increase

May 20, 2025

Latest Posts

-

Bundesliga Absteiger Bochum Und Holstein Kiel Leipzigs Cl Traum Geplatzt

May 20, 2025

Bundesliga Absteiger Bochum Und Holstein Kiel Leipzigs Cl Traum Geplatzt

May 20, 2025 -

Resilience And Mental Health From Setback To Success

May 20, 2025

Resilience And Mental Health From Setback To Success

May 20, 2025 -

Damaging Winds And Fast Moving Storms A Guide To Protection

May 20, 2025

Damaging Winds And Fast Moving Storms A Guide To Protection

May 20, 2025 -

Goretzkas Nations League Call Up Nagelsmanns Selection

May 20, 2025

Goretzkas Nations League Call Up Nagelsmanns Selection

May 20, 2025 -

Can Germany Overcome Italy In The Quarterfinals

May 20, 2025

Can Germany Overcome Italy In The Quarterfinals

May 20, 2025