Did Warren Buffett Time His Apple Sale Perfectly? Market Analysis And Predictions

Table of Contents

Analyzing Warren Buffett's Apple Stock Sales

The Timeline of Sales

Berkshire Hathaway's gradual reduction of its Apple stock holdings began in [Insert specific date and quarter] and continued through [Insert most recent date and quarter]. The sales involved a significant number of shares, representing a [percentage]% decrease in Berkshire's overall Apple stake. [Insert specific numbers of shares sold in each quarter or period. Include a visually appealing chart or graph depicting the sales over time. Label axes clearly, e.g., "Date" and "Shares Sold (in millions)"]. The sheer volume of these transactions underscores the magnitude of the Warren Buffett Apple sale and its potential impact on the market.

Buffett's Rationale (Explained)

While Buffett rarely explicitly reveals his investment reasoning, we can infer potential motives behind the Apple stock sales by analyzing publicly available information and his known investment philosophy.

- Valuation concerns relative to intrinsic value: Buffett is famously known for his value investing approach. It's possible he felt Apple's stock price, while still high, had reached a level exceeding his assessment of its intrinsic value.

- Diversification needs for Berkshire Hathaway's portfolio: Maintaining a diversified portfolio is crucial for risk management. Reducing Berkshire's significant Apple stake allows for investments in other sectors and opportunities, thereby lessening overall portfolio concentration.

- Potential shifts in the tech sector outlook: The tech sector is inherently volatile. Changes in regulations, competition, and consumer demand might have led Buffett to re-evaluate his long-term outlook on Apple's growth.

- Alternative investment opportunities: Buffett and his team are constantly searching for undervalued assets. The sale of Apple stock might indicate the discovery of more promising investment opportunities elsewhere.

Market Reaction to the Sales

The market's initial reaction to news of the Warren Buffett Apple sale was [Describe the immediate impact – e.g., a slight dip in Apple's stock price, increased trading volume]. [Insert a chart illustrating stock price fluctuations around the time of the sales]. However, the long-term impact remains to be seen. The subsequent price movements reflected [Describe subsequent trends – e.g., a recovery, continued downward pressure, or sideways trading]. Analyzing trading volume during this period offers further insight into investor sentiment and the overall impact of the Warren Buffett Apple Sale on market activity.

Market Predictions Based on Buffett's Actions

Short-Term Outlook for Apple Stock

Predicting short-term price movements is inherently challenging. However, considering various factors:

- Analyst predictions and ratings: Many analysts maintain [positive/negative/neutral] ratings on Apple stock, citing [reasons].

- Current market conditions: The prevailing macroeconomic climate – including inflation, interest rates, and geopolitical events – will undoubtedly play a role.

- Impact of global economic uncertainties: Global economic uncertainty can significantly influence investor sentiment and affect Apple's stock performance.

- Apple's upcoming product releases and financial reports: The success of new product launches and strong financial reports could mitigate any negative impacts from the Warren Buffett Apple sale.

suggests a [Bullish/Bearish/Neutral] short-term outlook.

Long-Term Implications for Apple and the Tech Sector

Buffett's actions could have significant long-term implications.

- Potential impact on investor confidence: While some investors may view the sale as a negative signal, others might see it as an opportunity to enter or increase their holdings.

- Future competition and market dynamics: Increased competition and changes in market dynamics could influence Apple's long-term growth.

- Analysis of Apple's future growth prospects: Apple’s innovation pipeline, its services revenue, and its global brand recognition are key factors determining its long-term growth prospects.

Alternative Investment Strategies

Given Buffett's move, investors might consider exploring alternative investment strategies, such as [mention specific sectors or asset classes, e.g., energy, infrastructure, emerging markets]. However, each investment strategy carries varying levels of risk; thorough due diligence and risk assessment are paramount.

Comparing Buffett's Apple Sale to Previous Investment Decisions

Buffett's investment history provides valuable context. [Provide examples of past investment decisions, both successful and unsuccessful, and compare/contrast them with the Apple sale, highlighting similarities and differences in timing, rationale, and market impact]. This comparative analysis illuminates the nuances of Buffett's investment strategy and adds further depth to the interpretation of the Warren Buffett Apple Sale.

