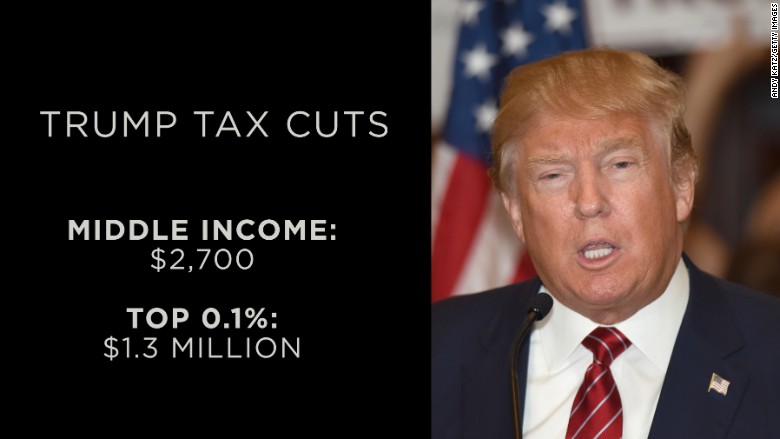

Details Emerge: House Republicans' Plan For Trump Tax Cuts

Table of Contents

Core Tenets of the Proposed Tax Cuts

The overarching goals of the proposed tax cuts, mirroring the philosophy behind the 2017 Tax Cuts and Jobs Act, are to stimulate economic growth and benefit both businesses and individuals. House Republicans are framing this as a necessary measure to boost the economy after a period of perceived economic sluggishness. The plan reportedly centers on several key tenets:

-

Simplification of the Tax Code: The proposed legislation aims to streamline the current tax code, making it easier for individuals and businesses to comply. This includes reducing the number of tax brackets and simplifying deductions. This simplification is a key selling point, promising to reduce the burden of tax preparation for many Americans.

-

Lower Corporate Tax Rates: A central component of the plan is a reduction in the corporate tax rate. While the exact proposed rate remains unclear, the aim is to make the US more competitive globally and encourage business investment and job creation. Lowering this rate is expected to incentivize domestic and foreign investment.

-

Changes to Individual Income Tax Brackets: The plan is expected to include adjustments to individual income tax brackets. While details are scarce, the general expectation is a reduction in rates for certain income levels, potentially offering tax relief to middle-class families and high-income earners. This aspect will likely be heavily debated.

-

Impact on Deductions and Credits: The proposal may modify existing deductions and credits. Some deductions might be eliminated or reduced while others could be expanded or created. The net effect on individuals will depend on the specifics of these changes. The fine print here will heavily influence the overall public reception.

-

Addressing Tax Loopholes: The plan may also address perceived loopholes in the current tax code, aiming to prevent tax avoidance and ensure fair taxation across all income levels. This is a contentious area, with definitions of "loopholes" varying widely.

Projected Economic Impacts of the Plan

The potential economic effects of the proposed Trump tax cuts are complex and subject to differing interpretations. Economists are divided on the likely outcomes.

-

GDP Growth Projections: Proponents argue the tax cuts will boost GDP growth by encouraging investment and consumer spending. However, critics suggest the stimulative effect might be limited or even negative, citing the potential for increased national debt and inflation. (Further research and citation of economic models needed here).

-

Impact on Inflation: Lower taxes could potentially fuel inflation if the increased spending outpaces the economy's ability to produce goods and services. This could erode purchasing power and negate some of the benefits of the tax cuts. (Source needed).

-

Effects on Job Creation: Supporters predict the cuts will lead to significant job creation, particularly in the business sector. Opponents counter that the benefits may not trickle down to the broader workforce, and job growth could be minimal or even negatively affected by increased automation or outsourcing. (Source needed).

-

Increase in National Debt: A major concern is the potential increase in the national debt, particularly if the tax cuts are not accompanied by spending cuts elsewhere. This could have long-term consequences for the US economy and its global standing. (Source needed).

-

Distributional Effects: The distributional effects of the tax cuts are crucial. While some proponents argue they will benefit all income levels, others believe the biggest beneficiaries will be high-income earners and corporations, exacerbating income inequality. This disparity could lead to political backlash.

Political Landscape and Challenges to Passage

The proposed Trump tax cuts face significant political hurdles.

