Buying A House: Managing Student Loan Debt Effectively

Table of Contents

Assessing Your Financial Situation

Before you even begin browsing open houses, a thorough assessment of your financial health is crucial. This involves understanding your debt, evaluating your credit score, and determining your affordable home price.

Understanding Your Debt

The first step is to get a clear picture of your student loan debt. This means:

- Calculate your total student loan debt: Add up the principal balance of all your federal and private student loans.

- Determine interest rates and repayment plans: Note the interest rate for each loan as this significantly impacts your total repayment cost. Identify your current repayment plan (Standard, Extended, Income-Driven Repayment (IDR), etc.). Using a "student loan repayment calculator" can help visualize your total repayment.

- Estimate your debt-to-income ratio (DTI): Your DTI ratio is a crucial factor in mortgage approval. Use online tools to calculate your DTI, considering your student loan payments alongside other debts. Understanding your DTI ratio for mortgage applications is essential for determining how much you can borrow. "Managing student loan debt before buying a house" often involves improving this ratio.

Evaluating Your Credit Score

Your credit score is another critical factor influencing your mortgage approval.

- Check your credit report: Review your credit report from each of the three major credit bureaus (Equifax, Experian, and TransUnion) for errors. Dispute any inaccuracies promptly.

- Improve your credit score: Consistent on-time student loan payments significantly impact your credit score. Focus on paying down other debts and maintaining a low credit utilization ratio to boost your score. Strategies for "credit score improvement" are readily available online. Understanding the "impact of student loans on credit" is key to strategic repayment. Meet the "mortgage credit score requirements" to maximize your chances of approval.

Determining Your Affordable Home Price

Knowing how much house you can realistically afford is vital.

- Use online mortgage calculators: Several online "affordable home price calculator" tools can estimate your purchasing power based on your income, debt, and desired down payment.

- Factor in all monthly expenses: Your monthly expenses should include not just your mortgage payment but also property taxes, homeowners insurance, potential HOA fees, and crucially, your student loan payments.

- Consider down payment options: A smaller down payment might seem attractive, reducing upfront costs, but remember that this will usually lead to higher monthly mortgage payments. Explore "down payment assistance programs" to see if you qualify for assistance.

Strategies for Managing Student Loan Debt

Effectively managing your student loan debt is crucial for successful homeownership.

Repayment Strategies

Explore various repayment options to optimize your monthly payments and overall repayment cost.

- Student loan repayment plans: Understand the differences between Standard, Extended, and Income-Driven Repayment (IDR) plans. An IDR plan may lower your monthly payments, making homeownership more feasible.

- Student loan refinancing: If your credit score has improved, refinancing your student loans could lower your interest rate, saving you money over the life of the loan. However, carefully weigh the pros and cons of "student loan refinancing" before proceeding.

Saving for a Down Payment

Saving for a down payment while managing student loan debt requires careful planning.

- Down payment savings plan: Create a realistic budget and savings plan. Prioritize saving aggressively, even small amounts consistently add up. Consider utilizing high-yield savings accounts or certificates of deposit (CDs) to maximize returns.

- Down payment assistance: Research available "down payment assistance" programs in your area. These programs can help reduce the upfront costs of homeownership. "Saving for a house with student loans" is achievable with a dedicated plan and exploration of these options.

Budgeting and Financial Planning

Strong financial planning is paramount.

- Budgeting for homeownership: Create a detailed monthly budget that accounts for all income and expenses, including student loan payments and projected housing costs.

- Financial planning for homebuyers: Tracking your spending and identifying areas for potential savings is crucial. Consider seeking help from a financial advisor who can create a personalized "financial planning for homebuyers" strategy, especially one that considers "managing finances with student loans."

Securing a Mortgage with Student Loan Debt

Despite existing student loan debt, securing a mortgage is achievable with careful planning.

Shopping for a Mortgage

Start early and compare offers from multiple lenders.

- Mortgage lenders: Shop around and compare interest rates and loan terms from various "mortgage lenders," including banks, credit unions, and online lenders.

