Sasol (SOL) Investor Concerns After Two-Year Strategy Silence

Table of Contents

The Significance of Strategic Communication for Sasol (SOL)

Effective communication is paramount for any publicly traded company, especially one operating in a dynamic and challenging market like Sasol. The company's two-year silence on its strategic direction has had significant repercussions.

Impact on Investor Confidence

A lack of transparency breeds uncertainty and fuels speculation. This is particularly detrimental to investor confidence.

- Decreased transparency leads to increased speculation and negative market sentiment. When a company is silent, investors fill the void with their own interpretations, often leading to negative assumptions about the company's financial health and future prospects. This can trigger a downward spiral in the Sasol stock price.

- Silence fuels uncertainty about the company's future prospects and financial health. Without clear communication about its investment strategy and growth plans, investors are left to guess, making it difficult to assess the risks and potential rewards associated with investing in Sasol.

- Potential for decreased share value due to lack of confidence. Investor anxiety directly translates into market behavior. As confidence diminishes, investors may sell their Sasol shares, leading to a drop in the Sasol share price and a decrease in the company's market capitalization.

Analysis of Sasol's (SOL) Recent Performance

Analyzing Sasol's financial performance over the past two years is crucial to understanding the context of these investor concerns. While specific figures require independent research, certain aspects warrant examination:

- Examine key financial metrics (revenue, profit, debt). Have these metrics shown consistent growth or decline? Any significant shifts warrant investigation in relation to the lack of communication from management.

- Analyze market share changes and competitive landscape. Has Sasol maintained or lost market share? How is it performing relative to its competitors in the chemical company and energy sectors?

- Discuss any relevant industry trends impacting Sasol's performance. Factors such as fluctuating commodity prices, geopolitical instability, and the global push for sustainability significantly affect Sasol's operations and should be addressed transparently.

Unanswered Questions and Investor Concerns Regarding Sasol (SOL)

The prolonged silence leaves numerous critical questions unanswered, fueling investor anxieties.

Future Strategy and Direction

Investors are understandably concerned about Sasol's long-term vision and how the company intends to navigate the challenges and opportunities ahead.

- Uncertainty about future investments and capital allocation. Investors need to understand where Sasol plans to invest its resources and how this aligns with its long-term strategic goals.

