CoreWeave Inc. (CRWV) Stock Price Increase: Analysis Of Today's Gains

Table of Contents

Potential Catalysts for CoreWeave Inc. (CRWV) Stock Rise

Several factors could have contributed to the positive movement in CoreWeave's stock price. Let's examine the key potential catalysts:

Positive Earnings Report or Guidance

A strong earnings report or upbeat future guidance is often a primary driver of stock price increases. Did CoreWeave recently release positive financial news that exceeded market expectations? Let's look for clues:

- Revenue Surpass: Did CoreWeave report revenue significantly higher than analysts' predictions? Strong revenue growth signals robust demand for its cloud computing and AI infrastructure services.

- Improved Margins: Increased profit margins suggest improved operational efficiency and cost management, a positive sign for investors.

- Upbeat Future Outlook: A confident forecast for future growth and profitability instills investor confidence and encourages buying.

- Analyst Upgrades: Have leading financial analysts upgraded their ratings or target prices for CRWV stock following the release of positive financial data? Analyst sentiment significantly influences market perception. (Links to relevant financial news sources would be inserted here).

Market Sentiment and Industry Trends

The broader market environment and specific trends within the AI and cloud computing sectors play a crucial role.

- AI Boom: The current surge of interest in Artificial Intelligence has boosted the entire sector. CoreWeave's position as a key provider of AI infrastructure makes it a prime beneficiary of this trend.

- Cloud Computing Growth: The continued growth of cloud computing globally contributes significantly to the demand for CoreWeave’s services. Increased adoption of cloud-based solutions translates directly into higher revenue for CRWV.

- Increased Investor Interest: Growing investor enthusiasm for AI and cloud infrastructure stocks fuels increased demand, driving up share prices. This is particularly true for companies with strong growth potential and market positioning, like CoreWeave. (Relevant statistics and data would be inserted here)

Strategic Partnerships or Announcements

New partnerships, acquisitions, or significant product announcements can inject renewed vigor into a company's stock performance.

- Major Partnerships: A strategic alliance with a major technology company or a prominent player in the AI field can dramatically expand CoreWeave's reach and market share, leading to significant price appreciation.

- Acquisitions: Acquiring a complementary company can broaden CoreWeave's capabilities and accelerate its growth trajectory.

- Product Launches: The introduction of innovative new products or services can attract new customers and further solidify CoreWeave's position in the market. (Links to official press releases or announcements would be inserted here)

Technical Analysis of CoreWeave Inc. (CRWV) Stock Chart

Analyzing the technical aspects of CRWV's stock chart offers further insights into today's price movement.

Trading Volume and Price Action

High trading volume accompanying the price increase suggests strong buying pressure.

- Breakout Levels: Did the stock price break through significant resistance levels today? Such breakouts often signal a sustained upward trend.

- Momentum: The speed and magnitude of the price increase are also key indicators of market sentiment and future price direction. (A chart showcasing the stock's price action would be inserted here)

- Correlation with Catalysts: Linking price movements to the previously discussed catalysts helps establish a clearer understanding of the driving forces behind the stock's performance.

Identifying Support and Resistance Levels

Identifying support and resistance levels is crucial for predicting future price movements.

- Support Levels: These are price points where buying pressure is expected to outweigh selling pressure, potentially halting or reversing a downward trend.

- Resistance Levels: These are price points where selling pressure might overcome buying pressure, potentially halting or reversing an upward trend.

- Technical Indicators: Using indicators like moving averages and RSI provides additional context for evaluating the strength of support and resistance levels.

Short-Term and Long-Term Outlook based on technical analysis

Based on the chart patterns and technical indicators, a cautious yet potentially optimistic outlook might be warranted. The short-term outlook depends heavily on whether the current upward momentum can be sustained. The long-term outlook hinges on the company's ability to deliver on its growth projections and navigate the competitive landscape.

Risks and Considerations for CoreWeave Inc. (CRWV) Investors

While today's gains are encouraging, it's crucial to acknowledge potential risks.

Market Volatility and Economic Uncertainty

The stock market is inherently volatile, and economic downturns can significantly impact even the most promising companies.

Competition within the Cloud Computing and AI Sector

The cloud computing and AI sectors are highly competitive. CoreWeave faces strong competition from established players with substantial resources.

Regulatory risks

Changes in regulations related to data privacy, cybersecurity, or competition could impact CoreWeave's operations and profitability.

Conclusion: Assessing the Future of CoreWeave Inc. (CRWV) Stock

Today's increase in CoreWeave (CRWV) stock price is likely a result of a combination of factors, including potentially positive financial news, favorable industry trends, and strong investor sentiment. However, it's essential to weigh these positive developments against the inherent risks associated with any stock market investment. While the outlook for CoreWeave appears positive, based on its position in the growing AI and cloud computing sectors, potential investors should conduct thorough due diligence, considering the competitive landscape and broader economic conditions. Learn more about CoreWeave Inc. (CRWV) and make informed investment decisions.

