Crude Oil Market Analysis: Key Developments On May 16

Table of Contents

Geopolitical Tensions and Their Impact on Crude Oil Prices

Geopolitical instability continues to be a major driver of crude oil price volatility. On May 16th, several events contributed to the market's fluctuations.

The Ongoing Conflict in Ukraine:

The ongoing conflict in Ukraine significantly impacted oil supply and prices on May 16th. The disruption of oil production and export routes from the region created uncertainty in the global oil market.

- Disruption of oil production in Russia: The conflict led to reduced oil exports from Russia, a major global producer, impacting global oil supply chains.

- Impact on global oil supply chains: Sanctions imposed on Russia, coupled with self-imposed restrictions by some buyers, further constricted the flow of Russian crude oil into the global market.

- Potential for further sanctions and their effect on trade: The threat of additional sanctions or further escalation of the conflict kept market participants on edge, leading to price volatility. Estimates suggest a reduction of approximately [Insert Statistical Data on Oil Production Reduction from Russia due to Conflict] barrels per day. This impacted Brent crude prices, which saw a [Insert Percentage Change] fluctuation on May 16th.

Other Geopolitical Factors:

Beyond the Ukraine conflict, other geopolitical factors played a role in shaping the crude oil market on May 16th.

- Political instability in [Specific Oil-Producing Region]: [Explain the situation and its impact, citing specific news sources]. This uncertainty added to the overall sense of risk in the market.

- Strained diplomatic relations between [Major Oil Producers]: [Discuss the implications of strained relations and their potential impact on oil production and supply agreements]. This contributed to the overall sense of uncertainty, leading to increased volatility.

OPEC+ and Production Decisions

OPEC+ plays a significant role in setting global oil production quotas. Any decisions made by the cartel have a substantial impact on crude oil prices.

OPEC+ Meeting Outcomes:

[If an OPEC+ meeting took place around May 16th, detail its outcomes]. For example: "The OPEC+ meeting held on [Date] resulted in a decision to [Increase/Decrease] oil production by [Amount]. The stated rationale for this decision was [Explain the stated reasoning – e.g., to balance supply and demand, address market concerns about inflation]." Link to official OPEC+ statements if available.

Market Reaction to OPEC+ Decisions:

The market's reaction to OPEC+ decisions is often immediate and significant.

- Price movements: [Describe the price movements following the OPEC+ announcement – e.g., "Following the announcement, Brent crude prices increased by X% while WTI crude saw a Y% increase."] Include charts or data to support your analysis.

- Trader sentiment: [Discuss the prevailing sentiment among traders – e.g., "Traders reacted with [Optimism/Pessimism] to the OPEC+ decision, reflecting concerns about [Specific Market Factors]."]

Economic Indicators and Demand

Global economic conditions significantly influence crude oil demand.

Global Economic Growth:

Forecasts of global economic growth are closely watched by oil market participants.

- Inflation and interest rates: High inflation and rising interest rates can slow economic growth, potentially reducing oil demand.

- Impact on oil consumption: Slower economic growth generally translates to lower oil consumption, putting downward pressure on prices. [Include relevant data from sources like the IMF or World Bank].

Demand from Specific Regions:

Regional variations in economic growth and energy policies create distinct demand patterns.

- Asia: [Discuss specific factors influencing oil demand in Asia – e.g., economic recovery in China, increased industrial activity].

- Europe: [Discuss factors such as the energy transition, potential for recession, and dependence on Russian oil].

- North America: [Discuss factors like shale oil production, economic growth, and seasonal demand changes].

Supply Chain Disruptions and Refineries

Disruptions to the supply chain can impact crude oil prices, even independent of production levels.

Refining Capacity and Maintenance:

Unexpected refinery shutdowns or scheduled maintenance can temporarily constrain refining capacity.

- Specific refinery issues: [Discuss any significant refinery outages or maintenance schedules on May 16th and their impact on product supply].

- Effect on supply: [Explain how these issues affected the availability of refined products, which can influence crude oil prices].

Logistics and Transportation:

Transportation bottlenecks can limit the delivery of crude oil to market hubs.

