Weekly CAC 40 Performance: Friday's Losses Offset By Earlier Gains (March 7, 2025)

Table of Contents

Early Week Gains: A Detailed Look

The beginning of the week saw a surge in positive sentiment for the CAC 40, resulting in considerable gains. Several key factors contributed to this bullish momentum. The index experienced a notable percentage increase, closing significantly higher than its Monday opening.

- Strong Economic Indicators: Positive economic data releases from France, including better-than-expected unemployment figures and robust manufacturing output, fueled investor confidence. This boosted the overall market sentiment, contributing significantly to the CAC 40's gains.

- Technology Sector Strength: The technology sector showed remarkable strength, with several key players posting significant gains. This sector's positive performance acted as a catalyst, pulling up the overall index.

- Increased Investor Confidence: A general feeling of optimism amongst investors played a role. This was partially fueled by positive global market trends and expectations of continued economic growth.

[Insert chart/graph illustrating early week CAC 40 performance here]

Friday's Losses: Understanding the Decline

The positive trend experienced a sharp reversal on Friday, with the CAC 40 experiencing a considerable decline. This downturn can be attributed to a confluence of factors that dampened investor enthusiasm.

- Geopolitical Uncertainty: Rising geopolitical tensions in [mention specific region/event] triggered risk aversion among investors, leading to a sell-off in various markets, including the CAC 40.

- Energy Sector Weakness: A sudden drop in oil prices negatively impacted energy stocks, which constitute a significant portion of the CAC 40, thus contributing to the overall index decline.

- Global Market Correction: Friday's losses were partly a reflection of a broader global market correction, indicating a potential shift in investor sentiment towards a more cautious approach.

[Insert chart/graph illustrating Friday's CAC 40 performance here]

Net Weekly Performance: A Balanced Perspective

Despite Friday's losses, the CAC 40 ended the week with a net positive change, showcasing a degree of resilience. The final closing price for the week reflected a [insert percentage]% increase compared to the previous week's closing price. This positive weekly performance, however, underscores the volatility and inherent risk associated with the French stock market.

- Comparison to Previous Weeks: This week's performance represents a [positive/negative] change compared to the average weekly performance over the past month. A detailed comparison with previous weeks is crucial for understanding the broader market trend.

- Investor Implications: This week's performance highlights the importance of diversification and a well-defined investment strategy within the context of market volatility. Investors should monitor market trends closely and remain adaptable.

Looking Ahead: Predictions and Market Outlook

Predicting the future performance of the CAC 40 is inherently uncertain. However, several factors could influence its trajectory in the coming weeks.

- Economic Data Releases: Upcoming economic data releases, both in France and globally, will significantly impact investor sentiment and, consequently, the CAC 40's performance.

- Global Market Trends: Continued global economic growth or potential downturns will inevitably affect the French stock market. Staying abreast of global trends is essential for informed investment decisions.

- Regulatory Changes: Any significant regulatory changes affecting French businesses or the broader European Union could also influence the performance of the CAC 40.

Conclusion: Weekly CAC 40 Performance: Key Takeaways and Next Steps

This week's CAC 40 performance demonstrated the market's inherent volatility. While early gains showcased strong economic indicators and positive investor sentiment, Friday's losses highlighted the impact of geopolitical uncertainty and global market corrections. The overall positive weekly performance, however, points to the resilience of the index. To make informed investment decisions, it's crucial to stay updated on the weekly CAC 40 performance and other key market indicators. Regularly check back for our in-depth analysis of the CAC 40 and other major stock market indices. Understanding the CAC 40's weekly performance is key to navigating the complexities of the French and global stock markets.

Featured Posts

-

Ferrarin Uusi 13 Vuotias Taehti

May 24, 2025

Ferrarin Uusi 13 Vuotias Taehti

May 24, 2025 -

Philips Shareholders Key Information On The 2025 Agm

May 24, 2025

Philips Shareholders Key Information On The 2025 Agm

May 24, 2025 -

Amundi Msci World Catholic Principles Ucits Etf A Guide To Its Net Asset Value Nav

May 24, 2025

Amundi Msci World Catholic Principles Ucits Etf A Guide To Its Net Asset Value Nav

