Buy-and-Hold Investing: The Long Game's Gut-Wrenching Reality

Table of Contents

The Allure of Buy-and-Hold Investing

Buy-and-hold, at its core, is a simple yet powerful strategy: buy high-quality assets and hold them for the long term, regardless of short-term market fluctuations. Its appeal lies in two primary factors: long-term growth potential and minimized transaction costs.

Long-Term Growth Potential

The magic of buy-and-hold lies in the power of compounding returns. Over time, your initial investment grows, and those earnings generate further earnings, creating a snowball effect. This effect is amplified by reinvesting dividends, further accelerating your wealth accumulation.

- Example: A $10,000 investment earning an average annual return of 7% will grow to approximately $40,000 in 20 years and nearly $100,000 in 30 years, showcasing the long-term power of compounding.

- Dividend Reinvestment: Reinvesting dividends automatically buys more shares, increasing your stake and compounding your returns even faster. This is a key element of successful long-term buy and hold strategies.

- Stock Selection: The success of a buy-and-hold strategy heavily depends on choosing fundamentally sound companies with a history of consistent growth and strong competitive advantages. Thorough due diligence is crucial.

Minimizing Transaction Costs

Actively trading stocks incurs significant transaction fees and, in some cases, capital gains taxes. Buy-and-hold drastically reduces these costs.

- Reduced Brokerage Fees: The fewer trades you make, the less you pay in brokerage commissions.

- Tax Efficiency: By holding investments long-term, you can potentially defer or reduce capital gains taxes, allowing more of your returns to compound. This is especially relevant for long-term buy and hold investors holding assets for longer than one year.

The Gut-Wrenching Reality of Buy-and-Hold

While the long-term potential of buy-and-hold is undeniable, the journey isn't always smooth. Market volatility and the potential for opportunity costs present significant psychological and financial challenges.

Market Volatility and Emotional Rollercoasters

Witnessing your portfolio's value plummet during market downturns can be emotionally draining. Even the most disciplined investors can be tempted to panic sell during these periods.

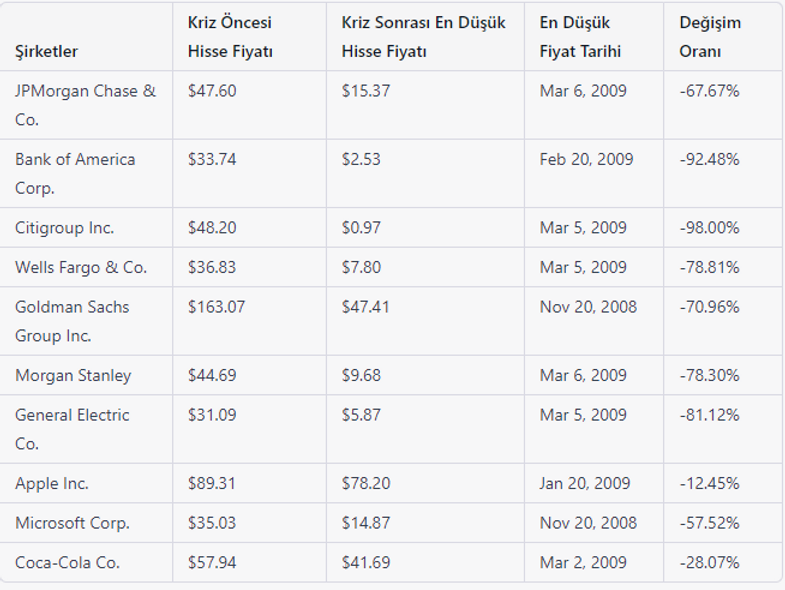

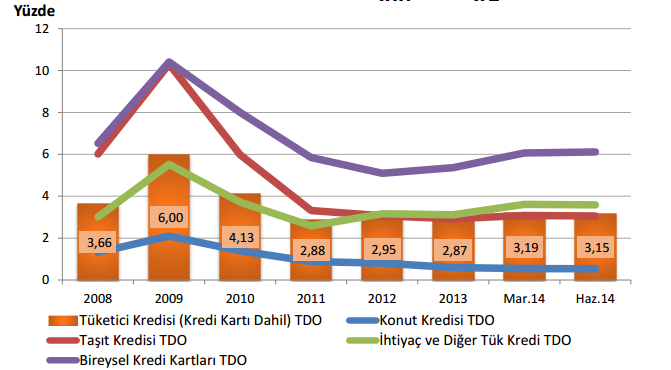

- Historical Examples: The dot-com bubble burst of 2000 and the 2008 financial crisis are stark reminders of the potential for significant and rapid market declines.

- Risk Tolerance: A high risk tolerance and strong emotional discipline are essential for navigating market volatility successfully while implementing a buy-and-hold strategy. Consider your own psychological limits and adjust your investment plans accordingly.

- Emotional Management: Strategies like dollar-cost averaging (investing a fixed amount regularly) and focusing on long-term goals can help mitigate emotional responses during market corrections.