- Shipping delays: [Discuss any shipping delays or disruptions affecting oil transport].

- Pipeline constraints: [Explain if any pipeline issues impacted the flow of crude oil].

Conclusion

The crude oil market on May 16th was characterized by a complex interplay of geopolitical tensions, particularly the ongoing conflict in Ukraine, OPEC+ production decisions, and fluctuating economic indicators impacting global demand. The combination of these factors resulted in [Summarize the overall price movement]. For traders and investors, staying informed about these crucial elements is essential for making sound decisions within the dynamic crude oil market. For continued insights into daily crude oil market analysis and price forecasts, check back regularly for further updates on the crude oil market.

Featured Posts

-

Knicks Coach Thibodeau Seeks Increased Determination Following 37 Point Loss

May 17, 2025

Knicks Coach Thibodeau Seeks Increased Determination Following 37 Point Loss

May 17, 2025 -

Tom Cruises Unpaid Debt To Tom Hanks The 1 Role He Never Played

May 17, 2025

Tom Cruises Unpaid Debt To Tom Hanks The 1 Role He Never Played

May 17, 2025 -

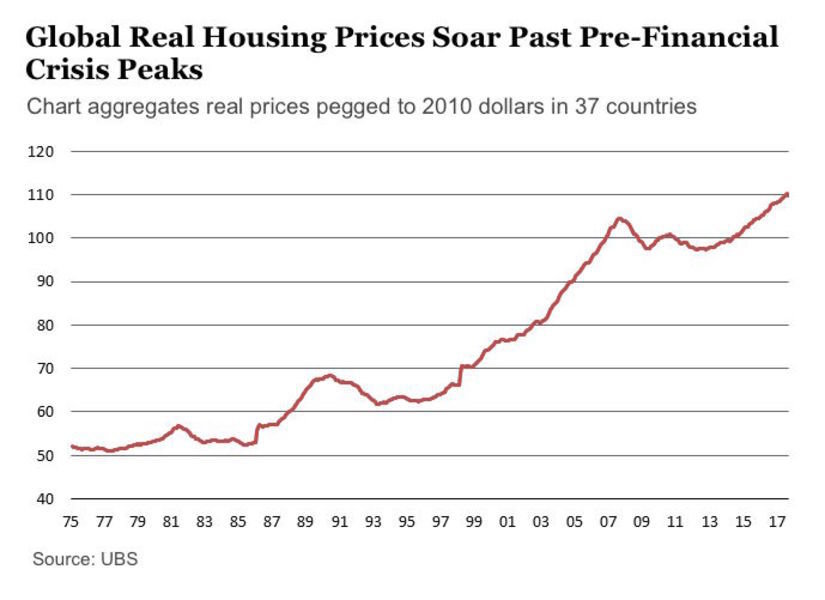

Market Downturn The Ultra High Net Worth Are Investing In Luxury Real Estate

