Can Palantir Reach A Trillion-Dollar Valuation By 2030?

Table of Contents

Palantir's Current Market Position and Growth Prospects

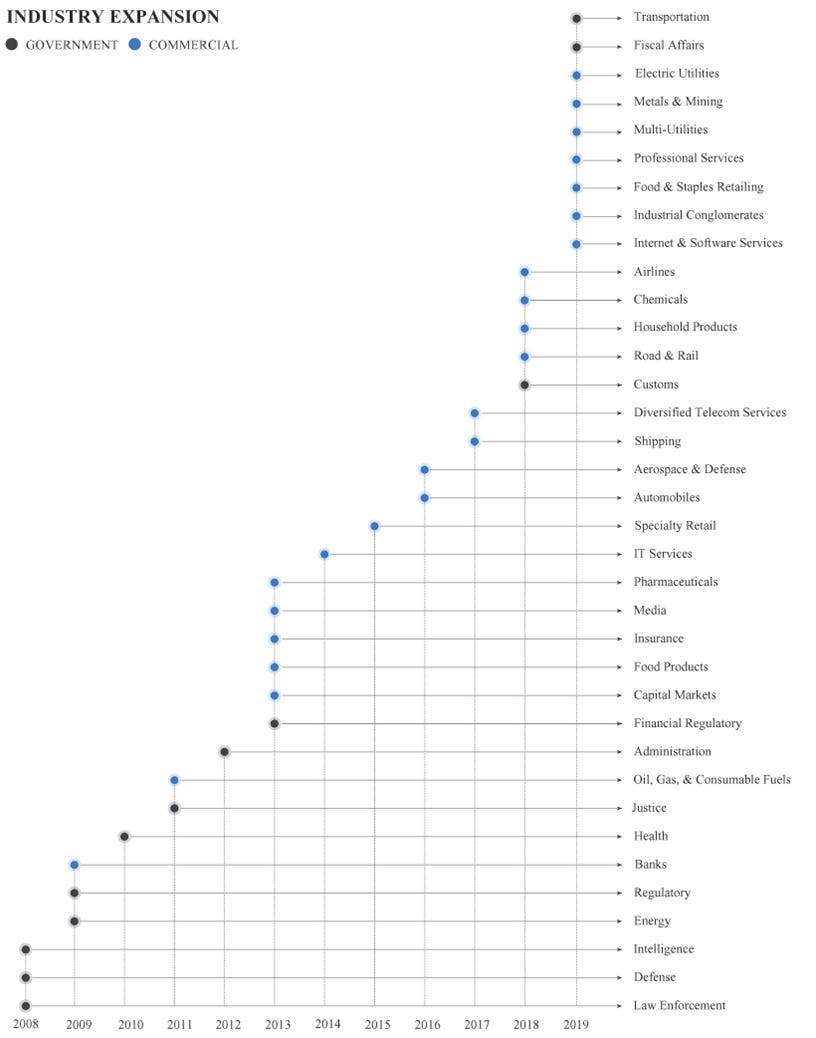

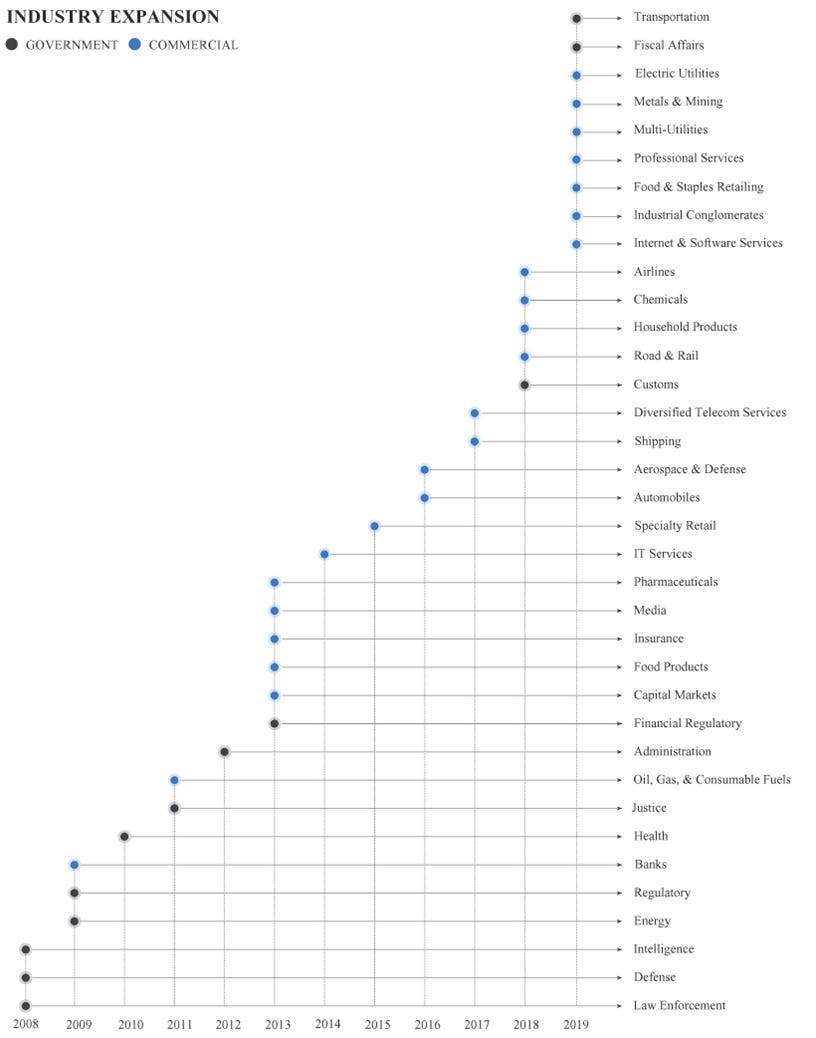

Palantir, known for its sophisticated big data analytics platforms serving government and commercial clients, currently holds a significant position in the market. However, reaching a trillion-dollar valuation requires explosive growth. Analyzing its current market capitalization and revenue streams is crucial. As of [Insert Current Date], Palantir's market cap is approximately [Insert Current Market Cap], and its revenue is [Insert Current Revenue]. The big data analytics market itself is experiencing rapid expansion, projected to reach [Insert Market Size Projection] by [Insert Year]. Palantir's share of this expanding market is vital to its future valuation.

