110% Potential: The BlackRock ETF Billionaires Are Betting On

Table of Contents

The BlackRock Advantage: Why Billionaires Choose These ETFs

BlackRock, a global investment management corporation, enjoys a stellar reputation built on stability, strong performance, and innovative investment solutions. Billionaires choose BlackRock ETFs for several compelling reasons:

- Massive asset under management (AUM): BlackRock boasts trillions of dollars in AUM, a clear indicator of trust and stability within the investment community. This scale provides economies of scale, leading to lower costs for investors.

- Access to diverse, expertly curated portfolios: BlackRock employs teams of experienced portfolio managers who meticulously select assets, offering investors diversified exposure to various markets and sectors. This diversification helps to mitigate risk.

- Low expense ratios: Compared to actively managed funds, BlackRock ETFs typically have lower expense ratios, meaning investors retain a larger percentage of their returns. This cost-effectiveness is a major draw for long-term investors.

- Transparency and readily available information: BlackRock provides transparent and readily accessible information on its ETFs, allowing investors to make informed decisions based on clear data and performance metrics. This transparency builds confidence.

- A wide range of ETFs: BlackRock offers a broad spectrum of ETFs catering to various investment strategies. Whether you're interested in sector-specific investments (like technology or healthcare ETFs), broad market exposure, or international diversification, BlackRock likely has an ETF tailored to your needs. This range allows for customized portfolio building.

Top Performing BlackRock ETFs Billionaires Are Targeting

While past performance is not indicative of future results, several BlackRock ETFs have demonstrated impressive growth, attracting significant investment from high-net-worth individuals. It's crucial to remember that all investments carry risk. (Note: Specific ETF ticker symbols and performance data should be added here, along with appropriate disclaimers. This information is subject to change and should be independently verified.)

- Example: The iShares CORE U.S. Aggregate Bond ETF (AGG) offers exposure to a broad range of U.S. investment-grade bonds. (Insert performance data and relevant news here, with appropriate disclaimers.)

- Example: The iShares Global Clean Energy ETF (ICLN) focuses on companies involved in renewable energy. (Insert performance data and relevant news here, with appropriate disclaimers.)

- Example: The iShares Robotics and Artificial Intelligence Multisector ETF (IRBO) is focused on the rapidly growing fields of robotics and AI. (Insert performance data and relevant news here, with appropriate disclaimers.)

Understanding the 110% Potential: Factors Contributing to High Growth

The potential for substantial returns from BlackRock ETFs stems from several key factors:

- Growth potential of specific sectors: Rapid advancements in artificial intelligence, sustainable energy, and biotechnology offer immense growth potential for the companies within ETFs focusing on these sectors.

- Impact of global macroeconomic factors: Favorable global economic trends, such as increasing consumer spending or infrastructure development, can significantly impact the performance of ETFs that hold assets in related sectors.

- The role of diversification: A well-diversified portfolio reduces risk by spreading investments across multiple asset classes and sectors, potentially increasing the likelihood of higher returns while minimizing losses.

- The long-term growth outlook: Investing in ETFs that focus on companies with strong long-term growth prospects can lead to substantial returns over time.

Risk Management and Diversification Strategies with BlackRock ETFs

While the potential for high returns exists, it's crucial to remember that all investments involve risk. Effective risk management and diversification are vital:

- Asset allocation strategies: Develop a strategy tailored to your risk tolerance and financial goals, carefully considering your investment time horizon.

- Diversification within and across ETFs: Don't put all your eggs in one basket. Diversify across different BlackRock ETFs and asset classes to mitigate risk.

- Individual financial goals and time horizons: Consider your personal financial goals and the timeframe you have available for investing.

- Thorough due diligence: Before investing in any ETF, conduct comprehensive research to understand the underlying assets, risks, and potential returns.

Accessing BlackRock ETFs: A Step-by-Step Guide

Investing in BlackRock ETFs is relatively straightforward:

- Choosing a reputable brokerage platform: Select a brokerage account that offers access to a wide range of ETFs with competitive fees.

- Understanding trading fees and commissions: Be aware of any trading fees or commissions charged by your brokerage.

- Setting up a brokerage account and funding it: Open an account and deposit funds to begin investing.

- Placing an order to buy BlackRock ETFs: Use the brokerage platform's trading tools to place orders to purchase the chosen ETFs.

- Monitoring your investments regularly: Track your investments regularly to monitor performance and make necessary adjustments to your portfolio.

Conclusion

This article explored the reasons behind the significant investment in BlackRock ETFs by high-net-worth individuals, highlighting the potential for substantial returns. We've examined top-performing ETFs (remembering past performance is not indicative of future results), analyzed contributing factors to their growth, and stressed the importance of risk management and diversification.

Call to Action: Unlock the 110% potential. Start exploring the world of BlackRock ETFs today. Research the options available, understand your risk tolerance, and make informed investment decisions to capitalize on the opportunities within these high-growth funds. Don't miss out on the potential of BlackRock ETFs – begin your journey to financial success. Remember to consult with a qualified financial advisor before making any investment decisions.

