Market Downturn? The Ultra-High-Net-Worth Are Investing In Luxury Real Estate

Table of Contents

Luxury Real Estate as a Hedge Against Inflation

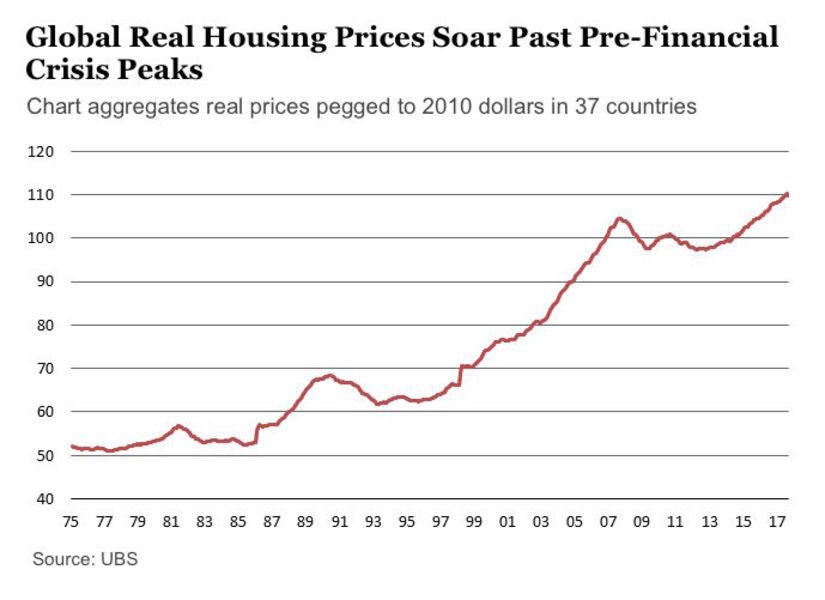

Luxury real estate acts as a powerful hedge against inflation, effectively preserving capital and potentially increasing its value during times of economic uncertainty. Unlike many other assets, luxury properties are tangible; their inherent value is tied to the physical asset itself, offering a level of security absent in volatile stock markets or cryptocurrency.

- Limited supply: The inherent scarcity of luxury properties in prime locations contributes to their value stability and potential appreciation. New developments are often slow to materialize, maintaining a limited supply that consistently outpaces demand.

- Increasing demand: A growing global population of UHNWIs fuels a continuous demand for prestigious properties, further underpinning their value.

- Tangible asset: Unlike stocks or bonds, luxury real estate represents a physical asset with inherent worth, offering a tangible sense of security and stability.

- Rental income potential: High-end properties often generate substantial rental income, offering a means to offset the effects of inflation and further enhance the investment's overall return. This passive income stream adds another layer of security and profitability.

Geopolitical Stability and Luxury Real Estate Investment

Geopolitical instability significantly influences the investment decisions of UHNWIs. In times of uncertainty, luxury real estate in politically and economically stable regions becomes particularly attractive.

- Safe haven for capital: Prime real estate in stable jurisdictions provides a safe haven for capital, safeguarding assets from the risks associated with geopolitical turmoil.

- Portfolio diversification: Investing in luxury real estate offers an effective way to diversify an investment portfolio, reducing overall risk exposure.

- Strong legal frameworks: Locations with robust legal frameworks and clear property rights offer added security and protection for UHNWIs’ investments. This reduces the risk of disputes or legal challenges.

- Prime locations: UHNWIs focus on prime locations with a proven track record of strong performance and appreciation, minimizing risk and maximizing returns. The history of these markets demonstrates their resilience.

Prime Locations Drive Demand for Luxury Real Estate Investment

Certain locations consistently attract significant investment from UHNWIs, driven by factors such as exclusivity, lifestyle amenities, and long-term growth potential.

- Examples of prime locations: London, New York, Miami, Hong Kong, and certain areas of Los Angeles are consistently popular choices, each offering a unique blend of appeal.

