D-Wave Quantum (QBTS): Stock Performance Following Kerrisdale Capital's Valuation Concerns

Table of Contents

Kerrisdale Capital's Report and its Key Arguments

Kerrisdale Capital's report on D-Wave Quantum raised serious concerns about the company's valuation and future prospects. The report's core criticisms centered on several key areas:

-

Overvaluation Claims: Kerrisdale argued that QBTS's stock price significantly exceeded its intrinsic value, based on its current revenue generation and technological capabilities. They questioned the company's ability to justify its market capitalization given its relatively limited commercial success compared to the hype surrounding quantum computing.

-

Concerns about Revenue Generation: The report highlighted D-Wave's relatively low revenue compared to its operating expenses, expressing skepticism about its ability to achieve sustainable profitability in the near future. This lack of robust revenue streams fueled concerns about the long-term viability of the business model.

-

Technological Limitations Compared to Competitors: Kerrisdale compared D-Wave's technology to that of other players in the quantum computing space, arguing that D-Wave's adiabatic quantum computing approach possessed limitations compared to gate-based quantum computing models pursued by competitors. This raised questions about D-Wave's technological competitiveness in the long run.

-

Analysis of D-Wave's Market Position and Competitive Landscape: The report dissected D-Wave's position within the competitive quantum computing landscape, emphasizing the presence of well-funded competitors pursuing potentially more scalable and versatile technologies. This competitive analysis underscored the challenges D-Wave might face in securing market share and achieving long-term dominance.

QBTS Stock Performance Before and After the Report

Before Kerrisdale Capital's report, QBTS stock exhibited [insert description of pre-report price trends and any relevant chart/graph]. The release of the report immediately triggered a significant [percentage] drop in the stock price. This dramatic market reaction clearly indicated a negative investor response to Kerrisdale's assessment.

- Pre-report stock price trends: [Describe the trends – e.g., steady growth, sideways movement, volatility].

- Immediate post-report price drop (percentage change): [Insert percentage drop and timeframe].

- Subsequent price recovery or further decline: [Describe the stock price's trajectory following the initial drop – did it recover, continue to decline, or stabilize? Include chart/graph if possible].

- Trading volume changes: [Comment on any significant changes in trading volume after the report – increased volume often suggests heightened market interest and volatility].

Investor Response and Market Sentiment

The market's reaction to Kerrisdale Capital's report was swift and multifaceted. Many investors and analysts expressed concerns, leading to a decline in investor confidence. This sentiment was reflected in:

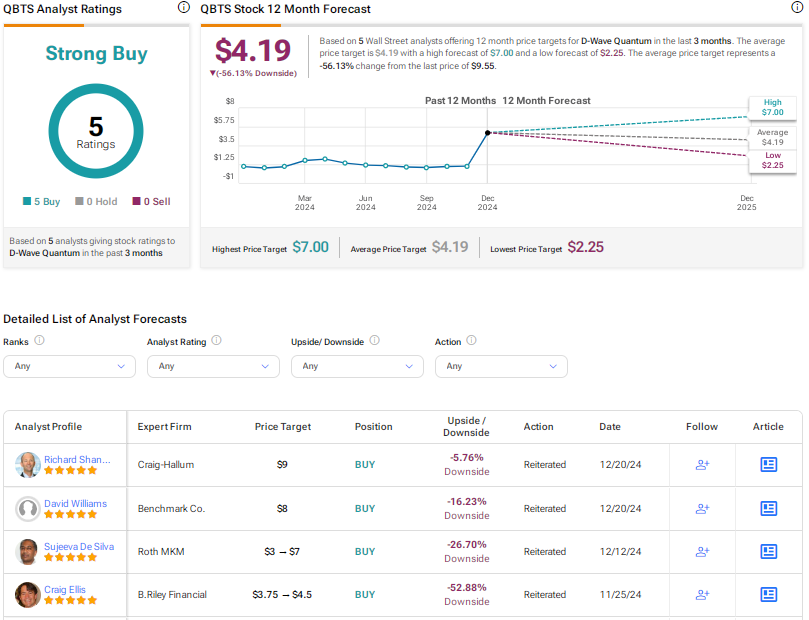

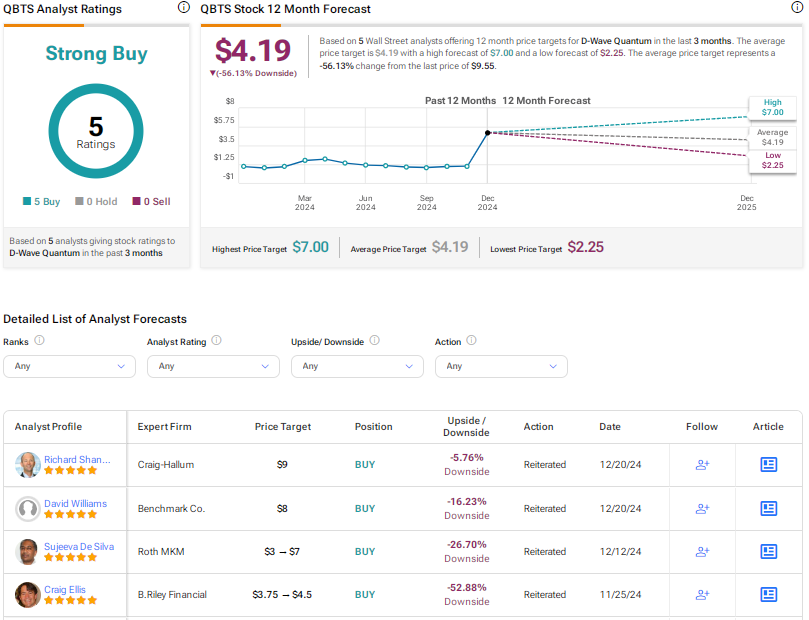

- Changes in analyst ratings: [Mention any downgrades or changes in ratings from investment firms].

