Dissecting The GOP Tax Cuts: A Deep Dive Into The Numbers

Table of Contents

Key Provisions of the Tax Cuts and Jobs Act (TCJA)

The TCJA aimed to simplify the tax code, boost economic growth, and increase competitiveness. It achieved this through several major provisions, many of which had significant and lasting impacts.

Individual Income Tax Rate Reductions

The TCJA reduced individual income tax rates across the board. This resulted in lower tax burdens for many taxpayers, although the extent of the reduction varied significantly depending on income level.

- Changes to Tax Brackets: The number of tax brackets was reduced, and the rates within each bracket were lowered.

- Impact on Income Levels: Higher-income individuals generally benefited more from the lower rates than lower-income individuals. Middle-income taxpayers experienced some tax relief, but the benefits were less pronounced.

- Sunset Provisions: Some of the individual tax cuts were temporary, meaning they were set to expire after a certain period. This created uncertainty for long-term financial planning. These sunset provisions are a key area of ongoing debate and potential future tax policy changes.

- Relevant Statistics: While precise figures vary depending on the specific income and filing status, studies from organizations like the Tax Policy Center provide detailed breakdowns of the tax cuts' impact across different income groups. These studies help illustrate the distribution of tax savings.

These changes to tax brackets, income tax, and individual tax rates were central to the TCJA. The tax reform involved significantly altered the tax burden for many Americans.

Corporate Tax Rate Reduction

One of the most significant changes in the TCJA was the reduction of the corporate tax rate from 35% to 21%. This was a substantial decrease, intended to boost business investment and job creation.

- Intended Effects: Proponents argued that the lower rate would encourage businesses to invest more, expand operations, and hire more workers, ultimately leading to increased economic growth.

- Arguments For and Against: Opponents argued that the corporate tax cut primarily benefited large corporations and wealthy shareholders, disproportionately increasing income inequality and doing little to stimulate broad-based economic growth. They also expressed concerns about the impact on the national debt.

- Revenue Impact: Data on corporate tax revenue before and after the cuts reveal a significant decrease in revenue collected. This fuels ongoing discussions about the trade-offs between stimulating economic activity and maintaining government revenue.

The corporate tax rate reduction is a key component of the corporate income tax discussion and its implications for business tax policy.

Changes to Standard Deduction and Itemized Deductions

The TCJA also made significant changes to the standard deduction and itemized deductions.

- Increased Standard Deduction: The standard deduction was significantly increased, benefiting many taxpayers by simplifying their tax filings and reducing their tax liability.

- Limitations on Itemized Deductions: The TCJA placed limitations on certain itemized deductions, notably the state and local tax (SALT) deduction. This change disproportionately affected taxpayers in high-tax states.

- Impact on Taxpayers: The changes resulted in a larger number of taxpayers opting for the standard deduction rather than itemizing. This had significant consequences for taxpayers in high-tax states who previously benefited significantly from itemizing their deductions.

The changes to the standard deduction and itemized deductions, including the impact on the SALT deduction, significantly altered the tax landscape for many individuals.

Pass-Through Business Tax Deduction

The TCJA introduced a new deduction for pass-through businesses, such as sole proprietorships, partnerships, and S corporations. This deduction allowed business owners to deduct up to 20% of their qualified business income (QBI).

- Complexity and Limitations: This deduction, while intended to benefit small businesses, proved to be complex and had several limitations and restrictions. This led to confusion and challenges for many small business owners.

Understanding the pass-through business deduction is crucial for navigating the complexities of small business tax and self-employment tax.

Economic Impact of the GOP Tax Cuts

The economic effects of the TCJA remain a subject of ongoing debate and analysis.

Impact on Economic Growth

Proponents argued that the tax cuts would stimulate economic growth through increased business investment and consumer spending. However, the actual impact on GDP growth is still debated. Data on GDP growth following the implementation of the cuts shows mixed results, with some periods of stronger growth and others that are less conclusive. GDP growth was a major consideration in evaluating the effectiveness of the economic stimulus measures implemented. Fiscal policy analyses remain crucial in evaluating the long-term effects.