- Mortgage types: Understand the differences between conventional, FHA, and VA loans to determine the best fit for your financial situation.

- Mortgage pre-approval: Obtaining "mortgage pre-approval" demonstrates your financial readiness to lenders and strengthens your negotiating position. Understanding the "best mortgage rates" is crucial for securing favorable terms.

Negotiating with Lenders

Present yourself as a responsible borrower.

- Negotiating a mortgage: Highlight your consistent student loan payments, improved credit score, and stable income to demonstrate your ability to manage debt responsibly.

- Mortgage interest rates: Be prepared to negotiate "mortgage interest rates" and loan terms. Clearly articulate your financial situation and commitment to responsible repayment. Successfully "getting a mortgage with student loan debt" requires proactive communication and negotiation.

Conclusion

Buying a house with student loan debt is challenging but not impossible. By assessing your financial situation, exploring various student loan repayment options, and creating a comprehensive savings plan, you can significantly increase your chances of homeownership. Don't let student loan debt derail your dream of owning a home. Start planning your path to homeownership today by assessing your financial situation and exploring your student loan options. Take control of your financial future and buy your dream house!

Featured Posts

-

Chinese Ambassadors Proposal Formal Trade Agreement With Canada

May 17, 2025

Chinese Ambassadors Proposal Formal Trade Agreement With Canada

May 17, 2025 -

Ontarios Best Online Casino For Big Wins Mirax Casino

May 17, 2025

Ontarios Best Online Casino For Big Wins Mirax Casino

May 17, 2025 -

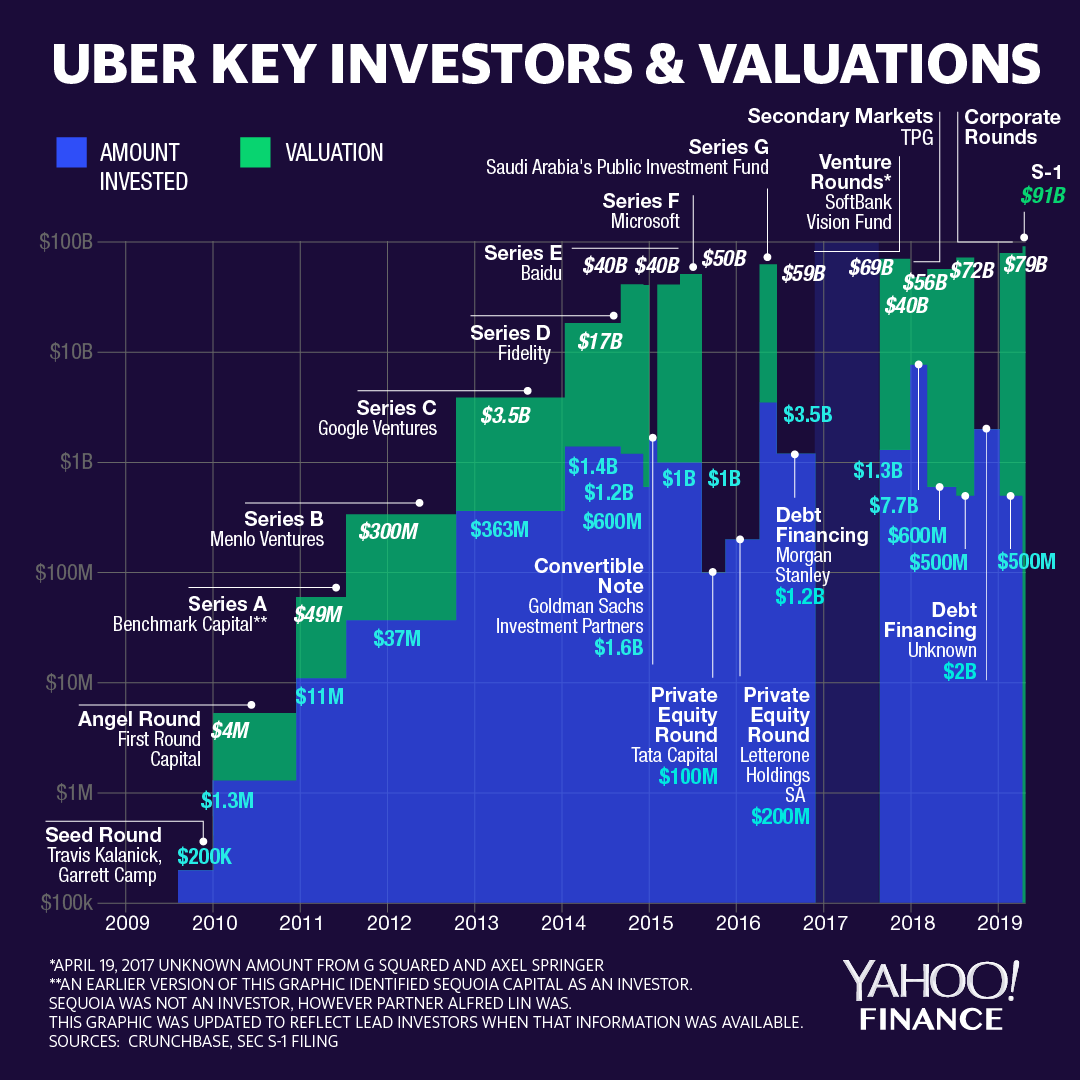

Assessing The Investment Potential Of Uber Uber Stock

May 17, 2025

Assessing The Investment Potential Of Uber Uber Stock

May 17, 2025 -

The People Behind Tony Bennetts Success A Look At His Career

May 17, 2025

The People Behind Tony Bennetts Success A Look At His Career

May 17, 2025 -

New York Knicks Mitchell Robinsons Post Surgery Return Season Debut Achieved

May 17, 2025

New York Knicks Mitchell Robinsons Post Surgery Return Season Debut Achieved

May 17, 2025

Latest Posts

-

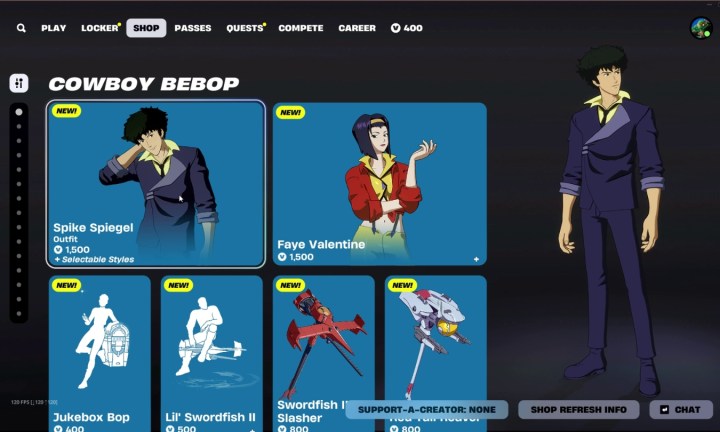

Free Cowboy Bebop Themed Items Available In Fortnite Act Fast

May 17, 2025

Free Cowboy Bebop Themed Items Available In Fortnite Act Fast

May 17, 2025 -

Miami Acik Ta Djokovic In Final Yolu

May 17, 2025

Miami Acik Ta Djokovic In Final Yolu

May 17, 2025 -

Fortnite Cowboy Bebop Crossover Offers Free Cosmetic Items

May 17, 2025

Fortnite Cowboy Bebop Crossover Offers Free Cosmetic Items

May 17, 2025 -

Djokovic In Miami Acik Finalindeki Basarisi

May 17, 2025

Djokovic In Miami Acik Finalindeki Basarisi

May 17, 2025 -

Claim Your Free Fortnite Cowboy Bebop Items Time Sensitive

May 17, 2025

Claim Your Free Fortnite Cowboy Bebop Items Time Sensitive

May 17, 2025