China Steel Output Curbs: Impact On Iron Ore Prices

Table of Contents

Reduced Steel Demand and its Direct Impact on Iron Ore Prices

The relationship between steel production and iron ore demand is direct and undeniable. Iron ore is the primary raw material in steelmaking; therefore, reduced steel production automatically translates to decreased iron ore demand. This fundamental supply and demand dynamic is the cornerstone of understanding recent price fluctuations in the iron ore market. China, being the world's largest steel producer, holds significant sway over this relationship.

- Lower steel output directly translates to decreased iron ore consumption. When Chinese steel mills reduce their output, their need for iron ore diminishes proportionally.

- Reduced demand leads to a surplus of iron ore, putting downward pressure on prices. This surplus creates a buyer's market, driving prices down as suppliers compete for limited orders.

- This effect is amplified by the sheer scale of China's steel industry. Even a small percentage reduction in China's steel production can significantly impact global iron ore demand and prices.

- Recent price movements in iron ore have demonstrably correlated with announced production cuts. Observing these price movements alongside official announcements provides strong empirical evidence for this relationship.

- Potential scenarios based on the severity and duration of the output curbs vary widely. Short-term, moderate cuts might lead to temporary price dips, while prolonged, substantial cuts could trigger more significant and sustained price declines. The commodity trading community closely monitors these factors.

Environmental Concerns and Government Regulations

China's commitment to carbon neutrality is a driving force behind the recent steel output curbs. The government is implementing stringent environmental regulations aimed at reducing carbon emissions from the steel industry, a significant contributor to greenhouse gas emissions. These regulations directly impact production capacity and, consequently, iron ore prices. The shift towards "green steel" production adds another layer of complexity.

- China's commitment to carbon neutrality significantly impacts steel production targets. The country's ambitious goals necessitate a reduction in overall steel production to meet emissions targets.

- Specific government policies, such as stricter emission standards and production quotas for steel mills, are directly impacting output. These policies create uncertainty and limit the production capacity of many steel mills.

- The potential for long-term changes in the steel production landscape is substantial. The move towards greener production methods will likely reshape the industry's structure and supply chains.

- The implications for sustainable steel production extend to iron ore sourcing. Demand for iron ore produced with lower environmental impact is likely to increase, influencing sourcing patterns.