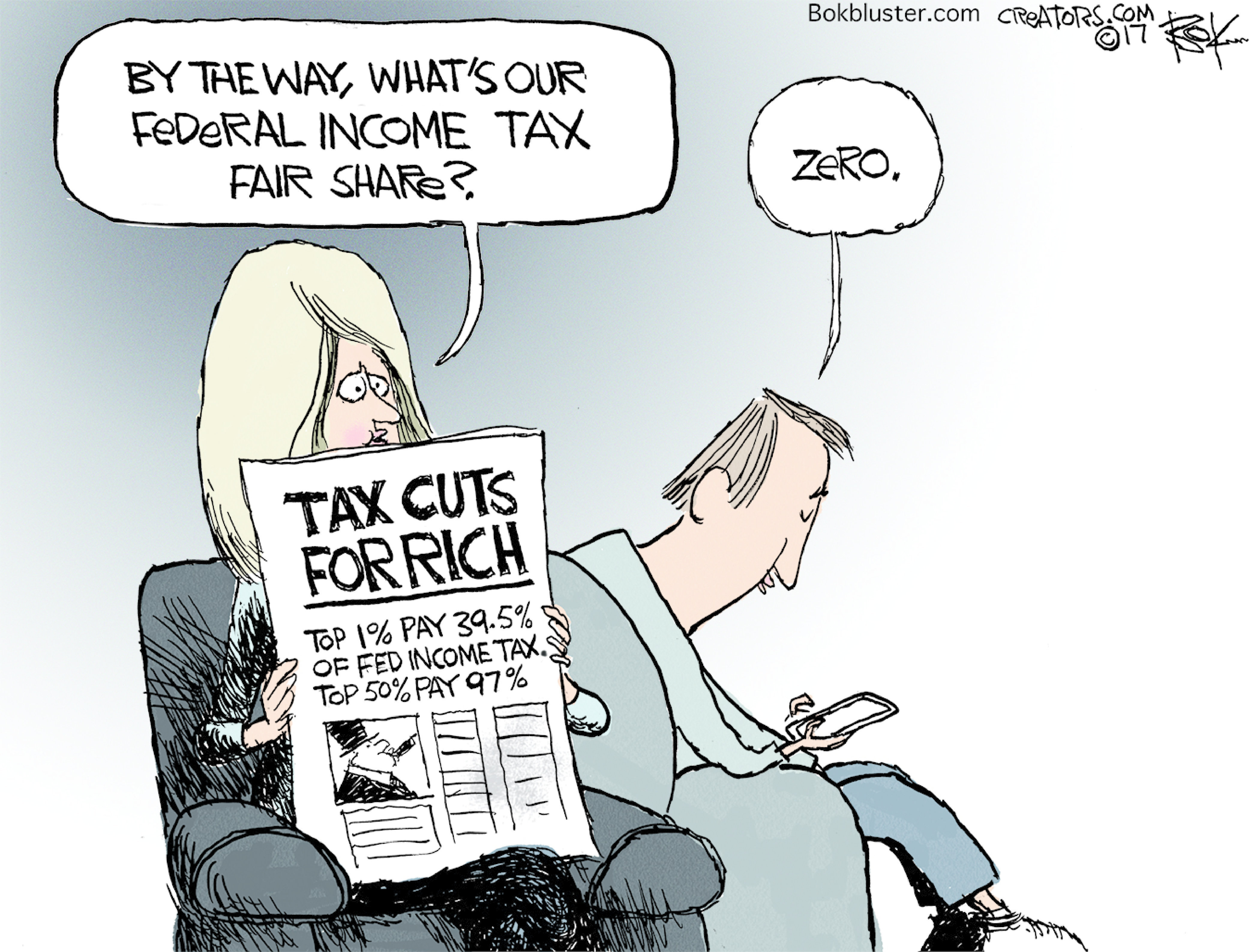

Impact on Income Inequality

Studies on the income inequality effects of the TCJA show varying conclusions. Some indicate that the tax cuts exacerbated existing income inequality, while others suggest a more moderate impact. The distribution of tax benefits, combined with indirect economic effects, continues to be a key focus of research into wealth distribution and economic disparity.

Impact on the National Debt

The TCJA undeniably increased the budget deficit and the national debt. This increase stems from the combination of reduced tax revenue and increased government spending. The long-term implications for fiscal responsibility continue to be a significant concern.

Long-Term Effects and Future Considerations

Many provisions of the TCJA, including some of the individual tax cuts, have sunset provisions. This means they are scheduled to expire at a future date. The potential expiration of these provisions will significantly affect tax policy and economic forecasts. The future of tax policy and tax reform is inextricably linked to the legacy and long-term effects of the TCJA, influencing debates surrounding future long-term economic impact. The ongoing discussion of the effectiveness and fairness of the TCJA will undoubtedly shape future legislation and tax debates.

Conclusion

The 2017 GOP tax cuts, officially the Tax Cuts and Jobs Act, represent a significant shift in US tax policy. This deep dive into the numbers reveals both intended and unintended consequences, highlighting the complexities of analyzing such sweeping legislation. Understanding the intricacies of these cuts – from individual tax bracket changes to the impact on corporate tax revenue and the national debt – is crucial for informed civic engagement. Continue your research on the lasting effects of the GOP tax cuts to better understand their impact on your finances and the economy. Further exploration into the details of the tax reform and its various components will equip you with the knowledge to engage in meaningful discussions surrounding tax policy and its implications for the future.

