BSE Stocks Surge: Top Performers And Market Analysis

Table of Contents

Top Performing BSE Stocks

The recent BSE stocks surge has propelled several companies to impressive heights. Analyzing these top performers across different sectors provides a clearer picture of the market's current dynamics.

Sector-wise Analysis

Several sectors have demonstrated exceptional growth, showcasing the diverse drivers behind the overall BSE surge.

-

Information Technology (IT): The IT sector has been a star performer, fueled by strong global demand for technology services and the ongoing digital transformation across industries.

- Top Performers:

- Infosys (+15%) - Strong quarterly results and a positive outlook for future growth.

- Tata Consultancy Services (TCS) (+12%) - Continued expansion into new markets and successful project deliveries.

- Wipro (+10%) - Focus on digital technologies and strategic acquisitions contributed to growth.

- Top Performers:

-

Pharmaceuticals: The pharmaceutical sector has shown resilience and growth, driven by increasing healthcare spending and the demand for innovative medicines.

- Top Performers:

- Sun Pharmaceuticals (+8%) - Strong product pipeline and expansion into new therapeutic areas.

- Cipla (+7%) - Focus on generic drugs and a robust presence in emerging markets.

- Dr. Reddy's Laboratories (+6%) - Successful product launches and strategic partnerships.

- Top Performers:

-

Financials: The financial sector's performance reflects improving economic conditions and increased lending activity.

- Top Performers:

- HDFC Bank (+10%) - Strong credit growth and a robust balance sheet.

- ICICI Bank (+9%) - Improved asset quality and expanding digital banking services.

- SBI (+8%) - Government initiatives and a large customer base supported growth.

- Top Performers:

The success of these sectors can be attributed to various factors including strong quarterly earnings, positive industry outlooks, and supportive government policies.

Individual Stock Deep Dive

Let's take a closer look at a few top performers across different sectors:

-

Infosys: A global leader in IT services, Infosys's recent surge is driven by strong demand for its digital services, successful project deliveries, and a positive outlook for future growth. (Insert relevant chart showing Infosys stock price performance)

-

HDFC Bank: One of India's largest private sector banks, HDFC Bank's consistent growth is underpinned by its strong credit growth, efficient operations, and expansion into new markets. (Insert relevant chart showing HDFC Bank stock price performance)

-

Sun Pharmaceuticals: A leading pharmaceutical company, Sun Pharma's rise is fueled by its diversified product portfolio, successful new product launches, and its robust presence in both domestic and international markets. (Insert relevant chart showing Sun Pharma stock price performance)

Factors Driving the BSE Stocks Surge

The recent surge in BSE stocks is a result of a confluence of factors, encompassing macroeconomic conditions, market sentiment, and company-specific performances.

Macroeconomic Factors

Global and domestic macroeconomic factors significantly influence the BSE.

- Foreign Institutional Investor (FII) Inflows: Increased foreign investment indicates confidence in the Indian economy and its growth potential.

- Falling Interest Rates: Lower interest rates stimulate borrowing and investment, driving economic activity and boosting stock prices.

- Government Policies: Supportive government policies focused on infrastructure development, ease of doing business, and economic reforms contribute positively.

- Improved GDP Growth: Stronger GDP growth generally translates to higher corporate earnings and increased investor confidence.

Market Sentiment and Investor Confidence

Positive market sentiment plays a crucial role in driving stock prices upward.

- Reduced Volatility: Lower market volatility creates a more stable investment environment, encouraging investor participation.

- Positive News: Positive news flow regarding economic indicators, corporate earnings, and government policies enhances investor confidence.

- Increased Trading Volume: Higher trading volumes reflect increased investor interest and activity in the market.

Company-Specific Factors

Strong corporate performance is another key driver.

- Strong Corporate Earnings: Companies reporting robust earnings attract investor interest and drive stock prices higher.

- Successful Product Launches: Successful new product introductions can boost revenue and market share, positively impacting stock prices.

- Strategic Acquisitions: Strategic acquisitions can expand a company's market reach and capabilities, contributing to increased valuation.

Risk Assessment and Future Outlook

While the current trend is positive, it's essential to consider potential risks.

Potential Risks and Challenges

- Global Uncertainties: Geopolitical events and global economic slowdowns can negatively impact the BSE.

- Inflationary Pressures: Rising inflation can erode corporate profits and impact investor sentiment.

- Regulatory Changes: Changes in government regulations can influence the performance of specific sectors and companies.

Investment Strategies and Recommendations

The BSE stocks surge offers opportunities, but careful consideration is crucial.

- Diversification: Diversifying your portfolio across different sectors and asset classes mitigates risk.

- Long-Term Investment: A long-term investment strategy allows for weathering short-term market fluctuations.

- Thorough Research: Conduct thorough due diligence before investing in any stock. Avoid speculative trading.

