China's Steel Industry Slowdown: Effect On Global Iron Ore Market

Table of Contents

Reduced Steel Production in China: The Primary Driver

The primary driver of the current instability in the global iron ore market is the undeniable reduction in Chinese steel production. Several interconnected factors contribute to this decline:

-

Stringent Environmental Regulations: The Chinese government is actively implementing stricter environmental regulations aimed at curbing carbon emissions. This includes limiting steel production in regions with high pollution levels and pushing for the adoption of more sustainable steelmaking technologies. This has led to production cuts and plant closures in several key steel-producing provinces.

-

Weakening Domestic Construction and Infrastructure Activity: A slowdown in China's once-booming construction and infrastructure sectors has significantly reduced the demand for steel. This is partly due to a shift in economic priorities and a cooling real estate market. The decrease in large-scale infrastructure projects directly translates to lower steel consumption.

-

Decreased Demand from Key Sectors: Reduced demand from key steel-consuming sectors such as automobiles and home appliances further exacerbates the situation. Economic uncertainty and softening consumer spending contribute to this decline.

The impact is substantial. Statistics show a noticeable decline in Chinese steel output, with [insert data and charts showing decline in steel output]. This significant drop in Chinese steel production directly translates into decreased demand for iron ore, impacting producers and the global iron ore supply chain.

Impact on Iron Ore Demand and Prices

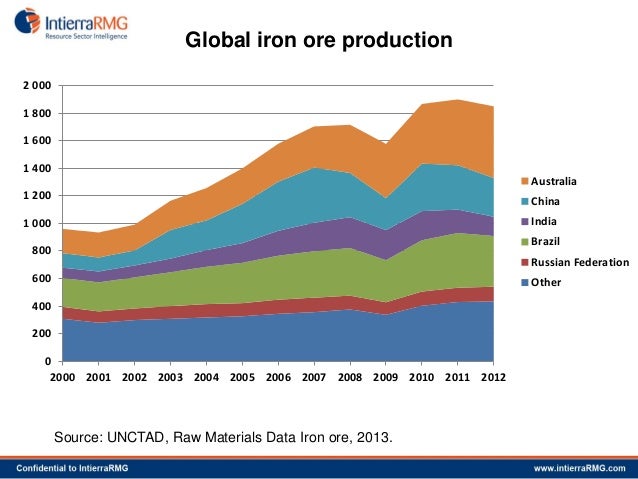

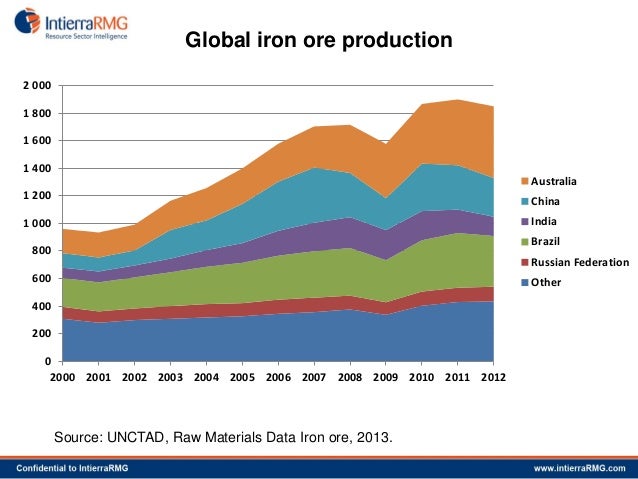

The direct correlation between reduced Chinese steel production and lower iron ore demand is undeniable. As China, the world's largest consumer of iron ore, reduces its steel output, the demand for iron ore naturally follows suit. This leads to a decrease in iron ore prices, impacting major iron ore producing nations like Australia and Brazil.

-

Iron Ore Price Forecast: The reduced demand is expected to maintain downward pressure on iron ore price forecast in the short to medium term. The extent of the price decrease will depend on various factors, including the pace of the Chinese economic recovery and the response of other steel-producing nations.

-

Vulnerable Iron Ore Producers: Australia and Brazil, as the two largest iron ore producers, are particularly vulnerable to fluctuations in Chinese demand. Their economies are significantly reliant on iron ore exports, and a sustained decrease in demand could have significant consequences.

Shifting Global Iron Ore Trade Dynamics

Reduced Chinese demand is forcing a reshuffling of the global iron ore trade. We're seeing a potential shift in trade routes and partnerships.

-

Increased Reliance on Other Steel-Producing Nations: Steel-producing nations outside China may experience a relative increase in demand. However, this increase might not entirely offset the decrease in demand from China, impacting overall market stability.

-

Iron Ore Transportation and Logistics: The shift in demand will likely impact the iron ore shipping routes and logistics. We may see a redistribution of shipping volumes, potentially influencing freight costs and port operations. The global iron ore supply chain is being re-evaluated and re-structured to adapt to this new reality.

Potential Long-Term Implications for the Global Iron Ore Market

The slowdown in China's steel industry has the potential to trigger a long-term structural shift in the global iron ore market.

-

Long-Term Iron Ore Outlook: The long-term iron ore outlook is uncertain, with the future heavily reliant on China's economic trajectory and global decarbonization efforts.

-

Sustainable Steel and Steel Alternatives: The push for sustainable steel production and the exploration of steel alternatives could further reshape the market. Investments in greener steelmaking technologies and research into alternative construction materials will impact future iron ore demand.

-

Investment in Sustainable Steel Production: We may see increased investments in sustainable steel production in other countries, potentially leading to a more geographically diversified iron ore market.

Conclusion: Navigating the Uncertainties in the Global Iron Ore Market Due to China's Steel Slowdown

China's steel slowdown significantly impacts global iron ore demand and prices, causing shifts in trade dynamics and long-term uncertainties. The interdependency between the Chinese steel industry and the global iron ore market is undeniable. Monitoring China's steel industry for signs of recovery or further decline is crucial for forecasting future iron ore market trends.

To make informed decisions in this evolving landscape, stay informed about developments in China's steel industry and the global iron ore market. Explore further resources on China steel market analysis and iron ore market research to stay ahead of the curve. Understanding these dynamics is critical for all stakeholders in the global iron and steel industry.

Featured Posts

-

Analyzing Figmas Ai Advantage Over Adobe Word Press And Canva

May 09, 2025

Analyzing Figmas Ai Advantage Over Adobe Word Press And Canva

May 09, 2025 -

Dijon Psg Victoire Parisienne En Arkema Premiere Ligue

May 09, 2025

Dijon Psg Victoire Parisienne En Arkema Premiere Ligue

May 09, 2025 -

Suncors Record Production Impact Of Inventory Buildup On Sales Volumes

May 09, 2025

Suncors Record Production Impact Of Inventory Buildup On Sales Volumes

May 09, 2025 -

Antipremiya Zolotaya Malina Razgromnye Rezultaty Dlya Dakoty Dzhonson

May 09, 2025

Antipremiya Zolotaya Malina Razgromnye Rezultaty Dlya Dakoty Dzhonson

May 09, 2025 -

Liga Chempionov 2024 2025 Predvaritelniy Obzor Matchey Arsenal Ps Zh I Barselona Inter

May 09, 2025

Liga Chempionov 2024 2025 Predvaritelniy Obzor Matchey Arsenal Ps Zh I Barselona Inter

May 09, 2025