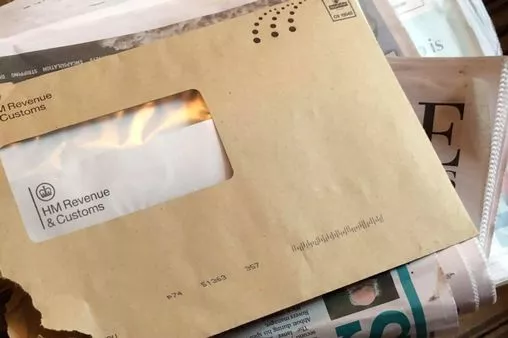

Thousands Of UK Households Receiving HMRC Letters: Income Tax Checks Explained

Table of Contents

Why is HMRC Sending Out So Many Letters?

HMRC's increased scrutiny regarding income tax is a multi-faceted issue. The government is actively pursuing several initiatives to close the UK's tax gap – the difference between the tax that should be collected and what is actually collected. This involves a concerted effort to tackle tax evasion and improve the overall efficiency of tax collection.

Several factors contribute to this intensified focus:

- Increased use of data analytics: HMRC utilizes sophisticated data analysis techniques to identify potential discrepancies between declared income and actual earnings. This allows for more targeted investigations, focusing resources where they're most needed.

- Focus on specific sectors or income brackets: Certain industries, like the gig economy, and specific income brackets are often subject to increased scrutiny due to higher perceived risks of underreporting.

- Response to increased self-assessment inaccuracies: A significant number of self-assessment tax returns contain errors or omissions, prompting HMRC to increase checks to ensure accuracy.

- Addressing concerns about the 'gig economy' and unreported income: The rise of the gig economy has presented challenges in accurately tracking and taxing income, leading to increased efforts to ensure compliance.

What Do the HMRC Letters Typically Include?

HMRC letters regarding income tax checks usually contain crucial information you need to understand. These letters are not always the same, varying in severity. Common features include:

- Reference number: A unique identifier for your specific case.

- Request for information: This clearly outlines the specific information HMRC requires, including deadlines for submission.

- Deadlines: Failure to meet these deadlines can result in penalties.

- Potential penalties for non-compliance: This clearly states the potential financial consequences of failing to respond or provide the requested information.

Different types of letters include:

- Requests for information: These letters ask for supporting documentation to verify your income and tax declarations.

- Formal investigations: These indicate a more serious inquiry into your tax affairs and may involve a more detailed review of your financial records.

- Penalty notices: Issued if you've failed to comply with previous requests or deadlines.

Examples of common requests include:

- Bank statements

- Payslips

- Invoices

- Business records

HMRC has significant powers to investigate and obtain information relevant to your tax affairs. Understanding the specific requirements of the letter is paramount.

How to Respond to an HMRC Letter Regarding Income Tax Checks

Responding promptly and accurately to an HMRC letter is crucial. Here's a step-by-step guide:

- Read the letter carefully: Understand the specific request and deadlines.

- Gather necessary documentation: Collect all relevant bank statements, payslips, invoices, and other supporting documents.

- Complete the forms accurately: Ensure all information provided is correct and complete.

- Keep copies of all correspondence: Maintain a record of all communication with HMRC.

- Contact HMRC directly if you have questions: Don't hesitate to reach out if you need clarification.

- Consider seeking professional help: If you are struggling to understand the letter or need assistance gathering the necessary information, seek advice from a qualified tax advisor. They can offer expert guidance and ensure you comply fully with HMRC requirements.

What Happens If You Don't Respond to an HMRC Letter?

Ignoring HMRC correspondence can have serious consequences. Non-compliance can lead to:

- Financial penalties for late submissions: These penalties can be substantial and increase over time.

- Increased interest charges on unpaid tax: Interest will be added to any unpaid tax, further increasing your debt.

- Potential for legal proceedings: In cases of persistent non-compliance, HMRC may take legal action.

- Damage to credit rating: A poor tax record can negatively impact your creditworthiness.

Understanding Your HMRC Letters and Avoiding Income Tax Problems

In summary, the increased number of HMRC letters reflects the government's commitment to closing the tax gap. Understanding the reasons for these letters, their contents, and how to respond appropriately is essential for avoiding potential penalties and legal issues. Prompt and accurate responses are crucial to maintaining your tax compliance. Don't ignore those HMRC letters! Take control of your income tax with professional guidance if needed. If you're struggling to understand your HMRC tax letters or need help with your income tax check, seek professional advice from a qualified tax advisor. Don't delay – act now to ensure your compliance with UK tax regulations.

Featured Posts

-

Is Prioritizing Hamilton A Risk For Ferrari And Leclerc

May 20, 2025

Is Prioritizing Hamilton A Risk For Ferrari And Leclerc

May 20, 2025 -

100 Sueper Lig Maci Dusan Tadic In Basarisi

May 20, 2025

100 Sueper Lig Maci Dusan Tadic In Basarisi

May 20, 2025 -

Miami Gp Tea Break Hamilton Ferrari Dispute Reignites

May 20, 2025

Miami Gp Tea Break Hamilton Ferrari Dispute Reignites

May 20, 2025 -

Manchester Uniteds Cunha Pursuit Accelerated Talks And Plan B

May 20, 2025

Manchester Uniteds Cunha Pursuit Accelerated Talks And Plan B

May 20, 2025 -

Lou Gala The Decamerons Breakout Star Biography And Career

May 20, 2025

Lou Gala The Decamerons Breakout Star Biography And Career

May 20, 2025

Latest Posts

-

Assessing The Feasibility Of Returning Factory Jobs To The Us Under Trumps Policies

May 20, 2025

Assessing The Feasibility Of Returning Factory Jobs To The Us Under Trumps Policies

May 20, 2025 -

Manufacturing Jobs In America Can Trumps Vision Be Realized

May 20, 2025

Manufacturing Jobs In America Can Trumps Vision Be Realized

May 20, 2025 -

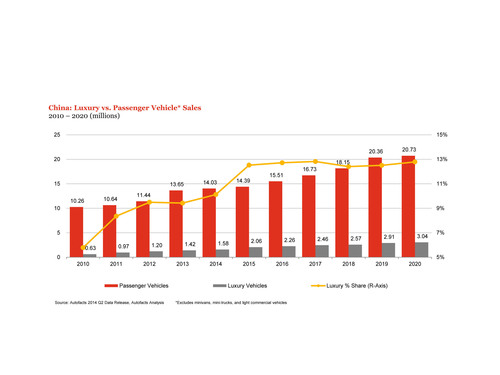

The Future Of Luxury Cars In China A Case Study Of Bmw And Porsches Struggles

May 20, 2025

The Future Of Luxury Cars In China A Case Study Of Bmw And Porsches Struggles

May 20, 2025 -

Navigating The Complexities Luxury Automakers And The Chinese Market

May 20, 2025

Navigating The Complexities Luxury Automakers And The Chinese Market

May 20, 2025 -

Chinas Automotive Market Challenges For Bmw Porsche And Other Foreign Brands

May 20, 2025

Chinas Automotive Market Challenges For Bmw Porsche And Other Foreign Brands

May 20, 2025