May 24, 2025 -

Porsche Koezuti Autok F1 Technologia A Kormany Moegoett

May 24, 2025

Porsche Koezuti Autok F1 Technologia A Kormany Moegoett

May 24, 2025 -

Konchita Vurst Predskazala Pobediteley Evrovideniya 2025 Podrobnosti Ot Unian

May 24, 2025

Konchita Vurst Predskazala Pobediteley Evrovideniya 2025 Podrobnosti Ot Unian

May 24, 2025

Latest Posts

-

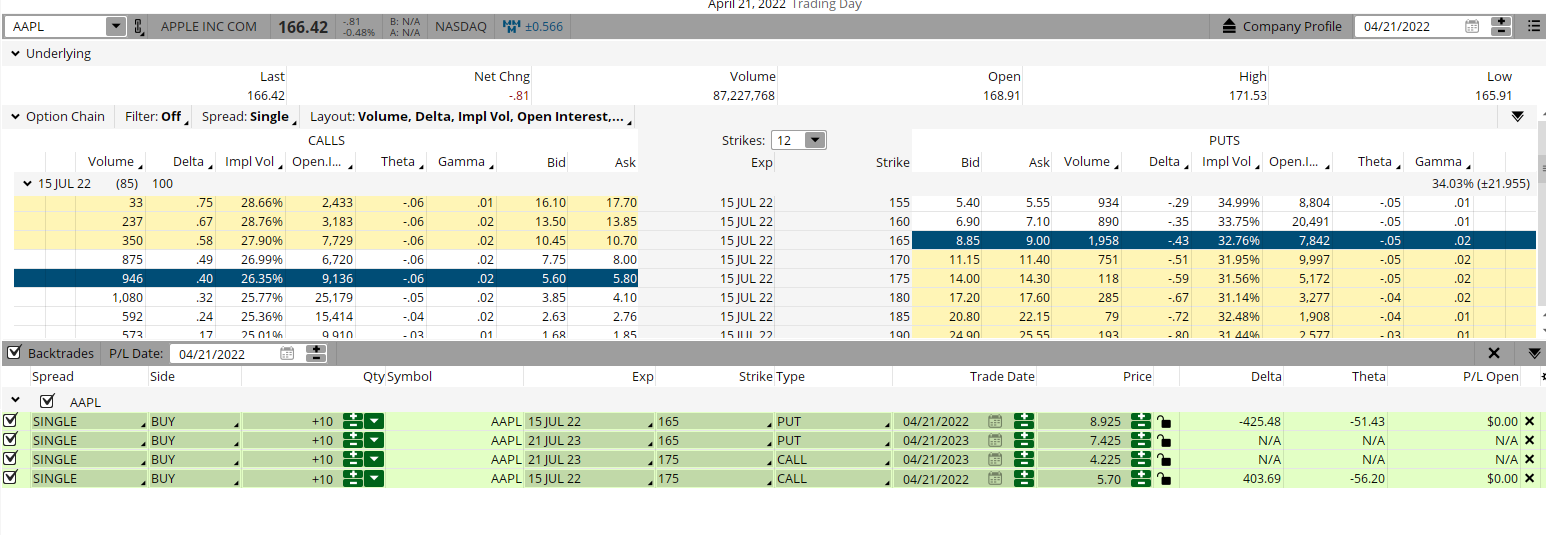

Is Apple Stock A Buy Ahead Of Its Q2 Report Analysis Of Current Levels

May 24, 2025

Is Apple Stock A Buy Ahead Of Its Q2 Report Analysis Of Current Levels

May 24, 2025 -

Apple Price Target Cut Wedbushs Long Term Perspective And Investment Implications

May 24, 2025

Apple Price Target Cut Wedbushs Long Term Perspective And Investment Implications

May 24, 2025 -

Trump Tariffs And Apple A Deep Dive Into Buffetts Investment Strategy

May 24, 2025

Trump Tariffs And Apple A Deep Dive Into Buffetts Investment Strategy

May 24, 2025 -

Apple Stock Aapl A Technical Analysis Of Key Price Levels

May 24, 2025

Apple Stock Aapl A Technical Analysis Of Key Price Levels

May 24, 2025 -

Apple Stock Key Levels Breached Q2 Earnings Looming

May 24, 2025

Apple Stock Key Levels Breached Q2 Earnings Looming

May 24, 2025