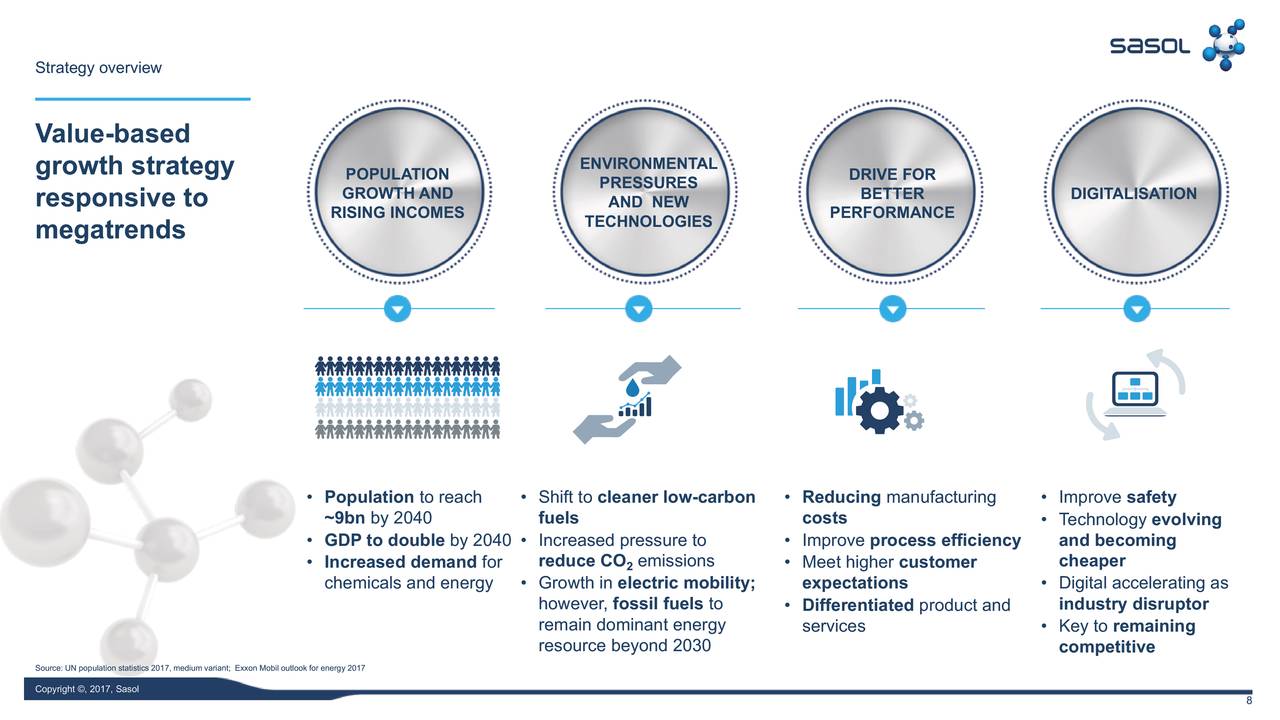

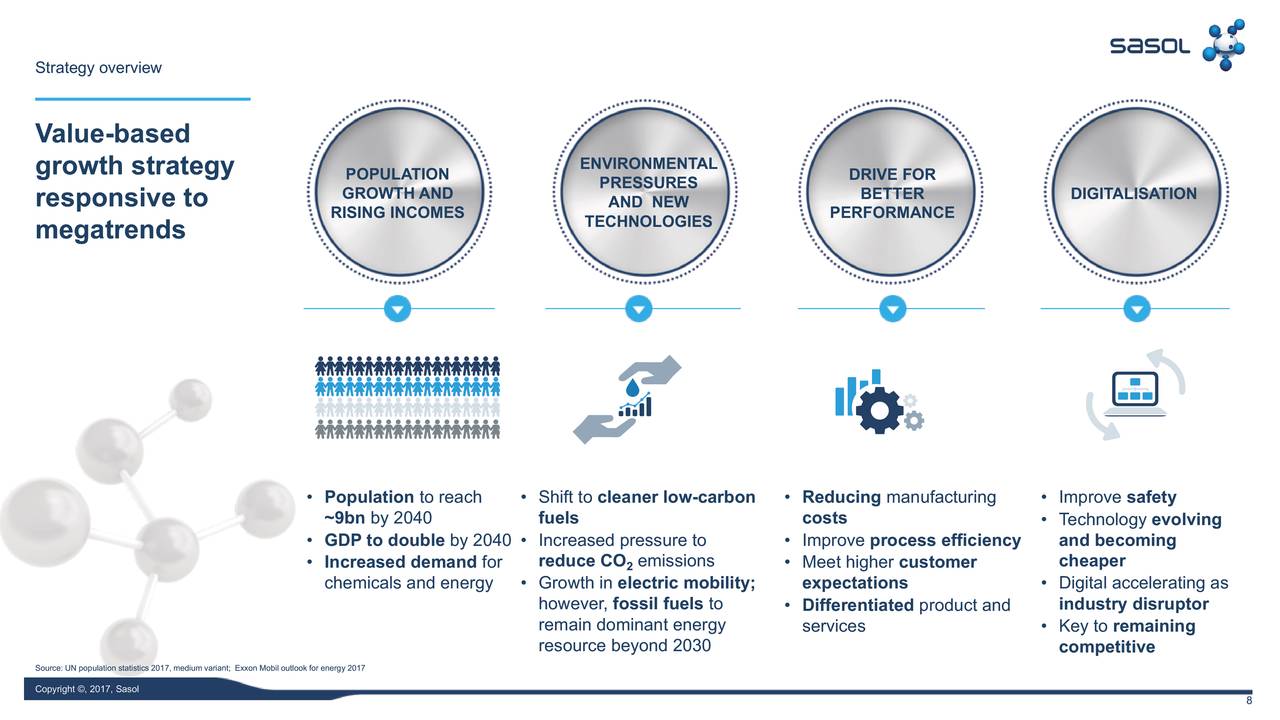

- Lack of clarity on the company’s approach to sustainability and ESG factors. Increasingly, investors prioritize environmental, social, and governance (ESG) considerations. Sasol’s silence on these crucial aspects leaves investors uncertain about its commitment to sustainable practices.

- Concerns about competition and market dynamics. The chemical and energy sectors are highly competitive. Investors need assurance that Sasol has a robust strategy to maintain its market position and profitability.

Risk Assessment and Mitigation

The lack of communication exacerbates existing risks, creating further uncertainty for investors.

- Geopolitical risks and their potential impact on Sasol's operations. Sasol's operations span multiple countries, making it susceptible to geopolitical risks. Transparent communication about how these risks are being addressed is critical.

- Financial risks, including debt levels and fluctuating commodity prices. Sasol's financial health is intertwined with commodity prices and debt levels. Openness about these factors helps investors assess the risks involved.

- Operational risks related to production and safety. Operational disruptions can significantly impact profitability. Regular updates on safety measures and operational efficiency are essential for maintaining investor confidence.

Potential Scenarios and Predictions for Sasol (SOL)

Several scenarios could unfold depending on Sasol's future actions.

Best-Case Scenario