Conclusion

The Warren Buffett Apple sale is a complex event with multifaceted implications. While the immediate market reaction was [reiterate the initial market impact], the long-term consequences for Apple and the broader tech sector remain uncertain. Buffett's potential rationale, involving valuation concerns, diversification, and perhaps promising alternative investments, underscores the dynamic nature of even the most successful investment strategies. The key takeaway is that even legendary investors like Buffett adjust their portfolios based on evolving market conditions and perceived opportunities.

Key Takeaways: The Warren Buffett Apple sale highlights the importance of diversification, ongoing evaluation of investment holdings, and adapting to changing market conditions.

Call to Action: Stay informed on future developments regarding the Warren Buffett Apple sale and adjust your investment strategy accordingly. Continue researching Apple's performance and consider consulting a financial advisor for personalized advice. Remember, responsible investing involves thorough research and a clear understanding of your own risk tolerance.

Featured Posts

-

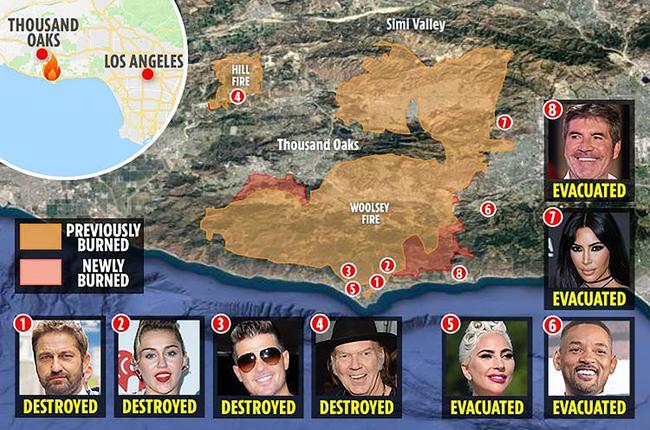

Los Angeles Palisades Fires A List Of Celebrities Whose Homes Were Damaged Or Destroyed

Apr 23, 2025

Los Angeles Palisades Fires A List Of Celebrities Whose Homes Were Damaged Or Destroyed

