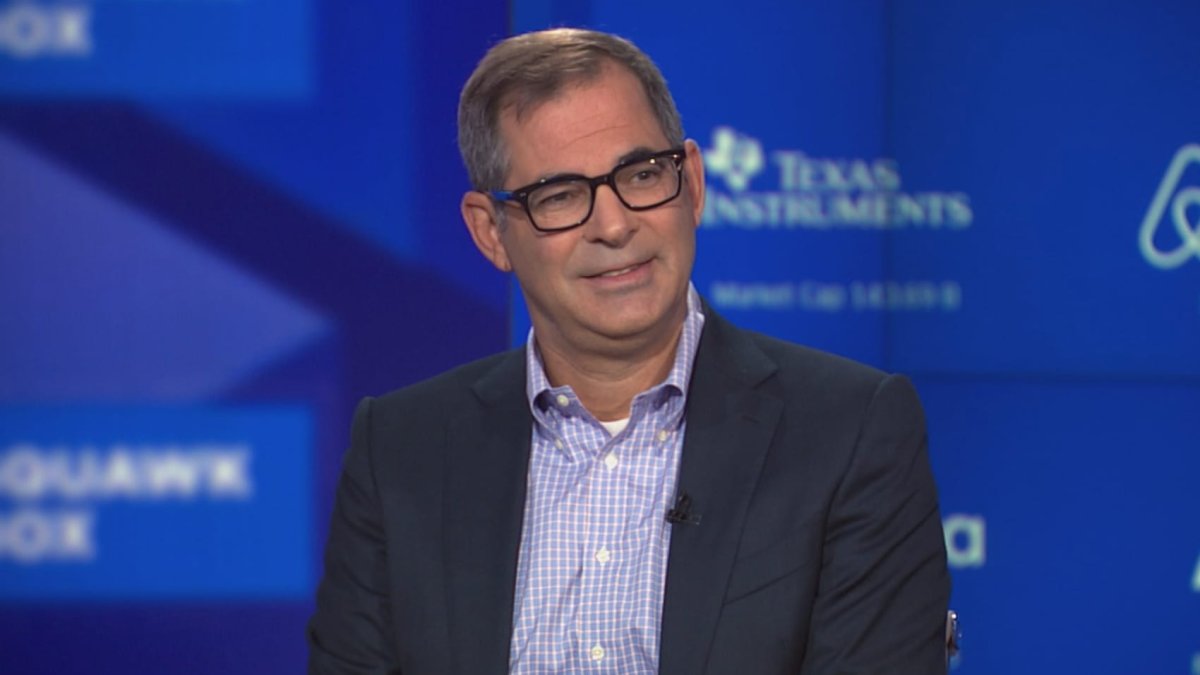

CoreWeave's IPO Pricing: $40 Per Share, Revised Downward

Table of Contents

Initial IPO Expectations and the Subsequent Downgrade

Prior to the revision, speculation placed CoreWeave's IPO price range considerably higher. Analysts and investors anticipated a significantly more bullish valuation, reflecting the company's strong growth in providing high-performance cloud computing solutions tailored to the burgeoning Artificial Intelligence sector. However, several factors contributed to the downward revision of the CoreWeave stock price to $40 per share.

- Original IPO price range speculation: Early estimates suggested a much higher price range, potentially exceeding $50 per share.

- Factors contributing to the price reduction: The revised CoreWeave IPO pricing likely reflects a combination of macroeconomic headwinds, a general downturn in the tech sector, and perhaps some specific concerns about CoreWeave's own growth trajectory or competitive landscape. Increased interest rates and a more cautious investor sentiment have impacted many tech IPOs.

- Comparison with other recent tech IPOs: A comparison with other recent technology IPOs, which have also faced pricing adjustments, provides context for understanding the CoreWeave situation. Many similar companies have seen their initial valuations adjusted downwards due to market volatility.

CoreWeave's Business Model and Market Position

CoreWeave differentiates itself by offering specialized cloud computing infrastructure optimized for demanding AI workloads. Its target market comprises AI developers, researchers, and businesses requiring substantial processing power and scalable resources for machine learning, deep learning, and other computationally intensive tasks.

- CoreWeave's competitive advantages: CoreWeave leverages sustainable and efficient infrastructure, potentially giving them a cost and environmental advantage over competitors. Their specialized focus on AI workloads also positions them strategically within a rapidly growing market segment.

