Budget-Friendly Country Living: Homes Under £1 Million

Table of Contents

Identifying Affordable Countryside Locations in the UK

Finding cheap areas in the countryside might seem like a challenge, but with the right approach, you can discover beautiful, affordable rural locations in the UK. The key is to think outside the box and explore areas that offer excellent value for money without sacrificing charm.

-

Explore regions outside major cities: London and other major cities naturally command higher property prices. Consider exploring regions like parts of Wales, particularly in the more rural areas; Northern England, especially counties like Northumberland or Cumbria; and certain parts of Scotland. These locations often offer stunning scenery and a peaceful lifestyle at a fraction of the cost of properties closer to major urban centers. You might find charming cottages or even larger properties for significantly less than you'd pay for a comparable home in a more densely populated area. Look into specific towns and villages within these regions - often, smaller communities provide better value than larger, more popular villages.

-

Consider smaller villages and towns: While larger villages might offer more amenities, smaller communities often provide better value for money. Smaller villages may have less competition for properties, leading to more affordable prices. This is particularly true if they are located slightly further from major transport links.

-

Research local amenities and transport links: Balancing affordability with accessibility is crucial. While you may find incredibly cheap country houses in remote locations, consider the practicalities. Ensure there's reasonable access to essential services such as schools, healthcare facilities, and supermarkets, even if it means a slightly longer commute. Research transport links carefully, considering bus routes, train stations, and the distance to the nearest larger town or city.

-

Use online property portals to filter by price and location: Websites like Rightmove, Zoopla, and OnTheMarket allow you to refine your search effectively. Utilize their advanced search filters to specify your maximum budget (£1 million), desired location, property type, and other preferences. Regularly check these sites for newly listed properties and set up email alerts for properties that meet your criteria to stay ahead of the competition.

Negotiating the Best Price for Your Country Home

Securing the best deals on country homes requires a strategic approach. Haggling the house price isn't always easy, but knowing the market and presenting a strong offer can significantly reduce the final cost.

-

Research comparable properties: Before making an offer, thoroughly research similar properties that have recently sold in the same area. This will give you a realistic understanding of the local market value and help you formulate a competitive yet fair offer. Look at sold prices, not just asking prices, for a true picture.

-

Prepare a strong offer: Present your offer professionally, clearly outlining the terms and conditions. Include a realistic timeframe for completion and highlight your financial strength (e.g., pre-approved mortgage or cash offer).

-

Highlight any property drawbacks: If the property has any flaws – needing renovation, a dated kitchen, or a less-than-perfect garden – use this to your advantage during negotiations. Politely point these out and use them to justify a slightly lower offer.

-

Be prepared to walk away: This is a critical aspect of successful negotiation. Knowing your limit and being willing to walk away if the seller isn't willing to compromise strengthens your position and prevents you from overpaying.

-

Consider offering a cash buyer's advantage: Offering a cash purchase can sometimes give you a significant advantage, as it removes the risk and uncertainty for the seller associated with mortgage approvals. However, this requires having sufficient funds readily available.

Understanding the Costs Beyond the Purchase Price

While the purchase price is significant, numerous other costs associated with country living need careful consideration. These hidden costs of country property can significantly impact your budget.

-

Factor in renovation costs: Older country properties often require renovations. Budget for potential repairs, updates, and improvements. Even seemingly minor issues can escalate quickly. Obtain multiple quotes from reputable builders and contractors to accurately assess these costs.

-

Account for higher energy bills: Rural properties can have higher energy bills due to factors like older insulation, larger spaces, and reliance on less-efficient heating systems. Consider the potential for increased heating and electricity costs when calculating your overall budget. Look into energy-efficient solutions from the outset.

-

Consider council tax and other local taxes: Council tax rates vary depending on the property's value and location. Research the local council tax band for potential properties to understand this additional expense. Other local taxes or charges might also apply, so investigate these thoroughly.

-

Plan for maintenance and upkeep: Maintaining a country property involves ongoing costs, including gardening, repairs, and general upkeep. Budget for these expenses; they can add up over time. Factor in costs like gutter cleaning, roof maintenance, and pest control.

-

Factor in travel costs: Commuting to work or accessing amenities might involve longer distances and higher fuel costs than living in a city. Carefully calculate potential transportation expenses before making a decision.