Featured Posts

-

March 13 2025 Nyt Mini Crossword Hints Clues And Solutions

May 21, 2025

March 13 2025 Nyt Mini Crossword Hints Clues And Solutions

May 21, 2025 -

Carlo Ancelotti Nin Yerine Juergen Klopp Bir Karsilastirma

May 21, 2025

Carlo Ancelotti Nin Yerine Juergen Klopp Bir Karsilastirma

May 21, 2025 -

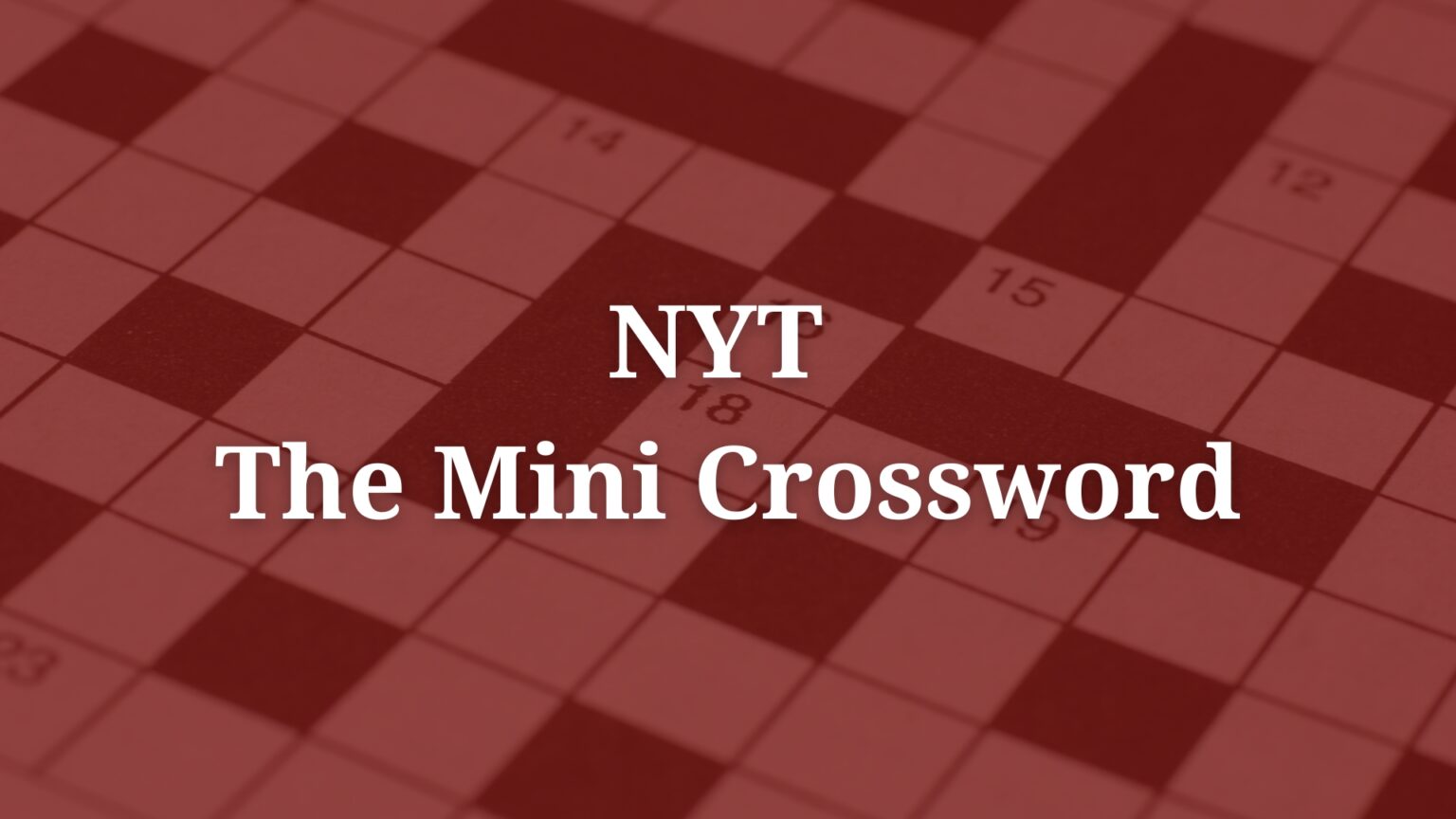

Complete Sandylands U Tv Listings And Airtimes

May 21, 2025

Complete Sandylands U Tv Listings And Airtimes

May 21, 2025 -

Britains Got Talent Understanding David Walliams Absence

May 21, 2025

Britains Got Talent Understanding David Walliams Absence

May 21, 2025 -

Bbc Antiques Roadshow Couple Jailed For Unknowingly Trafficking National Treasure

