David Rosenberg: Was The Bank Of Canada Too Timid?

Table of Contents

David Rosenberg's Critique of the Bank of Canada's Monetary Policy

David Rosenberg, a well-known economist and strategist, has been a vocal critic of the Bank of Canada's handling of inflation. His main arguments center around the belief that the Bank was too slow to raise interest rates and that the rate hikes implemented were insufficient to curb rising prices effectively. He argues that this hesitancy allowed inflation to become entrenched, leading to more significant economic challenges down the line.

-

Specific Examples: Rosenberg frequently points to the persistent inflation exceeding the Bank of Canada's 2% target as evidence of their delayed response. He has publicly predicted more aggressive inflation control measures would be needed, citing data showing the persistence of elevated inflation.

-

Citations: His views are frequently published in his daily reports and are widely covered by financial news outlets such as the Globe and Mail and Bloomberg. (Specific links to articles would be included here in a published version).

-

Key Data Points: Rosenberg often highlights Statistics Canada's inflation data, focusing on core inflation measures which exclude volatile components like food and energy to get a clearer picture of underlying price pressures. He uses these figures to argue for a more proactive approach to interest rate adjustments.

The Bank of Canada's Rationale for its Approach

The Bank of Canada, in its defense, maintains that its approach was carefully calibrated to balance several competing economic factors. The Bank's actions weren't simply a reaction to inflation numbers; they incorporated many other economic indicators into their analysis.

-

Economic Indicators: The Bank closely monitors employment rates, consumer confidence, and business investment alongside inflation figures. They consider the potential for economic slowdown and job losses when making interest rate decisions.

-

Stated Goals: The Bank aims for price stability and full employment. Their policies reflect a delicate balance between these two potentially competing goals. Raising interest rates too aggressively could stifle economic growth and increase unemployment.

-

Risk Mitigation: The Bank has openly acknowledged the risks associated with both overly aggressive and overly cautious monetary policy. Their approach reflected an attempt to navigate these risks, aiming for a "soft landing" – slowing inflation without triggering a recession.

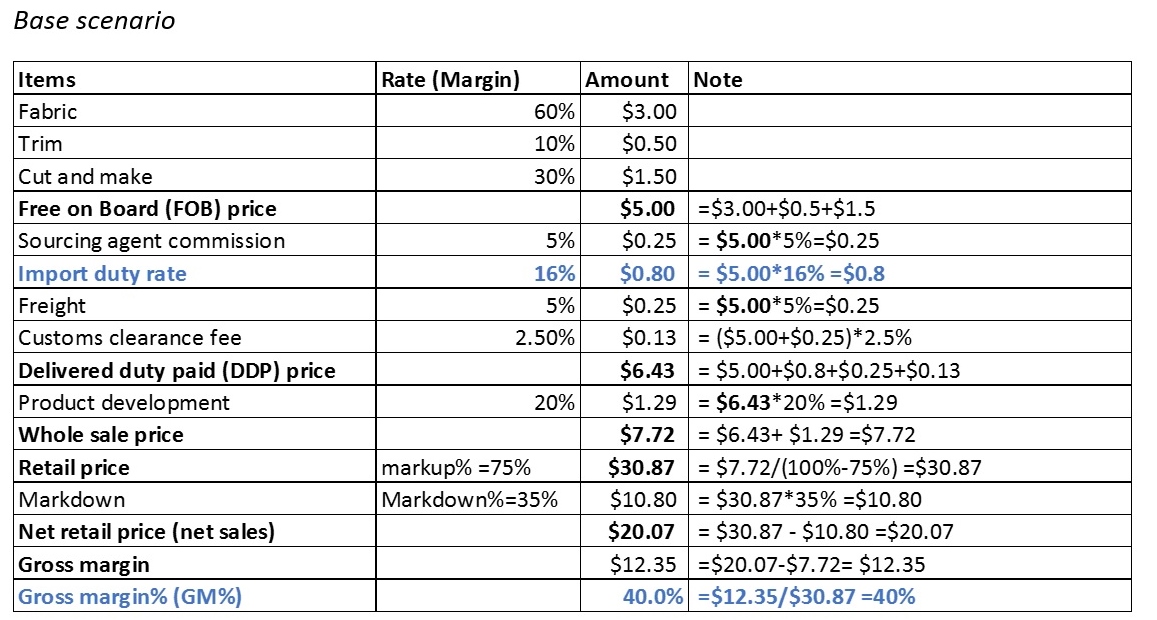

Analyzing the Economic Data: Supporting and Contradicting Evidence

Examining the economic data reveals a mixed picture, with some supporting Rosenberg’s criticisms and some supporting the Bank of Canada's more cautious approach.