Featured Posts

-

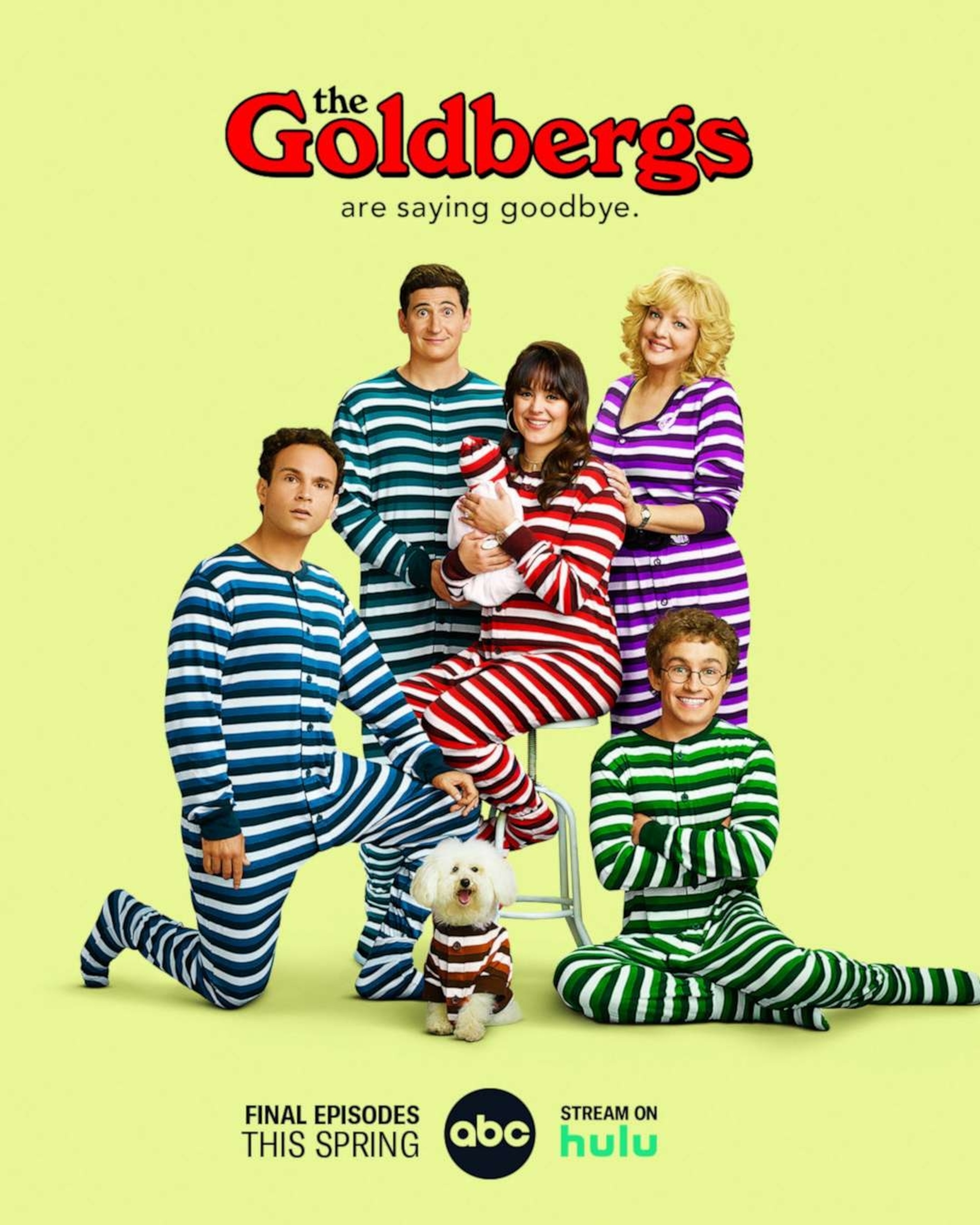

The Goldbergs The Shows Impact On Pop Culture

May 22, 2025

The Goldbergs The Shows Impact On Pop Culture

May 22, 2025 -

The Versatile Uses Of Cassis Blackcurrant In Cocktails And Cuisine

May 22, 2025

The Versatile Uses Of Cassis Blackcurrant In Cocktails And Cuisine

May 22, 2025 -

Vidmova Ukrayini Vid Nato Poglyad Z Yevropi Ta Potentsiyni Zagrozi

May 22, 2025

Vidmova Ukrayini Vid Nato Poglyad Z Yevropi Ta Potentsiyni Zagrozi

May 22, 2025 -

Within The Sound Perimeter Music And Social Cohesion

May 22, 2025

Within The Sound Perimeter Music And Social Cohesion

May 22, 2025 -

Abn Amro Voorspelt Stijging Huizenprijzen Ondanks Renteverhogingen

May 22, 2025

Abn Amro Voorspelt Stijging Huizenprijzen Ondanks Renteverhogingen

May 22, 2025

Latest Posts

-