-

Support within the Republican Party: While there's broad support within the Republican party for tax cuts, divisions exist regarding the specific details and the overall scale of the proposed reductions. Internal disagreements could hinder the legislative process.

-

Potential Opposition from Democrats: The Democratic party is likely to oppose the plan, arguing it will disproportionately benefit the wealthy, increase the national debt, and exacerbate income inequality. Their opposition could make passage extremely difficult.

-

Challenges in Gaining Senate Approval: Even if the House passes the legislation, obtaining Senate approval will be a major challenge, particularly with the current Senate's narrow margins. Compromise and amendments will be crucial.

-

Potential for Amendments and Compromises: The final legislation is likely to be significantly different from the initial proposal, reflecting compromises reached during the legislative process. The ultimate form of the bill is still highly uncertain.

-

Public Opinion: Public opinion will play a vital role. If the public perceives the tax cuts as unfair or economically unsound, it could pressure lawmakers to reconsider or amend the proposal.

Comparison to Trump-Era Tax Cuts

The proposed plan shares many similarities with the 2017 Tax Cuts and Jobs Act, focusing on lower corporate tax rates and individual income tax reductions. However, key differences likely exist.

-

Similarities in Policy Goals: Both plans aim to stimulate economic growth through tax cuts.

-

Differences in Specific Tax Rates or Provisions: The specific tax rates and provisions may differ substantially, reflecting changes in economic conditions and political priorities.

-

Impact of Economic Conditions: The current economic climate significantly impacts the feasibility and effectiveness of the proposed cuts, compared to the conditions in 2017.

Conclusion

House Republicans' proposed plan for Trump-style tax cuts aims for significant changes to the US tax code, prioritizing simplification and lower rates for businesses and individuals. While proponents predict economic growth, critics raise concerns about increased national debt and potential inflationary pressures. The plan faces significant political obstacles, requiring compromise and potentially substantial alterations during the legislative process. The distributional effects and ultimate impact on the American economy remain highly debated.

The details surrounding House Republicans’ plan for Trump tax cuts are still unfolding. Stay informed about the latest developments in this evolving story by following our ongoing coverage and further investigation into the proposed changes to the US tax system. Understanding the nuances of these proposed Trump tax cuts is critical for everyone concerned about the future of the US economy.

Featured Posts

-

Exploring Ethan Slaters Character In Elsbeth Season 2 Episode 17

May 13, 2025

Exploring Ethan Slaters Character In Elsbeth Season 2 Episode 17

May 13, 2025 -

Scarlett Johansson Es A Marvel Visszater A Moziuniverzumba

May 13, 2025

Scarlett Johansson Es A Marvel Visszater A Moziuniverzumba

May 13, 2025 -

Streaming Den Of Thieves 2 Netflix Availability Update

May 13, 2025

Streaming Den Of Thieves 2 Netflix Availability Update

May 13, 2025 -

Gibraltar Industries Rock Earnings Preview What To Expect

May 13, 2025

Gibraltar Industries Rock Earnings Preview What To Expect

May 13, 2025 -

Partynextdoors Apology The Full Story Behind The Tory Lanez Drama

May 13, 2025

Partynextdoors Apology The Full Story Behind The Tory Lanez Drama

May 13, 2025

Latest Posts

-

Disneys Snow White A Hilariously Abysmal Flop Im Dbs Worst Ranked Movies

May 14, 2025

Disneys Snow White A Hilariously Abysmal Flop Im Dbs Worst Ranked Movies

May 14, 2025 -

Box Office Disaster How Disneys Snow White Remake Failed To Connect With Viewers

May 14, 2025

Box Office Disaster How Disneys Snow White Remake Failed To Connect With Viewers

May 14, 2025 -

Disneys Snow White Bombs At The Box Office Worst Opening Ever

May 14, 2025

Disneys Snow White Bombs At The Box Office Worst Opening Ever

May 14, 2025 -

Snow White Box Office Bomb A Case Study In Political Backlash

May 14, 2025

Snow White Box Office Bomb A Case Study In Political Backlash

May 14, 2025 -

Disneys Woke Snow White Did Political Correctness Hurt The Films Success

May 14, 2025

Disneys Woke Snow White Did Political Correctness Hurt The Films Success

May 14, 2025