Apr 23, 2025 -

Discover Pentrich Brewing Factory Location Beers And Experiences

Apr 23, 2025

Discover Pentrich Brewing Factory Location Beers And Experiences

Apr 23, 2025 -

Broadcoms Proposed V Mware Price Hike A 1 050 Increase For At And T

Apr 23, 2025

Broadcoms Proposed V Mware Price Hike A 1 050 Increase For At And T

Apr 23, 2025 -

Potential Successors To Pope Francis 10 Cardinals To Watch

Apr 23, 2025

Potential Successors To Pope Francis 10 Cardinals To Watch

Apr 23, 2025 -

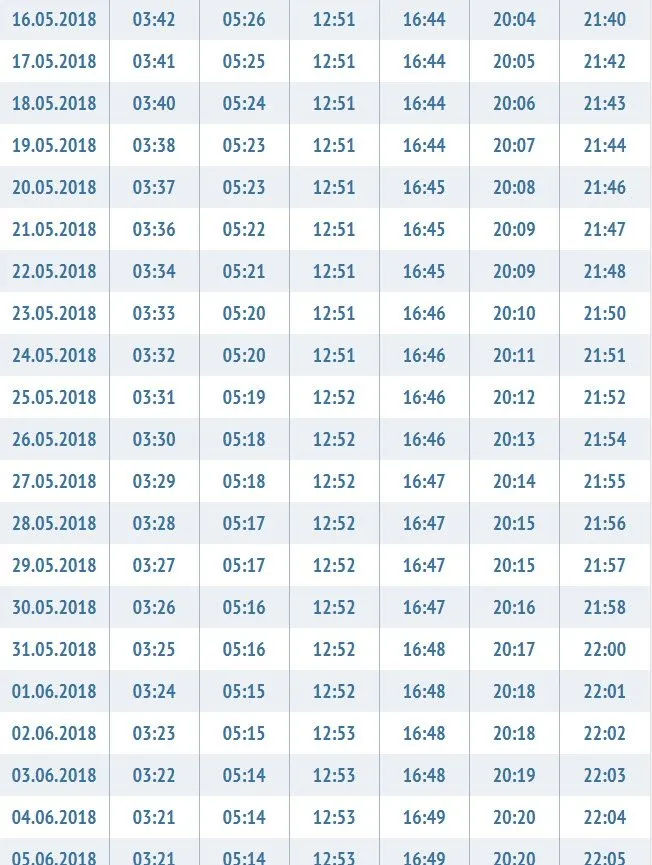

Ankara Iftar Sahur Vakitleri 3 Mart 2024 Pazartesi

Apr 23, 2025

Ankara Iftar Sahur Vakitleri 3 Mart 2024 Pazartesi

Apr 23, 2025

Latest Posts

-

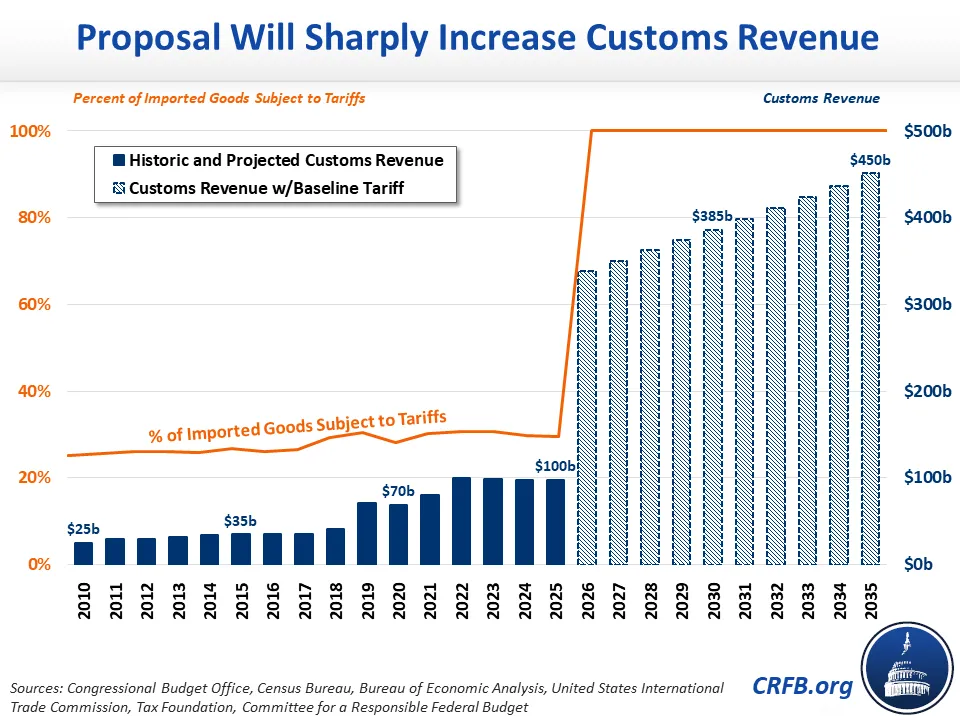

10 Tariff Baseline Trumps Condition For Trade Deals

May 10, 2025

10 Tariff Baseline Trumps Condition For Trade Deals

May 10, 2025 -

Cocaine At The White House Secret Service Completes Investigation

May 10, 2025

Cocaine At The White House Secret Service Completes Investigation

May 10, 2025 -

Trump Issues 10 Tariff Warning Exceptional Deals Only Exempt

May 10, 2025

Trump Issues 10 Tariff Warning Exceptional Deals Only Exempt

May 10, 2025 -

Omada Health Ipo Details On The Andreessen Horowitz Investment

May 10, 2025

Omada Health Ipo Details On The Andreessen Horowitz Investment

May 10, 2025 -

White House Cocaine Found Secret Service Investigation Concludes

May 10, 2025

White House Cocaine Found Secret Service Investigation Concludes

May 10, 2025