- Factors influencing desirability: Strong infrastructure, cultural attractions, a high quality of life, and a secure environment are crucial factors influencing the desirability of these prime locations.

- Past performance analysis: The historical performance of these markets consistently demonstrates their resilience and ability to appreciate over the long term.

The Psychology of Luxury Real Estate Investment

Beyond the purely financial aspects, psychological factors heavily influence UHNWIs' preference for luxury real estate.

- Status symbol: Owning a prestigious property serves as a symbol of success and high social standing.

- Legacy building: Investing in luxury real estate is often seen as a way to build a lasting legacy for future generations.

- Exclusive lifestyle: Luxury properties provide access to exclusive lifestyles and amenities, enhancing the overall quality of life.

- Tangible connection: UHNWIs often find greater emotional satisfaction in owning a tangible asset compared to intangible investments.

The Future of Ultra-High-Net-Worth Investment in Luxury Real Estate

The luxury real estate market is constantly evolving, and several factors will shape its future appeal to UHNWIs.

- Technological advancements: Smart home technology, automation, and sustainable design are transforming the luxury real estate landscape.

- Sustainability: Eco-friendly properties and sustainable building practices are increasingly important considerations for environmentally conscious UHNWIs.

- Continued growth: Specific prime markets are expected to experience continued growth, driven by factors such as limited supply and increasing demand.

- Emerging markets: Emerging markets in Asia, the Middle East, and other regions are also attracting the attention of UHNWIs seeking new investment opportunities.

Conclusion: Why Luxury Real Estate Remains a Top Choice for Ultra-High-Net-Worth Investors

Luxury real estate's resilience, coupled with its potential for inflation hedging, makes it a compelling investment for UHNWIs, particularly during periods of market uncertainty. Its tangible nature, potential for rental income, and appeal as a status symbol contribute to its enduring popularity. The limited supply in prime locations, combined with the increasing number of UHNWIs globally, further supports its long-term growth prospects. The stability and potential appreciation of luxury real estate in a volatile market provide a compelling reason for UHNWIs to prioritize this asset class within their diversified investment portfolios. Explore the world of luxury real estate investment today. Contact us to discuss how you can benefit from the stability and potential of luxury real estate in a volatile market.