If Sasol promptly addresses investor concerns with a clear, comprehensive communication strategy outlining its long-term vision, growth plans, and risk mitigation strategies, investor confidence could be restored, potentially leading to an increase in the Sasol share price.

Worst-Case Scenario

Continued silence or inadequate responses could lead to further erosion of investor confidence, resulting in a significant drop in the Sasol share price, difficulty securing further investment, and potential damage to the company's reputation.

Most Likely Scenario

A balanced perspective suggests a scenario where Sasol eventually addresses investor concerns, but the delay will have already caused reputational damage and potentially impacted the Sasol share price negatively. The extent of the damage will depend on the transparency and comprehensiveness of the future communication.

Conclusion

The prolonged silence surrounding Sasol's (SOL) strategic direction has understandably created significant Sasol (SOL) investor concerns. The lack of communication has negatively impacted investor confidence, fueled speculation, and potentially damaged the company’s reputation. To regain investor trust and mitigate further damage, Sasol needs to adopt a proactive and transparent communication strategy, addressing investor questions directly and providing a clear roadmap for the future. Monitoring Sasol (SOL) investor sentiment and analyzing Sasol (SOL) investment risks remains crucial for investors. It is imperative that investors remain informed by following Sasol's announcements and conducting thorough due diligence to navigate this uncertain period. Proactive communication from Sasol is vital to rebuild investor confidence and secure its future success.