May 17, 2025

Market Downturn The Ultra High Net Worth Are Investing In Luxury Real Estate

May 17, 2025 -

Lynas Emerges As Top Heavy Rare Earths Producer Beyond China

May 17, 2025

Lynas Emerges As Top Heavy Rare Earths Producer Beyond China

May 17, 2025 -

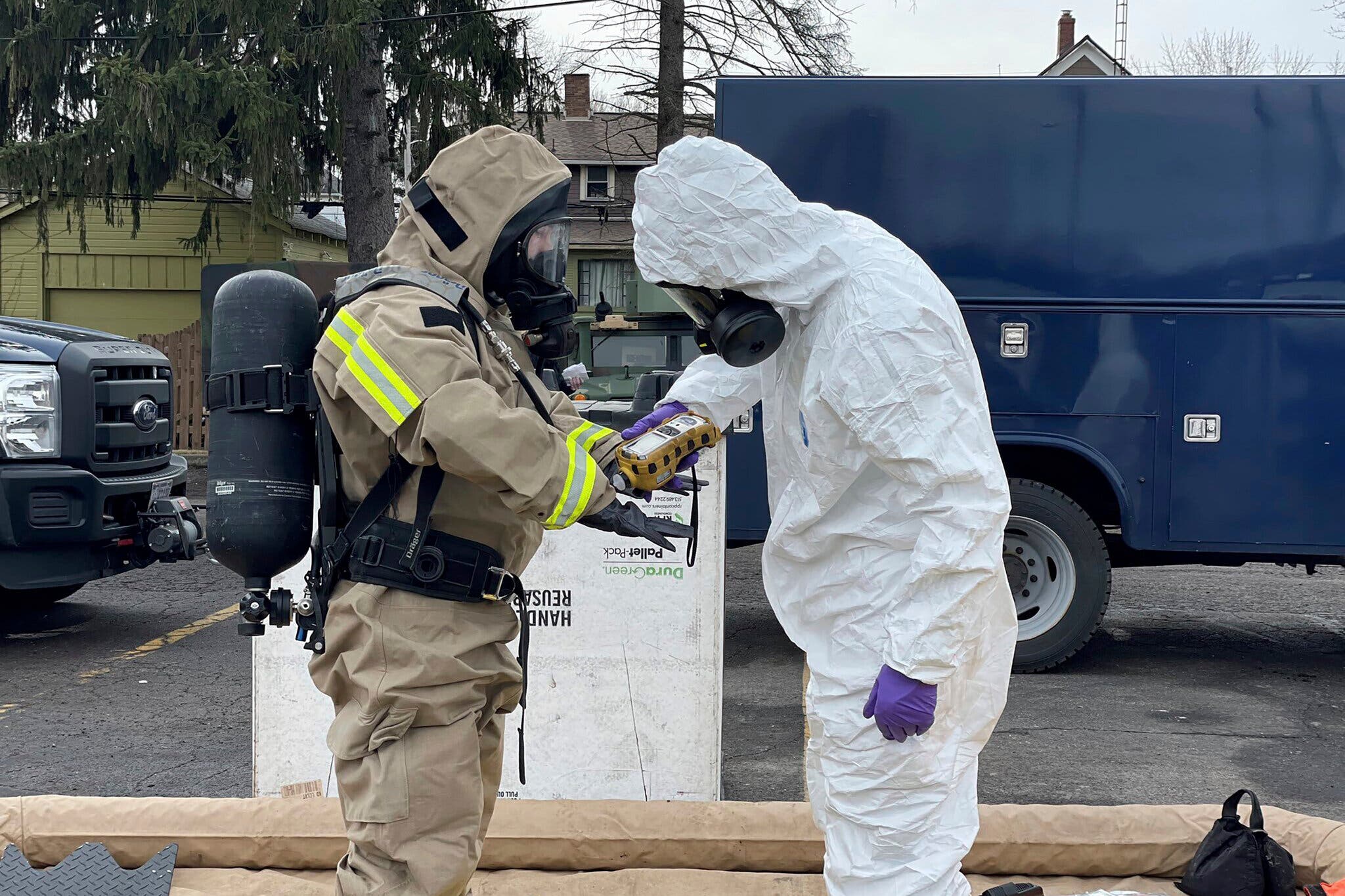

Investigation Into The Persistence Of Toxic Chemicals Following The Ohio Train Derailment

May 17, 2025

Investigation Into The Persistence Of Toxic Chemicals Following The Ohio Train Derailment

May 17, 2025

Latest Posts

-

Reeboks Ss 25 Drop A Collaboration With Angel Reese

May 17, 2025

Reeboks Ss 25 Drop A Collaboration With Angel Reese

May 17, 2025 -

Reebok And Angel Reese A Partnership Defining A New Era In Sports

May 17, 2025

Reebok And Angel Reese A Partnership Defining A New Era In Sports

May 17, 2025 -

Ref Controversies Thibodeau Speaks Out After Knicks Game 2

May 17, 2025

Ref Controversies Thibodeau Speaks Out After Knicks Game 2

May 17, 2025 -

New Reebok Ss 25 Collection Featuring Angel Reese

May 17, 2025

New Reebok Ss 25 Collection Featuring Angel Reese

May 17, 2025 -

Reebok X Angel Reese A Powerful Collaboration

May 17, 2025

Reebok X Angel Reese A Powerful Collaboration

May 17, 2025