Buying A Home In A Climate-Vulnerable Area: Credit Implications

Table of Contents

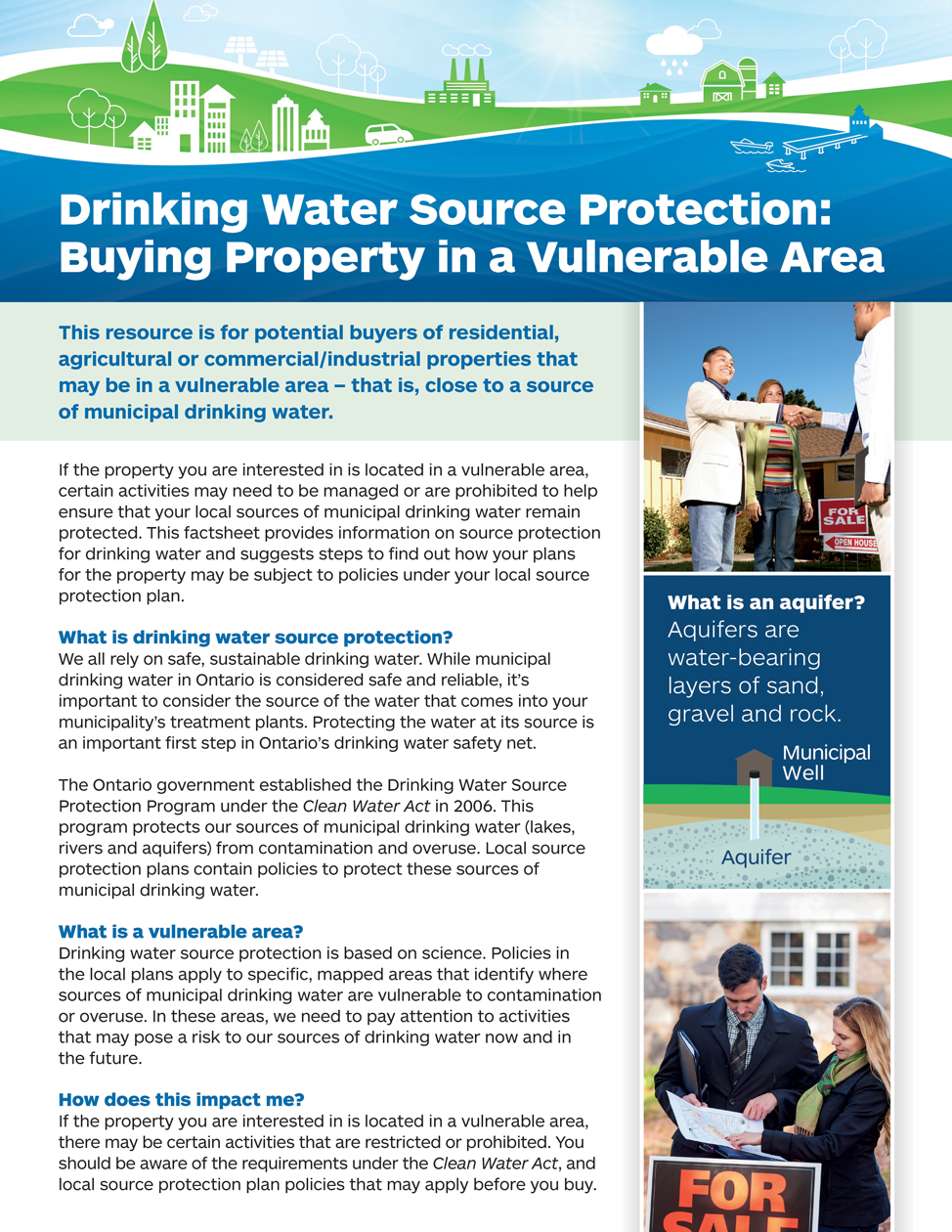

Increased Insurance Premiums and Their Impact on Credit

The cost of homeowner's insurance is a critical factor in your overall financial health, and this becomes even more pronounced in climate-vulnerable areas. Insurance companies meticulously assess risk based on location, considering factors like proximity to floodplains, wildfire zones, and hurricane-prone regions. This risk assessment directly impacts your premiums.

The Rising Cost of Homeowner's Insurance

- Climate-related risks dramatically increase insurance premiums. Areas prone to flooding, wildfires, hurricanes, or other extreme weather events face significantly higher insurance costs compared to those in lower-risk zones.

- Higher premiums strain budgets and impact your debt-to-income ratio (DTI). A larger portion of your income going towards insurance leaves less for other debt payments, potentially impacting your ability to secure a mortgage or maintain a healthy credit score.

- Unexpected increases can create financial hardship. Insurance companies can adjust premiums annually, and these increases can be substantial in high-risk areas, leading to budget shortfalls and potential difficulties in meeting financial obligations.

Difficulty Securing Insurance and its Credit Consequences

In some climate-vulnerable areas, obtaining homeowner's insurance can be extremely challenging, or even impossible. This lack of availability poses significant problems for homebuyers.

- Mortgage approval is contingent upon securing insurance. Lenders require proof of insurance before approving a mortgage, so the inability to secure coverage can derail the entire home-buying process.

- Lender-placed insurance is expensive and detrimental to credit. If you can't find insurance, the lender might place insurance on your property, but this is typically much more costly than standard coverage, impacting your monthly payments and increasing your debt burden.