Featured Posts

-

Viral Tik Tok Suki Waterhouse And The Twinks Controversy Z94

May 20, 2025

Viral Tik Tok Suki Waterhouse And The Twinks Controversy Z94

May 20, 2025 -

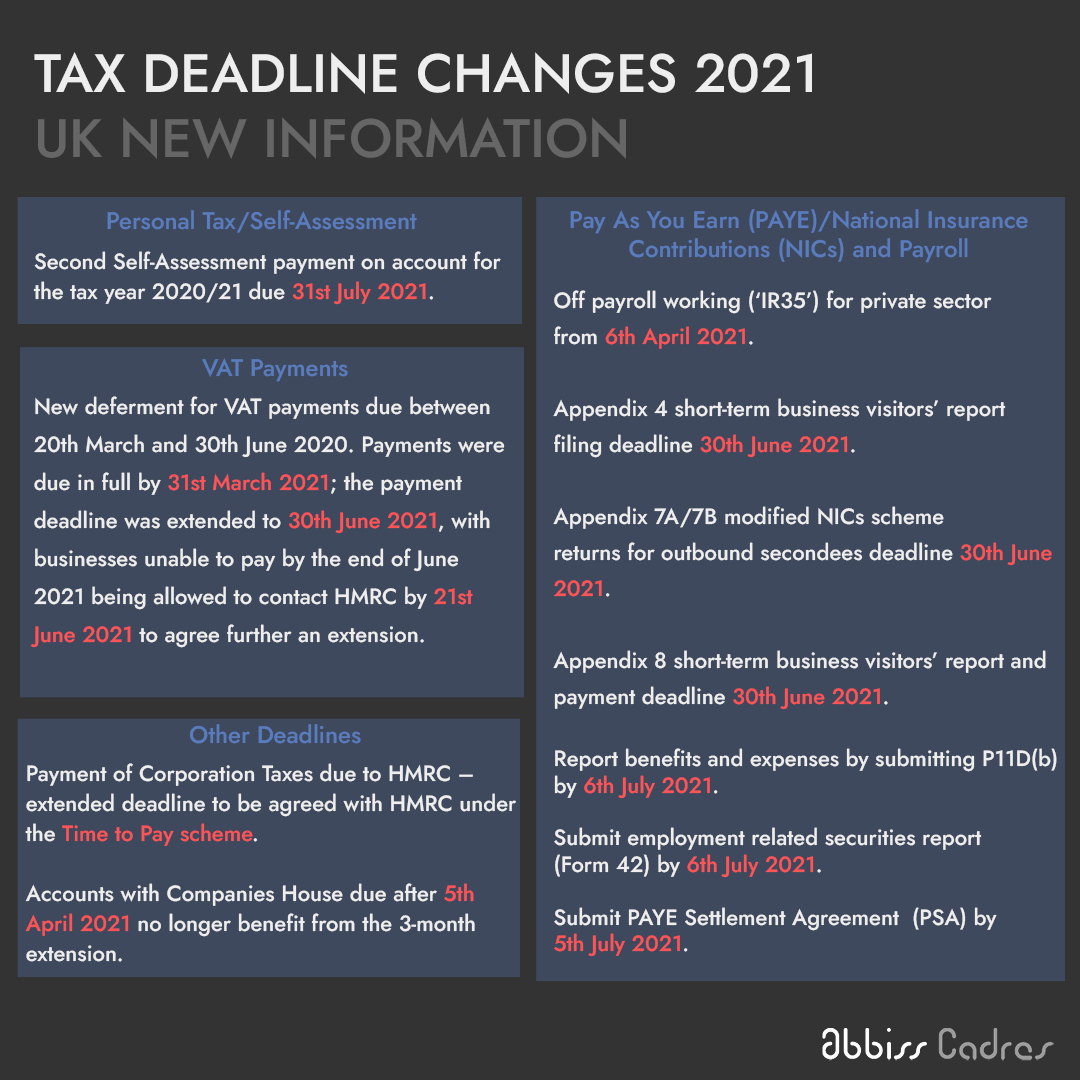

Significant Hmrc Tax Return Rule Changes Impacting Thousands From This Week

May 20, 2025

Significant Hmrc Tax Return Rule Changes Impacting Thousands From This Week

May 20, 2025 -

Femicide In Latin America The Deaths Of A Colombian Model And Mexican Influencer

May 20, 2025

Femicide In Latin America The Deaths Of A Colombian Model And Mexican Influencer

May 20, 2025 -

Agatha Christies Poirot A Comprehensive Guide To The Master Detective

May 20, 2025

Agatha Christies Poirot A Comprehensive Guide To The Master Detective

May 20, 2025 -

Biarritz La Nouvelle Scene Culinaire Adresses Et Chefs A Connaitre