Securing the best mortgage for your country home

Getting the right mortgage is crucial for anyone buying a country home, especially when aiming for budget-friendly options. Rural mortgages, often offered by specialist lenders, might provide better terms.

-

Shop around for the best mortgage deals: Don't settle for the first offer you receive. Compare offers from various lenders to ensure you're getting the best interest rate and mortgage terms.

-

Consider fixed-rate mortgages for stability: Fixed-rate mortgages provide certainty regarding your monthly repayments over a specific period, offering protection against interest rate fluctuations.

-

Look for lenders experienced with rural properties: Some lenders have more experience and expertise in financing rural properties, potentially offering more tailored solutions.

-

Seek advice from a qualified mortgage broker: A mortgage broker can navigate the complex world of mortgages, helping you find the most suitable option for your needs and circumstances.

Conclusion

Achieving budget-friendly country living under £1 million is achievable with careful planning, research, and negotiation. By targeting specific locations, understanding the associated costs, and securing a favourable mortgage, you can find your dream rural retreat without breaking the bank.

Start your search for your perfect budget-friendly country home under £1 million today! Explore our resources and begin your journey to a peaceful and affordable countryside life. Don't delay your dream of budget-friendly country living; find your perfect home under £1 million now!

Featured Posts

-

Exploring Ferraris State Of The Art Bengaluru Service Centre

May 24, 2025

Exploring Ferraris State Of The Art Bengaluru Service Centre

May 24, 2025 -

Inside The New Ferrari Service Centre Bengalurus Automotive Landmark

May 24, 2025

Inside The New Ferrari Service Centre Bengalurus Automotive Landmark

May 24, 2025 -

Your Country Escape Awaits Practical Advice And Inspiration

May 24, 2025

Your Country Escape Awaits Practical Advice And Inspiration

May 24, 2025 -

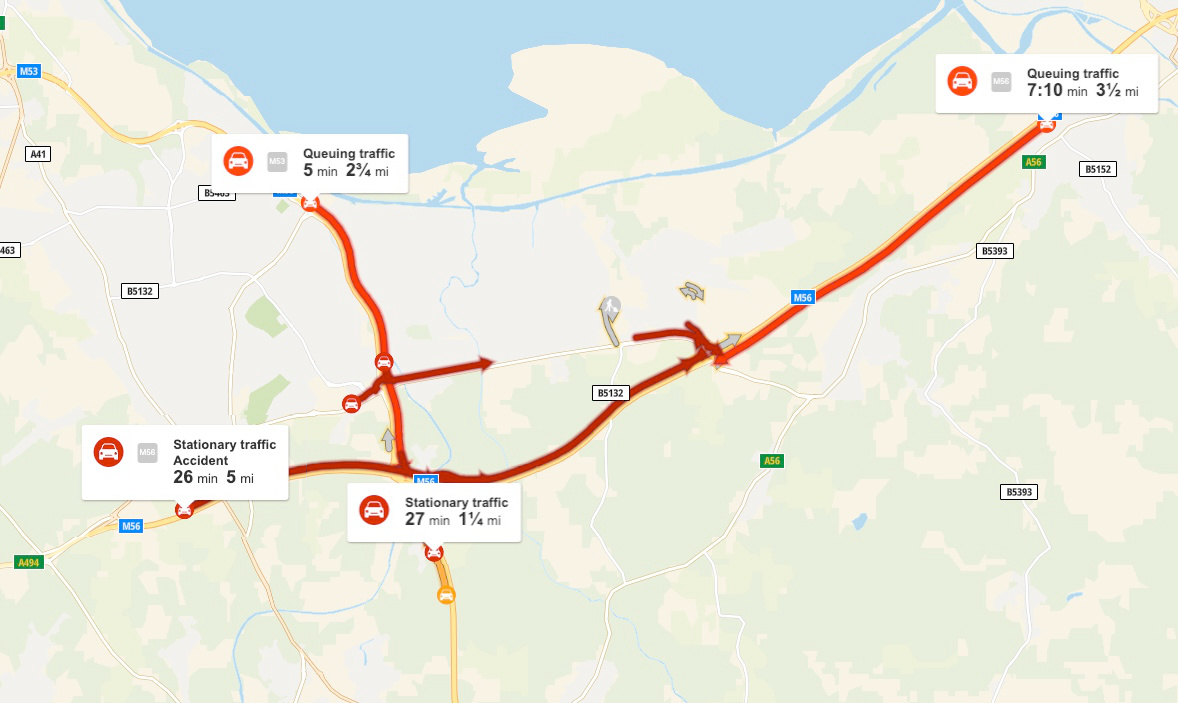

M56 Cheshire Deeside Traffic Update Following Collision

May 24, 2025

M56 Cheshire Deeside Traffic Update Following Collision

May 24, 2025 -

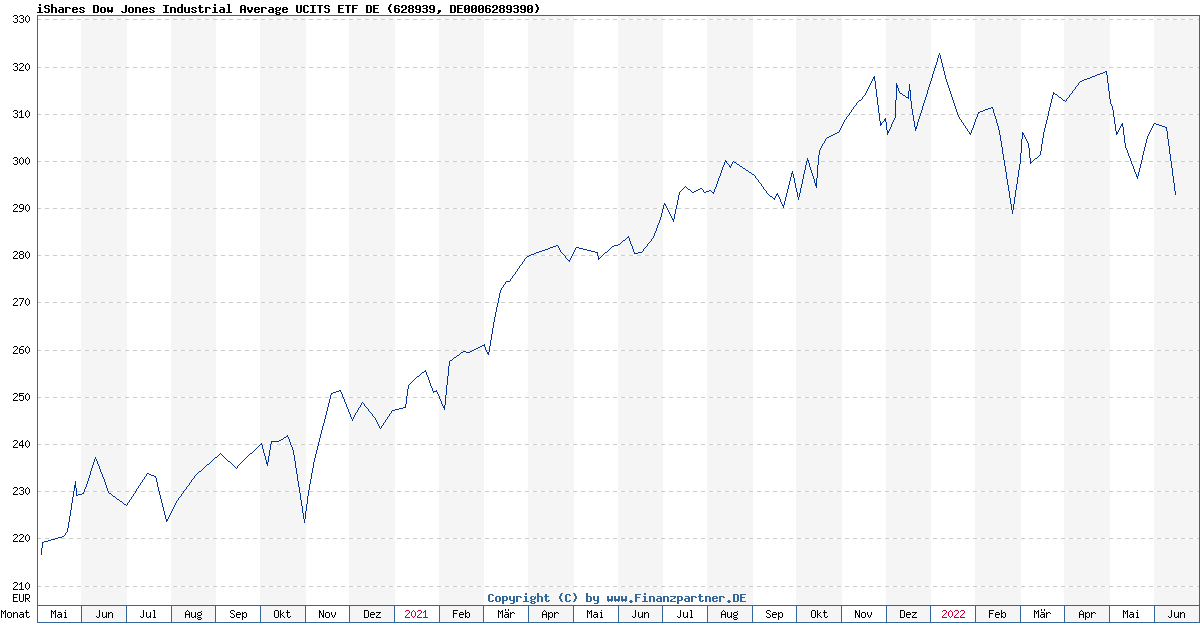

Investing In The Amundi Dow Jones Industrial Average Ucits Etf Nav Considerations

May 24, 2025

Investing In The Amundi Dow Jones Industrial Average Ucits Etf Nav Considerations

