Climate Change And Your Mortgage: Understanding The Risks

Table of Contents

Increased Risk of Property Damage from Extreme Weather

The frequency and intensity of hurricanes, floods, wildfires, and droughts are increasing globally, posing significant risks to property and, consequently, mortgages. These extreme weather events can lead to devastating consequences for homeowners. The damage caused can far exceed insurance coverage, leading to financial hardship and, in some cases, mortgage default.

- Higher insurance premiums: As climate-related risks rise, insurance companies are forced to increase premiums to cover potential losses. This makes homeownership more expensive and can place a significant burden on homeowners.

- Potential for mortgage default: Severe property damage from extreme weather can render a property uninhabitable and leave homeowners unable to meet their mortgage payments, leading to foreclosure.

- Difficulty securing mortgage refinancing: After experiencing climate-related damage, securing refinancing can be incredibly difficult. Lenders may be hesitant to offer new mortgages on damaged properties, leaving homeowners in precarious financial situations.

- Increased costs for property repairs and mitigation: Repairing damage caused by extreme weather events can be costly, often exceeding the value of the repairs themselves. Furthermore, implementing mitigation measures to protect against future damage adds to the financial burden. This includes things like installing flood barriers or reinforcing structures against wildfires.

Declining Property Values in High-Risk Areas

Properties located in areas vulnerable to climate change impacts, such as coastal regions prone to flooding or areas with high wildfire risk, are experiencing declining property values. This trend is driven by a number of factors.

- Buyer reluctance: Potential buyers are increasingly wary of purchasing properties in high-risk zones, leading to decreased demand and lower prices. The perception of increased risk, even without immediate damage, can significantly impact market value.

- Lower appraisals: Appraisals, crucial for securing mortgages, often reflect the increased climate risks. Appraisers consider factors like flood risk, wildfire proximity, and the potential for future damage, leading to lower valuations.

- Difficulty selling: Selling a property in a climate-vulnerable area can be challenging, particularly if the risks are not fully disclosed or mitigated. Buyers may offer significantly lower prices or refuse to purchase altogether.

- Negative equity: If property values drop significantly due to climate-related risks, homeowners could find themselves in negative equity, owing more on their mortgage than their property is worth.

The Role of Mortgage Lenders and Insurance Companies

Mortgage lenders and insurance companies are increasingly aware of the financial risks posed by climate change. They are adapting their practices to reflect these risks.

- Stricter lending criteria: Lenders are implementing stricter lending criteria for properties located in high-risk areas. This may involve requiring higher down payments, denying mortgages altogether, or demanding significant climate-related improvements before loan approval.

- Increased mortgage insurance premiums or denial of coverage: Mortgage insurance premiums are likely to rise, or coverage may even be denied altogether for properties located in areas considered high-risk. This makes securing a mortgage more expensive and potentially impossible for some.

- Requirement for climate-related mitigation measures: Before approving a mortgage, lenders may require homeowners to implement climate-related mitigation measures such as flood-proofing or fire-resistant landscaping. These requirements add significant upfront costs.

- Growing importance of climate risk disclosures: Mortgage applications are increasingly incorporating climate risk disclosures, requiring borrowers to disclose known climate-related risks associated with their properties. Transparency about these risks is becoming crucial.

Proactive Steps to Mitigate Risk

Taking proactive steps can significantly reduce the financial risks associated with climate change and your mortgage.

- Conduct thorough research: Before purchasing a property, conduct thorough research on the climate risks in the area. Use resources like FEMA flood maps, wildfire risk assessments, and local climate reports.

- Invest in climate-resilient improvements: Consider investing in property improvements that enhance climate resilience, such as installing flood barriers, using fire-resistant building materials, and improving drainage.

- Purchase climate-related insurance: Consider purchasing flood insurance, wildfire insurance, or other climate-related insurance policies to protect against potential damage.

- Discuss climate risks with your lender and insurer: Openly discuss climate risks with your mortgage lender and insurance provider to understand their policies and assess your level of risk.

Conclusion

Climate change poses significant and growing risks to mortgages, affecting property values, insurance costs, and lender practices. Property damage from extreme weather, declining property values in high-risk areas, and stricter lending practices are all consequences homeowners need to consider. Understanding and mitigating these risks is crucial for protecting your financial future. Don't let climate change jeopardize your financial future. Take proactive steps to understand the risks associated with climate change and your mortgage and protect your investment today. Learn more about assessing climate risks in your area and explore strategies to mitigate potential financial impacts.

