China-US Trade Surge: Exporters Rush To Beat Trade Deal Deadline

Table of Contents

Increased Export Volumes from China to the US

Motivations Behind the Rush

Exporters are driven by several key factors fueling this pre-deadline rush:

- Avoidance of Potential Future Tariffs: The looming threat of increased tariffs or renewed trade tensions is a significant motivator. Exporters aim to secure sales and ship goods before any potential policy shifts that could negatively impact their profitability.

- Meeting Existing Order Backlogs: Many US businesses placed large orders in anticipation of potential future disruptions. Chinese exporters are now working overtime to fulfill these commitments before the deadline.

- Securing Market Share Before Potential Changes in Trade Policy: A pre-emptive move to maintain or gain market share is another key driver. Exporters are keen to establish a strong position before any potential changes in trade agreements alter the competitive landscape.

Supporting this observation are numerous reports from industry analysts showing a significant uptick in shipping activity from China to the US in recent weeks. Anecdotal evidence from Chinese exporters also confirms this surge, highlighting the pressure to meet deadlines and capitalize on current market conditions.

Specific Product Categories Showing the Largest Increases

Certain product categories are experiencing particularly significant growth:

- Electronics: A 25% increase in electronic component exports has been reported in the last quarter.

- Textiles: Apparel and textile exports show a 15% rise compared to the same period last year.

- Machinery: Industrial machinery exports have seen a notable 10% jump.

- Agricultural Products: Soybean and other agricultural product exports are also showing significant increases.