Palantir's competitive advantages include its proprietary technology, particularly its Gotham platform for government clients and Foundry for commercial clients, and its strong relationships with government agencies. However, it faces stiff competition from established tech giants.

- Current market cap and revenue figures: [Insert specific numbers and source]

- Projected growth rate based on analyst predictions: [Insert range of predictions and source]

- Key competitive advantages: Proprietary technology, strong government relationships, adaptable platforms.

- Key competitive disadvantages: High price point, dependence on large contracts, competition from cloud giants.

- Expansion into new markets: Healthcare, finance, and other sectors present significant growth opportunities.

Key Challenges and Risks Hindering Palantir's Trillion-Dollar Goal

The path to a trillion-dollar valuation is fraught with challenges. Intense competition from cloud giants like AWS, Google Cloud, and Microsoft Azure poses a significant threat. These companies offer similar data analytics capabilities, often at a lower cost and with greater scalability. Furthermore, Palantir's reliance on large government contracts exposes it to the risks of budgetary constraints, shifting political priorities, and regulatory hurdles.

Economic downturns can significantly impact Palantir's revenue, as both government and commercial clients may curtail spending on data analytics during periods of economic uncertainty.

- Major competitors and their market share: [Discuss key competitors and their market share, citing sources.]

- Potential regulatory risks and compliance issues: Data privacy regulations and government oversight present ongoing risks.

- Sensitivity of Palantir's business to economic fluctuations: Explain the potential impact of recessions or economic slowdowns.

- Dependence on large government contracts: Highlight the risks associated with this business model.

Technological Innovation and Future Growth Drivers

Palantir's ongoing investments in research and development (R&D) are crucial to its future growth. The company is actively developing and integrating artificial intelligence (AI) and machine learning (ML) capabilities into its platforms, enhancing their analytical power and expanding their application in various sectors. Emerging technologies like AI and ML are key growth drivers, enabling more sophisticated data analysis and automation. New product lines and expansion into untapped markets will also be crucial.

- Recent R&D investments and their potential impact: [Cite examples of R&D initiatives and their potential returns.]

- Key technological advancements driving Palantir's future growth: AI, ML, and advancements in data processing.

- Potential for new product launches and market expansion: Identify potential new product areas and market segments.

- Integration of AI and machine learning into existing platforms: Explain how these technologies enhance Palantir's offerings.

Financial Projections and Valuation Analysis

Assessing the likelihood of a trillion-dollar valuation requires a rigorous financial analysis. Different valuation methodologies, such as discounted cash flow (DCF) analysis and comparable company analysis, can be employed. However, each model relies on assumptions about future growth rates, profit margins, and discount rates. A sensitivity analysis is needed to understand the impact of varying these key assumptions.

- Different valuation methods and their applicability to Palantir: Compare and contrast different valuation approaches.

- Key assumptions underlying each valuation model: Clearly state the assumptions used in each model.

- Potential range of future market cap based on different scenarios: Present best-case, worst-case, and most likely scenarios.

- Sensitivity analysis of key variables (growth rate, margins, discount rate): Show how changes in these variables affect the valuation.

Conclusion: Palantir's Path to a Trillion-Dollar Valuation – A Realistic Goal?

Reaching a trillion-dollar valuation by 2030 presents a significant challenge for Palantir. While its strong technology, government contracts, and expansion into new markets offer considerable potential, the company faces intense competition, regulatory risks, and economic vulnerabilities. Our analysis suggests that while a trillion-dollar valuation is not impossible, it depends heavily on sustained high growth, successful navigation of competitive pressures, and continued technological innovation. The path forward requires continued investment in R&D, strategic expansion into new markets, and effective management of risks. Will Palantir achieve a trillion-dollar valuation by 2030? Share your prediction in the comments below!

Featured Posts

-

Vremennoe Zakrytie Aeroporta Permi Prichiny I Posledstviya Snegopada

May 09, 2025

Vremennoe Zakrytie Aeroporta Permi Prichiny I Posledstviya Snegopada

May 09, 2025 -

110 Potential The Black Rock Etf Billionaires Are Betting On

May 09, 2025

110 Potential The Black Rock Etf Billionaires Are Betting On

May 09, 2025 -

Wynne Evans Under Fire From Joanna Page On Bbc Programme

May 09, 2025

Wynne Evans Under Fire From Joanna Page On Bbc Programme

May 09, 2025 -

Fast Paced Farce Takes Flight At St Albert Dinner Theatre

May 09, 2025

Fast Paced Farce Takes Flight At St Albert Dinner Theatre

May 09, 2025 -

Stephen Kings Best Short Tv Series A Binge Worthy 5 Hour Watch

May 09, 2025

Stephen Kings Best Short Tv Series A Binge Worthy 5 Hour Watch

May 09, 2025