Featured Posts

-

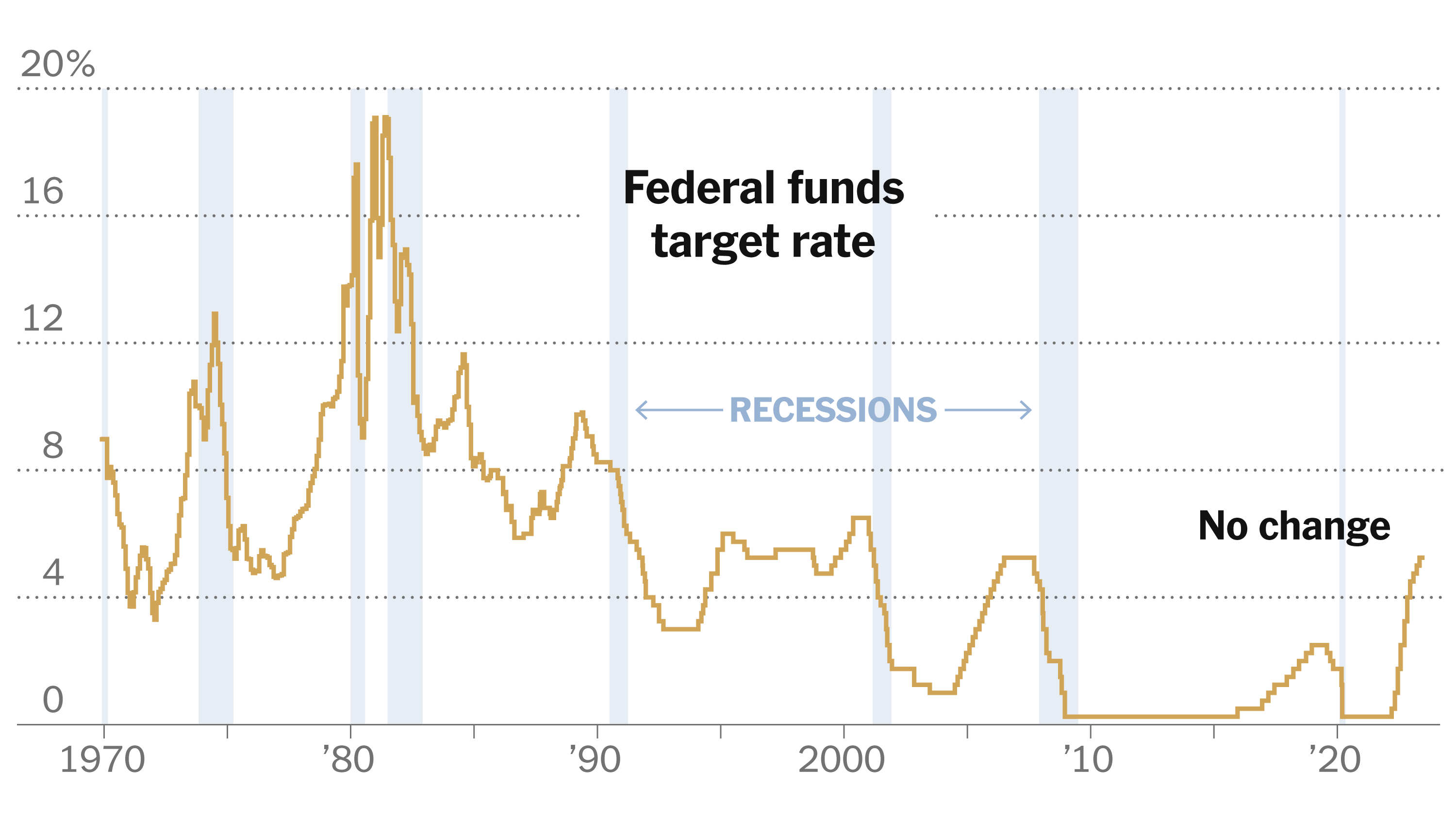

Interest Rate Outlook The Federal Reserves Balancing Act

May 09, 2025

Interest Rate Outlook The Federal Reserves Balancing Act

May 09, 2025 -

Wynne Evanss Strictly Scandal A Fight For Reputation With New Evidence

May 09, 2025

Wynne Evanss Strictly Scandal A Fight For Reputation With New Evidence

May 09, 2025 -

To Buy Or Not To Buy Palantir Stock Before May 5th Analyst Predictions

May 09, 2025

To Buy Or Not To Buy Palantir Stock Before May 5th Analyst Predictions

May 09, 2025 -

Indias First Man In Space Rakesh Sharmas Journey And Present Activities

May 09, 2025

Indias First Man In Space Rakesh Sharmas Journey And Present Activities

May 09, 2025 -

Harry Styles Reaction To That Awful Snl Impression Devastated

May 09, 2025

Harry Styles Reaction To That Awful Snl Impression Devastated

May 09, 2025