May 20, 2025

Biarritz La Nouvelle Scene Culinaire Adresses Et Chefs A Connaitre

May 20, 2025

Latest Posts

-

Gmas Ginger Zee Addresses Critics Remarks On Aging

May 20, 2025

Gmas Ginger Zee Addresses Critics Remarks On Aging

May 20, 2025 -

Ginger Zees Sharp Reply To Aging Comment

May 20, 2025

Ginger Zees Sharp Reply To Aging Comment

May 20, 2025 -

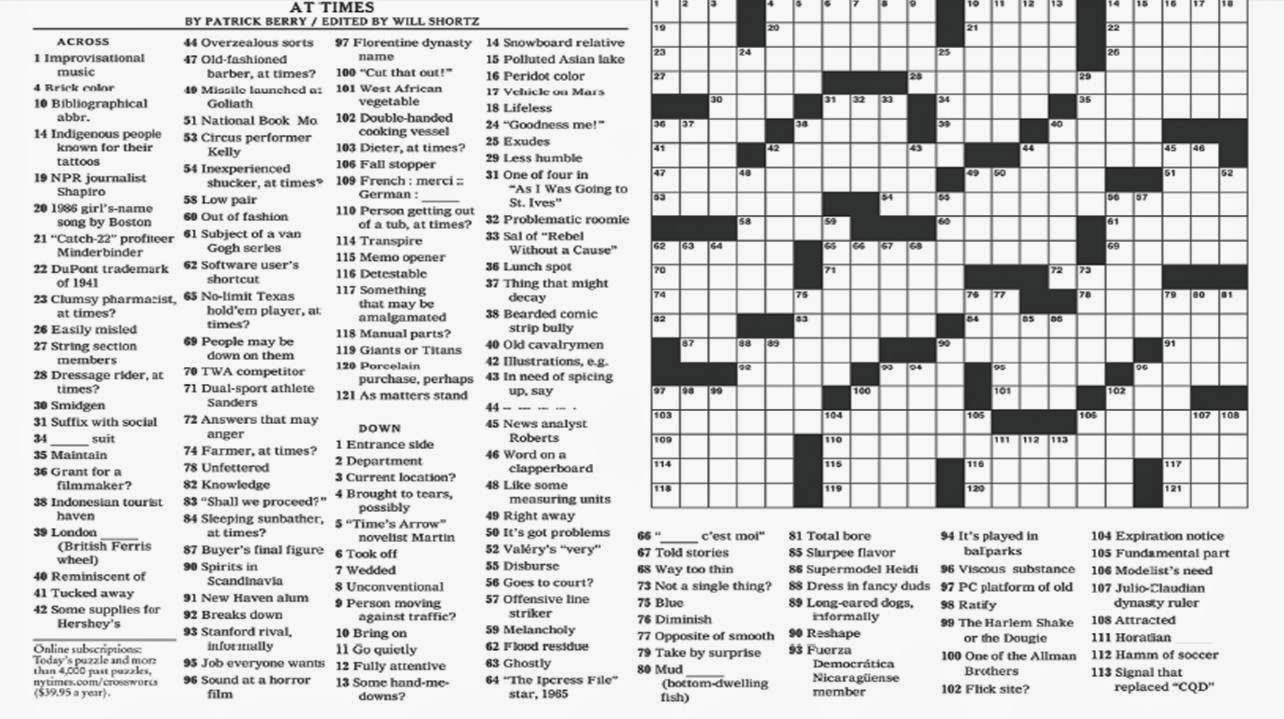

April 25 2025 New York Times Crossword Answers

May 20, 2025

April 25 2025 New York Times Crossword Answers

May 20, 2025 -

Ginger Zee Responds To Aging Criticism

May 20, 2025

Ginger Zee Responds To Aging Criticism

May 20, 2025 -

Nyt Crossword April 25 2025 All Clues And Answers

May 20, 2025

Nyt Crossword April 25 2025 All Clues And Answers

May 20, 2025