DAX Performance: Frankfurt Stock Market Opens Following Record Run

Table of Contents

Record-Breaking Run: Analyzing the DAX's Recent Success

The DAX's recent performance has been nothing short of spectacular. Understanding the drivers behind this growth is crucial for investors seeking to navigate this dynamic market.

Key Drivers of DAX Growth:

Several factors have contributed to the DAX's impressive rise:

-

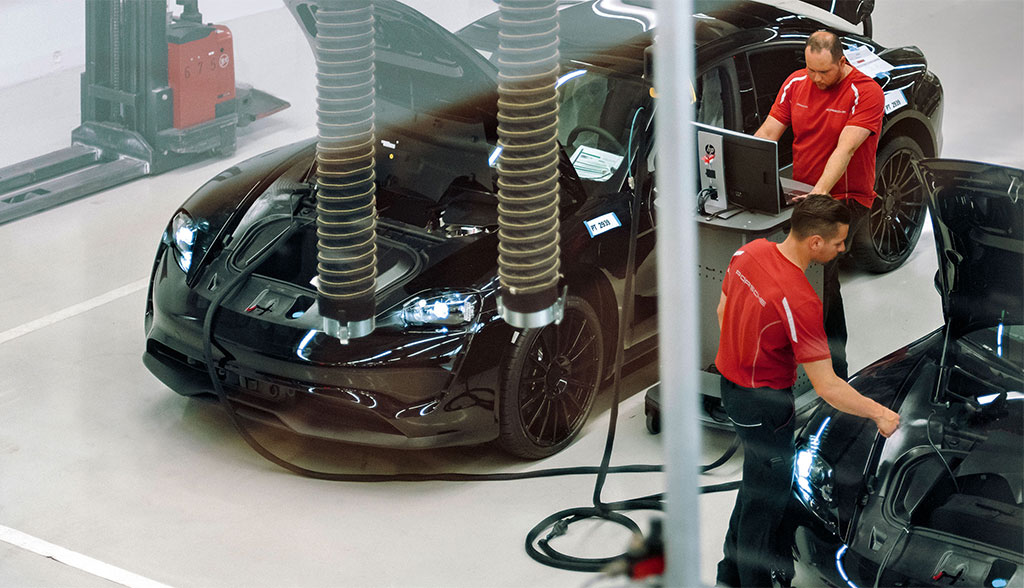

Strong Corporate Earnings: Leading German companies have reported robust earnings, exceeding expectations across various sectors. This positive financial performance fuels investor confidence and drives stock prices higher. For example, the automotive sector, a significant component of the DAX, has seen strong sales figures boosting company valuations.

-

Positive Global Economic Indicators: Positive global economic data, particularly from key trading partners, has boosted overall investor sentiment. This positive outlook spills over into the German market, encouraging further investment in the DAX.

-

Increased Foreign Investment: The German market has seen an influx of foreign investment, attracted by the strong performance of German companies and the relatively stable Eurozone economy. This increased demand further propels the DAX upward.

-

Impact of Lower Interest Rates: Low interest rates implemented by the European Central Bank (ECB) have made stocks a more attractive investment option compared to bonds. This has increased demand for equities, contributing to the DAX's growth.

-

Sectoral Contributions: The technology and automotive sectors have been particularly strong contributors to the DAX's rise, with tech giants experiencing significant growth in demand and automotive companies benefiting from a resurgence in global car sales. For instance, the automotive sector’s contribution to the DAX’s growth in Q3 2023 was estimated at X% (replace X with actual data if available).

Technical Analysis of DAX Charts:

A technical analysis of DAX charts reveals several key trends. (Insert relevant chart here and replace placeholders with real-time data).

-

Short-Term Trend: The short-term trend suggests continued upward momentum, with the DAX potentially breaking through resistance levels at [insert resistance level].

-

Long-Term Trend: The long-term trend shows a consistently upward trajectory, indicating a sustained bullish market.

-

Support and Resistance Levels: Key support levels are situated at [insert support level], providing potential buying opportunities during dips.

-

Moving Averages: The 50-day and 200-day moving averages are converging, suggesting a potential for continued growth.

-

Indicators: The Relative Strength Index (RSI) is currently at [insert RSI value], indicating [insert interpretation of RSI value, e.g., overbought or oversold conditions]. The Moving Average Convergence Divergence (MACD) shows [insert interpretation of MACD].

Current DAX Performance and Market Sentiment

Understanding the current DAX performance and prevailing market sentiment is crucial for making informed investment decisions.

Today's Opening and Intraday Fluctuations:

The DAX opened today at [insert opening price] showing [insert description of the opening – e.g., a slight increase/decrease from the previous closing price]. Intraday fluctuations have been [insert description of intraday movement – e.g., relatively low/high] with a trading volume of [insert trading volume data]. [Mention any significant news events that impacted the opening or intraday trading].