- Missed payments due to unaffordable insurance costs severely damage credit scores. Failing to meet insurance premium payments will negatively affect your credit history, making it harder to secure future loans or credit cards.

Depreciating Property Values and Their Effect on Equity and Credit

Climate change poses a significant threat to property values in vulnerable areas. Extreme weather events can cause devastating damage, leading to a sharp decline in home equity.

The Financial Impact of Climate-Related Damage

- Property values plummet after extreme weather events. Flooding, wildfires, and hurricanes can inflict substantial damage, rendering homes uninhabitable or significantly reducing their market value.

- Decreased home equity limits refinancing and selling options. If your home's value falls below your mortgage balance (negative equity), refinancing or selling becomes incredibly difficult.

- Repair costs can add significant debt, further impacting credit. The expense of repairing climate-related damage can be substantial, increasing debt and potentially leading to missed mortgage payments.

The Long-Term Effects on Creditworthiness

The long-term financial consequences of declining property values in climate-vulnerable areas can be severe.

- Struggles with mortgage payments can lead to foreclosure. Difficulty making mortgage payments due to decreased income, increased insurance costs, or repair expenses can result in foreclosure, severely impacting your credit score.

- Foreclosure significantly damages credit history for years. A foreclosure remains on your credit report for seven years, making it difficult to obtain new loans or credit in the future.

- Difficulty obtaining future loans restricts financial opportunities. A damaged credit history caused by climate-related financial distress can make it challenging to secure financing for other major purchases or investments.

Mortgage Approval Challenges in High-Risk Areas

Lenders are increasingly aware of the financial risks associated with lending in climate-vulnerable areas. This translates to stricter lending criteria and increased scrutiny for potential homebuyers.

Stricter Lending Criteria

- Higher interest rates are applied to properties in high-risk zones. Lenders compensate for increased risk by charging higher interest rates on mortgages for homes located in areas susceptible to climate-related events.

- Stricter down payment requirements are imposed to mitigate lender risk. Larger down payments are frequently demanded to minimize the lender's potential losses in case of property damage or devaluation.

- Increased scrutiny of financial stability ensures borrower solvency. Lenders thoroughly evaluate your financial situation to ensure you can withstand potential financial shocks related to climate-related events.

The Importance of Thorough Due Diligence

Before committing to a purchase in a climate-vulnerable area, conducting comprehensive research is crucial.

- Utilize resources like FEMA flood maps and wildfire risk assessments. These tools provide valuable data on the potential risks associated with specific properties and locations.

- Consult with real estate agents and insurance brokers specializing in high-risk areas. Their expertise can help you understand the unique challenges and potential costs associated with purchasing in these areas.

- Obtain independent property assessments to understand the true value and potential risks. An independent assessment can help you make an informed decision, ensuring you aren't overpaying for a property with significant climate-related risks.

Conclusion

Buying a home in a climate-vulnerable area presents significant credit risks, including higher insurance premiums, potential property value depreciation, and challenges in securing a mortgage. Thorough research and understanding of these risks are crucial before making such a significant financial commitment. Careful consideration of factors such as flood risk, wildfire risk, and the availability and cost of insurance are essential for protecting your credit and long-term financial stability.

Before investing in a property in a climate-vulnerable area, carefully assess the potential credit implications. Conduct thorough research, consult with financial professionals, and understand the long-term financial commitment. Making informed decisions about buying a home in climate-vulnerable areas protects your credit and your future.

Featured Posts

-

Exploring The World Of Agatha Christies Poirot Novels Adaptations And Legacy

May 20, 2025

Exploring The World Of Agatha Christies Poirot Novels Adaptations And Legacy

May 20, 2025 -

Agatha Christie Une Vie D Aventures Et De Mysteres L Integrale

May 20, 2025

Agatha Christie Une Vie D Aventures Et De Mysteres L Integrale

May 20, 2025 -

Manchester Uniteds Pursuit Of Matheus Cunha Intensifies

May 20, 2025

Manchester Uniteds Pursuit Of Matheus Cunha Intensifies

May 20, 2025 -

Biarritz Budget Locations Saisonnieres Et Sainte Eugenie Points Forts Du Conseil Municipal

May 20, 2025

Biarritz Budget Locations Saisonnieres Et Sainte Eugenie Points Forts Du Conseil Municipal

May 20, 2025 -

Nyt Mini Crossword Answers For March 31

May 20, 2025

Nyt Mini Crossword Answers For March 31

May 20, 2025

Latest Posts

-

Wintry Mix Developing What To Expect

May 20, 2025

Wintry Mix Developing What To Expect

May 20, 2025 -

Preparing For A Wintry Mix Of Rain And Snow

May 20, 2025

Preparing For A Wintry Mix Of Rain And Snow

May 20, 2025 -

Wintry Mix Rain And Snow Forecast

May 20, 2025

Wintry Mix Rain And Snow Forecast

May 20, 2025 -

Big Bear Ai Stock Risk Assessment And Potential Returns

May 20, 2025

Big Bear Ai Stock Risk Assessment And Potential Returns

May 20, 2025 -

Planning For Drier Weather Essential Steps For Homeowners And Gardeners

May 20, 2025

Planning For Drier Weather Essential Steps For Homeowners And Gardeners

May 20, 2025