May 24, 2025

Latest Posts

-

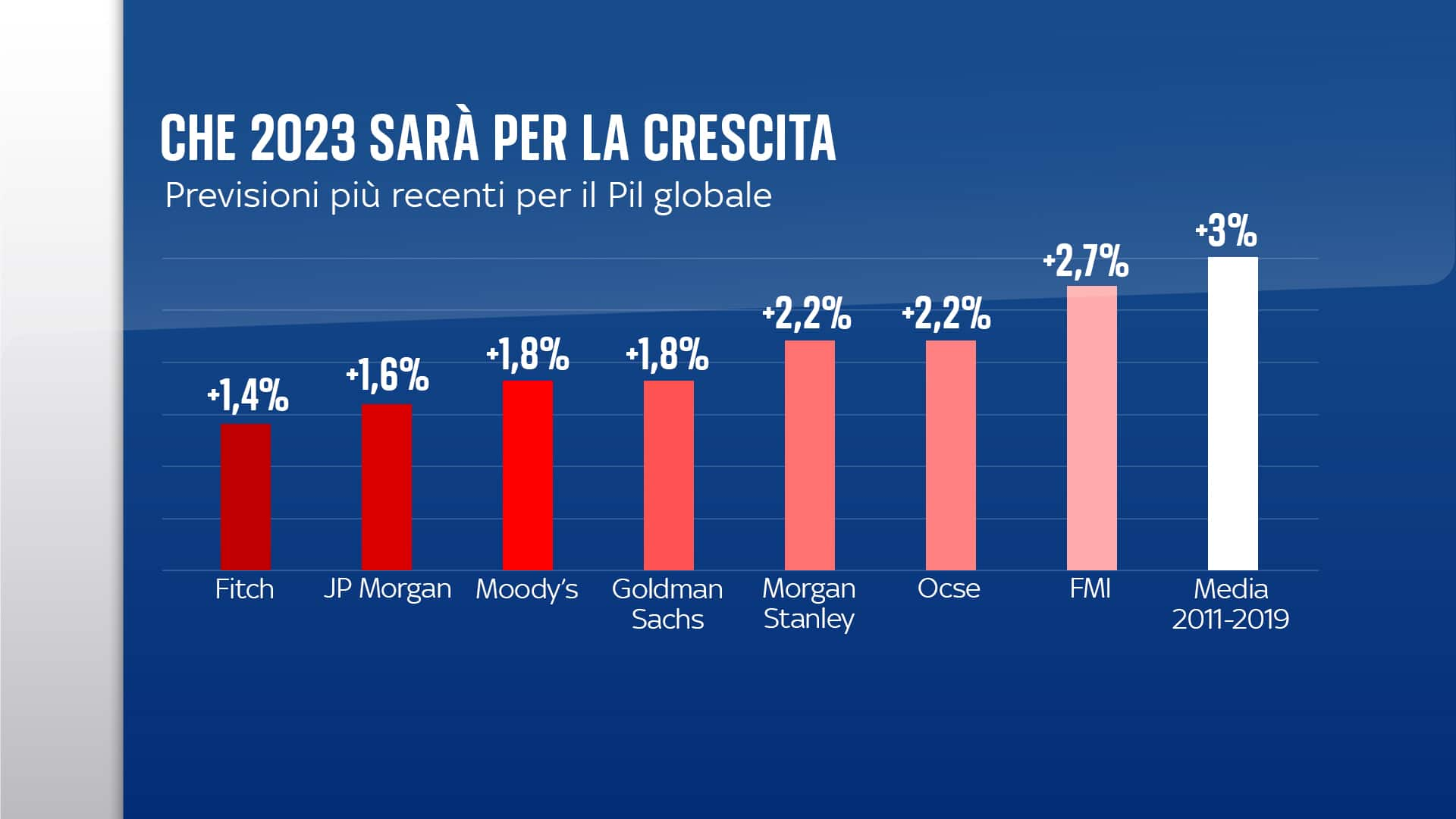

Analisi Dell Impatto Dei Dazi Di Trump Sul Settore Moda Nike Lululemon E Gli Altri

May 24, 2025

Analisi Dell Impatto Dei Dazi Di Trump Sul Settore Moda Nike Lululemon E Gli Altri

May 24, 2025 -

Trump E I Dazi L Effetto A Cascata Sul Mercato Della Moda

May 24, 2025

Trump E I Dazi L Effetto A Cascata Sul Mercato Della Moda

May 24, 2025 -

Dazi Trump 20 Impatto Sul Settore Moda Europeo

May 24, 2025

Dazi Trump 20 Impatto Sul Settore Moda Europeo

May 24, 2025 -

Auto Tariff Relief Hopes Lift European Equities Lvmh Decline

May 24, 2025

Auto Tariff Relief Hopes Lift European Equities Lvmh Decline

May 24, 2025 -

European Stocks Gain As Trump Signals Auto Tariff Relief

May 24, 2025

European Stocks Gain As Trump Signals Auto Tariff Relief

May 24, 2025