Featured Posts

-

Asbh Deplacement A Biarritz En Pro D2 Analyse Du Facteur Mental

May 20, 2025

Asbh Deplacement A Biarritz En Pro D2 Analyse Du Facteur Mental

May 20, 2025 -

Wayne Gretzky And Donald Trump A Legacy Under Scrutiny

May 20, 2025

Wayne Gretzky And Donald Trump A Legacy Under Scrutiny

May 20, 2025 -

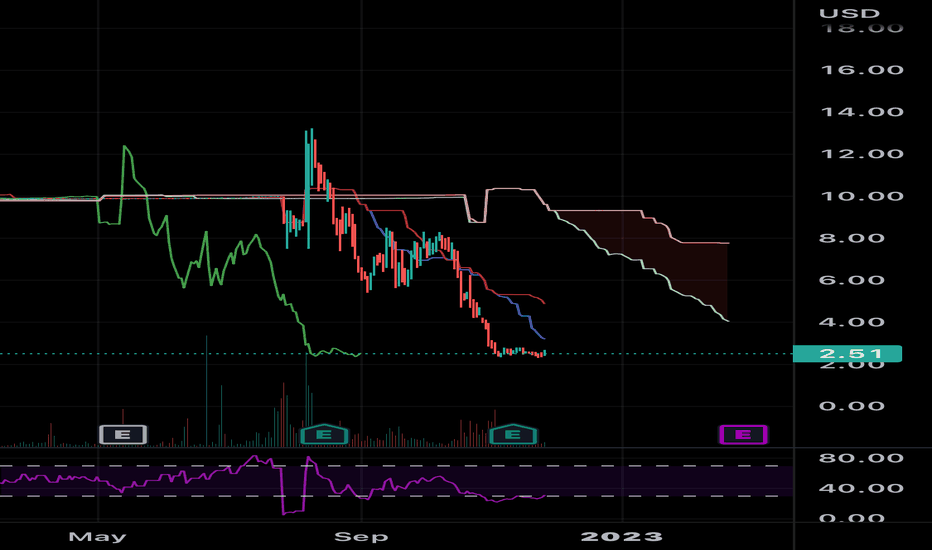

Understanding The D Wave Quantum Qbts Stocks Significant Drop On Monday

May 20, 2025

Understanding The D Wave Quantum Qbts Stocks Significant Drop On Monday

May 20, 2025 -

Wayne Gretzky Fast Facts For Hockey Fans

May 20, 2025

Wayne Gretzky Fast Facts For Hockey Fans

May 20, 2025 -

Antrasis Jennifer Lawrence Vaikas Bado Zaidynes Zvaigzdes Seimos Dziaugsmas

May 20, 2025

Antrasis Jennifer Lawrence Vaikas Bado Zaidynes Zvaigzdes Seimos Dziaugsmas

May 20, 2025

Latest Posts

-

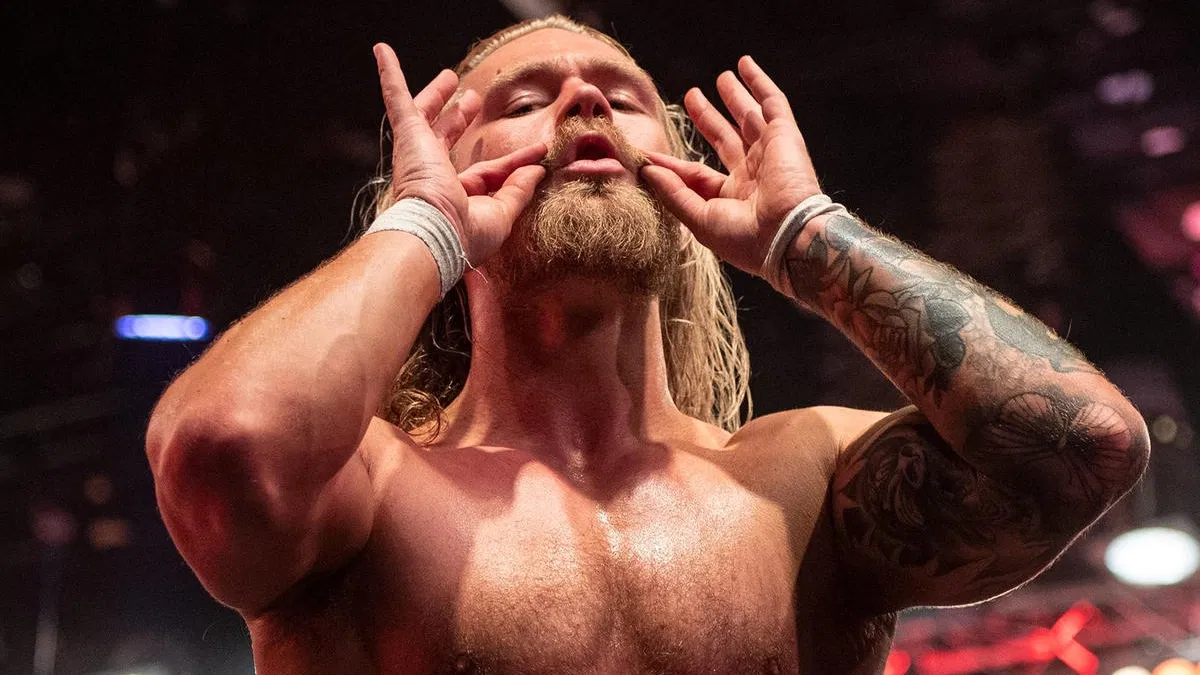

Wwe News Tyler Bate Returns To The Ring

May 20, 2025

Wwe News Tyler Bate Returns To The Ring

May 20, 2025 -

Wwe Raw 5 19 2025 Review Best And Worst Moments

May 20, 2025

Wwe Raw 5 19 2025 Review Best And Worst Moments

May 20, 2025 -

Tyler Bate Back On Wwe Television A Breakdown Of His Comeback

May 20, 2025

Tyler Bate Back On Wwe Television A Breakdown Of His Comeback

May 20, 2025 -

Wwes Monday Night Raw The New Womens Tag Team Title Reign Begins

May 20, 2025

Wwes Monday Night Raw The New Womens Tag Team Title Reign Begins

May 20, 2025 -

Rey Fenix Officially Joins Wwe Smack Down Next Week

May 20, 2025

Rey Fenix Officially Joins Wwe Smack Down Next Week

May 20, 2025