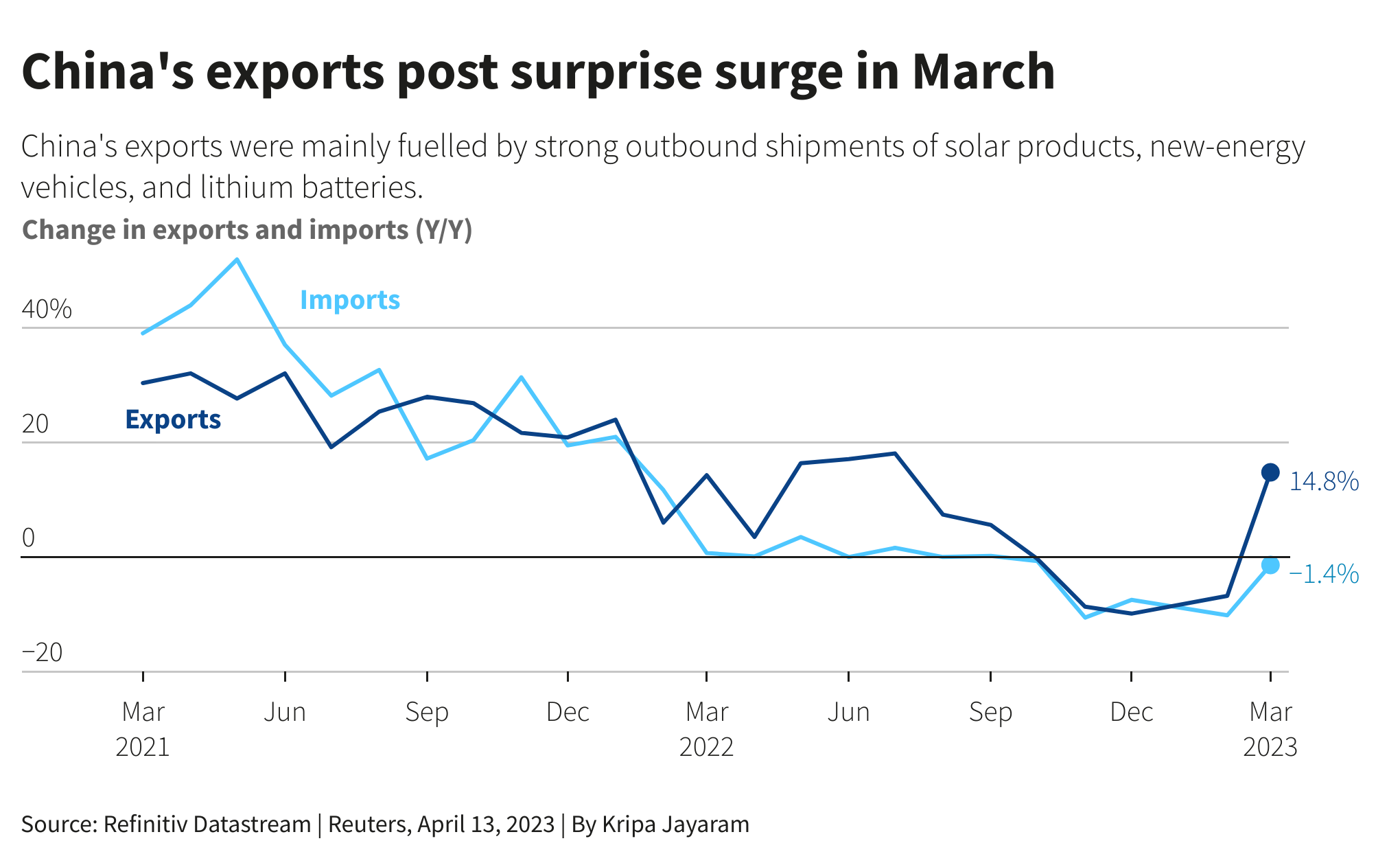

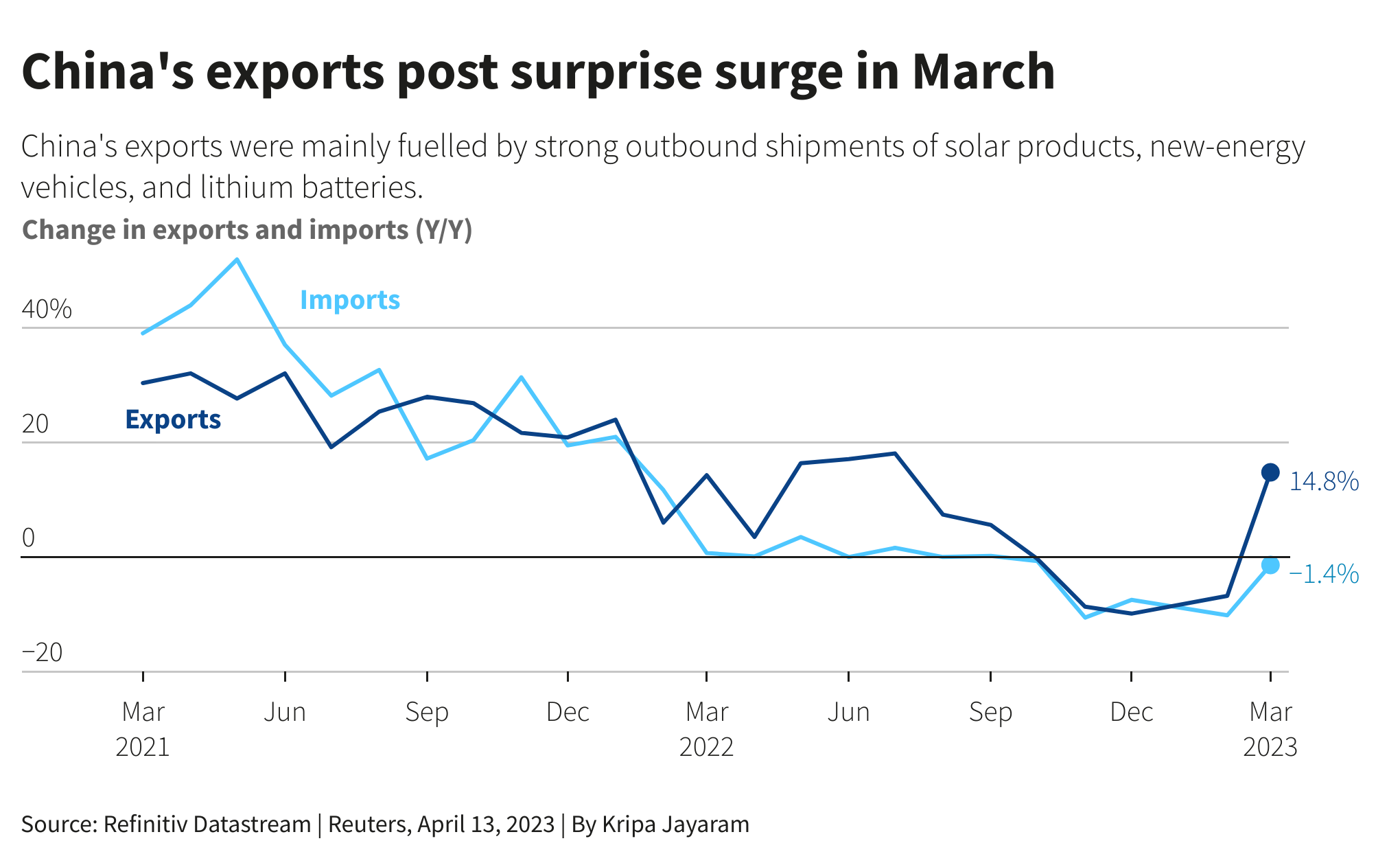

Data visualization through charts and graphs would further illustrate these increases, providing a clearer picture of the specific products driving the surge in China-US trade.