-

Inflation: While inflation did remain above the Bank of Canada's target for an extended period, recent data shows a downward trend in both headline and core inflation. This supports the Bank's claim that their actions, albeit delayed, are proving effective.

-

Unemployment: Unemployment rates remained relatively low throughout the period under review, suggesting the Bank’s concern about triggering significant job losses was valid. This data partially counters Rosenberg’s argument for more aggressive rate hikes.

-

GDP Growth: While GDP growth has slowed, it hasn't contracted, avoiding a recession. This is a point of contention, with some arguing that a more aggressive approach would have curbed inflation more effectively even at the risk of a mild recession. Data from Statistics Canada provides a detailed picture of this growth trajectory.

Alternative Perspectives on Canadian Monetary Policy

The debate surrounding the Bank of Canada’s monetary policy isn’t limited to Rosenberg’s perspective. Other economists offer diverse viewpoints.

-

Dissenting Opinions: Some economists agree with Rosenberg's assessment, arguing for a more hawkish approach from the beginning. Others concur with the Bank's approach, emphasizing the risks of overreacting to temporary inflationary pressures.

-

Expert Arguments: Experts cite differences in their interpretations of the available data and their assessments of the relative weights of inflation versus employment targets. This demonstrates the inherent complexities involved in monetary policy decision-making.

-

Consensus: There's no broad consensus among experts, highlighting the challenging nature of predicting and managing macroeconomic variables.

The Impact of Global Economic Factors

Global economic factors significantly influenced both the Bank of Canada's decisions and Rosenberg's critique. The war in Ukraine, supply chain disruptions, and global inflationary pressures complicated the situation, making it challenging to isolate the impact of domestic policies. These external factors added further uncertainty to the already difficult task of managing the Canadian economy.

Conclusion

This article has explored the ongoing debate surrounding the Bank of Canada's monetary policy, focusing on David Rosenberg's critical perspective. While Rosenberg's arguments highlight the risks of delayed action in combating inflation, the Bank of Canada's response points to a deliberate attempt to balance inflation control with the potential for economic slowdown and unemployment. The available economic data presents a mixed picture, making a definitive judgment difficult. Analyzing inflation, unemployment, and GDP growth trends reveals a complex interplay of factors. Whether the Bank of Canada was "too timid" remains a matter of ongoing debate and interpretation.

To form your own informed opinion on the Bank of Canada's monetary policy and its effectiveness, delve deeper into the economic data from Statistics Canada, review publications from the Bank of Canada itself, and engage with analyses from various economic commentators. Considering the ongoing implications of the Bank of Canada's actions, do you believe their approach was appropriately balanced, or could a different approach have yielded better results?

Featured Posts

-

Convicted Cardinals Right To Vote In Papal Conclave

Apr 29, 2025

Convicted Cardinals Right To Vote In Papal Conclave

Apr 29, 2025 -

Teens Rock Throwing Spree Ends In Murder Conviction

Apr 29, 2025

Teens Rock Throwing Spree Ends In Murder Conviction

Apr 29, 2025 -

Executive Order On Sanctuary Cities Details Of Trumps Action

Apr 29, 2025

Executive Order On Sanctuary Cities Details Of Trumps Action

Apr 29, 2025 -

Trumps Tax Reform Faces Challenges From Within The Gop

Apr 29, 2025

Trumps Tax Reform Faces Challenges From Within The Gop

Apr 29, 2025 -

Make February 20 2025 A Happy Day

Apr 29, 2025

Make February 20 2025 A Happy Day

Apr 29, 2025

Latest Posts

-

The Closure Of Anchor Brewing Company A Look Back At Its Legacy

May 12, 2025

The Closure Of Anchor Brewing Company A Look Back At Its Legacy

May 12, 2025 -

Canada Us Tariffs A Partial Removal Predicted

May 12, 2025

Canada Us Tariffs A Partial Removal Predicted

May 12, 2025 -

The Ftc Investigates Open Ai Understanding The Concerns

May 12, 2025

The Ftc Investigates Open Ai Understanding The Concerns

May 12, 2025 -

Edan Alexander Hostage Situation Hamas Announces Release

May 12, 2025

Edan Alexander Hostage Situation Hamas Announces Release

May 12, 2025 -

Us Ambassador Hints At Continued Canadian Tariffs

May 12, 2025

Us Ambassador Hints At Continued Canadian Tariffs

May 12, 2025