CAC 40: Weekly Market Recap - Slight Dip, Overall Stable (March 7, 2025)

Table of Contents

Key Performance Indicators of the CAC 40 Index

This week, the CAC 40 index showed a resilience amidst some volatility. The index closed with a modest 0.5% decrease, indicating a period of consolidation rather than a significant downturn. Let's break down the key figures:

- Opening Value (Monday): 7250

- Closing Value (Friday): 7195

- Weekly High: 7305

- Weekly Low: 7180

- Weekly Change: -0.5%

- Trading Volume: Trading volume remained relatively consistent with the previous week, suggesting a degree of market stability despite the slight decline. Higher-than-average volume would typically signal increased investor activity and potentially stronger price movements in either direction.

[Insert Chart/Graph Here – Alt Text: "Line graph showing the CAC 40 index performance from [Start Date] to [End Date], highlighting the opening and closing values, weekly high and low, and overall 0.5% decrease."]

The relatively stable trading volume suggests investors are cautiously assessing the situation rather than engaging in large-scale panic selling or aggressive buying.

Sector-Specific Performance within the CAC 40

While the overall index saw a minor dip, performance varied considerably across sectors. This highlights the importance of sector-specific analysis when investing in the French stock market:

-

Top Performers:

- Energy (+1.2%): Benefited from rising oil prices due to geopolitical concerns.

- Technology (+0.8%): Showed resilience despite broader market uncertainty.

- Financials (+0.3%): Experienced modest growth, driven by positive interest rate expectations.

-

Underperformers:

- Consumer Goods (-1.5%): Suffered from concerns about inflation and consumer spending.

- Healthcare (-1%): Faced pressure from regulatory changes and concerns about future growth.

These variations underscore the need for diversified investment strategies within the CAC 40. Analyzing industry-specific news and trends is vital for understanding the performance of individual sectors.

Impact of Major News and Events on the CAC 40

Several significant events influenced the CAC 40's performance this week:

- Interest Rate Hike Announcement: The European Central Bank's announcement of a 0.25% interest rate hike created uncertainty across the market, impacting several sectors.

- Geopolitical Tensions: Rising geopolitical tensions in Eastern Europe caused some investors to seek safer investments, leading to cautious trading in the CAC 40.

- Strong Corporate Earnings: Positive earnings reports from several major companies in the technology and energy sectors helped to mitigate some of the negative impact from other factors.

These events demonstrate the interconnectedness of global market trends and the CAC 40's performance. Monitoring international news and understanding their potential effects is crucial for effective market navigation.

Technical Analysis and Future Outlook for the CAC 40

Technically, the CAC 40 is currently trading near key support levels. While the slight dip is concerning, it hasn't yet broken through significant support, suggesting potential for a rebound. However, we must consider the ongoing global uncertainty.

- Support Levels: The 7150-7180 range appears to be acting as significant support.

- Resistance Levels: Resistance sits around the 7300-7350 levels.

- Moving Averages: The 50-day moving average is currently above the 200-day moving average, a generally positive signal.

The outlook for the CAC 40 remains cautious. While a rebound is possible, continued global uncertainty and potential economic slowdown could exert further downward pressure. Investors should monitor key economic indicators and geopolitical developments closely.

Conclusion: Understanding the CAC 40 Weekly Market Recap and Planning Ahead

This week's CAC 40 market recap revealed a period of slight decline amidst overall stability. The modest 0.5% decrease highlights the importance of monitoring sector-specific performance and global market trends when analyzing the French stock market. Understanding the interplay of interest rate decisions, geopolitical events, and corporate earnings is vital for navigating the complexities of the CAC 40. The relatively stable trading volume suggests a wait-and-see approach from investors.

Stay tuned for next week's CAC 40 market recap for further insights and analysis! For continuous updates on CAC 40 performance, bookmark this page and check back regularly.