Featured Posts

-

A Financial Planners Advice For Student Loan Borrowers

May 17, 2025

A Financial Planners Advice For Student Loan Borrowers

May 17, 2025 -

Aljzayr Tushyd Bmwhbt Almkhrj Allyby Sbry Abwshealt

May 17, 2025

Aljzayr Tushyd Bmwhbt Almkhrj Allyby Sbry Abwshealt

May 17, 2025 -

Mariners Vs Reds Prediction Picks And Odds For Todays Mlb Game

May 17, 2025

Mariners Vs Reds Prediction Picks And Odds For Todays Mlb Game

May 17, 2025 -

New York Daily News May 2025 Archives News And Headlines

May 17, 2025

New York Daily News May 2025 Archives News And Headlines

May 17, 2025 -

Post Game Antics Thibodeaus Comments On Game 2 Officiating

May 17, 2025

Post Game Antics Thibodeaus Comments On Game 2 Officiating

May 17, 2025

Latest Posts

-

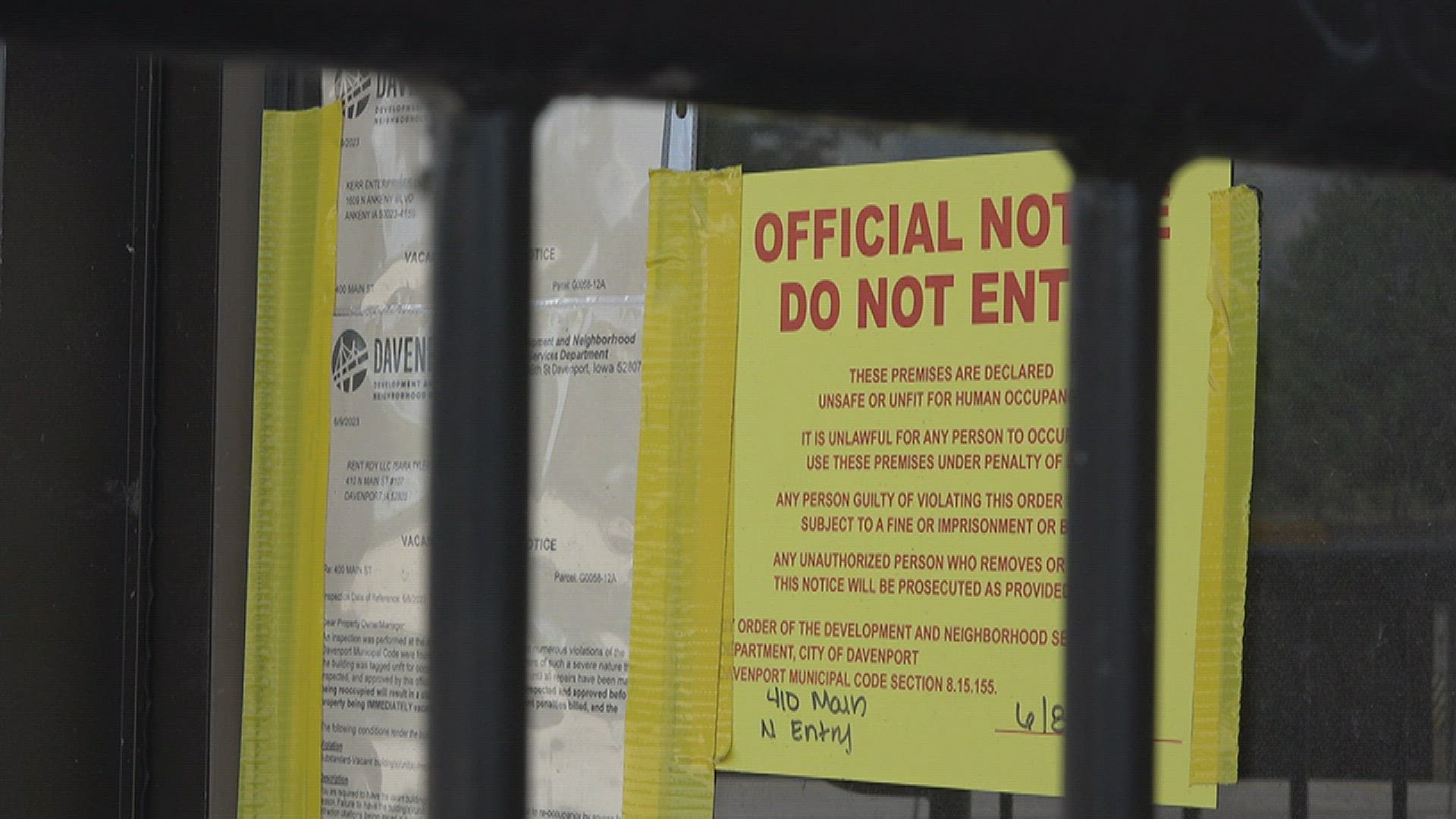

Davenport City Council Greenlights Apartment Building Demolition

May 17, 2025

Davenport City Council Greenlights Apartment Building Demolition

May 17, 2025 -

Apartment Building Demolition Approved By Davenport Council

May 17, 2025

Apartment Building Demolition Approved By Davenport Council

May 17, 2025 -

Sheyenne High Schools Eagleson Recognized For Excellence In Science Education

May 17, 2025

Sheyenne High Schools Eagleson Recognized For Excellence In Science Education

May 17, 2025 -

Davenport Council Votes To Demolish Apartment Building

May 17, 2025

Davenport Council Votes To Demolish Apartment Building

May 17, 2025 -

Sheyenne Highs Eagleson Outstanding Science Educator

May 17, 2025

Sheyenne Highs Eagleson Outstanding Science Educator

May 17, 2025