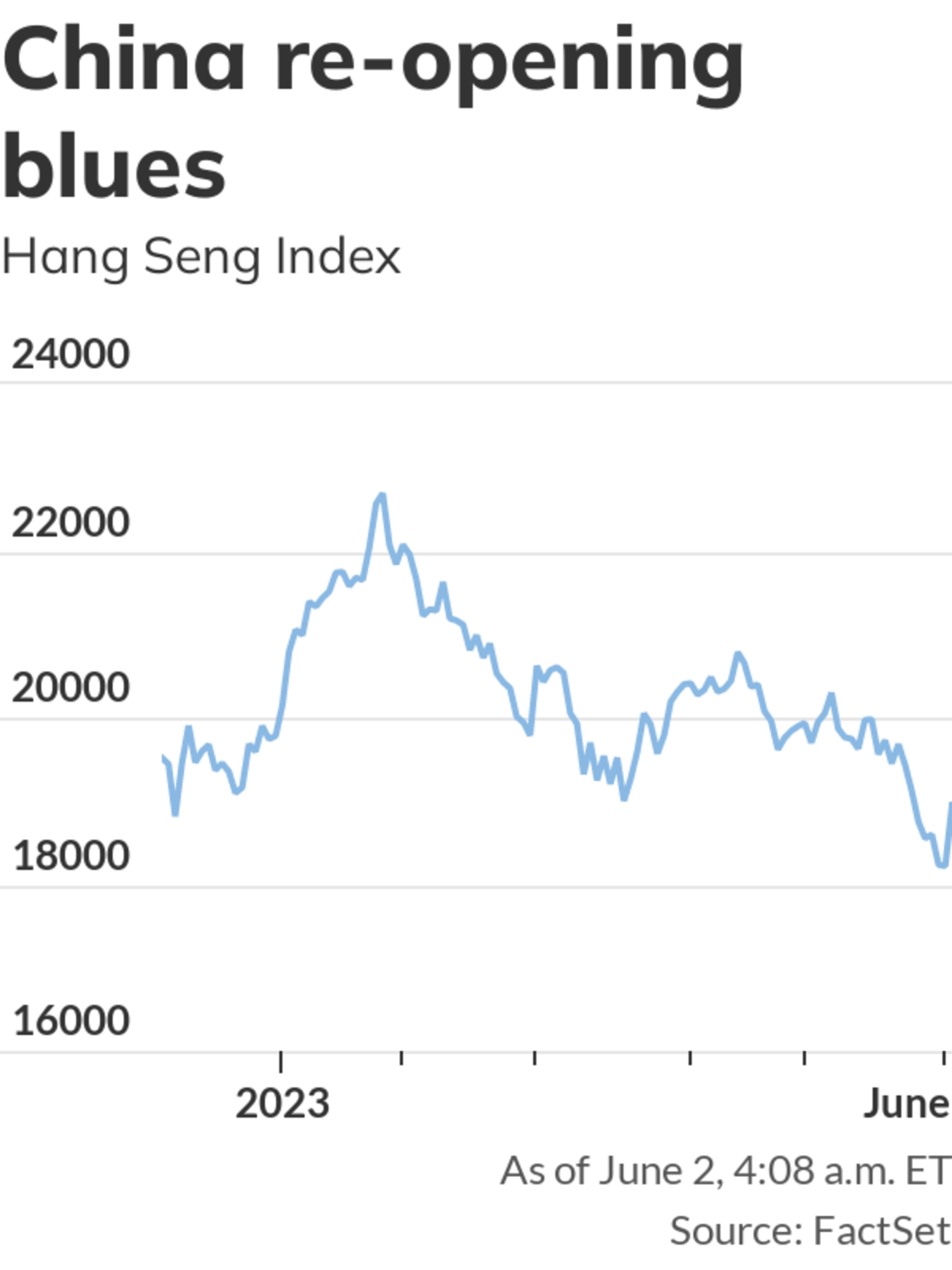

Global Impact and Market Volatility

China's steel output curbs don't just affect the domestic market; they have far-reaching global implications, influencing iron ore supply chains and creating volatility in the international steel market. The ripple effect is felt across the globe.

- The impact on iron ore producers in Australia, Brazil, and other major exporting countries is substantial. Reduced demand from China directly affects their export volumes and revenue.

- Potential price fluctuations in the global iron ore market due to supply chain disruptions are a key concern. Uncertainty about future demand can lead to price volatility as suppliers try to adjust to the changing market.

- Increased competition among iron ore suppliers is likely. With reduced demand, suppliers will compete more aggressively for market share, further impacting prices.

- Ripple effects on other related industries, such as shipping and logistics, are also evident. The reduced demand for iron ore transportation will affect these sectors as well.

The Role of Speculation and Market Sentiment

Market sentiment and speculation play a significant role in amplifying the price volatility caused by China's steel output curbs. Investor confidence, driven by news and predictions, influences trading activity and price movements in commodity futures markets.

- Investor predictions influence trading activity, potentially exacerbating price fluctuations. Negative predictions can lead to sell-offs, further depressing prices.

- The role of commodity futures markets is crucial. These markets provide a platform for speculation and hedging, which can significantly impact spot prices.

- News and announcements regarding steel production cuts and environmental policies directly affect market sentiment. Any positive or negative news related to China steel output instantly impacts investor confidence and market prices.

Conclusion

China's steel output curbs have a profound and multifaceted impact on iron ore prices. Reduced steel demand directly decreases iron ore consumption, leading to price drops. Stringent environmental regulations further exacerbate this trend, pushing the market towards sustainable steel production and influencing sourcing practices. The global impact is undeniable, creating supply chain disruptions and increased market volatility. Speculation and market sentiment amplify these effects. Understanding the intricate interplay of these factors is key to navigating this dynamic market. To make informed decisions regarding investments and trading in the iron ore market and related commodities, stay informed about the evolving situation regarding China steel output and its impact on iron ore prices. Regularly monitor market analysis and expert predictions to better understand the intricacies of China steel output and its direct correlation to iron ore prices for better market navigation.

Featured Posts

-

Jogsertes Floridaban Transznemu No Letartoztatasa Noi Mosdo Miatt

May 10, 2025

Jogsertes Floridaban Transznemu No Letartoztatasa Noi Mosdo Miatt

May 10, 2025 -

Living Legends Of Aviation Awards Ceremony Recognizes Bravery And Service

May 10, 2025

Living Legends Of Aviation Awards Ceremony Recognizes Bravery And Service

May 10, 2025 -

14 Edmonton Schools Accelerated Construction Timeline Announced

May 10, 2025

14 Edmonton Schools Accelerated Construction Timeline Announced

May 10, 2025 -

Woman Sentenced For Unprovoked Racist Stabbing Death Of Man

May 10, 2025

Woman Sentenced For Unprovoked Racist Stabbing Death Of Man

May 10, 2025 -

Big Wall Street Comeback How Bear Market Bets Are Failing

May 10, 2025

Big Wall Street Comeback How Bear Market Bets Are Failing

May 10, 2025