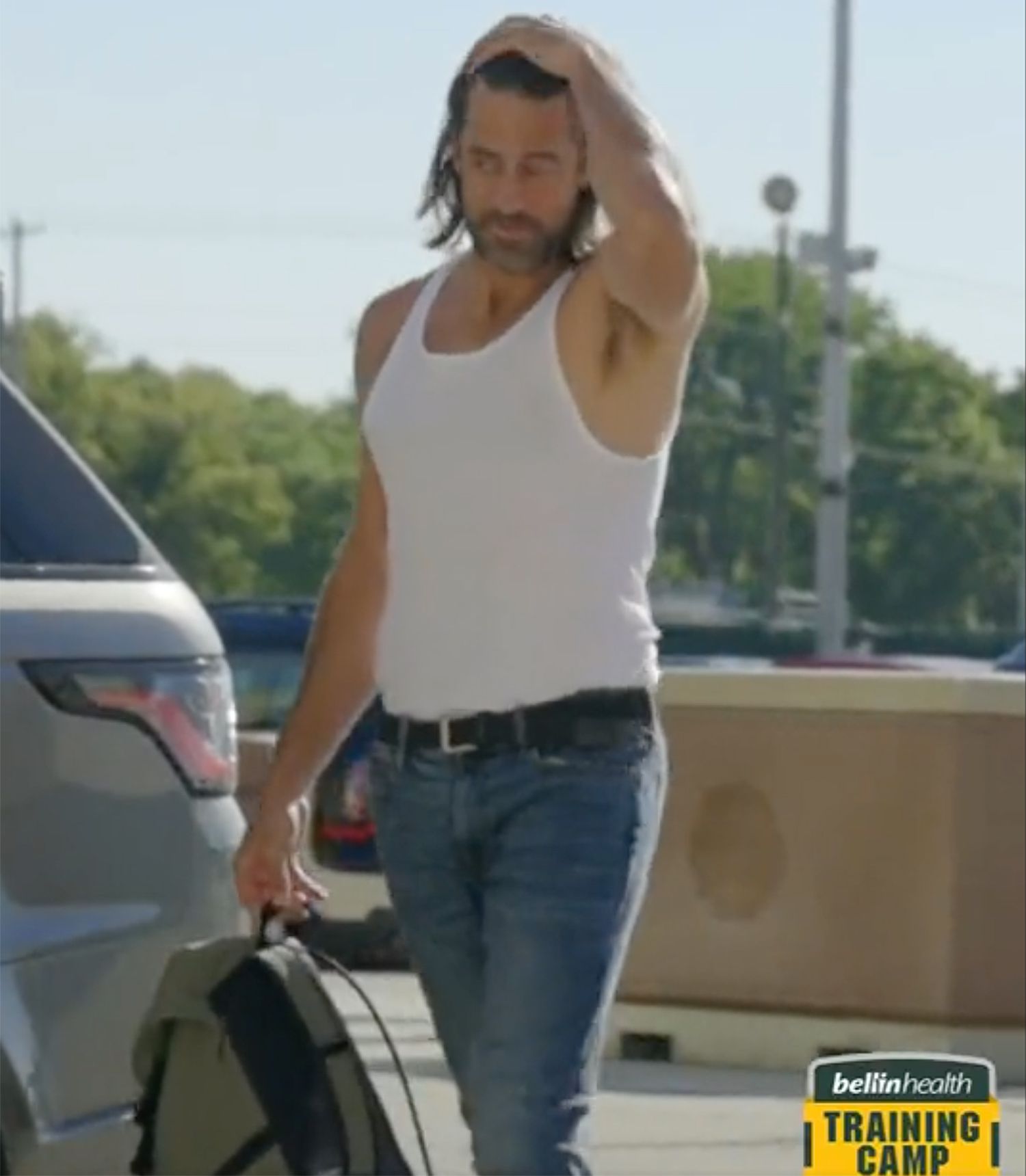

Is Aaron Rodgers Headed To Pittsburgh Recent Training Facility Visit Examined

May 22, 2025

Is Aaron Rodgers Headed To Pittsburgh Recent Training Facility Visit Examined

May 22, 2025 -

Rodgers Steelers Visit Fuels Nfl Trade Speculation

May 22, 2025

Rodgers Steelers Visit Fuels Nfl Trade Speculation

May 22, 2025 -

Aaron Rodgers At Steelers Training Camp Speculation And Analysis

May 22, 2025

Aaron Rodgers At Steelers Training Camp Speculation And Analysis

May 22, 2025 -

Steelers Fans Face Potential Ireland Matchup Disappointment

May 22, 2025

Steelers Fans Face Potential Ireland Matchup Disappointment

May 22, 2025 -

Aaron Rodgers Visits Steelers Training Facility What Does It Mean

May 22, 2025

Aaron Rodgers Visits Steelers Training Facility What Does It Mean

May 22, 2025