Opportunity Cost and Missed Gains

Sticking to a buy-and-hold strategy means potentially missing out on short-term gains that could be achieved through active trading or alternative investment strategies.

- Alternative Strategies: Strategies like day trading or swing trading aim to profit from short-term market movements, but carry significantly higher risk.

- Market Timing: Attempting to time the market (buying low and selling high) is notoriously difficult and often unsuccessful. Many studies show that it's difficult to consistently outperform the market by timing it perfectly.

- Goal Alignment: The best investment strategy aligns with your individual financial goals and time horizon. Buy-and-hold is not a one-size-fits-all solution.

The Need for Diversification

Diversification is critical for mitigating risk within a buy-and-hold portfolio. Don't put all your eggs in one basket.

- Asset Classes: A well-diversified portfolio typically includes a mix of stocks, bonds, real estate, and potentially other asset classes like commodities or alternative investments.

- Reducing Volatility: Diversification helps to reduce the overall volatility of your portfolio, protecting you from significant losses in any single asset class.

Is Buy-and-Hold Right for You? Assessing Your Investment Profile

Before embracing buy-and-hold, you need to honestly assess your investment profile. This involves considering your time horizon, risk tolerance, and financial goals.

Time Horizon

Buy-and-hold thrives on a long-term investment horizon. The longer you can hold your investments, the greater the potential for compounding returns to overcome short-term market fluctuations.

- Short-Term Needs: If you need access to your funds within a few years, buy-and-hold might not be the most suitable strategy. Consider less volatile options.

Risk Tolerance

Your risk tolerance determines how much market volatility you're comfortable with.

- Risk Tolerance Levels: Investors are typically categorized as conservative, moderate, or aggressive, based on their comfort level with risk.

- Determining Your Tolerance: Consider your financial situation, personality, and investment goals to determine your risk tolerance before starting any buy and hold strategy.

Financial Goals

Buy-and-hold aligns well with long-term financial objectives such as retirement planning or wealth building.

- Retirement Planning: Buy-and-hold is often a core component of long-term retirement investment strategies.

- Wealth Building: The compounding effect of buy-and-hold can significantly contribute to long-term wealth accumulation.

Conclusion

Buy-and-hold investing offers significant potential for long-term growth and wealth creation, but it's crucial to understand the emotional challenges involved. While minimizing transaction costs and maximizing compounding returns are key advantages, the gut-wrenching experience of market volatility requires careful consideration. Before embracing this strategy, thoroughly assess your risk tolerance, time horizon, and financial goals. Remember that a well-diversified portfolio is essential for mitigating risk. If you're prepared for the long game and understand the potential downsides, buy-and-hold investing could be a suitable strategy for building wealth. Start planning your buy-and-hold investment strategy today!

Featured Posts

-

G 7 To Discuss De Minimis Threshold For Chinese Goods

May 26, 2025

G 7 To Discuss De Minimis Threshold For Chinese Goods

May 26, 2025 -

Formula 1 Monaco Gp Fp 1 Leclerc Dominates Verstappens Close Pursuit

May 26, 2025

Formula 1 Monaco Gp Fp 1 Leclerc Dominates Verstappens Close Pursuit

May 26, 2025 -

Understanding Jensons Fw 22 Extended Collection

May 26, 2025

Understanding Jensons Fw 22 Extended Collection

May 26, 2025 -

Crowd Violence At Paris Roubaix Mathieu Van Der Poel Attacked Calls For Justice

May 26, 2025

Crowd Violence At Paris Roubaix Mathieu Van Der Poel Attacked Calls For Justice

May 26, 2025 -

Jamie Foxx Defends All Star Weekend Casting Decision Robert Downey Jr As A Hispanic Character

May 26, 2025

Jamie Foxx Defends All Star Weekend Casting Decision Robert Downey Jr As A Hispanic Character

May 26, 2025

Latest Posts

-

Understanding Finance Loans A Comprehensive Guide To Interest Emis And Tenure

May 28, 2025

Understanding Finance Loans A Comprehensive Guide To Interest Emis And Tenure

May 28, 2025 -

Abd De Tueketici Kredilerinin Mart Ayi Performansi Ve Etkileri

May 28, 2025

Abd De Tueketici Kredilerinin Mart Ayi Performansi Ve Etkileri

May 28, 2025 -

Finance Loans 101 Everything You Need To Know About Loan Applications

May 28, 2025

Finance Loans 101 Everything You Need To Know About Loan Applications

May 28, 2025 -

Abd Tueketici Kredileri Mart Ayi Raporu Ve Gelecek Tahminleri

May 28, 2025

Abd Tueketici Kredileri Mart Ayi Raporu Ve Gelecek Tahminleri

May 28, 2025 -

Rayan Cherki What A German Insider Says

May 28, 2025

Rayan Cherki What A German Insider Says

May 28, 2025