- Key competitors and their market share: The cloud computing sector is highly competitive, with major players like Amazon Web Services (AWS), Microsoft Azure, and Google Cloud Platform (GCP) dominating the overall market. However, CoreWeave focuses on a niche segment, offering specialized services that may differentiate it from the broader competitors.

- Potential growth opportunities for CoreWeave: The continued growth of the AI industry presents significant growth opportunities for CoreWeave. As more businesses adopt AI-driven solutions, demand for specialized cloud infrastructure will likely increase.

Investor Reaction and Market Implications of the Revised IPO Price

The market's reaction to the revised CoreWeave IPO pricing at $40 per share has been mixed. While some investors might see it as a more attractive entry point, others may interpret it as a sign of underlying weakness or uncertainty.

- Early investor response: Initial responses have ranged from cautious optimism to concern, depending on individual investment strategies and risk tolerance.

- Potential risks associated with investing in CoreWeave: As with any IPO, investing in CoreWeave carries inherent risks. These include competition, technological advancements, and the overall performance of the cloud computing market.

- Long-term growth projections: Despite the downward revision, many analysts still see potential for long-term growth in CoreWeave, given the expanding AI market and the company's specialized infrastructure.

Analyzing the $40 per Share Price: A Fair Valuation?

Whether $40 per share is a fair valuation for CoreWeave is a complex question. A thorough analysis requires scrutinizing the company's financials and comparing them to industry peers.

- Key financial metrics: Analyzing CoreWeave's revenue growth, profitability, and operating margins is crucial in determining the fairness of the $40 per share price. Access to detailed financial projections from the IPO documentation is essential for a comprehensive assessment.

- Comparison with valuations of peer companies: Comparing CoreWeave's valuation multiples (like Price-to-Sales or Price-to-Earnings ratios) with those of similar companies in the cloud computing sector can provide valuable context.

- Discounted cash flow analysis: A discounted cash flow (DCF) analysis, if available, could offer an independent valuation estimate based on projected future cash flows. This analysis is often used to determine the intrinsic value of a company.

Conclusion: Understanding the CoreWeave IPO Pricing Revision

The downward revision of CoreWeave's IPO pricing to $40 per share reflects a combination of macroeconomic factors, general market sentiment, and potentially company-specific concerns. While the reduced price might present a more attractive entry point for some investors, it also highlights the inherent risks associated with investing in the volatile tech sector. Understanding CoreWeave's business model, market position, and financial performance is crucial for making informed investment decisions. Stay updated on the CoreWeave IPO, follow CoreWeave's stock performance, and learn more about the CoreWeave $40 per share IPO to make the best decisions for your portfolio.

Featured Posts

-

Core Weave Crwv Stock Price Action On Tuesday An In Depth Look

May 22, 2025

Core Weave Crwv Stock Price Action On Tuesday An In Depth Look

May 22, 2025 -

Female Pub Landlords Angry Rant Goes Viral After Employees Resignation

May 22, 2025

Female Pub Landlords Angry Rant Goes Viral After Employees Resignation

May 22, 2025 -

Trans Australia Run World Record On The Brink

May 22, 2025

Trans Australia Run World Record On The Brink

May 22, 2025 -

Australian Crossing William Goodge Sets New Speed Record

May 22, 2025

Australian Crossing William Goodge Sets New Speed Record

May 22, 2025 -

Solve Wordle Today Hints And Answer For March 18 1368

May 22, 2025

Solve Wordle Today Hints And Answer For March 18 1368

May 22, 2025

Latest Posts

-

Dropout Kings Lose Vocalist Adam Ramey At 32

May 22, 2025

Dropout Kings Lose Vocalist Adam Ramey At 32

May 22, 2025 -

Death Of Adam Ramey Dropout Kings Vocalist Passes Away At 32

May 22, 2025

Death Of Adam Ramey Dropout Kings Vocalist Passes Away At 32

May 22, 2025 -

Adam Ramey Dropout Kings Vocalist Dead At 32

May 22, 2025

Adam Ramey Dropout Kings Vocalist Dead At 32

May 22, 2025 -

Adam Ramey Death Remembering The Dropout King Singer

May 22, 2025

Adam Ramey Death Remembering The Dropout King Singer

May 22, 2025 -

Wordle 363 Thursday March 13th Hints And Answer

May 22, 2025

Wordle 363 Thursday March 13th Hints And Answer

May 22, 2025