Understanding The D-Wave Quantum (QBTS) Stock's Significant Drop On Monday

Table of Contents

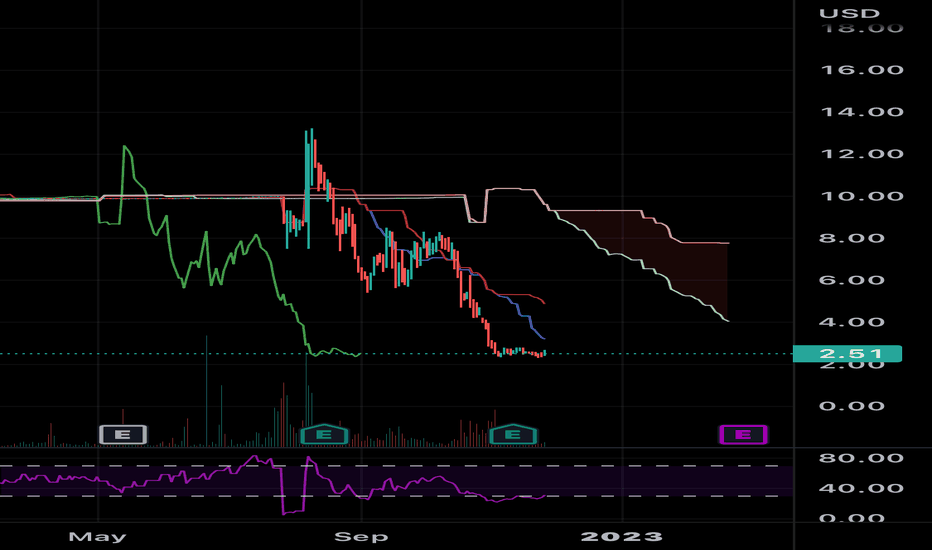

Analyzing D-Wave Quantum's Recent Financial Performance

Understanding the recent performance of D-Wave Quantum is crucial to grasping Monday's stock plunge. We need to look at both the reported numbers and the company's future projections.

Earnings Report and Revenue Figures

The most recent D-Wave earnings report revealed key figures impacting investor confidence. Analyzing QBTS earnings, we find several areas of concern. Let's look at some key data points:

- Revenue: (Insert actual revenue figure from the latest report). This represents a (increase/decrease) compared to the previous quarter and (increase/decrease) compared to the same quarter last year.

- Net Income: (Insert actual net income figure). This indicates (profit/loss) and reflects (positive/negative) trends in profitability.

- Operating Expenses: (Insert actual operating expenses figure). High operating expenses could be a factor contributing to the low profitability of D-Wave. Analysis of these expenses, and how they compare to previous quarters, is essential.

The implications of these numbers for investors are significant. The (positive/negative) revenue growth coupled with the (positive/negative) net income suggests (positive/negative) investor sentiment towards the company's current financial health. This likely played a role in the stock's downward trajectory. The relationship between QBTS earnings and the stock price demonstrates the market's sensitivity to financial performance.

Guidance and Future Projections

D-Wave's guidance for future financial performance is another critical factor. Analyzing QBTS guidance, we see (insert key projections here, e.g., projected revenue growth for the next quarter/year). Key aspects of the outlook include:

- Revenue Growth Projections: (Insert projected revenue growth figures and the timeframe). The market may have reacted negatively to these projections if they fell short of expectations.

- Profitability Timeline: (Insert projected timeline for profitability). Investors are likely assessing whether this timeline is realistic and achievable given the current market conditions.

- Factors Impacting Future Performance: (Discuss any mentioned challenges, such as competition or technological hurdles). This transparency is important but might have contributed to the sell-off if challenges were perceived as substantial.

The market's reaction to these projections likely contributed to the drop in QBTS stock. Any perceived shortfall in expectations can lead to a sell-off, emphasizing the importance of D-Wave meeting or exceeding investor projections in the future outlook for the quantum computing market.

Market Sentiment and Investor Confidence in QBTS

Beyond D-Wave's internal performance, broader market factors and overall investor sentiment played a role in the QBTS stock drop.

Impact of Broader Market Trends

Monday's market downturn, impacting various sectors, needs to be considered. The overall tech stock performance on Monday was (positive/negative), and market volatility was (high/low). Specific events that may have influenced the broader market include:

- (List specific events, e.g., a major economic announcement, a geopolitical event, or a significant shift in interest rates).