- Major news outlets' coverage and perspectives: [Summarize the coverage and the overall tone of news articles].

- Social media sentiment towards QBTS: [Describe the sentiment expressed on social media platforms like Twitter or StockTwits].

- Impact on future funding rounds or partnerships: [Discuss potential effects on D-Wave's ability to secure future funding or partnerships].

Long-Term Implications for D-Wave Quantum

The long-term implications of Kerrisdale Capital's report on D-Wave Quantum remain uncertain. However, several factors will likely shape the company's future trajectory:

- D-Wave's plans for addressing the criticisms: [Discuss any public statements or actions taken by D-Wave to respond to the report's criticism].

- Potential future partnerships or acquisitions: [Speculate on the potential for strategic partnerships or acquisitions to enhance D-Wave's competitiveness].

- Expected advancements in their quantum computing technology: [Discuss the potential for future technological advancements that could alleviate some of the concerns raised].

- Predictions about future stock performance: [Offer a cautiously optimistic or pessimistic outlook on the future stock performance based on the factors discussed].

Conclusion: Assessing the Future of D-Wave Quantum (QBTS) Stock

The Kerrisdale Capital report significantly impacted D-Wave Quantum's stock price, revealing vulnerabilities in its valuation and competitive positioning. While the immediate market reaction was negative, the long-term effects depend on D-Wave's ability to address the criticisms and deliver on its technological promises. The company's response, future technological advancements, and overall market dynamics for quantum computing will all play crucial roles in shaping QBTS's future. Understanding the intricacies of the D-Wave Quantum (QBTS) stock performance after the Kerrisdale Capital report is crucial for informed investment decisions. Continue your own research on D-Wave Quantum and its position in the rapidly evolving quantum computing market. Remember to always conduct thorough due diligence before making any investment decisions related to D-Wave Quantum or other quantum computing stocks.

Featured Posts

-

Everything You Need To Know About Sandylands U On Tv

May 21, 2025

Everything You Need To Know About Sandylands U On Tv

May 21, 2025 -

Is This Australian Transgender Influencers Record Legitimate Examining The Debate

May 21, 2025

Is This Australian Transgender Influencers Record Legitimate Examining The Debate

May 21, 2025 -

Confronting Your Inner Love Monster

May 21, 2025

Confronting Your Inner Love Monster

May 21, 2025 -

Tory Councillors Wife Receives Prison Sentence For Hate Speech

May 21, 2025

Tory Councillors Wife Receives Prison Sentence For Hate Speech

May 21, 2025 -

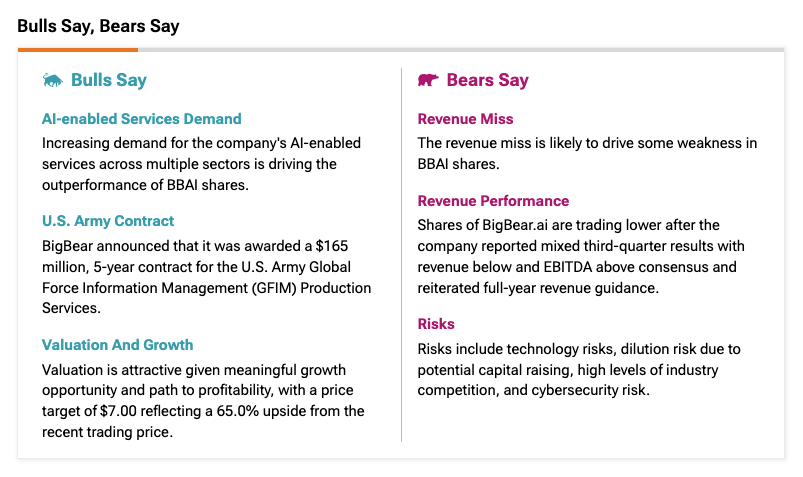

Big Bear Ai Bbai Retains Buy Rating Defense Spending Fuels Investment

May 21, 2025

Big Bear Ai Bbai Retains Buy Rating Defense Spending Fuels Investment

May 21, 2025

Latest Posts

-

David Walliams Attack On Simon Cowell A Britains Got Talent Controversy

May 22, 2025

David Walliams Attack On Simon Cowell A Britains Got Talent Controversy

May 22, 2025 -

Juergen Klopps Liverpool A Decade Of Triumph And Transformation

May 22, 2025

Juergen Klopps Liverpool A Decade Of Triumph And Transformation

May 22, 2025 -

From Underdogs To Champions Liverpools Journey Under Juergen Klopp

May 22, 2025

From Underdogs To Champions Liverpools Journey Under Juergen Klopp

May 22, 2025 -

Juergen Klopp Set For Anfield Return Before Seasons End

May 22, 2025

Juergen Klopp Set For Anfield Return Before Seasons End

May 22, 2025 -

The David Walliams Simon Cowell Britains Got Talent Fallout

May 22, 2025

The David Walliams Simon Cowell Britains Got Talent Fallout

May 22, 2025