Conclusion

The recent BSE stocks surge represents a dynamic investment landscape, shaped by macroeconomic factors, positive market sentiment, and robust company-specific performances. While identifying top performers like Infosys, TCS, and HDFC Bank presents compelling opportunities, a comprehensive understanding of contributing factors and inherent risks is paramount for making informed investment decisions. Remember to conduct thorough research and adopt a diversified investment strategy before investing in BSE stocks. Stay informed about market trends and continue analyzing the performance of these top-performing BSE stocks to optimize your investment potential. By understanding the factors driving this BSE stocks surge, you can position yourself for success in this evolving market.

Featured Posts

-

Bim Aktueel Katalog 25 26 Subat Iste Bu Haftanin Firsatlari

May 15, 2025

Bim Aktueel Katalog 25 26 Subat Iste Bu Haftanin Firsatlari

May 15, 2025 -

Reciprocal Tariffs Assessing Second Order Risks To Key Indian Industries

May 15, 2025

Reciprocal Tariffs Assessing Second Order Risks To Key Indian Industries

May 15, 2025 -

Bruins En Npo Toezichthouder Gesprek Over Leeflang Noodzakelijk

May 15, 2025

Bruins En Npo Toezichthouder Gesprek Over Leeflang Noodzakelijk

May 15, 2025 -

Unexpected Drop In Pbocs Daily Yuan Support

May 15, 2025

Unexpected Drop In Pbocs Daily Yuan Support

May 15, 2025 -

12 Milyon Avroluk Kktc Yardimi Politika Analizi Ve Gelecek Senaryolari

May 15, 2025

12 Milyon Avroluk Kktc Yardimi Politika Analizi Ve Gelecek Senaryolari

May 15, 2025

Latest Posts

-

Navigating The Chinese Market The Struggles Of Bmw Porsche And Other Auto Brands

May 15, 2025

Navigating The Chinese Market The Struggles Of Bmw Porsche And Other Auto Brands

May 15, 2025 -

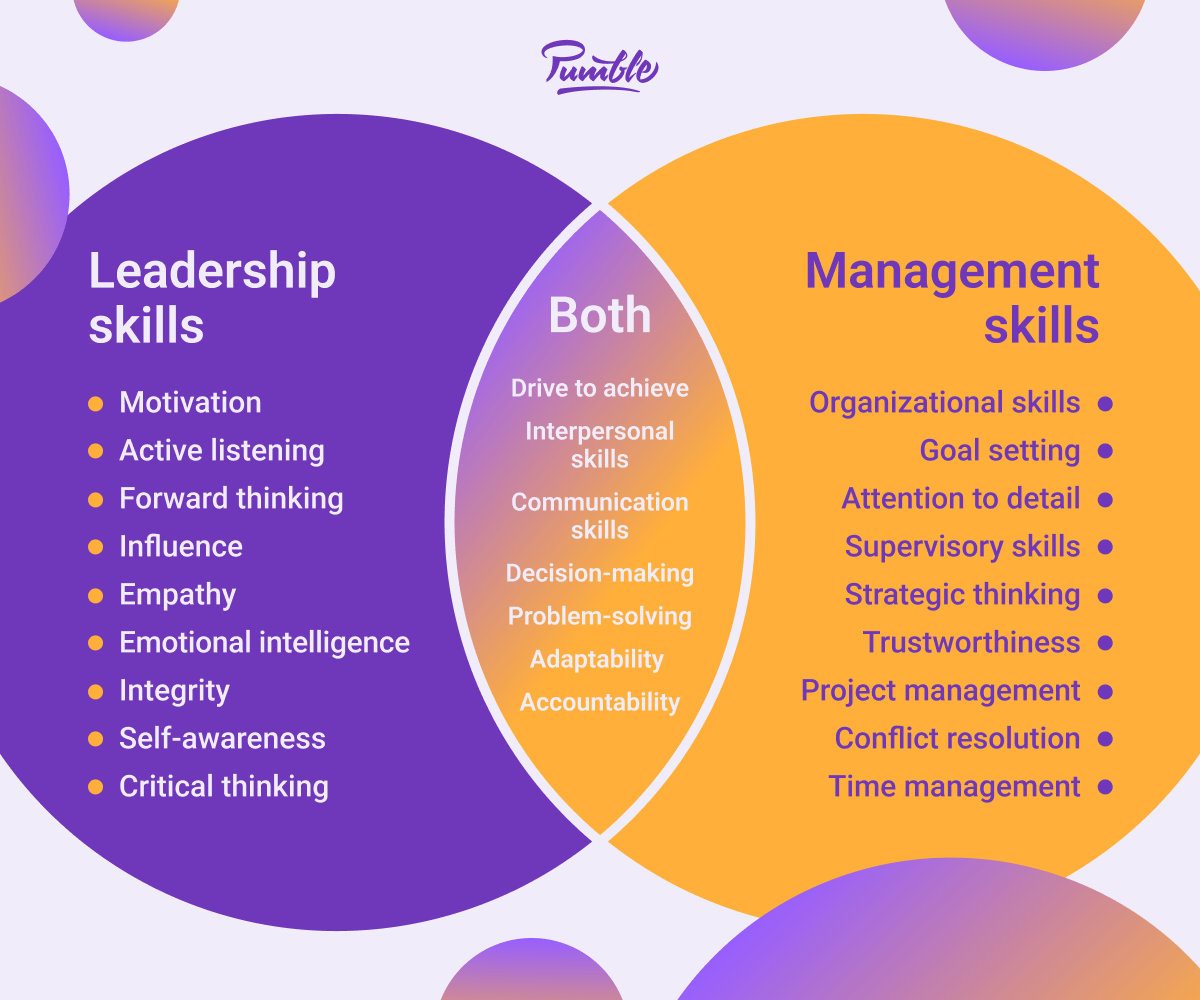

Unlocking Potential The Value Of Middle Managers In Todays Workplace

May 15, 2025

Unlocking Potential The Value Of Middle Managers In Todays Workplace

May 15, 2025 -

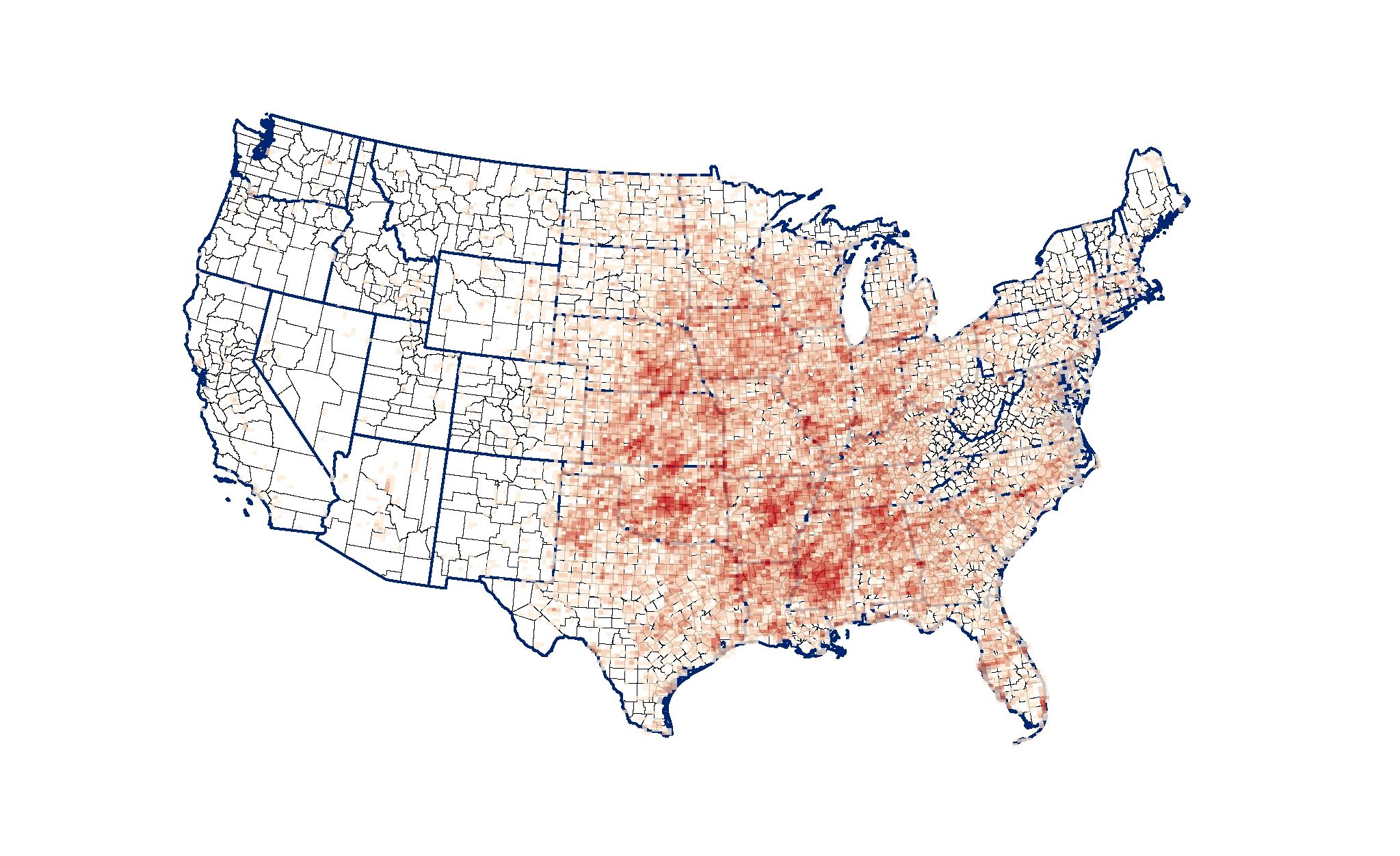

Identifying The Countrys Top Business Growth Areas

May 15, 2025

Identifying The Countrys Top Business Growth Areas

May 15, 2025 -

Middle Management A Critical Link Between Leadership And Workforce

May 15, 2025

Middle Management A Critical Link Between Leadership And Workforce

May 15, 2025 -

New Business Hot Spots Across The Nation A Geographic Analysis

May 15, 2025

New Business Hot Spots Across The Nation A Geographic Analysis

May 15, 2025