May 21, 2025

Bbc Antiques Roadshow Couple Jailed For Unknowingly Trafficking National Treasure

May 21, 2025

Latest Posts

-

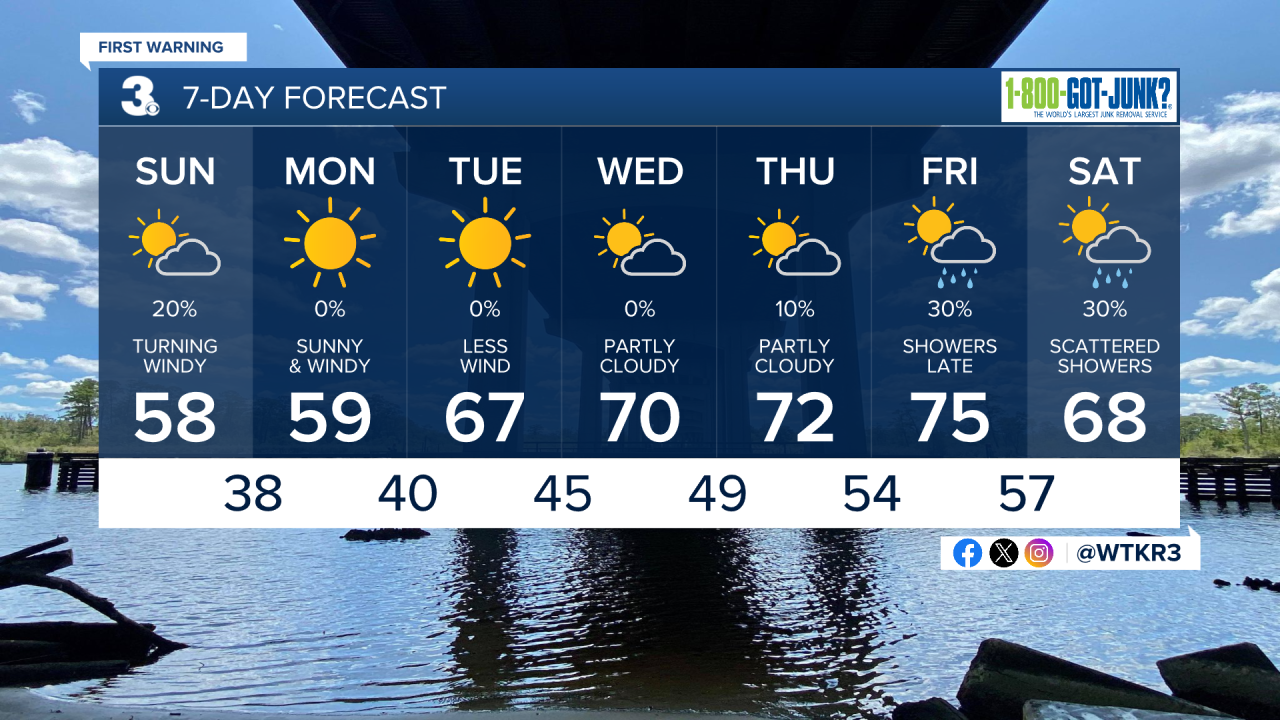

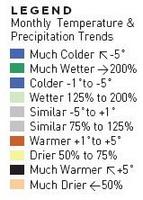

Is Drier Weather Finally In Sight A Look At The Forecast

May 21, 2025

Is Drier Weather Finally In Sight A Look At The Forecast

May 21, 2025 -

Is Big Bear Ai Stock Worth Buying In 2024

May 21, 2025

Is Big Bear Ai Stock Worth Buying In 2024

May 21, 2025 -

Drier Weather Is In Sight What To Expect

May 21, 2025

Drier Weather Is In Sight What To Expect

May 21, 2025 -

Big Bear Ai Stock A Motley Fool Perspective And Buy Sell Recommendation

May 21, 2025

Big Bear Ai Stock A Motley Fool Perspective And Buy Sell Recommendation

May 21, 2025 -

Should You Buy Big Bear Ai Stock Now Investment Analysis

May 21, 2025

Should You Buy Big Bear Ai Stock Now Investment Analysis

May 21, 2025