- These broader market trends might have exacerbated the already present concerns regarding D-Wave's financial situation.

This general negative sentiment likely amplified the drop in QBTS stock, regardless of D-Wave's specific performance.

Analyst Ratings and Target Prices

Changes in analyst ratings and target prices often significantly impact investor confidence. Following the drop, we saw:

- (List specific changes in ratings from key analysts). Any downgrades from major firms would contribute to negative sentiment.

- (List changes in target prices from key analysts). Lowered target prices reflect reduced expectations for future QBTS stock performance.

Analyst opinions carry weight, influencing investor decisions. Negative revisions in ratings and target prices following the earnings report likely contributed significantly to the sell-off. Understanding QBTS analyst ratings is crucial for interpreting market sentiment.

Specific Events Triggering the D-Wave Quantum (QBTS) Stock Drop

In addition to financial performance and market conditions, specific events might have triggered the QBTS stock drop.

News and Announcements

Any news released by D-Wave or related companies could influence investor sentiment. Recent news included:

- (List specific news items, e.g., a delay in a product launch, a partnership failure, or regulatory issues). Clearly explain how these events potentially influenced the negative market reaction. Careful consideration of D-Wave news is crucial for interpreting stock movement.

The impact of these events, if negative, would directly influence the QBTS stock price.

Competitor Activity

The quantum computing sector is competitive. Actions by rivals could impact D-Wave's stock price:

- (Discuss any significant announcements or progress from competitors, particularly related to technological breakthroughs or market share gains). This competitive landscape directly affects investor confidence in D-Wave's future prospects.

This analysis of the competitive dynamics surrounding D-Wave helps investors understand the context of the stock price drop. Evaluating QBTS competitive landscape is crucial for long-term investment strategies.

Conclusion

The significant drop in D-Wave Quantum (QBTS) stock on Monday resulted from a combination of factors. Disappointing financial performance, reflected in the QBTS earnings report and outlook, coupled with negative market sentiment and potentially concerning news or competitor activity, all contributed to the decline. Analyzing QBTS guidance and understanding the competitive landscape are crucial aspects of assessing the risk and potential reward of investing in this emerging technology company.

Understanding the intricacies of the D-Wave Quantum (QBTS) stock requires ongoing monitoring. Stay informed and make well-researched decisions before investing.

Featured Posts

-

Todays Nyt Mini Crossword Answers May 9

May 20, 2025

Todays Nyt Mini Crossword Answers May 9

May 20, 2025 -

El Viaje De Schumacher De Mallorca A Suiza En Helicoptero

May 20, 2025

El Viaje De Schumacher De Mallorca A Suiza En Helicoptero

May 20, 2025 -

Beiers Two Goals Secure Dortmund Win Against Mainz

May 20, 2025

Beiers Two Goals Secure Dortmund Win Against Mainz

May 20, 2025 -

Nyt Mini Crossword March 8 Answer Key

May 20, 2025

Nyt Mini Crossword March 8 Answer Key

May 20, 2025 -

Thousands Of Uk Households Receiving Hmrc Letters Income Tax Checks Explained

May 20, 2025

Thousands Of Uk Households Receiving Hmrc Letters Income Tax Checks Explained

May 20, 2025

Latest Posts

-

Kaellmanin Nousu Miten Haen On Kehittaenyt Peliaeaen Ja Tuonut Sen Huuhkajien Tasolle

May 20, 2025

Kaellmanin Nousu Miten Haen On Kehittaenyt Peliaeaen Ja Tuonut Sen Huuhkajien Tasolle

May 20, 2025 -

Huuhkajat Kaellmanin Maalivireen Merkitys

May 20, 2025

Huuhkajat Kaellmanin Maalivireen Merkitys

May 20, 2025 -

Friis Paljastaa Avauskokoonpanon Kamara Ja Pukki Sivussa

May 20, 2025

Friis Paljastaa Avauskokoonpanon Kamara Ja Pukki Sivussa

May 20, 2025 -

Benjamin Kaellman Kasvu Ja Maalinteko Huuhkajissa

May 20, 2025

Benjamin Kaellman Kasvu Ja Maalinteko Huuhkajissa

May 20, 2025 -

Huuhkajat Saavat Vahvistusta Benjamin Kaellman Tuo Maalintekovoimaa

May 20, 2025

Huuhkajat Saavat Vahvistusta Benjamin Kaellman Tuo Maalintekovoimaa

May 20, 2025