US Businesses Stockpiling Goods from China

The Impact of Tariff Uncertainty

The uncertainty surrounding future trade policies significantly impacts US business decisions and supply chain strategies:

- Hedging Against Future Price Increases: Businesses are stockpiling goods to mitigate the risk of higher prices resulting from potential tariffs or trade restrictions.

- Minimizing Supply Chain Disruptions: Stockpiling helps to ensure a continuous supply of essential goods, reducing the vulnerability to potential future disruptions in the supply chain.

- Maintaining Competitive Pricing: By securing inventory at current prices, businesses can maintain competitive pricing for their products.

Quotes from US business leaders emphasize the importance of these strategies in navigating the uncertainties in the current trade environment.

Sectors Most Affected by Stockpiling

Several sectors are predominantly stockpiling goods from China:

- Manufacturing: Companies relying heavily on imported components and raw materials from China are particularly active in stockpiling.

- Retail: Retailers are building up inventories to avoid shortages and price increases in consumer goods.

- Technology: The technology sector, which heavily relies on Chinese-manufactured components, is also significantly impacted.

Examples of specific companies implementing stockpiling strategies would further illustrate this trend within various industries.

Implications of the Pre-Deadline Trade Surge

Economic Effects on Both Countries

The pre-deadline trade surge has significant economic implications for both China and the US:

- Positive Effects (China): Short-term boost to Chinese exports, increased employment in export-oriented industries.

- Negative Effects (China): Potential for overcapacity in certain sectors once the surge subsides, vulnerability to future trade policy changes.

- Positive Effects (US): Short-term supply security, potentially lower prices for consumers due to existing stockpiles.

- Negative Effects (US): Potential for increased trade deficit in the short term, vulnerability to supply chain disruptions if future trade relations deteriorate.

Macroeconomic indicators, expert opinions, and risk assessments would provide a comprehensive analysis of these short-term and long-term implications.

Geopolitical Ramifications

The trade surge has broader geopolitical implications:

- Impact on Bilateral Relations: The surge could influence future trade negotiations between the two countries.

- Global Supply Chain Dynamics: It highlights the interconnected nature of global supply chains and their vulnerability to geopolitical uncertainties.

- Future Trade Policy: The outcome of the trade deal will significantly shape future trade policies and relations between China and the US.

Political analysis and commentary contribute to a deeper understanding of these ramifications and their potential impact on future trade relations.

Conclusion: Understanding the China-US Trade Surge and its Future

The surge in China-US trade before the potential trade deal deadline is a complex phenomenon driven by multiple factors, primarily the desire to avoid potential future tariffs and secure market share before potential policy changes. The economic and geopolitical implications are significant for both countries, with both short-term benefits and long-term risks involved. The deadline's impact remains crucial in shaping future trade flows and the bilateral relationship. What happens after the deadline remains uncertain, with potential scenarios ranging from continued cooperation to renewed trade tensions. Stay informed about the ongoing developments in the China-US trade relationship by following our regular updates on the China-US trade surge and its future implications.

Featured Posts

-

Neuer Injury Update Bayern Goalkeepers Return Uncertain

May 26, 2025

Neuer Injury Update Bayern Goalkeepers Return Uncertain

May 26, 2025 -

Captured In Gaza The Enduring Strength Of Idf Soldiers

May 26, 2025

Captured In Gaza The Enduring Strength Of Idf Soldiers

May 26, 2025 -

Wta Rome Zheng Qinwens Shock Win Against Sabalenka

May 26, 2025

Wta Rome Zheng Qinwens Shock Win Against Sabalenka

May 26, 2025 -

Myrtle Beach Annual Cleanup Volunteer Registration Open

May 26, 2025

Myrtle Beach Annual Cleanup Volunteer Registration Open

May 26, 2025 -

Southern Tourist Destination Reassesses Security Following Recent Violence

May 26, 2025

Southern Tourist Destination Reassesses Security Following Recent Violence

May 26, 2025

Latest Posts

-

Up To 30 Off Enjoy A Lavish Hotel Stay This Spring

May 31, 2025

Up To 30 Off Enjoy A Lavish Hotel Stay This Spring

May 31, 2025 -

Book Now And Save 30 Off Lavish Spring Hotel Stays

May 31, 2025

Book Now And Save 30 Off Lavish Spring Hotel Stays

May 31, 2025 -

The Reality Of Ai Navigating The Challenges Of Responsible Ai Development

May 31, 2025

The Reality Of Ai Navigating The Challenges Of Responsible Ai Development

May 31, 2025 -

Luxury Hotel Spring Break 30 Off Your Stay

May 31, 2025

Luxury Hotel Spring Break 30 Off Your Stay

May 31, 2025 -

Why Ai Doesnt Learn And How This Impacts Responsible Ai Practices

May 31, 2025

Why Ai Doesnt Learn And How This Impacts Responsible Ai Practices

May 31, 2025