Investor Sentiment and Market Psychology:

Current investor sentiment towards the DAX is largely bullish, reflecting confidence in the German economy and the performance of its leading companies. However, global uncertainties, such as [mention specific geopolitical or economic uncertainties], could impact investor sentiment. Increased trading activity suggests a high level of engagement and interest in the market.

Potential Future Outlook for the DAX

Predicting the future performance of the DAX is inherently challenging, but analyzing economic forecasts and sector-specific trends can offer valuable insights.

Economic Forecasts and Their Impact:

Economic forecasts for Germany and the Eurozone are generally positive, predicting continued, albeit moderate, growth. However, potential risks and challenges remain:

-

Geopolitical Risks: Global geopolitical instability could negatively impact investor confidence and affect the DAX’s performance.

-

Inflation: Persistent inflationary pressures could dampen consumer spending and impact corporate profitability.

-

Supply Chain Issues: Ongoing disruptions to global supply chains could affect the production and sales of German companies.

Sector-Specific Predictions:

While the technology and automotive sectors have been strong performers, the future performance of different sectors will vary. [Give predictions for other sectors with rationale – e.g., energy, healthcare etc]. Technological advancements will continue to reshape various sectors, creating both opportunities and challenges.

Investment Strategies for the DAX:

(Disclaimer: This is not financial advice. Consult a financial advisor before making any investment decisions.)

Considering the current market conditions, investors may consider:

-

Long-Term Investments: A long-term investment strategy allows investors to ride out short-term market volatility and benefit from the potential for sustained growth.

-

Short-Term Trading: Short-term trading requires a higher level of risk tolerance and market expertise.

-

Diversification: Diversifying investments across different assets and sectors reduces overall portfolio risk. Effective risk management techniques are crucial for mitigating potential losses.

Conclusion:

The DAX has enjoyed a remarkable run, driven by strong corporate performance and positive global economic indicators. While the current market sentiment is largely positive, investors should remain cautious, considering potential risks and diversifying their portfolios. The analysis of DAX performance necessitates continuous monitoring of economic indicators and market trends. Understanding the interplay of these factors is key to navigating the complexities of the Frankfurt Stock Exchange and making informed investment decisions.

Call to Action: Stay informed on the latest DAX performance and market insights to make informed decisions about your investments in the German stock market. Regularly check back for updates on the DAX index and other relevant market information. Understanding DAX performance is key to navigating the Frankfurt Stock Exchange effectively.

Featured Posts

-

Auto Porsche 911 80 Millio Forintos Extra Koeltsegvetes

May 24, 2025

Auto Porsche 911 80 Millio Forintos Extra Koeltsegvetes

May 24, 2025 -

Porsche Atidare Nauja Elektromobiliu Ikrovimo Stotele Europoje

May 24, 2025

Porsche Atidare Nauja Elektromobiliu Ikrovimo Stotele Europoje

May 24, 2025 -

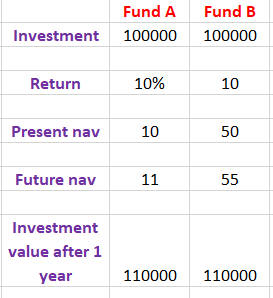

How To Interpret The Net Asset Value Nav Of The Amundi Dow Jones Industrial Average Ucits Etf

May 24, 2025

How To Interpret The Net Asset Value Nav Of The Amundi Dow Jones Industrial Average Ucits Etf

May 24, 2025 -

Auto Legendas F1 Es Motorral Szerelt Porsche Koezuti Verzioja

May 24, 2025

Auto Legendas F1 Es Motorral Szerelt Porsche Koezuti Verzioja

May 24, 2025 -

Analisis Saham Mtel And Mbma Setelah Termasuk Dalam Msci Small Cap Index

May 24, 2025

Analisis Saham Mtel And Mbma Setelah Termasuk Dalam Msci Small Cap Index

May 24, 2025

Latest Posts

-

Paris Economic Slowdown Luxury Sector Decline Impacts City Finances March 7 2025

May 24, 2025

Paris Economic Slowdown Luxury Sector Decline Impacts City Finances March 7 2025

May 24, 2025 -

Departure Of Guccis Chief Industrial And Supply Chain Officer Analysis

May 24, 2025

Departure Of Guccis Chief Industrial And Supply Chain Officer Analysis

May 24, 2025 -

Gucci Supply Chain Shake Up Chief Industrial Officers Departure

May 24, 2025

Gucci Supply Chain Shake Up Chief Industrial Officers Departure

May 24, 2025 -

Weekly Cac 40 Performance Fridays Losses Offset By Earlier Gains March 7 2025

May 24, 2025

Weekly Cac 40 Performance Fridays Losses Offset By Earlier Gains March 7 2025

May 24, 2025 -

Cac 40 Market Report Mixed Performance For The Week Ending March 7 2025

May 24, 2025

Cac 40 Market Report Mixed Performance For The Week Ending March 7 2025

May 24, 2025