Featured Posts

-

Escape To The Country The Benefits Of Rural Living

May 24, 2025

Escape To The Country The Benefits Of Rural Living

May 24, 2025 -

Manny Garcias Lego Workshop Veterans Memorial Elementary School Visit

May 24, 2025

Manny Garcias Lego Workshop Veterans Memorial Elementary School Visit

May 24, 2025 -

L Impact De Mathieu Avanzi Sur La Perception Du Francais

May 24, 2025

L Impact De Mathieu Avanzi Sur La Perception Du Francais

May 24, 2025 -

Amundi Msci World Ex Us Ucits Etf Acc Nav Calculation And Implications

May 24, 2025

Amundi Msci World Ex Us Ucits Etf Acc Nav Calculation And Implications

May 24, 2025 -

Amundi Msci World Ii Ucits Etf Usd Hedged Dist A Guide To Its Net Asset Value

May 24, 2025

Amundi Msci World Ii Ucits Etf Usd Hedged Dist A Guide To Its Net Asset Value

May 24, 2025

Latest Posts

-

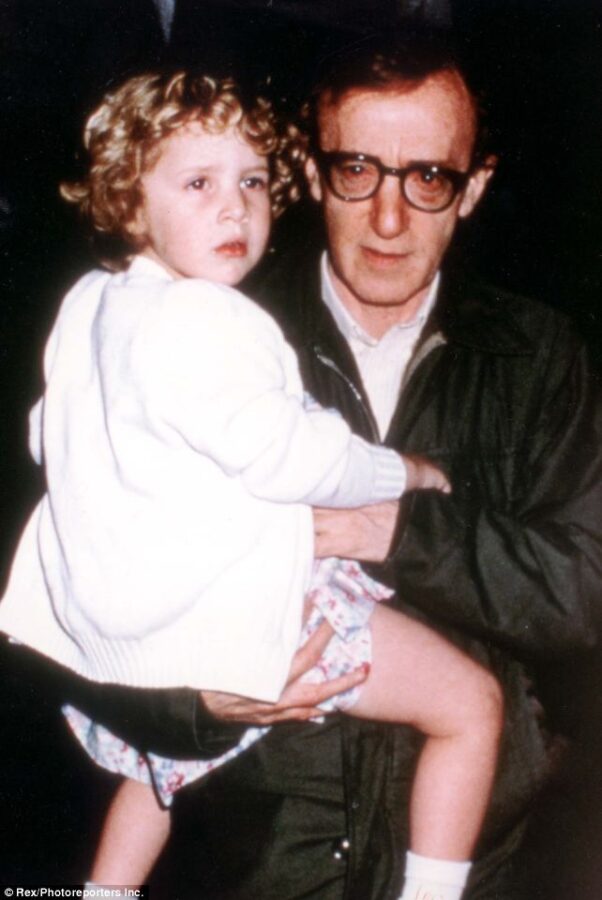

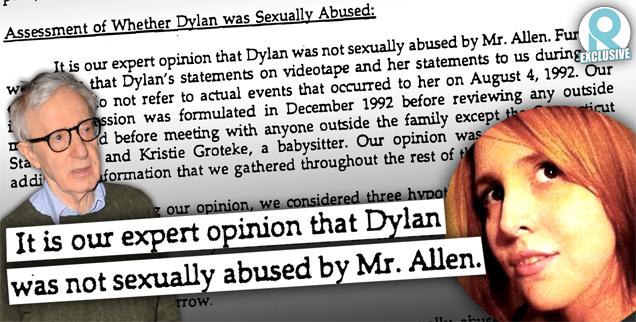

The Woody Allen Dylan Farrow Case Sean Penns Perspective

May 24, 2025

The Woody Allen Dylan Farrow Case Sean Penns Perspective

May 24, 2025 -

17 Famous Figures Whose Images Were Tarnished Forever

May 24, 2025

17 Famous Figures Whose Images Were Tarnished Forever

May 24, 2025 -

Sean Penns Comments On The Woody Allen Dylan Farrow Case

May 24, 2025

Sean Penns Comments On The Woody Allen Dylan Farrow Case

May 24, 2025 -

The Fall From Grace 17 Celebrities Who Lost Everything

May 24, 2025

The Fall From Grace 17 Celebrities Who Lost Everything

May 24, 2025 -

Apple Stock Investment Evaluating A 254 Price Target From An Analyst

May 24, 2025

Apple Stock Investment Evaluating A 254 Price Target From An Analyst

May 24, 2025